Introduction

With the COVID-19 virus surpassing 100,000 cases as of the time of writing, investors have turned to selling equities in fear that the virus will spark a global recession. This idea has been fueled further by the virus spreading in Europe and North America. Investors should probably be cautious here, as equities have been volatile and will likely continue to be for some time. But there are some investments that still make sense. Here are two companies that are, for the most part, going to do well in spite of the COVID-19 virus.

Company #1 – Physicians Realty Trust (DOC)

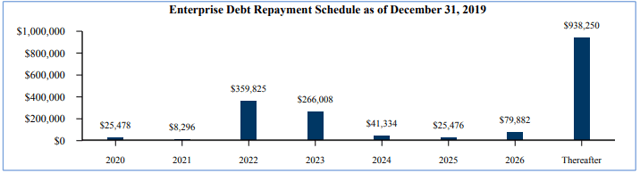

Physicians Realty Trust is a REIT that looks to acquire, develop, own and manage healthcare properties leased to physicians, hospitals, and healthcare delivery systems. The company has a strong track record of making solid acquisitions and now has 266 properties for which the company has paid $4.767B. As of December 31, 2019 96% of the properties were being leased. Management expects to be able to do another $400 to $700 million of investments in 2020 with a 5.25% to 6.25% average cap rate. The company deploys a reasonable amount of debt and has staggered debt maturities to allow for continued growth.

Obviously, the need for healthcare facilities will be necessary as the COVID-19 virus continues to spread. This is a very solid company with good management that should see even greater lease out rates going forward, should the virus get significantly worse.

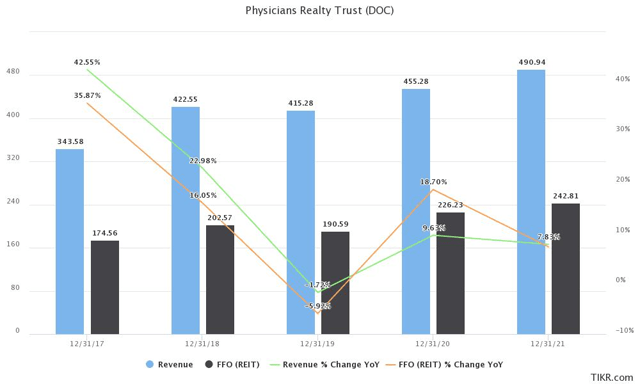

2019 saw a slight decline in revenue for the company, but analysts have the company growing revenue in the high single digits once again in 2020 and 2021, and funds from operations growing low to mid-double digits in 2020.

Source: TIKR.com

Finally, since this company is a REIT it pays a relatively high $0.23 quarterly distribution. With the stock at $19.60 as of the time of writing, this works out to an annual yield of 4.7%. Higher yielding stocks could help more conservative investors ride out some of the volatility in the market right now.

All things considered, DOC stands out as a company with strong financials and management in a business that isn’t going anywhere any time soon. Furthermore, the stock has held up better than most, down just 5% from the recent highs, back to where it was in late January. I expect this stock to continue holding up even in the midst of a market correction. It could be a solid anchor in virtually any portfolio.

Company #2 – HUYA Inc (HUYA)

HUYA is one of China’s leading online gaming live streaming platforms. Readers familiar with the Amazon-owned (AMZN) website Twitch.tv will be familiar with this concept. HUYA is essentially China’s Twitch.tv. Popular gamers will live stream their gameplay on the site for others to watch. Viewers are able to subscribe to the streamer for a small payment per month for various perks. That money is then split between HUYA and the streamer.

This company is not only immune to COVID-19, but will likely benefit as a result of the breakout. Parts of China are in lockdown mode. Schools and businesses are closed, meaning there are more people with more time to tune in to entertainment like video games. More viewers naturally leads to more advertising and subscription revenue for HUYA.

I consider HUYA to be a hyper-growth company. The company will likely have grown revenue by nearly 80% in 2019 when the numbers for Q4 come in. This is, however, expected to decline in 2020 to around 36% growth. The last few quarters have seen profitability skyrocket, something that I think will continue as the company has strong operating leverage built into the business model, as I explained in my February article on the company.

Furthermore, the company showed over $1.3B USD in cash on its balance sheet as of the end of Q3 2019.

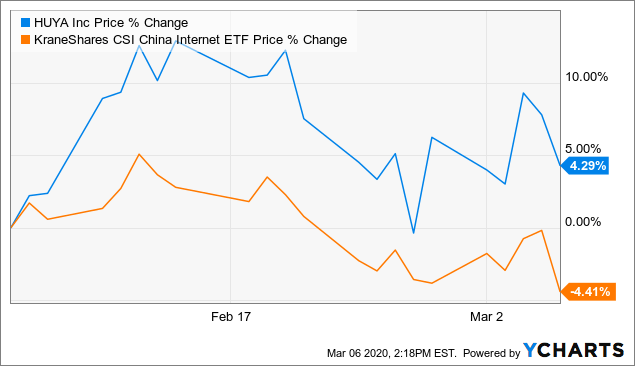

The stock has held up well posting a positive 4% gain in the last month, while the China internet ETF (KWEB) has seen a modest 4% decline.

Conclusion

Both of these companies should hold up well even in the face of a severe global pandemic and resulting global recession. And if that doesn’t happen, these are still excellent companies that investors can buy and hold for some time. Readers should consider researching these companies further if they’re looking for stocks that should remain solid investments despite the COVID-19 virus.

I’ll be writing more articles on great (or sometimes not so great) stocks. If you enjoyed this article and wish to receive updates on my latest research, click “Follow” next to my name at the top of this article. Also, be on the lookout for my upcoming Marketplace service, Superior Smallcaps.

Disclosure: I am/we are long HUYA. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Be the first to comment