fcafotodigital/E+ via Getty Images

Tyson Foods, Inc. (NYSE:TSN) is one of the globe’s largest food companies and holds a leading position among producers of animal protein products. Tyson released Q3 2022 results last week, and the stock initially fell more than 10%.

The poor results were largely caused by the current macroeconomic climate. The tight labor market, mounting input costs, and consumers’ response to inflationary pressures are all taking a toll on the stock.

Although the quarterly results speak volumes regarding macroeconomic pressures, the numbers do not reveal the trends and initiatives that will likely bode well for investors over the long haul.

Everybody Has To Eat, Right?

The investing community is deluged of late by articles highlighting recession and inflation-resistant stocks. Of course, one theme points to how companies with business models rooted in necessities will hold their ground despite inflationary pressures. Until we are required to purchase oxygen, food will rank at the top of every person’s gotta-buy-list. Therein lies why Tyson was deemed an essential business during the pandemic.

So companies that sell food products are inflation resistant. Yes, or no?

In my article that debuted the day after Christmas, I warned readers that Tyson’s business model should not be expected to perform well during periods of high inflation.

Tyson and similar companies are often touted as investments that are inflation proof. However, studies by Morningstar reveal that over the last ten years, Tyson was only able to increase its prices on chicken above prevailing inflation about half the time.

The same study indicated that over the last five years, Tyson’s price increases lagged inflation by 1.5%. However, management touts the company’s ability to maneuver its way through mounting inflationary risks.

My opinion is buttressed by a list recently put forth by UBS analysts of the Riskiest defensive stocks as a recession looms. Tyson ranked second among fifteen companies “which may not be as defensive as commonly perceived.”

While perusing the Q3 results, it is apparent that inflationary pressures present a fierce headwind for the stock.

Tyson’s Q3 Results: A Window Into Weaknesses

Taken at a glance, Tyson’s Q3 results might not appear particularly poor. Non-GAAP EPS of $1.94 missed by $0.03, but revenue of $13.5B beat consensus by $250M. Furthermore, organic sales grew 9%.

Tyson finished the quarter as the market share leader in the majority of the retail core categories in which it competes, the company’s e-commerce sales grew 15% versus last year, and the balance sheet grew stronger.

The International/Other segment posted volume increases of 11.7% year-to-date and 21.9% versus the same quarter last year.

However, digging a bit deeper, there are ample causes for concern. Adjusted operating income fell 27% year-over-year, and adjusted EPS by 28% from the comparable quarter.

Q3 marked the first year-over-year fall in Tyson’s adjusted operating margin since the outbreak of COVID-19, and the revenue beat was largely driven by Tyson increasing pricing to meet input costs. While organic sales increased 9%, price/mix accounted for 8% of the growth.

Total volume was down for both the quarter and year-to-date. Volumes for Prepared Foods dropped 5.5% year-over-year, Pork volumes were down 2.1% year-to-date, and Beef volumes also fell, although they were up 1.3% over the comparable quarter. Those three segments account for 68% of the company’s revenues.

However, the loss in volumes only tells half the story. Due to increases in input costs, the adjusted operating income of the Beef segment fell year-over-year by 55% and in Pork by 63%.

Look no further than the statements provided during the earnings call for the cause of the poor results.

Volumes were down both for the third quarter and year-to-date due to supply constraints and a challenging macroeconomic environment impacting consumer demand.

…We saw continued increases in cost of goods across the business, in some instances, up to 15%. Notable examples were labor, feed ingredients, live animals and freight costs.

…Global demand is being impacted domestically by high retail prices and internationally by the strong dollar, making U.S. pork relatively expensive as compared to alternative sources globally.

Stewart Glendinning, EVP and CFO

Management now guides for FY22 volumes to fall .21 billion pounds below FY21 numbers. 2022 volumes relative to FY21 for Beef are expected to drop by 1.5%, for Pork by 2.1%, and by Prepared Foods by 5.5%.

Positive Developments And Trends

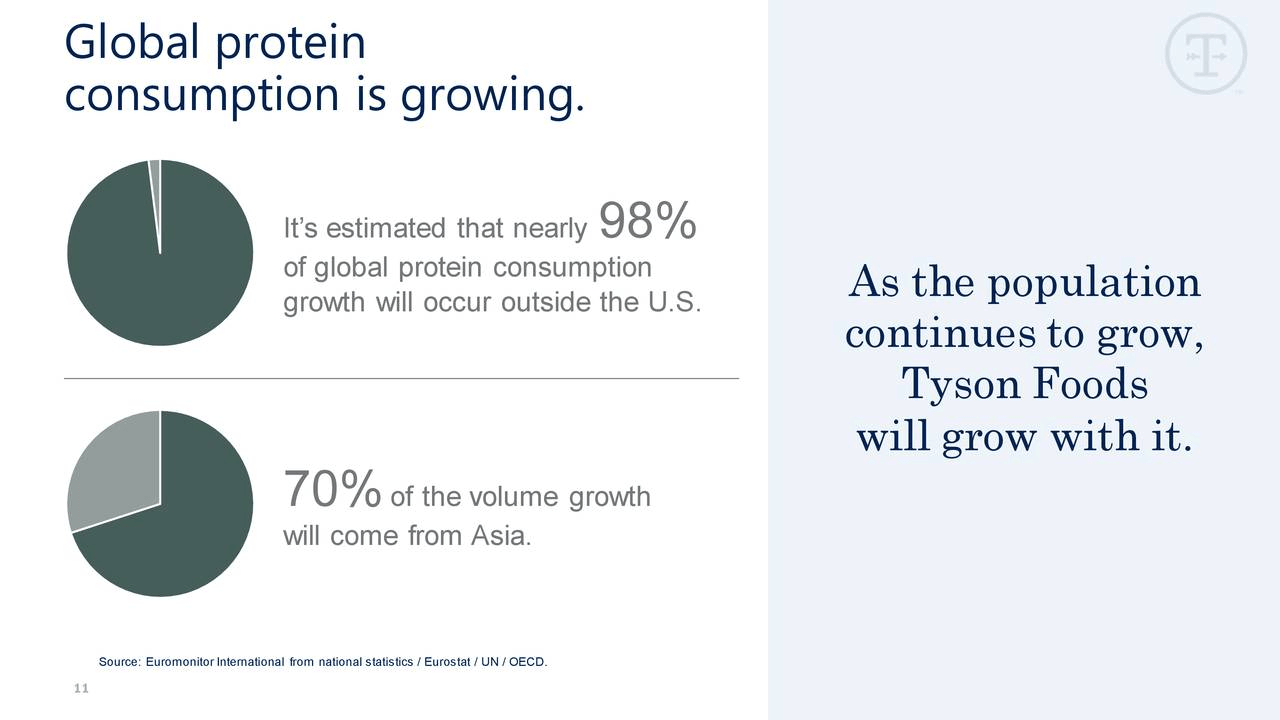

Tyson is largely a US-centric company. However, management is making inroads into foreign markets. Therein lies enormous growth potential tied to a burgeoning global middle class that increasingly consumes quantities of animal proteins.

Seeking Alpha/Tyson Presentation

The 2018 acquisition of Keystone Foods brought eight production facilities under Tyson’s banner in the Asia-Pacific region.

In 2019, Tyson took a 40% stake in the Brazilian poultry behemoth Grupo Vibra, a company that serves more than 50 countries. That followed a move earlier that year in which Tyson acquired the Thai and European businesses of BRF S.A. That deal included four production facilities in Thailand, and one each in the Netherlands and the United Kingdom.

Roughly a month ago, Tyson acquired stakes in two Saudi Arabian companies, Supreme Foods Processing, and Agriculture Development. Both of the companies are subsidiaries of meat provider Tanmiah Food Company.

Supreme Foods deals in pre-cooked chicken and beef products and operates a distribution network across the Middle East. Agriculture Development Company operates hatcheries and feed mills and produces broiler chickens.

In FY21, Tyson reported $4.8 billion in U.S. export sales and $2 billion in foreign country revenues. In toto, that represented 14% of the company’s sales. The International/Other segment reported an increase in volumes of 11.7% year-to-date and 21.9% versus the same quarter last year.

Herein lies a long, broad growth path for TSN. From 2000 through 2018, population growth and a burgeoning middle class led to a 40% increase in global protein consumption.

Furthermore, Allied Market Research reported the global animal protein market hauled in over $44 billion in 2019. They forecast a CAGR of 5.4% for the global animal protein market through 2027.

Recent trade deals will allow Tyson to increase sales to our nearest neighbors. Canada and Mexico are the first and third-largest export markets for US food and agricultural products. Beginning in 2020, the USMCA trade deal increases chicken exports to Canada to 57,000 metric tons over a six-year period. The agreement also allows for an additional 1% annual increase over the following ten years. Imports of Turkey products will also increase by 1,000 metric tons.

This doubles the market access allowed by the previous agreements.

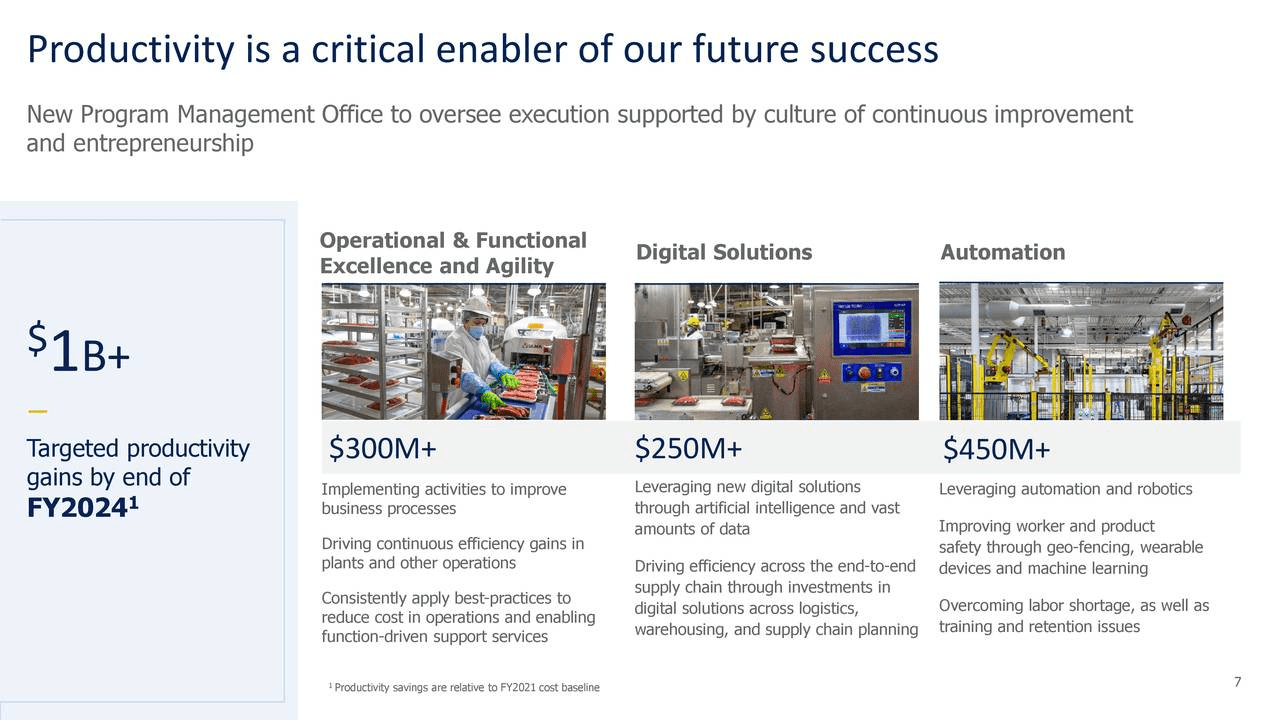

Management is also working to lower costs and increase production through a variety of initiatives. Tyson’s productivity program is designed to deliver $1 billion in savings by FY24. The program incorporates the widespread use of automation to combat labor shortages and employee retention issues.

During the Q3 earnings call, management affirmed that the productivity program is delivering results at the upper range of initial projections.

Seeking Alpha/Tyson Presentation

TSN devoted $1.9 billion in FY22, focused primarily on new capacity and automation objectives. The company has eight plants under construction, with two expected to begin operations this fiscal year, and six more coming online by the end of FY23.

Debt, Dividend, And Valuation

Fitch rates Tyson’s debt as BBB/stable, the lower end of the investment grade.

Tyson’s current net debt to adjusted EBITDA ratio of 1.2x is well below management’s target of 2x EBITDA or less. This provides the company with the flexibility to add production facilities and pursue acquisitions.

The current yield is 2.32%, the payout ratio is a bit below 20%, and the 5-year dividend growth rate is 17.21%.

TSN currently trades for $79.36 per share. The average one-year price target of the 7 analysts covering the stock is $92.00. The price target of the 4 analysts that rated the stock following the last earnings report is $88.25. The stock is rated as a hold by 6 of the 7 analysts.

TSN has a forward P/E of 9.86x, somewhat below its 5-year average P/E of 11.59x. The stock’s PEG ratio is 2.61x, on par with the sector’s median PEG.

Is TSN A Buy, Sell, Or Hold?

Tyson’s recent results are a reality check for those claiming companies in the food products industry are impervious to inflation. The loss of volumes for several segments, coupled with the large double-digit decline in adjusted operating incomes for two segments, point to a company that will likely face further headwinds from the current macroeconomic climate.

While management is maintaining sales guidance at a range of $52 billion to $54 billion, investors need to factor in the role price increases and ballooning costs will play in that number.

We saw continued increases in cost of goods across the business, in some instances, up to 15%. Notable examples were labor, feed ingredients, live animals and freight costs.

Stewart Glendinning, EVP/CFO

Nonetheless, Tyson has posted 12.4% average annual earnings growth over the past five years. The company has a strong financial position, and the strategy to expand overseas is slowly but surely gaining traction. During the Q3 earnings call, management noted the company cannot meet customer demand.

I view Tyson’s long-term prospects as strong. The company has a solid financial position and a rapidly growing, safe dividend.

However, I believe the company is likely to experience continued headwinds related to the current inflationary climate. I will add that despite the initial double-digit percentage drop in the share price that followed the Q3 earnings report, the current PEG ratio is not particularly appealing.

Therefore, I rate TSN as a HOLD.

Assuming no changes in the fundamentals, I would consider adding to my position in TSN should shares fall into the low $70 range.

Be the first to comment