Natali_Mis/iStock via Getty Images

Twist Bioscience (NASDAQ: TWST) has emerged more recently as one of the leading biotech firms working with DNA. Headquartered in San Francisco, Twist was founded in 2013 by Emily Leproust, Bill Banyai, and Bill Peck. Their mission far exceeds just medical research. By mastering the process of synthesizing DNA and maximizing the abilities of what it’s capable of, Twist hopes to change the world in all aspects, from agricultural to medical and industrial. They hope that their contributions will help people live better lives, while also improving the sustainability of the planet.

In this article, I will show that Twist’s development of DNA synthesis technology and the ability to produce a superior product at a fraction of the cost makes them stand out in the industry. Their foray into future medicine was risky, but early results show promise. With the expected 2022 market growth and Twist’s untapped market potential and high growth ceiling, investors would be wise to look past last year and view the future of this company in a positive light.

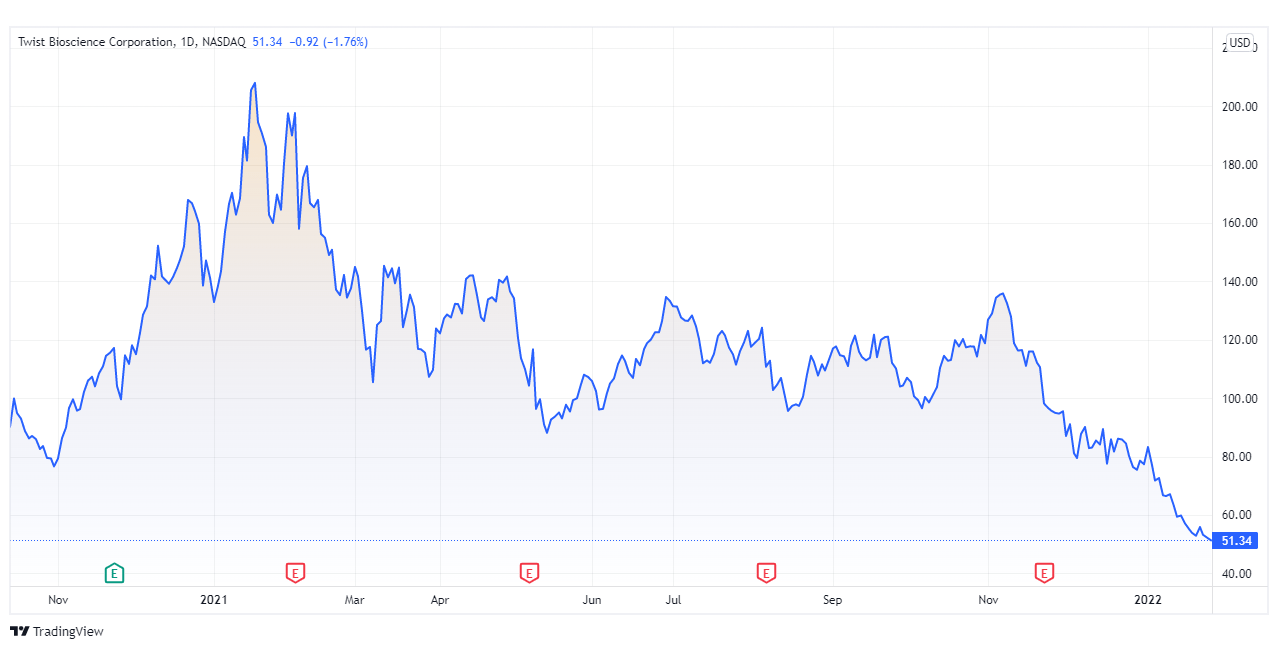

tradingview.com

Success is in Their DNA

Artificial DNA synthesis is a byproduct of research done with replicating and synthesizing RNA. The biggest structural difference between the two is that RNA contains a sugar called ribose, while DNA contains a sugar called 2-deoxyribose. Although this may seem like a small difference on the surface, replacing RNA treatments and medical research with DNA has opened up a whole new frontier within the biotech industry. Human DNA serves as a sort of blueprint for biological functions. With the advancements in science and technology related to DNA, many new and existing treatments have begun to come to market. Through DNA synthesis, treatments for depression, Alzheimer’s, and even low energy levels have begun to emerge. With all of the market influx, many companies have jumped into the DNA-synthesizing market. It’s a smart move, as demand in this field is always significantly higher than supply. With all the influx in competition, it is worth wondering just how Twist plans to emerge as the front runner.

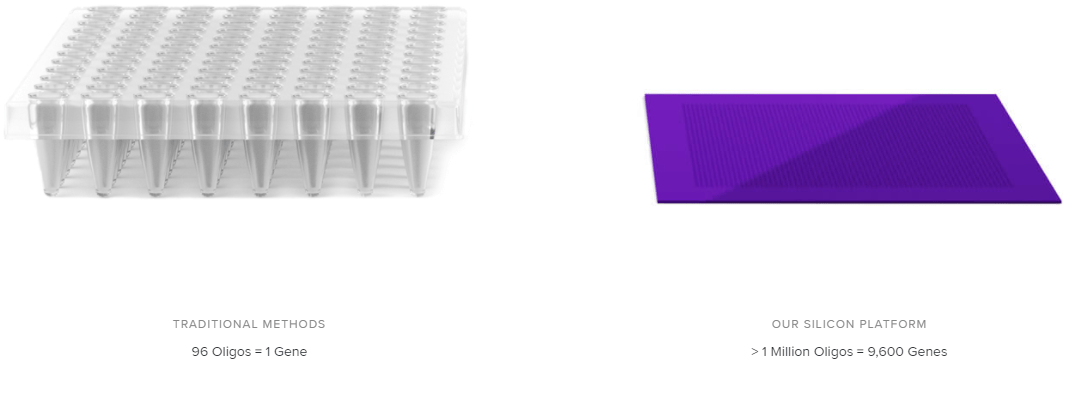

Twist has stayed relevant in the market by making itself the go-to source for DNA synthesis. While many companies are focusing on the treatments made with the DNA, Twist has focused almost exclusively on the process of synthesizing it. As a result, they have developed a way to synthesize DNA that contains over 10,000 genes on a single chip. In comparison to what most other companies can offer, this is about 100x the gene count. As if that isn’t impressive enough, Twist Bioscience can also produce this synthesized DNA at 2-3 times lower cost than their competitors who offer an inferior product. For these reasons, Twist has quickly gained a reputation in the industry as one of the best companies when it comes to synthesizing DNA.

twistbioscience.com

Financials: The Perils of Science and Research

It is expected that in 2022, the biotech sector will receive a bump of 4.3% to the market scope overall after years of relative stagnation. This is likely due to the fallout from the Covid-19 pandemic and the influx of new research and development projects that have received funding.

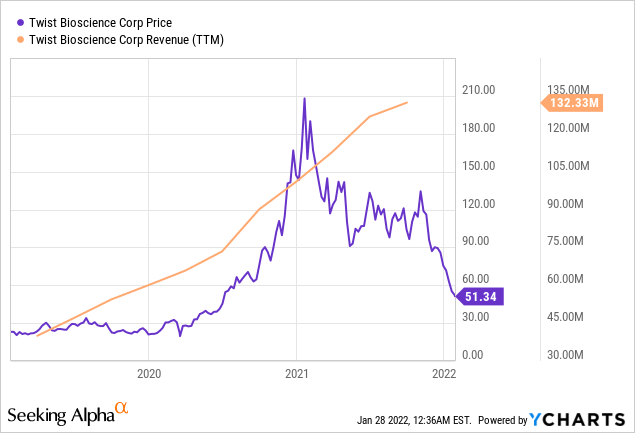

ycharts.com

From Q2 2020 to Q2 2021, Twist received a yearly revenue growth of 38.14%, going from $19.3 million to $31.2 million. This revenue increase is a positive sign moving forward, as it reflects their expanding customer base. This is evidenced by the fact that, in 2021, they shipped products to 1400 different customers, and in 2021 that number increased to 1700. In an effort to meet their new demand, they have also secured the rights to their “factory of the future” located near Portland, Oregon, which will allow Twist to double their output.

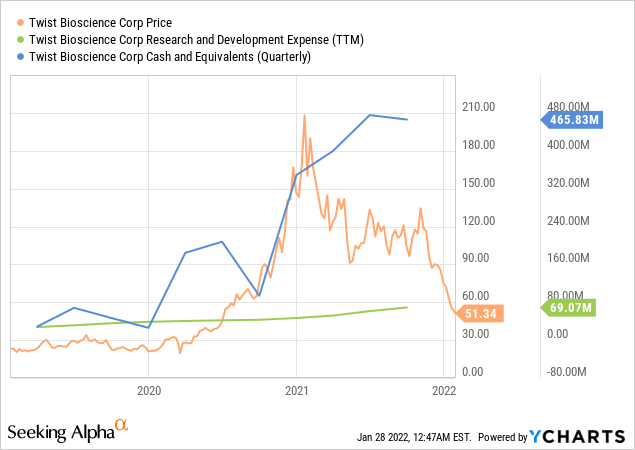

ycharts.com

Twist Bioscience posted a net loss of $37.9 million in 2021. This is an increase of 16% from the previous year, which saw a net loss of $31.8 million. Looking beyond the rise in bottom-line reduction, this is not a surprising revelation. Biotech firms in particular are subject to these swings as science takes a great deal of investment. While Twist does have products on the market, their goal is to continually expand in their capabilities in order to build a bigger market, and thus a larger profit margin. When looking at their financials, the $6.1 million in net loss can almost all be attributed to a rise in research and development expenses. In 2020, the cost of R&D for the company sat at $10.6 million – in 2021, that number rose to $15.8 million.

Twist also reported a good portion of funds in their cash positions. Their 2021 earnings reports indicated $555.7 million in short-term investments, cash equivalents, and cash. This is another good sign that Twist is prepared to push forward into expansion and is prepared for the expenses that come with that. Between the cash in hand and the growing cost spent in R&D, it is clear that Twist is pushing towards the future and investing in its own capabilities. Given this, investors should look out for the continued expansion in their synthesis technologies along with new programs in related subjects.

Conclusion

Despite a poor year in the market, Twist Bioscience is poised to make a big rebound in 2022. Starting with their DNA synthesis technology, their ability to create DNA that boasts a 100x gene capacity than their competitor at half the cost puts them in a league of their own. It all but assures that any company looking to do serious DNA treatment trials or research will utilize Twist as their DNA synthesis company. While the lower cost of their product may be serving as an anchor currently, their focus is on expanding the customer. As the market catches up to DNA treatment possibilities, so too will the profits and long-term prospects of Twist Bioscience.

When it comes to science, there is always a myriad of risks. Research and development costs are expensive and new and evolving science always changes the landscape, which can sometimes lead to a perilous shift in technology. With a company that has posted back-to-back years of a bottom-line loss on their balance sheet, there is always a fair bit of trepidation on whether or not to invest in it. Sometimes it requires focusing less on the numbers, and more on the viability of their potential impact on the market in order to make a decision. Admittedly, though Twist Bioscience is coming off one of the worst years of any company on the market, they have increased their research costs and doubled down on different aspects of DNA synthesis. Their development of DNA synthesis technology and the ability to produce a superior product at a fraction of the cost makes them stand out in the industry. Their foray into future medicine was risky, but early results show promise. With the market growth in the biotech sector expected in years to come, Twist’s untapped market potential with a superior product, and strong demand from biotech companies around the world, investors would be wise to look past last year and consider the future implications of Twist’s advanced synthesis technology.

Be the first to comment