Investment Thesis

Twitter (TWTR) used to be a very attractive investment while the economy was ticking along strongly in 2018-2019. But in 2020, the advertising sector has been dramatically impaired – even if just temporarily.

For now, investors are being asked to pay more than 7 times forward revenues, for a company that is likely to post revenue declines in 2020 compared with 2019.

On the other hand, Twitter’s newly-found larger audience can help investors build their bullish thesis if Twitter suddenly improves its ability to monetize these users.

For now, my enthusiasm for this investment opportunity sours.

Ad Revenue Is An Industry-Wide Problem

Twitter reports that ad revenues are down 27% starting in the second week of March. This was an echo of Facebook (FB) and Alphabet (GOOGL)(GOOG). In the same manner that other social media giants reported an increase in users, Twitter has been no different, with mDAU (average monetizable daily active users) increasing 24% year-over-year.

This strong growth in mDAUs was particularly positive, and if Twitter is able to successfully retain these users subsequently, with strong engagement on topics that interest these newly-found users, this would be a highly compelling aspect of the bull thesis.

Indeed, apart from a substantial jump in users, the rest of its performance looks middling.

Indeed, we know from the shareholder letter that Twitter’s absolute number of mDAUs stabilized toward the end of March. So the critical question here is what level of success will Twitter have in keeping these users engaged? And what sustainable level of success will Twitter have in monetizing its user base?

Balance Sheet Remains Strong

Twitter’s balance remains very strong, with $7.7 billion of cash and equivalents. While Twitter does carry some debt in the form of senior notes and convertibles, its net cash position of $4.3 billion affords Twitter substantial flexibility.

Nevertheless, the tone of the shareholder letter felt more subdued than recent letters and talked of broad cutbacks on spending and hiring. Also, we can see that from a free cash flow perspective, Twitter’s ability to bring clean cash more than halved year-over-year, down to $126 million compared with $271 million in the same period a year ago.

Furthermore, of its $126 million generated in Q1 2020, nearly $100 million is in the form of stock-based compensation – a non-cash charge, and this brings up two problems:

1. At some point, management will cash in their options and substantially dilute its shareholders. Accordingly, this high level of stock compensation makes sense when the company is oozing free cash flow. But when the company is essentially working to pay management, it doesn’t make it overly compelling to invest alongside management.

2. Realistically, if the share price doesn’t migrate higher over the near term, management will require more stock-based compensation to retain top talent. For now, Twitter notes that it expects its stock-based compensation to increase by 25% sequentially. This would put this quarter already at $125 million of stock-based compensation before any additional increases to retain talented executives.

The Best Time To Turn Defensive?

In the past, I’ve been an outspoken bull of Twitter, believing that it could make for a terrific investment opportunity. Presently, while I’m still bullish this investment opportunity, I’ve been hit hard with a dose of reality – Twitter continues to struggle to increase and get strong ad revenue.

Twitter talks about cutting back on costs for the rest of the year. This is the opposite stance of what Facebook talks about in its recent quarterly report. Whereas CEO Mark Zuckerberg notes the need to continue to invest during the downturn to come out stronger, Twitter talks about dramatically taking its foot off spending.

Specifically, Twitter states that its total expense growth will be considerably less than the 20% it had pointed towards at the start of the year.

Again, on the surface level, it makes sense to be more defensive when the sector weakens. But ironically, that’s exactly the best time to go on the offensive and to grow the total addressable market.

Valuation – More Uncertain Than In The Past

I’ve tried hard to consider how much Twitter could be worth. There’s no question that there’s overall despondency amongst its shareholders – and this is typically a very attractive and bullish sign.

However, presently, analysts are still estimating that Twitter’s 2020 revenue should reach $3.3 billion. But I find this figure way too high.

Remember, for the latter part of March, Twitter’s ad revenue was down 27% year-over-year, with this trend continuing into April. Even if Twitter bounces back from this level rather quickly, I fail to see how Twitter’s revenues will even approximate $3 billion in 2020.

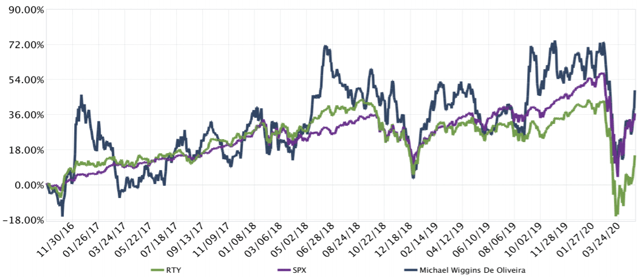

Consequently, paying up slightly more than 7 times forward revenues, for a company that was not a fast grower during a strong economic period as we had in 2018-2019, makes 2020 set up for too many negative surprises.

Bottom Line

Twitter’s ability to be a rewarding investment opportunity is contingent on its ability to retain these newly-found users and find ways to keep these users engaged while delivering value to these users.

Twitter’s valuation is in no way overvalued if it can get past 2020, and return to growth in 2021. But there’s still a lot of heavy lifting to be done in this very challenging and unprecedented period.

Did You Find This Article Helpful?

Investing is about growing your savings and avoiding risky investments. Investing is about being selective when choosing a diversified portfolio of opportunities.

Are You Pressed For Time?

I do the hard work of finding a select group of value stocks that grow your savings.

- Honest, helpful, and reliable service.

- Invest by avoiding losers.

- I’m very hardworking and make balanced arguments for my stocks.

- Helping you consider the importance of a balanced portfolio

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Be the first to comment