VioletaStoimenova

Dear readers and followers,

As I mention often in my general articles, the market tends to go in cycles – as do companies. Understanding and recognizing both when a cycle is in one place, and when it’s in another is a crucial part of being a value-oriented investor, as I am.

Over the course of the past few years, I can point to several companies that I bought at dirt-cheap valuation, then sold them at RoR of triple digits, netting returns that by far outpaced the market.

But more importantly for you – I can show you two companies in this article, that I believe may do exactly that until 2024E.

Let’s not beat around the bush – but get going.

The companies

First things first. Just so you know – both of these companies are:

- A-rated or above.

- 3.5% well-covered, growing dividend yield with over 10-15 years of safety.

- Over $8B in market cap at the very least – one of them is beyond triple that. These are not the small companies we’re talking about.

- Their upside is not based on premium, but on reversal and well-established earnings growth and dividend growth.

- Both companies have been in exactly the same sort of downcycling before – and recovered.

Sounds pretty exciting, doesn’t it?

This is what I like to do. I like to find companies that even if they drop further or if it takes years for them to deliver on what I expect, I’m never in any worry, because their fundamental business is simply “too good”. Neither of these companies could conceivably “fall” – not without significant headwinds well beyond what we’re currently seeing.

As long as that is coupled with the points above, some pretty amazing things can be happening.

So, here they are.

1. Lincoln National Corporation (LNC)

I haven’t been this excited about Lincoln national since the doldrums of the pandemic. The company is an L/H insurer, which comes with the COVID-19 risks as well as some other potential headwinds and issues.

However, at the same time, the company is A-rated, plays in everything from annuities to workplace solutions, and has a near-unparalleled distribution network and product diversity. The risk management, key for insurance businesses, is absolutely solid.

Some of the “star qualities” of its balance sheet include:

- a 400% RBC ratio.

- Over $450M in pure cash at the holding company level

- Pre-funded debt maturities, including the 2023E nearest one.

- Already executed on significant reinsurance deals, generating billions and hundreds of millions in capital.

- Repurchased a significant amount of shares at low valuation – over $100M in a single quarter, and 12% of all shares outstanding since early 2020.

- over 80% of the company’s sales are non-guaranteed, showcasing the skill of the salespeople as well as the like for the company’s products.

- Investments done by LNC are 97% investment-grade, and at competitive yields.

And, perhaps more importantly as we’ll look at the valuation, 2Q22 results were good.

Oh, there were some small issues. Pandemic-related claims, some investment incomes below expectations – you know the drill, businesses don’t just go up. Life insurance and health insurance haven’t had an easy time of it. But the company’s book value keeps growing, and the company guides for being able to deliver a CAGR EPS growth rate of 8-10% for the next few years.

Does this sound like a company to you that should be trading at less than 6x P/E?

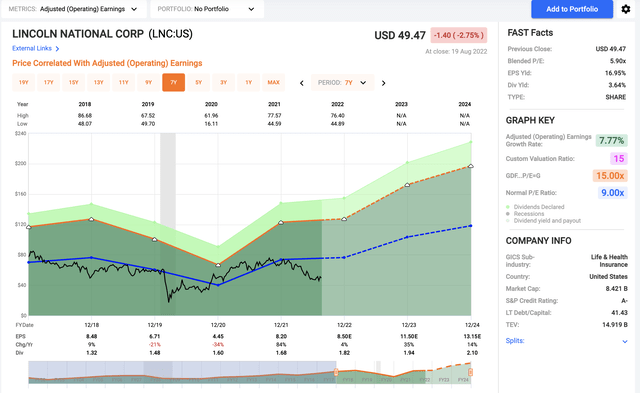

LNC valuation (F.A.S.T graphs)

Because that, as you can see, is literally what the company is currently doing. Despite decent EPS growth slated for this year, the company is trading below 6x P/E. The normalized company P/E-ratio is around 10x, or just below that depending on what time period you look at.

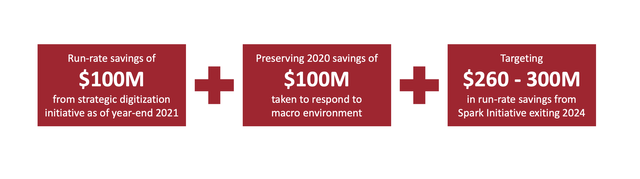

What’s more, there are plenty of indicators that the company will be able to deliver the growth it promised. It’s adding new products and features, repricing its products, and shifting to a more appealing customer mix. Additionally, the company is running several programs to improve expenses that are likely to generate additional savings going forward, delivering higher earnings.

The point that I want to make when it comes to LNC is simple. This is a top-class, industry-leading (in terms of risk management) insurance business that has a proven strategy leading to positive returns.

Since the financial crisis, the company has repurchased around 53% of shares outstanding, or $8B. This has put the company in a very appealing position in terms of valuation. The market does not seem to yet realize this in full.

I’m happy to field the bearish argument as well – but there is no obvious, bearish-specific argument for this company that holds any water. The general argument against insurance and finance is that the current situation can bring volatility. COVID-19 is also an argument against any health/life insurer. However, investing in LNC is much like investing in Unum (UNM) – except that LNC actually doesn’t have the block-specific issues with LTC that Unum has, and that LNC has a credit rating that’s 2 notches higher than Unum, which when you compare to BBB, is very significant.

Ergo, I see LNC being significantly safer in terms of investing, which also shows in its payout ratio compared to earnings, which is absolutely superb.

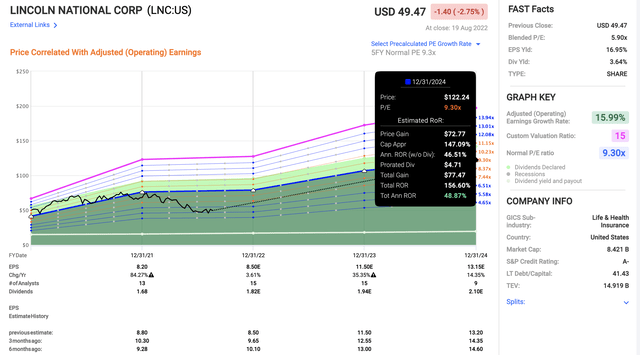

Even assuming only a very modest normalization to a 9.3x P/E and assuming realized growth rates, the upside for this company is no less than 45% and possibly as high as 50% per year. That makes it a 140%+ 3-year RoR, simply in the case of normalization.

I’ve recently pushed substantial amount of capital to work in LNC, and I intend to make it a full position over time, with a 5% portfolio allocation target based on the thesis presented here.

This is company #1.

The qualities of Munich Re should not be unknown to any serious investor. The company became famous after the San Francisco Earthquake in 1906, as it was the only insurer that remained fully solvent after paying out all claims, around 15.5M marks at the time. It is currently the largest reinsurance company on the planet, and it sports a coveted AA-credit rating, making it even safer and considered next to LNC.

Warren Buffett is a prominent shareholder of Munich Re. It was once his biggest holding, and now he owns around 3% of the business.

MURGY is also the largest primary insurer in all of Germany, with its semi-peer Allianz (OTCPK:ALIZY) located on the same street as Munich Re. Operations today come in three areas – Life, Non-life, and Reinsurance. Reinsurance is the largest at over 70% of sales revenues, with life at about 10% of revenues and non-life at around 6%. All said and done, Munich Re is still a reinsurance major, not a primary insurance major, at over 80% of annual revenues.

Munich Re has made a history of performing well when competitors have been down or posted losses, thanks to titanium-clad underwriting standards and safeties. It’s what allowed them to post a near €3B net profit during the financial crisis. Most European peers, including Swiss Re (OTCPK:SSREY) and Hannover Re (OTCPK:HVRRY), posted losses in 2008 – while MURGY went the opposite direction.

It is perhaps, the most conservative reinsurance business out here – and that’s a good place to start in the current situation we’re seeing around the world. In terms of net profit, reinsurance is the primary contributor here. More than 60% of Munich Re’s annual profit levels are from reinsurance.

Its ambition-2025 targets include:

• Return on equity to increase to 12-14% by 2025

• Earnings per share to increase annually by 5% on average by 2025

• Dividend per share to increase annually by 5% on average

• Solvency ratio to remain in the ideal corridor of 175-220%

• Extensive decarbonization strategy: shifting away from coal, oil, and natgas/LNG.

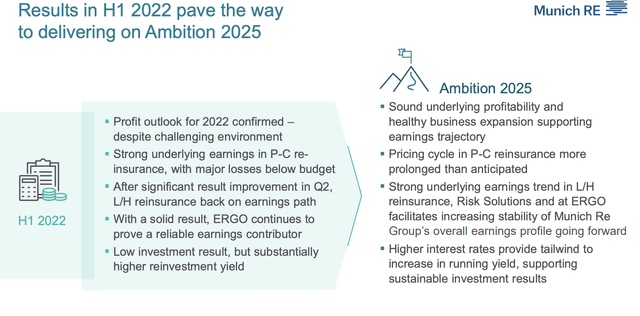

As of right now, it looks increasingly likely that the company will be able to deliver on these goals.

The company was able to expand its business and deliver increased premiums. Despite all the macro challenges currently clear in the market, the company is well-prepared for such trends through various hedging, positive results from the ERGO segment, and generally the fact that claims inflation isn’t driven by CPI or other more “common” consumer inflation drivers.

Renewals and new contracts show impressive prices, and the company saw an increased volume for its services and offerings, much like is typically the case for the company in economically challenging times.

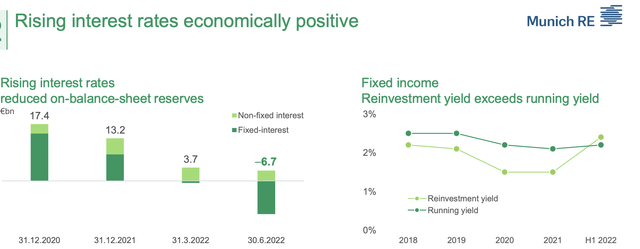

Also, remember, rising interest rates are generally positive for a company like Munich Re.

Despite the company trading relatively flat, there are no indicators that Munich Re wouldn’t be able to deliver on its goals. Indeed, its 2022E guidance has been confirmed, and the company expects to be able to deliver an EPS growth of a few percent.

However, the market is telling the company either “We don’t believe you”, or “We do not care.”

Why?

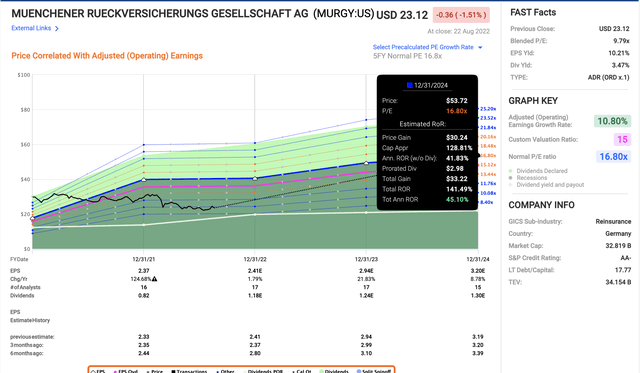

Because this AA-rated reinsurer is currently trading below 10x P/E, compared to a 5-year normalized 16.8x multiple. The market has not in any way taken into consideration the company’s EPS growth delivery and seems to ignore the realistic potential of a double-digit 3-year CAGR EPS growth.

Like with LNC, the upside for this company is massive. Over 45% per year, if normalization occurs. Over 140% in less than 3 years.

The yield displayed for the ADR is incorrect. The native yield based on current dividends for native MUV2 is 4.74%, making Munich Re:

- Better Yielding

- Better credit rating

- Longer history

- Better fundamentals

- more than 3x the market cap of LNC

LNC is far from a bad investment. It’s an amazing investment. But out of these two, MURGY is my #1 pick. That’s also why I’ve staked out a 5% portfolio position in the company, and why I’m hoping it drops more so I can add more.

Buying Munich Re at this valuation is, to my mind, insanity. But as always when I view the market as being irrational, I thank it and work from there. In this case, I work with the largest reinsurance company in the world that is currently undervalued.

This is company #2.

Wrapping up

This article serves as a very good snapshot of how I think about investing.

When I invest, I want the realistic potential of a 3-4-year upside of no less than 100%. If this isn’t the case, then I want the sort of safety that is typically only found in bonds.

I combine this with stringent safety demands and qualities in history, management, and other variables. I’m not saying I never invest outside of these parameters – but any investment outside of these is usually extremely limited. If I invest $100 in such a company, I usually would go for $10,000 or more in a safe company – as a means of comparing my usual capital allocation priorities.

The reason I work or invest like this is to protect the principal, at all costs. Some might say this is easy to do once you have a substantial amount that already covers all bases simply with the dividends alone. However, the fact is that I have never invested in any other way, not knowingly, nor have I ever considered the sort of speculative investments or Hail-Mary’s attractive that some investors want to do.

Because I am still relatively young – I’m 36 at this time, and was well under 30 when I started – this is a relatively uncommon view and approach in my age demographic. I often find that I share more in common with investors at least half again, or even twice my age.

My approach almost guarantees that I won’t be getting more than 100-500% RoR on any investment that I make over a 5-10 year period. The overall ranges I work with, and the companies I invest in – all of these factors more or less prohibit larger returns.

To garner returns of over 1,000%, usually in a shorter timeframe, you typically need to be prepared to take larger amounts of risk. What’s more, you still need to invest substantial amounts of capital in order to make a small investment into riches based on a 1,000% RoR.

Me, I took the long and patient road.

I continue on that road with the doggedness and patience of a long-time wanderer, determined to stay on the path.

It may not work for everyone – but it works for me – and it may work for you.

Let me know if you have questions.

Be the first to comment