jaanalisette

My Thesis On Twilio

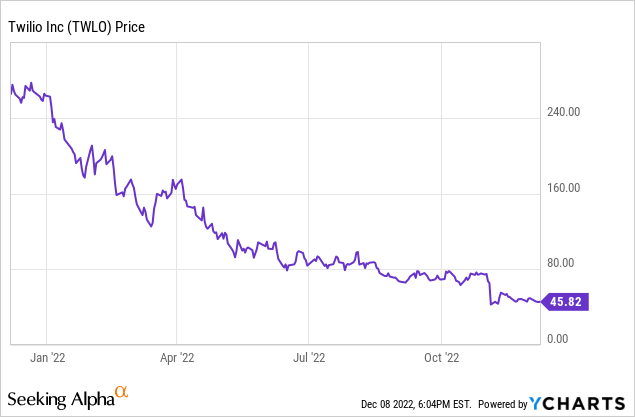

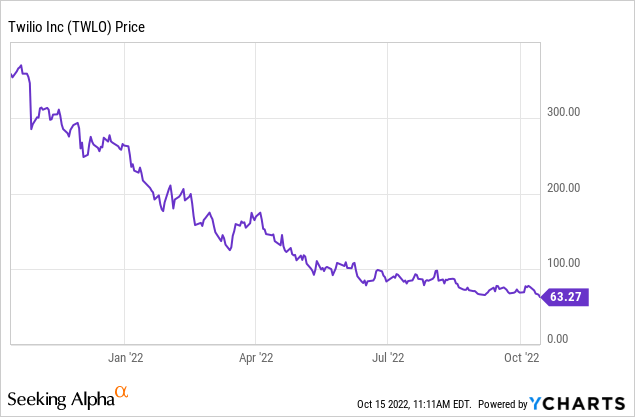

Twilio (NYSE:TWLO) is down 83% since last year and is now trading at $45.82 per share. This has made it stand out from the rest of the stocks as now it is not only a high-growth stock but also a potentially cheap one.

As the world is evolving, people are doing more and more things through the internet, and thus Twilio’s services will have more and more demand as time goes on. This will translate to growth for the business. It is a matter of time until Twilio’s potential and growth are reflected in the stock price and the stock gets to new 52-week highs.

These and some more reasons that I mention below make me bullish on this stock.

How Does Twilio Make Money?

With more than 275,000 users in 180 nations, Twilio generates revenue in two (2) ways:

The majority of Twilio’s income comes from usage-based fees collected from clients who utilize their software solutions through their Channel APIs.

Customers are billed for each usage-based product on a pay-per-use basis.

More than 1 trillion interactions were driven by Twilio in only 2021. This extends to conversations, video mails, emails, and emails. Twilio is profiting from each of these interactions.

The membership fees that Twilio charges users of its fee-based solutions are another source of revenue.

Twilio Flex, Twilio Segment, and other products are among these fee-based ones. Customers pay varying monthly fees depending on the sort of fee-based product they are using, exactly like with their usage-based products.

Twilio – Financials

The fact that Twilio has fallen more than 80% since the beginning of the year has made a lot of investors draw their money, although they were down on their investment for fear of losing even more. But did they make the right decision, or did they just miss a huge opportunity to buy the dip?

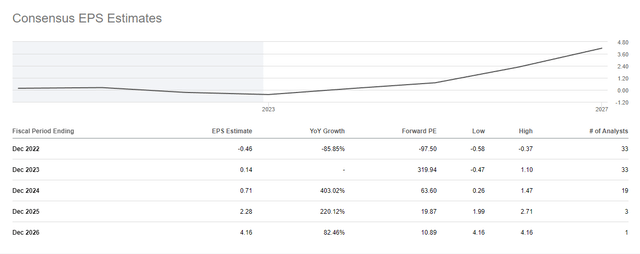

The biggest problem for Twilio right now is that it’s unprofitable. Not only it is currently losing money but also its net income, cash from operations, and free cash flow are all negative and keep getting worse. Twilio has never profited a penny since it first began trading on the New York Stock Exchange (NYSE) on June 23, 2016, so it makes sense for investors to wonder if and when can this company become lucrative.

To Twilio’s defense, most companies with that much YOY growth are unprofitable as they are reinvesting all their gross profit back into the business in order to make it grow as fast as possible. So if Twilio has a way of becoming fruitful at some point in the future, this should not bother investors that focus on high-growth companies with great upside potential.

Twilio’s EV/S is 1.48, 42% lower than its sector’s peers’ EV/S of 2.55. This EV/S in addition to its P/B ratio of 0.79 makes the company looks quite attractive if we take into consideration that the company is projected to grow its revenue by 18%-30% for the next three years according to analysts.

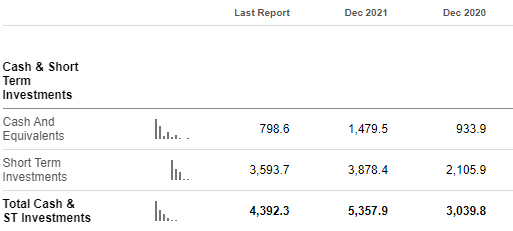

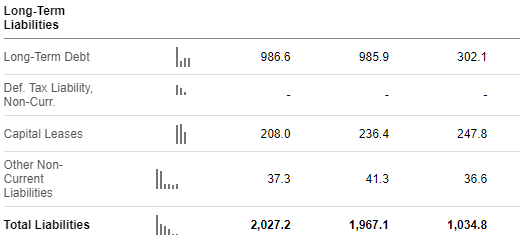

Twilio’s cash – SeekingAlpha Twilio’s total liabilities – SeekingAlpha

Also, Twilio has more total cash and short-term investments (>4.3 billion) than it has total liabilities (2 billion). A healthy balance sheet in addition to Twilio’s Debt/Equity ratio of 0.19 implies that the company’s management knows how to use its money and handle its debt. It also comforts investors that the company is not likely to go bankrupt any time soon.

For those who require a company to be profitable to invest in it, I can understand you. At the end of the day, growth without profit is meaningless. But in this case, unprofitability is not going to be the story for a long time. Twilio is projected to break even in 2023, and its EPS is believed to reach $4.16 by 2026.

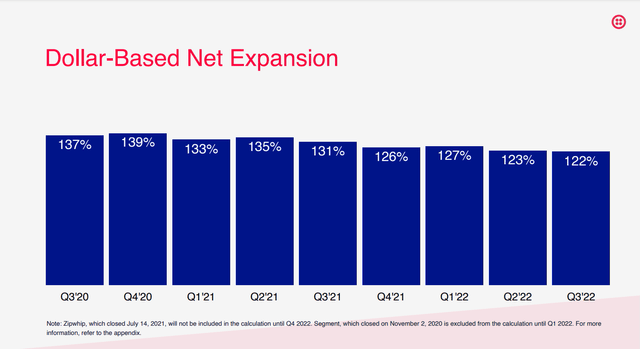

The dollar-based net expansion rate

The dollar-based net expansion rate (DBNER), which takes into account both customer growth and negative churn from current customers brought on by upselling, calculates how much a company’s revenue has increased or decreased over time. You are only examining cohort members who stayed clients the entire period since new and churned customers are excluded.

A high DBNER, such as the one that Twilio has, can help you understand how well the company keeps, engages, and grows its existing customers.

Founder-Led Company

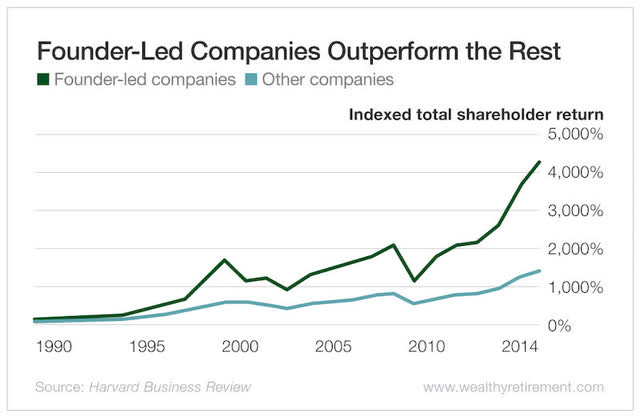

Jeff Lawson is Twilio’s founder, chairman, and CEO. The reason that this is important is that surveys have shown that founder-led companies usually outperform others.

Founder-Led Companies (wealthyretirement.com)

- The first explanation for this is that CEOs who created the company frequently view it as the work of a lifetime and are therefore strongly motivated to spend in the long run rather than worrying about short-term milestones like the earnings report for the following quarter.

- Also, the founder will steer the company in that direction because he has a distinct vision for where he wants to take it. Non-founder executives are knowledgeable about the business, yet they may lack the founders’ vision and only care about making money.

Jeff Lawson also has some skin in the game as he owns 3.1% of the company. This should be reassuring for Twilio’s investors as it shows that its founder still has faith in the company’s future and his interests are in line with theirs, as he makes money when they do.

Twilio – Valuation

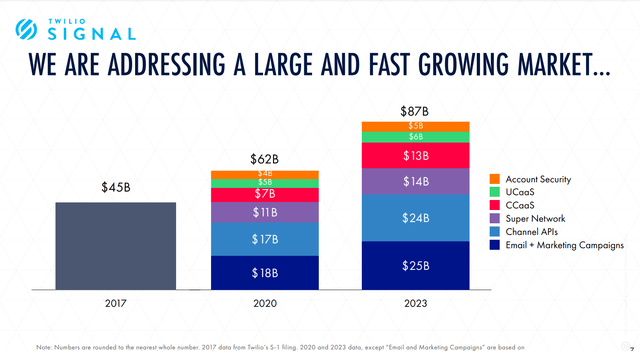

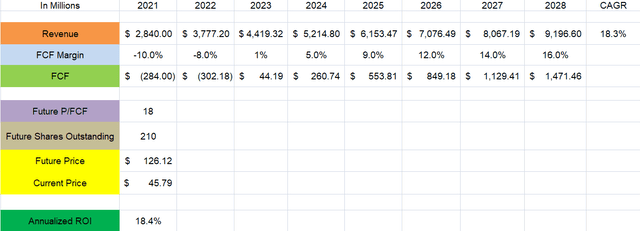

As shown above, CAGR for the next 6 years is projected to be 18.3%. If we take under consideration that the TAM that Twilio is in, is expected to grow from $348.4 billion to $518 billion up to 2027 implying a YOY growth of 13.40% in order for the company to hit that target the only thing it would have to do is to outpace its peers by a little, gaining a bigger and bigger piece of the pie. Add to that an FCF margin of 16% (which is pretty rational for a SaaS business) and a future P/FCF of 18, which I consider to be a bit conservative, and by buying this company at $45.79 (the price TWLO stock is currently trading at) you could enjoy an 18.4% annualized return for the next until 2028. Although this ROI looks tempting, you should not forget that Twilio is a risky investment. Not everyone can afford to take this kind of risk and if you don’t truly believe in the company, maybe it would be better to invest your money somewhere that you feel safer.

Risks

Although Twilio looks tempting at this price, investors should carefully consider the following risk.

1) Lack of profitability

Twilio is still unprofitable and will likely remain so at least in the near term. The company’s expenses may rise as it’s funding its sales and R&D departments in order to keep having these growth numbers. Margins could also be pressured by competition from rivals. Although analysts estimate that Twilio will be lucrative in the following year, it is currently unprofitable and only time will tell if they were right.

2) Dilution

As Twilio becomes profitable this will probably not be the story anymore, but since the company was unprofitable in the previous years, it had to find a way to fund its operations. As shown in the balance sheet, this way was not going into debt, so it had to be share issuance. Shareholders have been diluted in the past years and might be even more diluted until the company reaches the breakeven point.

Conclusion

Twilio stock is down 80% YTD. At the current price of $45.79 per share, TWLO looks like a value play, as its risk-reward profile shows a great upside with limited downside risks. I see this company beating the market in the long term and for every aggressive risk-taker out there I rate it as a Buy. However, if you prefer a more conservative way of investing, maybe, there are better options for you out there.

Be the first to comment