We Are/DigitalVision via Getty Images

Introduction

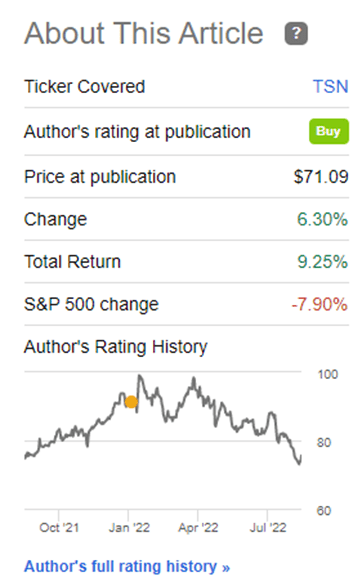

I’ve covered Tyson Foods, Inc. (NYSE:NYSE:TSN) several times and utilised the pullback during last summer to go long the stock. Over a short period, I established my position, but never managed to build it into a full position. As such, I’ve monitored the stock closely, waiting for that eventual pullback, and now, we are almost finally there. So far, my decision to go long Tyson has proven worthy, and I believe the strong fundamentals of Tyson will propel this company forward over the long run, as it fits the recipe of a strong dividend growth investment.

Seeking Alpha

My personal preference to picking up additional shares, is when the stock is trading at a forward yield of minimum 2.5%. With a current forward yield of $1.84, that requires a stock price of $73.38 per share, territory which the stock crossed into during last week, before trending upwards with the general market during the later parts of last week.

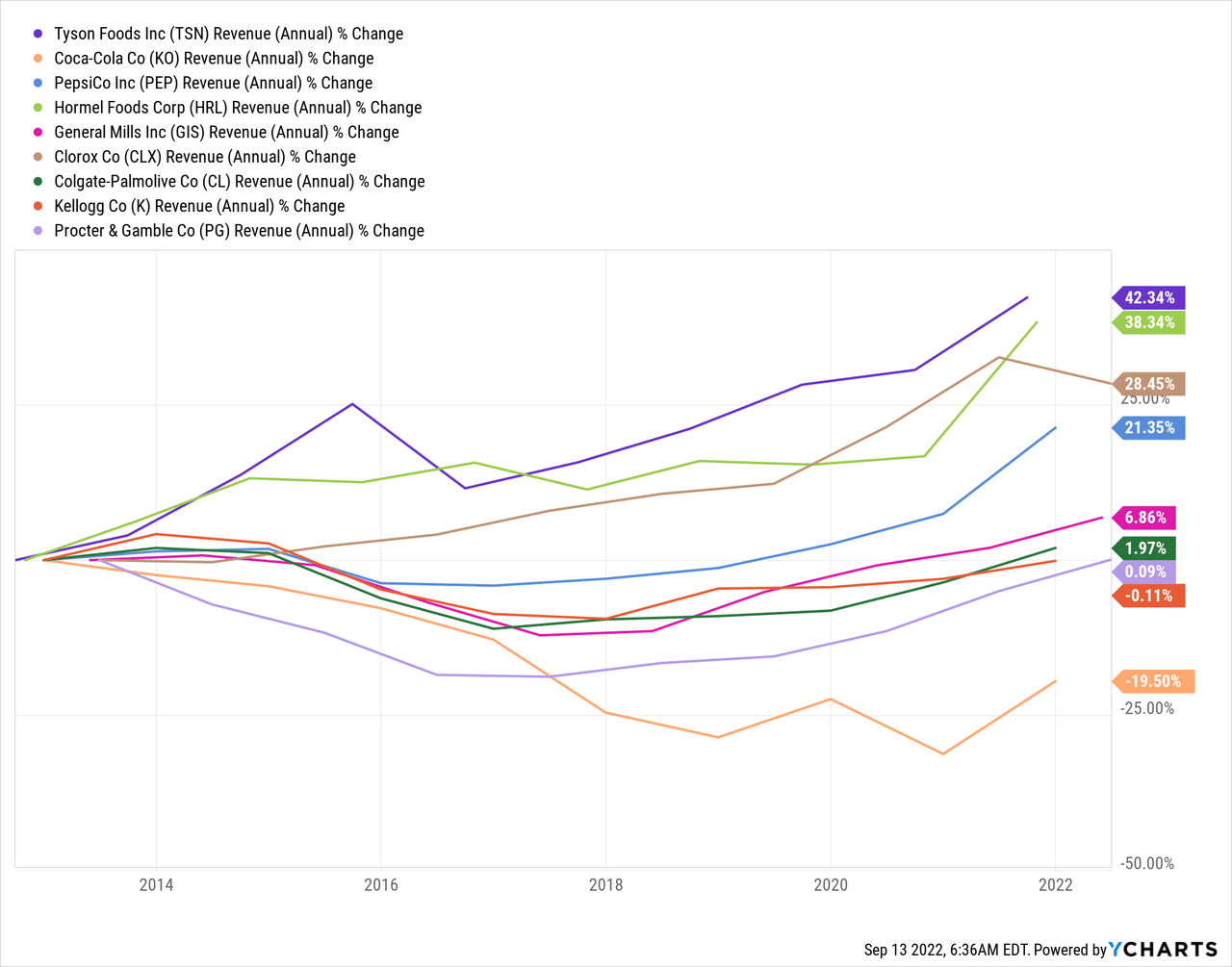

For dividend growth investors looking to add within consumer staples, I find that Tyson is a strong pick, financially outperforming some of its more famous peers. Please check out my previous article for an in-depth comparison of Tyson Foods versus The Clorox Company (CLX), Kellogg Company (K), Coca-Cola (KO), Procter & Gamble (PG), General Mills (GIS), Hormel Foods (HRL), Colgate-Palmolive (CL) and PepsiCo (PEP).

What I found was, that Tyson Foods beat these companies on payout ratio, revenue growth, share buybacks, free cash flow growth – all, while having the benefit of a strong family as majority shareholder.

Around the same time last year, there was a lot of headlines surrounding Tyson Foods, which covered the company in a negative manner including the company’s stance towards Covid-19 vaccinations, and similarly today, Tyson is suffering from negative sentiment as the Chinese authorities recently banned meat imports from one of Tyson’s plants. However, when I establish a position in a company, I do so with a long-term perspective, and outside of major litigations threatening the actual foundation of any given company, I consider most headlines as “short-term noise”, not least because most consumer staples have been around for several decades, including Tyson Foods who was founded in 1935. I believe they’ll also be here tomorrow, creating value for shareholders.

Who Is Tyson Foods?

For those not familiar with the company, Tyson Foods was founded in 1935 by John W. Tyson and has grown under three generations of family leadership. The company has grown into one of the world’s largest within protein-based foods stemming from chicken, beef, pork, etc. Products cover a wide range of fresh, value-added, frozen, and refrigerated products, sold at retailers, wholesalers, distributors, chain restaurants and so forth.

The company also own and operate a broad portfolio of own brands such as Tyson, Jimmy Dean, Hillshire Farm and Aidells amongst others. While products are sold in more than 130 countries, Tyson Foods does have a significant concentration within its sales, as Walmart (WMT) accounted for 18.3% of the total sales during 2021. While humans have been consuming protein from chickens, cattle and pigs for hundreds and thousands of years, causing one to think this business is without innovation, please note that Tyson Foods does spend roughly $100 million on R&D in a given year, resulting in the company also having launched its own plant-based meat alternatives, a topic which gathers significant interest in these times as consumers are switching to alternatives to regular animal-based protein. I’ve also aired the idea of long-term value creation by picking up one of the existing meat disruptors in an acquisition to supplement the existing R&D conducted at Tyson itself.

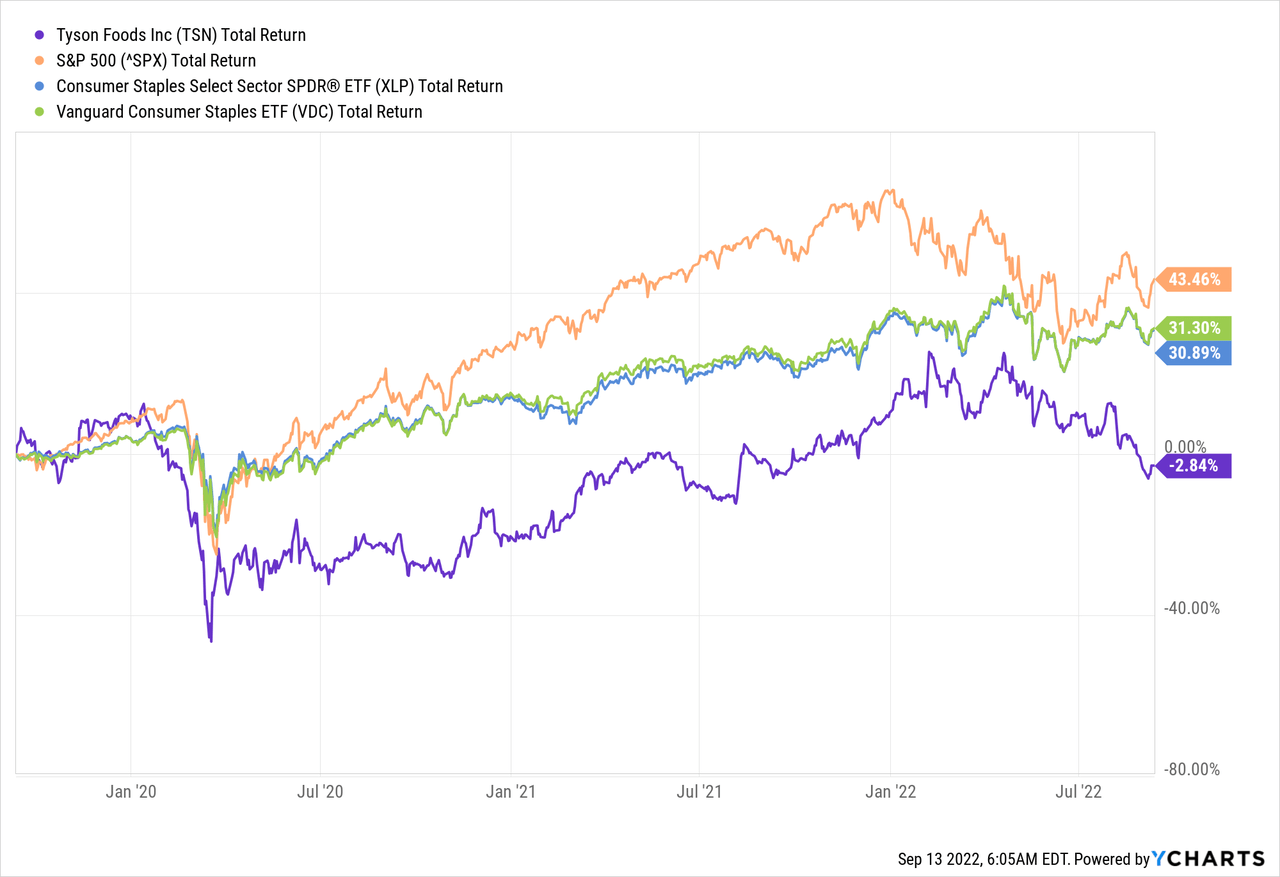

Looking at a three-year performance for its stock, and Tyson is down -2.84% from a total return level perspective, compared to the S&P 500 which is up 43.4%. Its peer index the Consumer Staples Select Sector SPDR (XLP) is also up 31.3% during that period, allowing one to believe business isn’t going well for Tyson Foods.

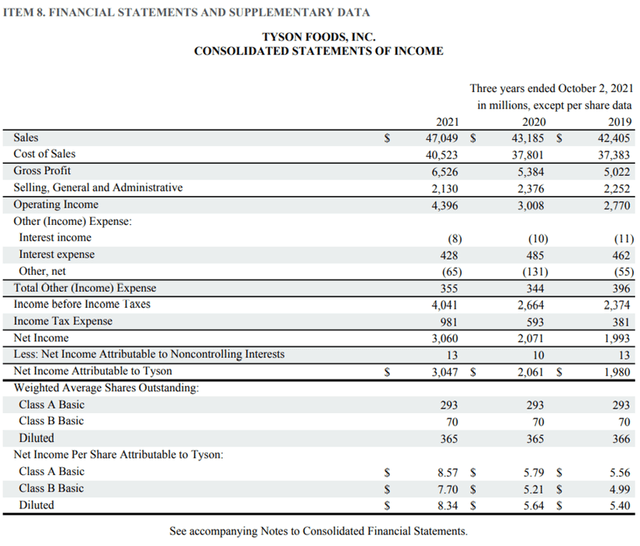

Tyson Foods Financial Statement (Tyson Foods 2021 10-K)

On the contrary, the actual business itself has been performing despite the stock having delivered no returns during that period. Mature consumer staples don’t belong to the segment of fast-growing companies, but Tyson Foods managed to grow revenue 1.8% during 2020 and 8.9% during 2021. Meanwhile, net income grew 3.4% and 47.8% respectively. We must, however, remember that these are accounting metrics, which somewhat clouds the picture as for instance depreciation can impact the profit levels.

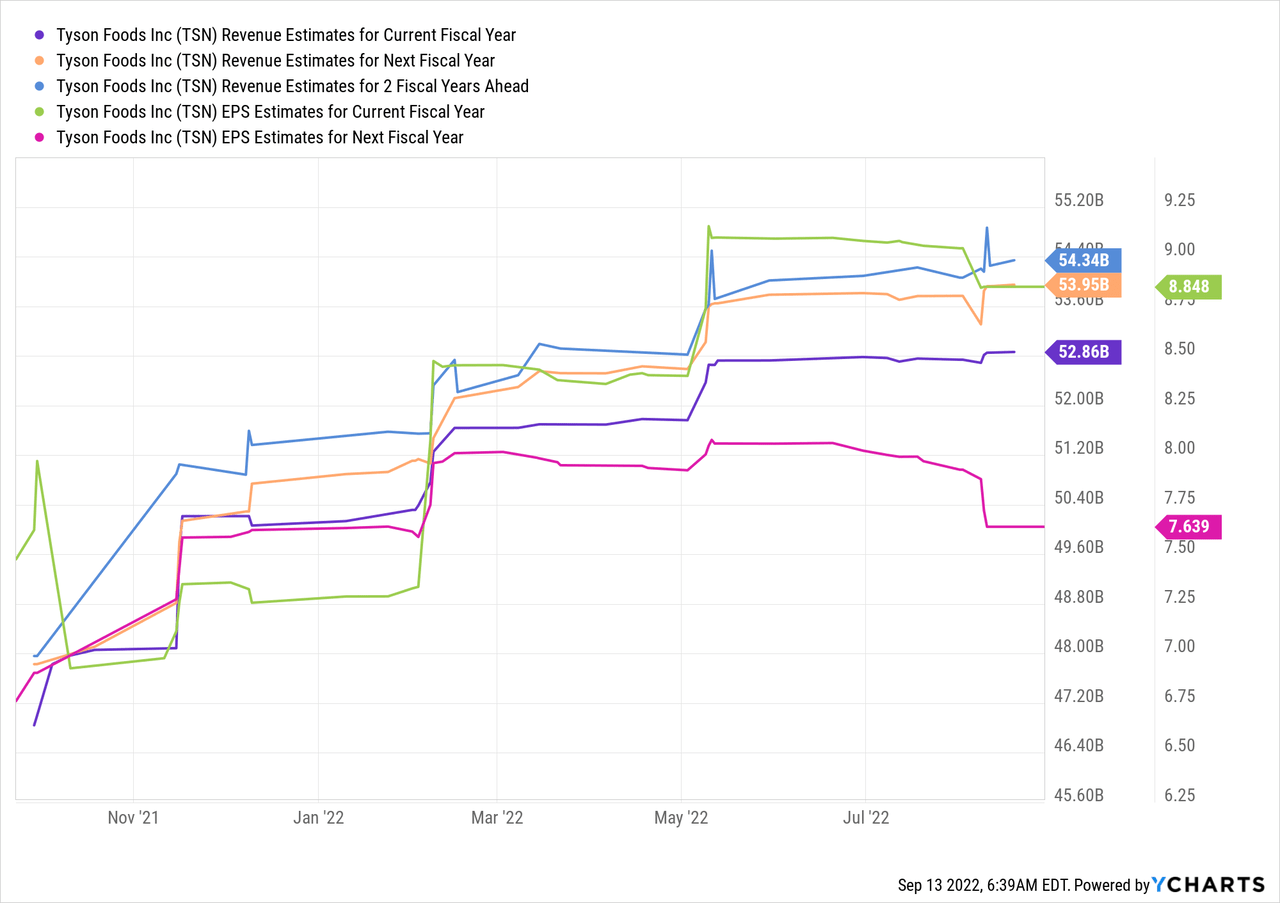

Looking ahead, and Tyson Foods is expected to close FY2022 with a revenue growth of 12.3% to $52.7 billion with EPS expected to land at $8.85, a 6.8% growth. If that ends up being the case, Tyson Foods is currently trading at a P/E of 8.5.

If we look to FY2023, revenue is still expected to grow, roughly in line with GDP at 2%, while EPS is expected to contract 13.6% to $7.64, meaning a forward P/E of 9.9

Recent Financial Performance

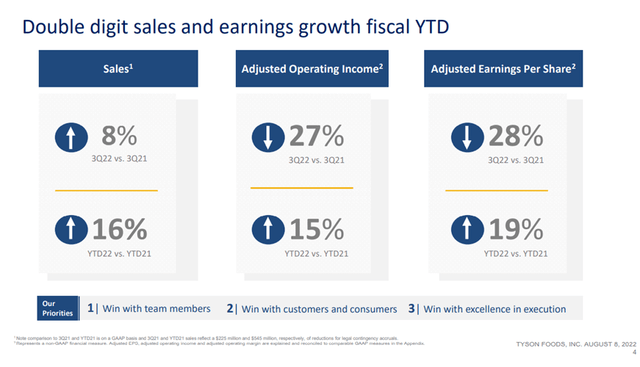

Management reported the Q3-2022 earnings on August 8th, with Wall Street consensus expectations pointing to a revenue of $13.25 billion, corresponding to a 6.2% growth YoY. EPS was expected at $1.97, corresponding to a 27% contraction YoY. The company delivered a beat on topline and a narrow miss on EPS with revenue at $13.5 billion (+8.2% YoY) and EPS at $1.94 (miss by $0.03).

Observing the recent results, three things stand out seen from my perspective.

Tyson Foods Q3-2022 Financial Highlights (Tyson Foods Q3-2022 Quarterly Results)

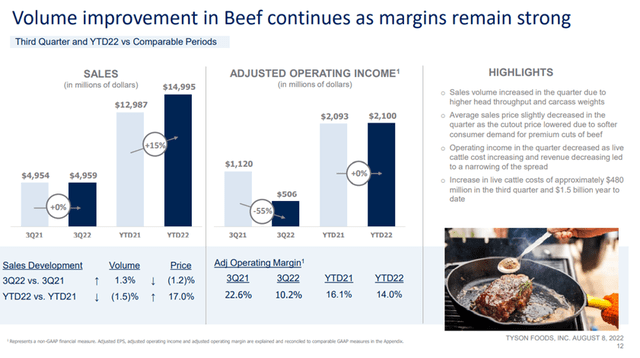

The company is doing fantastic YTD, but the stellar performance is drastically slowing as inflation is making its impact on financial performance. For Q3-22 in particular, management noted that margins in the beef segment suffered, and observing the 10K for FY2021, beef was the largest operating margin contributor, meaning that if that segment suffers in this financial year, the impact will be felt, as can be seen in the numbers.

The stock markets always look to the future, and not the past, and here we see the source of the expected EPS contraction for FY2023. Management pointed out that sales growth stemmed from general price increases to combat inflation, but the market is worried the company can’t transfer the increased costs in total and not just in the short-term.

On expenses, we incurred greater costs during the third quarter versus the comparable prior year period as live cattle costs increased approximately $480 million in the quarter. We had sufficient livestock available in the quarter driven by higher herd liquidation due to drought conditions. We delivered segment operating income of $506 million in the quarter, down 55% versus the prior year comparable period. Our operating margin of 10.2% was lower than the same quarter last year but remains a strong performance.

Stewart Glendinning, CFO, Earnings Call August 8th, Q3-2022

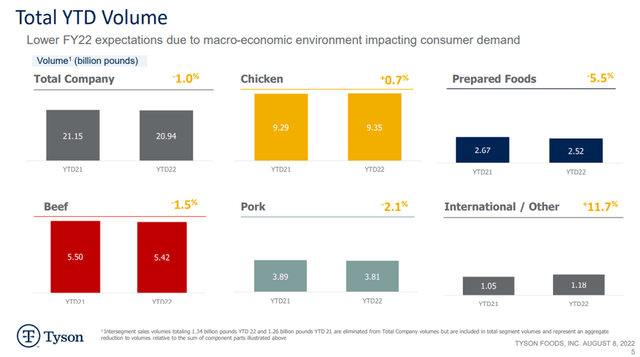

Tyson Foods Q3 Volumes (Tyson Foods Q3-2022 Quarterly Results)

My second observation concerns volumes and ties together with the sales increase, showing the effect of price hikes towards customers. However, as evident from the numbers, that price increase didn’t translate to earnings increase and it will be interesting to observe how this develops in the coming quarters. Tyson Foods is definitely a staple, but it’s also worth considering that if the macro environment worsens, that consumers may opt out of the pricier protein categories and settle for the less expensive options, which could impact Tyson Foods’ margins negatively.

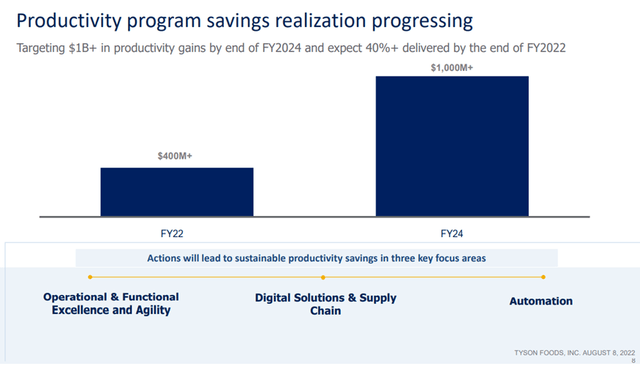

Tyson Foods Q3 Efficiency Program (Tyson Foods Q3-2022 Quarterly Results)

My third observation concerns the illustration above. During Tyson Foods investor day back in 2021, management launched three prioritised pillars. Winning with team members, winning with customers and winning with execution. When it comes to the execution, management was swiftly out of the gates with an efficiency program expected to yield a full $1 billion in cost savings by FY2024. This program has directly softened the earnings blow from increasing costs. Management notes, the direct effect on particularly the chicken segment, as also evident in the segment details below.

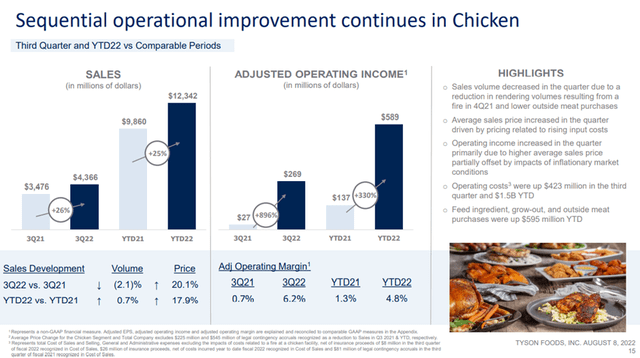

Tyson Foods Chicken Segment (Tyson Foods Q3-2022 Quarterly Results)

Tyson Foods’ sources of earnings is diversified across the different segments, but Beef remains the most important driver of income during these years, making up more than half of the operating income YTD. Unfortunately, we also see a negative impact during this quarter, where operating income from this segment has collapsed by 55%. As such, what carries Tyson Foods across the finish line in this quarter, is the margin improvement in the chicken segment as well as the operational efficiencies showed in a previous slide.

It’s an important gauge into how we can expect Tyson’s finances to develop over the coming quarters, as the company will suffer during the period where it strives to identify the new equilibrium of input costs and outgoing sales prices.

Tyson Foods Beef Segment (Tyson Foods Q3-2022 Quarterly Results)

The fluctuating segment performance aside, only Q4 remains to be seen before FY2022 comes to a close, meaning there should be little deviation from the FY2022 guidance shared during the Q3-22 performance update. As such, investors will be looking to the financial year of 2023, where earnings are expected to contract. No one can know for certain how inflation will develop over the coming year, meaning that estimates looking more than 6-12 months ahead quickly lose their meaning, however, Wall Street currently anticipated that EPS will start growing again in FY2024 with a 5.45% increase off the back of the expected contraction in FY2023.

Tyson Foods, The Shareholder-Friendly Company

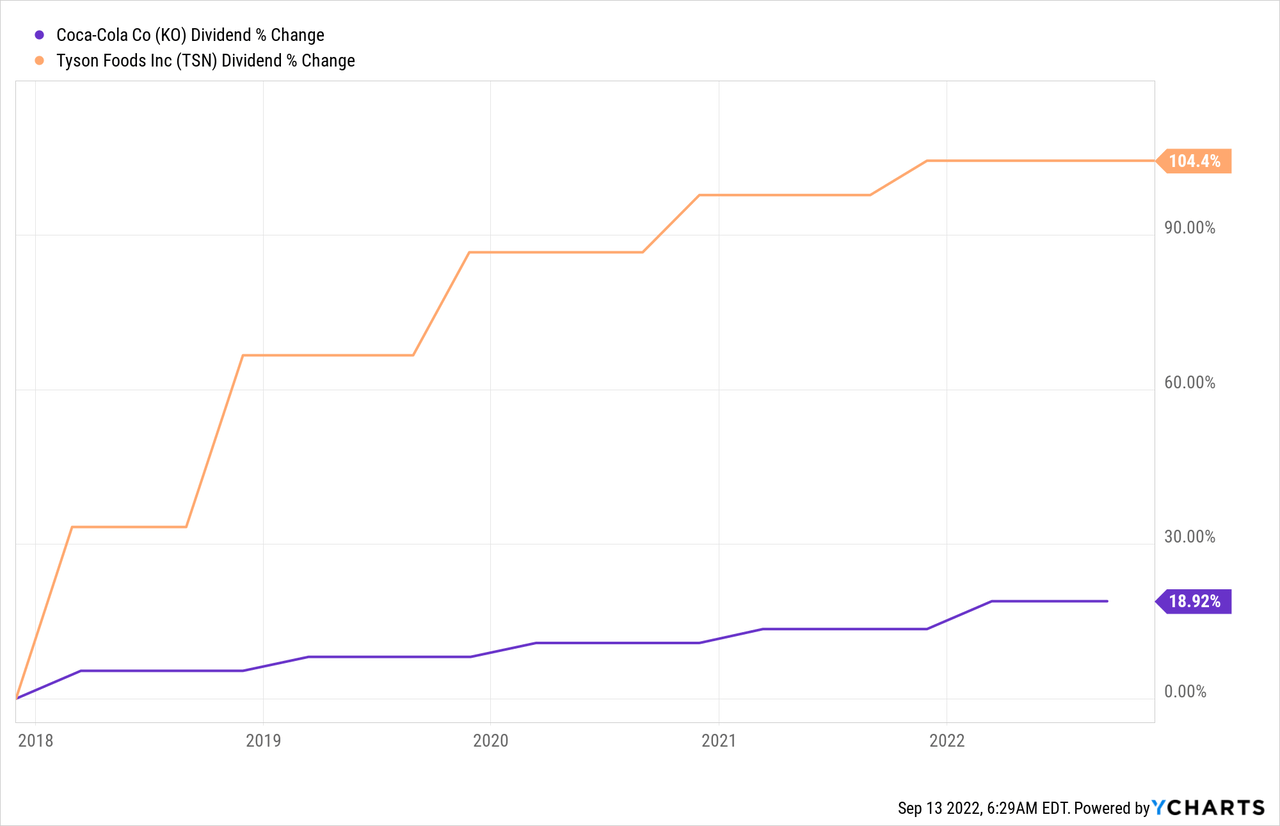

Tyson Foods has a dividend growth track record of ten years, which naturally bleaks compared to many of the dividend giants, such as Coca-Cola or the newly minted dividend king Pepsi. However, with my expected holding period counted in decades and not years, I’d rather own a company with a strong hiking outlook, than one I believe will most likely give token hikes more often than not. It is naturally a question of your holding period, as the initial yield paid by for instance Coca-Cola is currently higher at 2.82% but quite often at 3% or above, making the initial yield quite a bit stronger. However, in the longer run, the compounded annual growth rate of the dividend wins, not to mention the total returns perspective for a company in a healthier financial position.

For investors depending on the generated income via dividends, perhaps it would be more meaningful to go with the more mature blue chips who provide a higher initial yield with a weaker outlook for dividend growth.

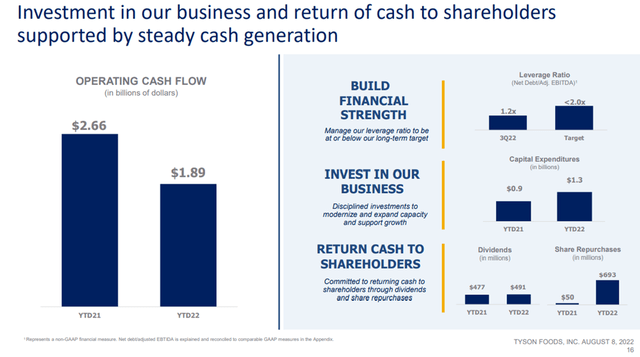

Tyson Foods Shareholder Returns (Tyson Foods Q3-2022 Quarterly Results)

Management is committed to rewarding shareholders for their patience by share repurchases and a growing dividend. Utilising Coca-Cola as a comparison, and the difference becomes clear. In the past five years, Tyson is vastly outgrowing Coca-Cola when it comes to management’s ability to provide a growing dividend. The sharp reader will of course identify that Tyson’s dividend grew strongest in the initial part of the observation period and has since flattened. Growth is never linear, but the prospects for a growing dividend can be determined by the payout ratio. With a payout ratio just below 20% for Tyson and a payout ratio just below 80% for Coca-Cola, it’s clear who holds the advantage. That doesn’t mean Coca-Cola can’t improve the payout ratio by growing its free cash flow, but it comes from a substantial disadvantage as it’s already at a point where the ability to grow the dividend in a meaningful way, is uncertain. On the other hand, I don’t expect Tyson to provide shareholders with a hike in line with the average of the past five years come this November. The economic environment is simply too uncertain, but there comes a day when the global economy returns to normal, giving management a clearer outlook, allowing for higher increases. Indeed, the consensus expectations are a 2-3% hike this year, followed by a 10% hike the following year.

Similarly, if we observe the development in number of outstanding shares, we’ll see that Coca-Cola after many years of repurchasing own shares have reached a slump where the buybacks don’t make up for the issuance of new shares, while Tyson is indeed reducing its float. Buying back own shares, is a meaningful way to distribute cash, especially in a situation where a stock is undervalued. Decreasing the number of outstanding shares also reliefs some of the burden associated with a growing dividend, as a given hike will have to be distributed amongst a reduced number of shares.

Valuation

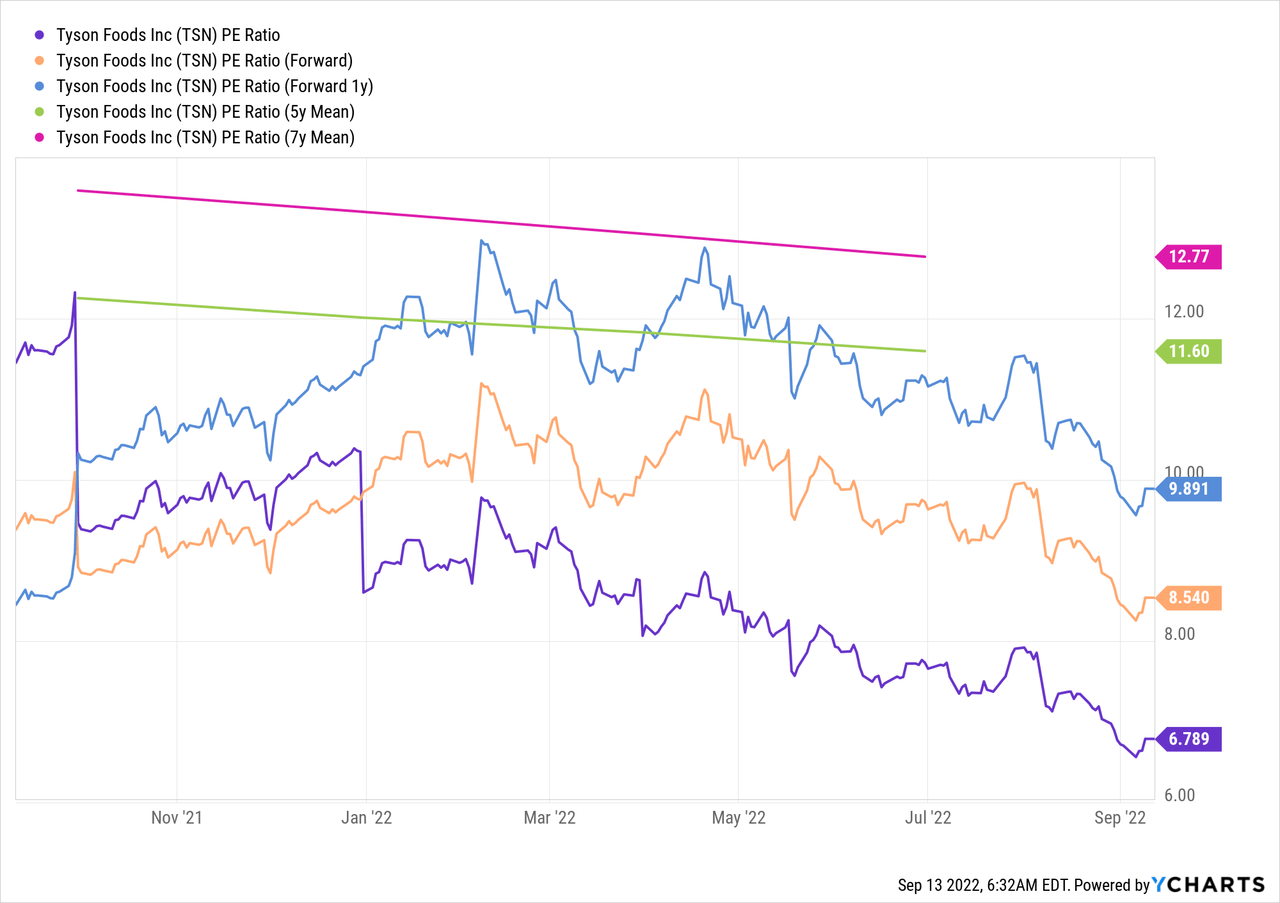

Tyson Foods is a mature company focused on optimising its earnings, making the price to earnings metric a reasonable choice to understand the current valuation.

The graph above, is in my opinion, the expression of a company that is currently out of favour. The mean P/E ratio seen in a 5-year and 7-year perspective, shows a company the market has appreciated less in recent years, despite the fact, that the underlying economics of the company has been doing fine. As we can see from the forward P/E ratios, there is significant volatility tied to the “earnings” part of this metric, meaning there is uncertainty to the actual expected earnings, but also some margin of safety compared to the long-term mean levels.

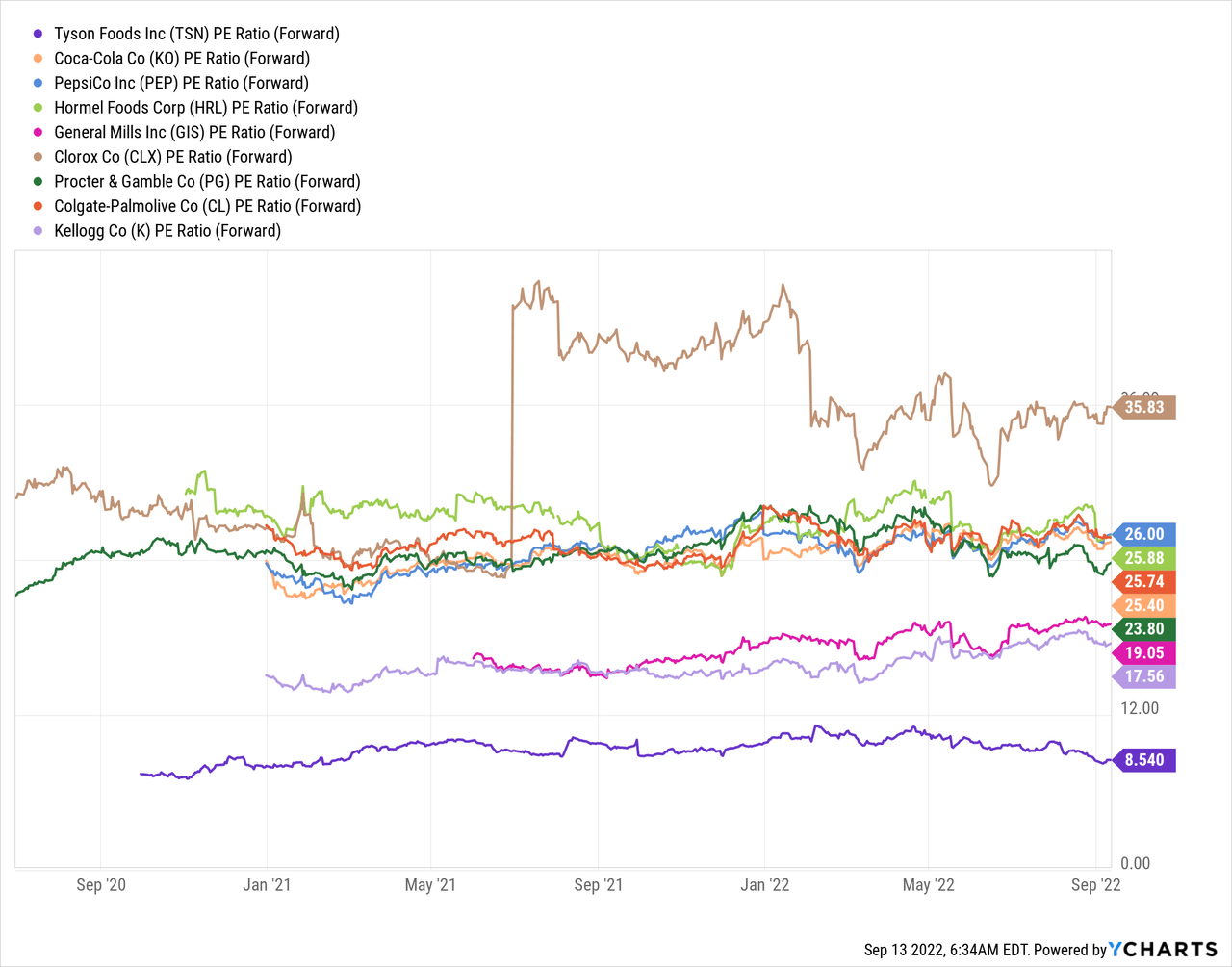

Taking a basket of consumer staple companies, and the difference becomes very clear. This section doesn’t contain a deep dive of all these individual companies, so including them here is only for providing a reference point, when taking into perspective that all these companies belong to the same basket, consumer staples.

Looking at revenue growth over the past decade, and Tyson beats them all, looking at a five-year horizon and Tyson narrowly loses to Pepsi and Hormel Foods, but still belongs in the top three. looking at free cash flow growth over the past decade, Tyson again wins, but comes in the middle of the pack when looking at a five-year or three-year period. However, there is little reason, as I see it, why Tyson should trade at such a significant discount to its peers, at least in the long run.

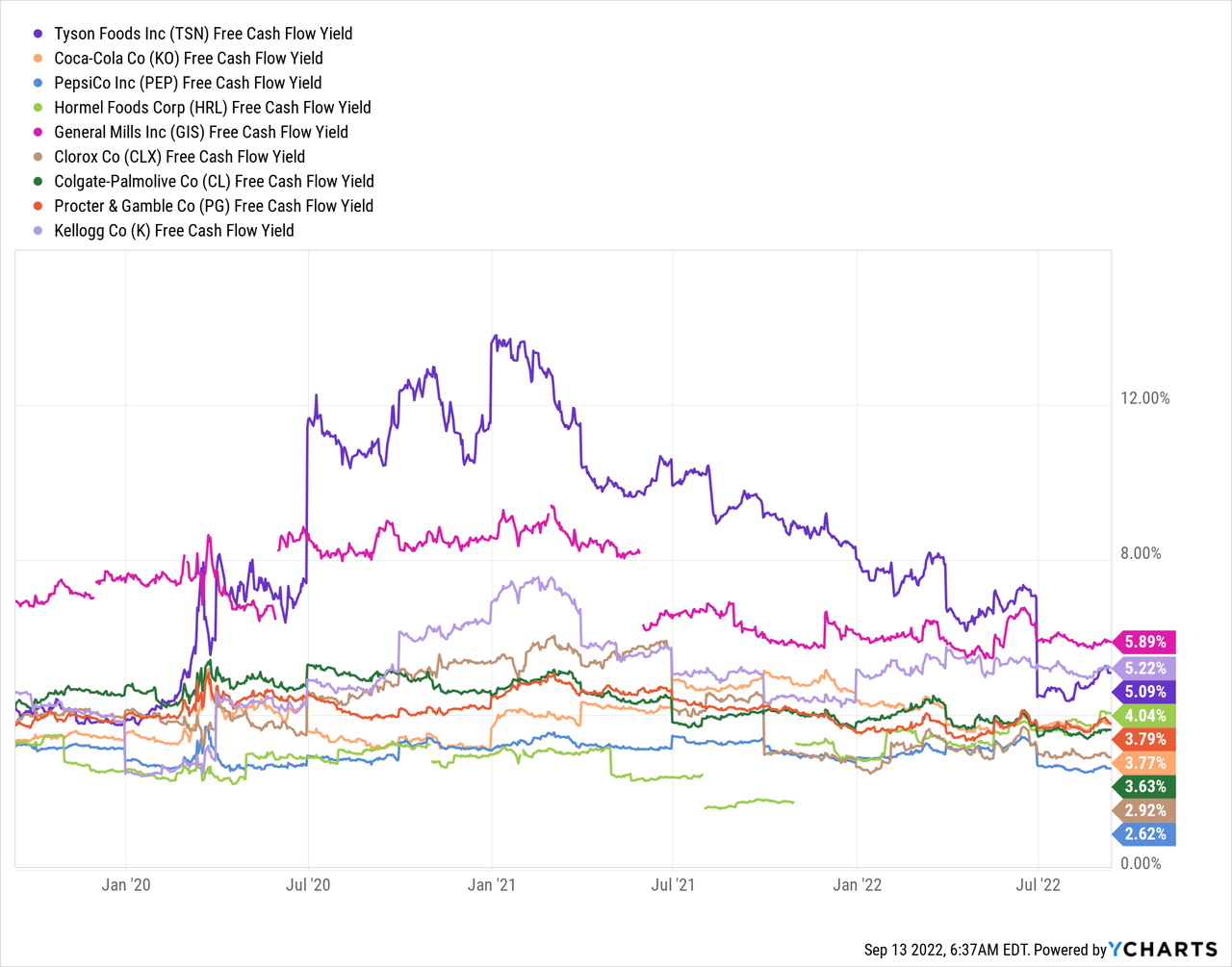

I’ve also inserted the free cash flow yield, an indication of how much cash is available for the company as a percentage of its market cap. Typically, a cash flow yield above 4% is what I would consider attractive for mature blue chips. Effectively, the higher the ratio, the more attractive it is for investors as it shows that a given company is capable of generating sufficient cash to take care of its debt, dividend and other obligations. With free cash flow currently in a trough period, the ratio stands to reach 7% if utilising the forward free cash flow expectations, suggesting to me, that today is a favourable period for investors to go long. However, as is very evident in the graph above, Tyson has seen its free cash flow dwindle dramatically YTD as economic conditions has worsened, meaning we can’t know for certain that the situation will have improved in a year should the current environment remain the same. In other words, in half a year from now, Tyson Foods may have to revise their FCF outlook causing the FCF yield to contract.

In order to round off this section, I’ve inserted the forward expectations for revenue and EPS, showing that in terms of earnings, the market is quite pessimistic on Tyson’s behalf for the coming year, and rightly so, as with many other companies and sectors. Tyson Foods has been around for almost a century at this point, and I’m feeling confident they’ll also be here tomorrow, so perhaps it’s worth considering the opportunity to go long in a period where consensus expectations are gloomy.

Wrapping up

In my perspective, Tyson Foods is an underappreciated dividend growth gem, which often disappears amongst its more famous consumer staple peers. However, it doesn’t take away that Tyson is running a profitable business, diversified across multiple divisions, having grown revenue and free cash flows over the past decade. While currently suffering from the same troublesome macro conditions as many other peers, Tyson Foods has been around for 87 years, and being a global leader in protein, odds are, they’ll be here tomorrow, growing the business and its dividend for many decades to come. As an investor with a time horizon counted in decades and not years, I’m confident holding Tyson Foods while the management continues to develop the business. For now, quarterly reporting is rougher than a year ago, but at a forward P/E of 8.5, I find there is sufficient margin of safety at the current valuation.

Be the first to comment