Dimitrios Kambouris

Elon Musk attempting to terminate the Twitter (NYSE:TWTR) merger is no surprise. The unknown has always been any outcome of an attempt by the social media company to sue Musk. Either way, Twitter doesn’t face a ‘code red’ event as suggested by a prominent analyst. My investment thesis remains ultra-bullish on the stock following a likely dip, as traders exit a position with a hoped for outcome of $54.20 per share.

Deal Termination

After the market close on Friday, Musk’s advisers filed with the SEC a formal notification of his attempt to terminate the merger agreement. Musk focused the termination notification almost entirely on the bot issue despite the original agreement having acknowledged a major benefit of acquiring the social media platform was to fix the supposed bot issue with the details here from a Twitter user.

On top of these points, CNBC merger expert David Faber doesn’t see Elon Musk having an out on the merger. Mr. Musk has to prove a material adverse effect from the bot totals and the financials would have to be fraudulent for this to be the case.

At no point has Musk actually provided any details proving that Twitter is wrong about the bot and spam account totals. The company has regularly provided details on the work to limit bot and spam traffic with my previous research highlighting how the language from Musk always differs from the company’s internal work to limit the amount of spam accounts counted in the monetizable daily active users (mDAUs). This number can far differ from what a user encounters on a daily basis without those users being counted in user totals.

The basis of these numbers being an issue is the ability to monetize actual users via either new subscription services or the primary digital advertising methods. Twitter wouldn’t be able to continue attracting billions worth of advertising dollars, if the user numbers weren’t close to accurate.

In no surprise, Twitter is fighting back to enforce the original merger agreement. The company hired the law firm Wachtell, Lipton, Rosen & Katz, LLP over the weekend and a deal closure would offer nice payout to shareholders holding onto the stock through this chaos.

For now though, we’ll ignore that the Chairman hadn’t tweeted since June 29th, other than an obligatory ‘Happy Independence Day’ tweet on July 4th. Twitter has shuffled a lot of executives and even laid off some recruiters in moves to streamline the business and possibly alter the direction of Twitter towards a more open platform with free speech goals.

Moving Forward

Regardless of the lawsuit, Twitter will likely remain an independent public company. The courts are highly unlikely to force Musk to purchase the social media site for $44 billion, as the Tesla (TSLA) CEO may not even be in a position to purchase Twitter in the future. The most likely outcome is a settlement with Musk required to pay at least the $1 billion breakup fee, and possibly much more.

The stock will likely plunge on the news of the company remaining independent and will initially trade at an elevated level due to hope by some traders of a lower deal price. The Twitter BoD has no reason to accept a lower deal from Musk with the current contractual obligation at $54.20.

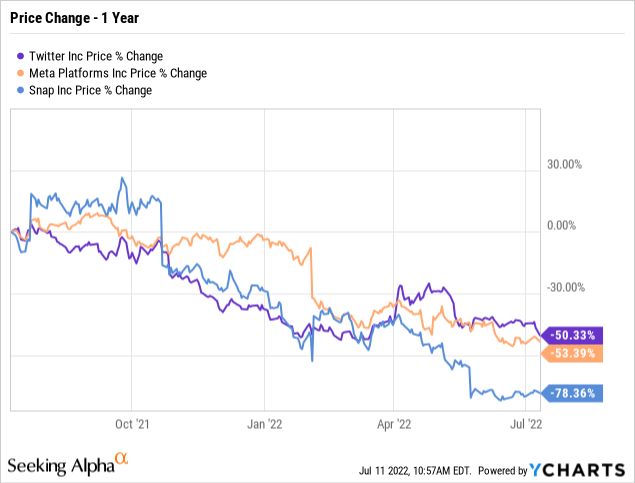

After a nearly 7% dip in initial trading this week on the announcement of the deal termination, Twitter is already down 50% over the last year. Both Meta Platforms (META) and Snap (SNAP) are down similar amounts in a sign of the potential further limited downside for Twitter, though these stocks have faced different issues this year.

Remember, Twitter traded at $70 last year when the user count was far lower. Unlike a lot of other social media platforms, the company hasn’t faced the same user issues with the war in Ukraine and other events boosting user counts far beyond the covid peak in 2020.

Despite the market collapse in social media and tech stocks, one can argue Twitter hasn’t lost value in this period. The stock is already down over 50% from peak levels despite growing users. Most of the stocks collapsing during this period have seen key metrics disappoint.

The fact that a prominent analyst calls this a ‘code red’ scenario for Twitter leads to some of the problems for the stock in the short term. While the company never needed a deal with Musk, Wall Street continues to promote such an outcome was needed.

Dan Ives of Wedbush Securities suggests Twitter is in dire straits, yet the user count is up 56 million mDAUs, or 30%, from the original covid peak of 186 million users in Q2’20. The company has struggled with growing ad revenues, but the social site has launched multiple subscription services this year.

Running some numbers, Twitter mDAUs were worth $305 at $70 last year when the market cap was ~$55 billion and the user total was 186 million. Now, each mDAU is worth only $116 with a market cap of $28 billion and 242 million users now. In essence, the per user value for Twitter is already down 62%.

The biggest question is the leadership for the platform. New CEO Parag Agrawal, along with the board, came to a decision to sell the company to Musk in a move planning his exit. Mr. Agrawal suddenly finds himself in the midst of upheaval at Twitter where the company has been exposed as lagging in a free speech focus and several leading executives were forced out presumably for the company to take a different approach.

In addition, the current CEO and CFO promoted the business as being on the 2023 path to 315 million mDAUs and revenues reaching $7.5 billion. The current trends in the digital ad market leaves some wriggle room for the executives to miss targets, but the new CEO could lose credibility in the process of both missing financial targets and failing to close a major deal.

Analysts already forecast revenues only hitting $7.2 billion in 2023. The market would probably be happy in a scenario where Twitter hits $5.9 in revenues this year and grows by over 20% next year.

Takeaway

The key investor takeaway is that the stock is only worth ~$28 billion on this dip. Twitter could fall further due to the Musk deal termination, but the stock is far too cheap here with revenues heading towards $7+ billion next year.

Be the first to comment