everythingpossible

A Quick Take On TTEC Holdings

TTEC Holdings (NASDAQ:TTEC) reported its Q3 2022 financial results on November 9, 2022, beating revenue and EPS estimates.

The firm provides a range of customer experience outsourcing and advisory services to organizations worldwide.

Given management’s tepid forward guidance amid a macroeconomic picture of ‘uncertainty,’ my near-term outlook on TTEC is a Hold.

TTEC Holdings Overview

TTEC Holdings, Inc. is a global customer experience technology and services company that designs, builds, and operates end-to-end customer experience solutions to enhance customer engagement.

The company’s primary offerings include omnichannel customer experience strategy, technology and outsourcing services.

The Chairman and Chief Executive Officer of TTEC is Ken Tuchman, who founded the firm as TeleTech Holdings in 1982.

The company has a dedicated sales team that reaches out to potential customers and provides them with information about the firm’s tailored solutions to meet their needs.

TTEC’s Market & Competition

According to a 2021 market research report by 360 Market Updates, the global market for digital transformation strategy consulting was an estimated $58.2 billion in 2019 and is forecast to reach $143 billion by 2025.

This represents a forecast CAGR of 16.2% from 2020 to 2025.

The main drivers for this expected growth in IT consulting are a large transition from on-premises, legacy systems to cloud-based environments with complex architectures.

There is also expected growth in the number of industries adopting digital transformation strategies, such as manufacturing, finance, and retail, as well as a growing demand for improved customer experience.

IT consulting firms can also leverage their expertise to help companies develop and maintain new or better business models which are better suited to the digital world. Many organizations are turning to IT consulting firms to help them align their digital transformation strategies with their business objectives. This can help companies better leverage technology to improve customer engagement, boost collaboration, and reduce costs.

Also, the COVID-19 pandemic has likely pulled forward significant demand to modernize enterprise systems, resulting in increased growth prospects for digital transformation consultancies.

The growth of IT consulting is expected to continue due to the evolving digital landscape, increased demand for improved customer experience, the need to develop and maintain new or better business models, and the accelerated demand for modernization due to the pandemic.

Major competitive or other industry participants include:

-

Globant (GLOB)

-

Thoughtworks (TWKS)

-

EPAM (EPAM)

-

Slalom

-

Accenture (ACN)

-

Deloitte Digital

-

McKinsey

-

BCG

-

Ideo

-

Cognizant Technology Solutions (CTSH)

-

Capgemeni (OTCPK:CGEMY)

-

Computer Task Group (CTG)

-

Company in-house development efforts

The company is also active in the customer experience services outsourcing market, which is a $270 billion global market.

TTEC’s Recent Financial Performance

-

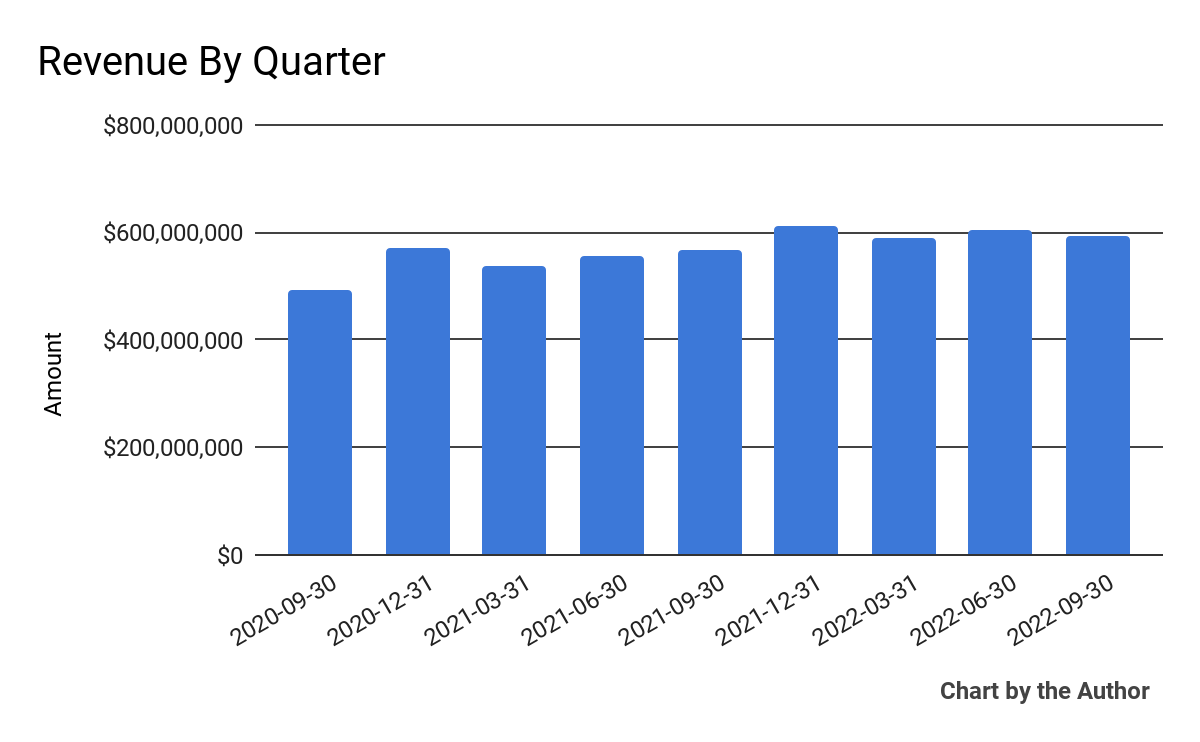

Total revenue by quarter has grown at a moderate rate of growth, as the chart shows below:

9 Quarter Total Revenue (Financial Modeling Prep)

-

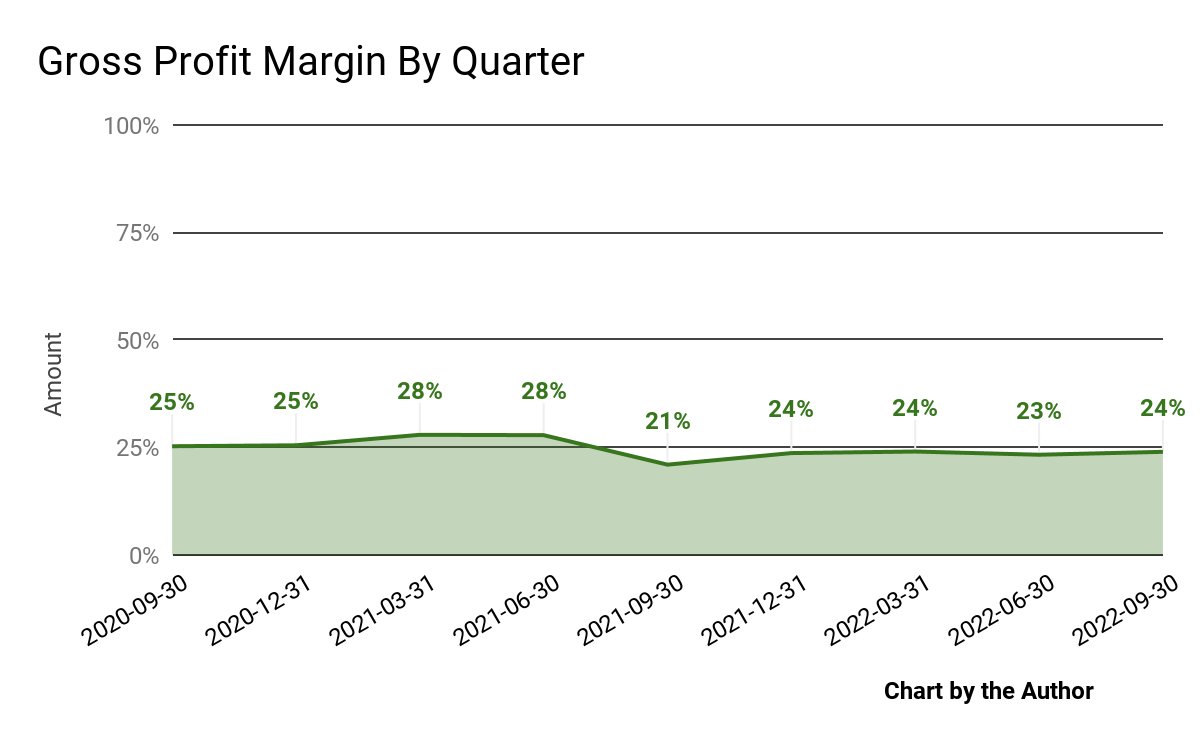

Gross profit margin by quarter has varied according to the following chart:

9 Quarter Gross Profit Margin (Financial Modeling Prep)

-

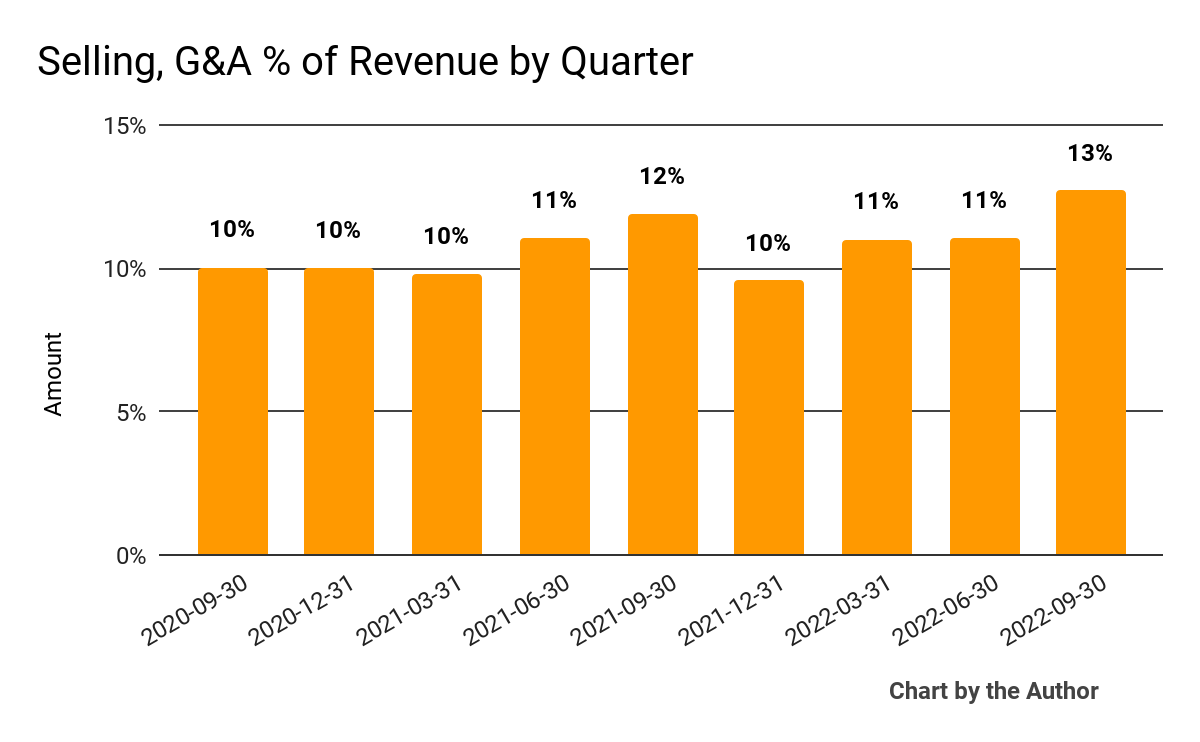

Selling, G&A expenses as a percentage of total revenue by quarter have increased recently:

9 Quarter Selling, G&A % Of Revenue (Financial Modeling Prep)

-

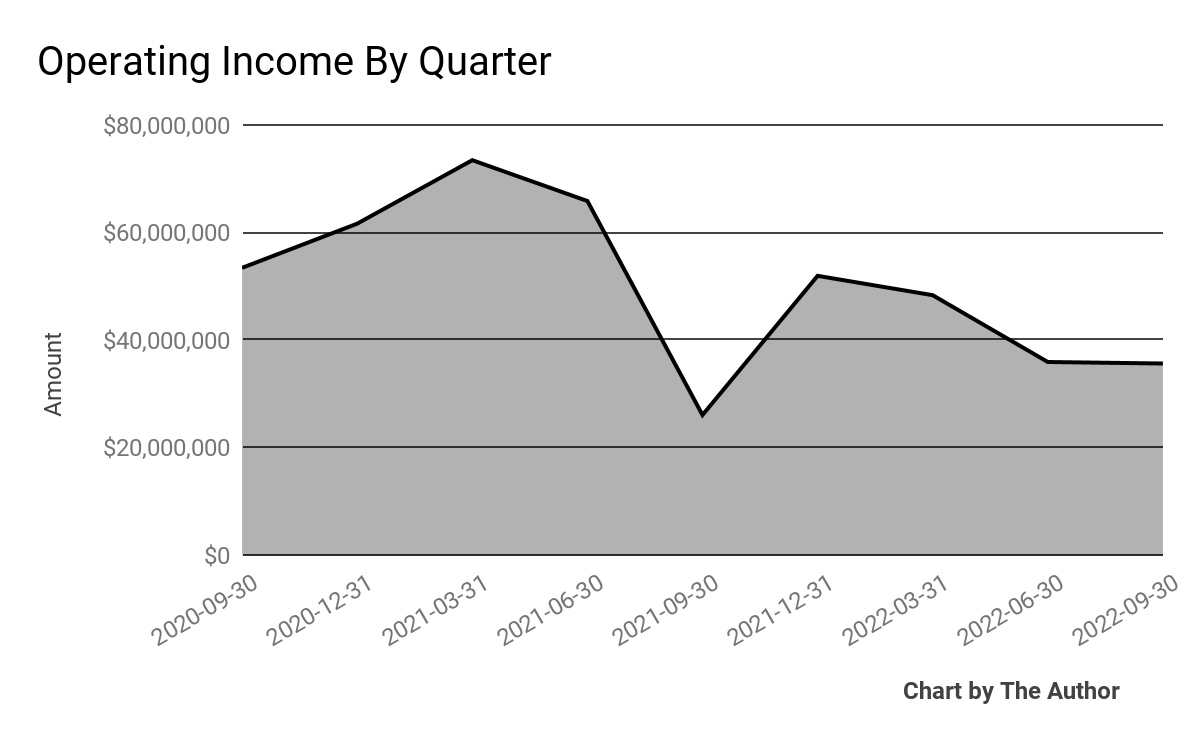

Operating income by quarter has trended lower in recent quarters:

9 Quarter Operating Income (Financial Modeling Prep)

-

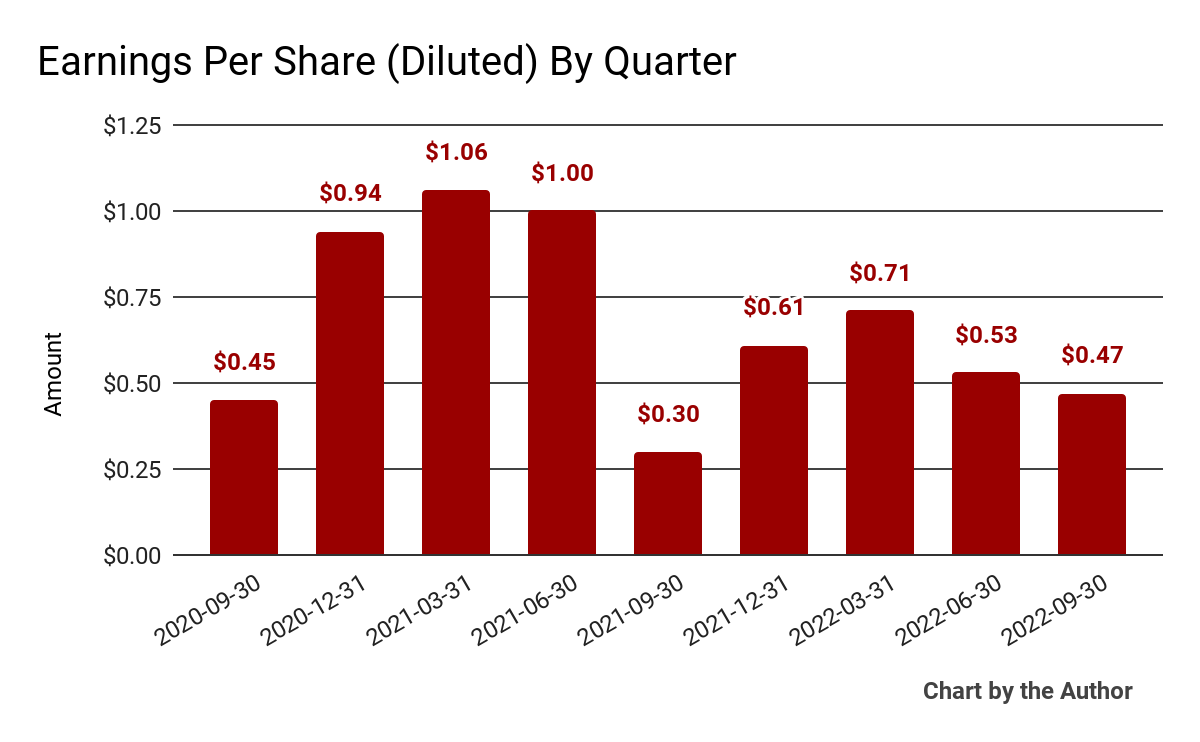

Earnings per share (Diluted) have produced the following historical results:

9 Quarter Earnings Per Share (Financial Modeling Prep)

(All data in the above charts is GAAP)

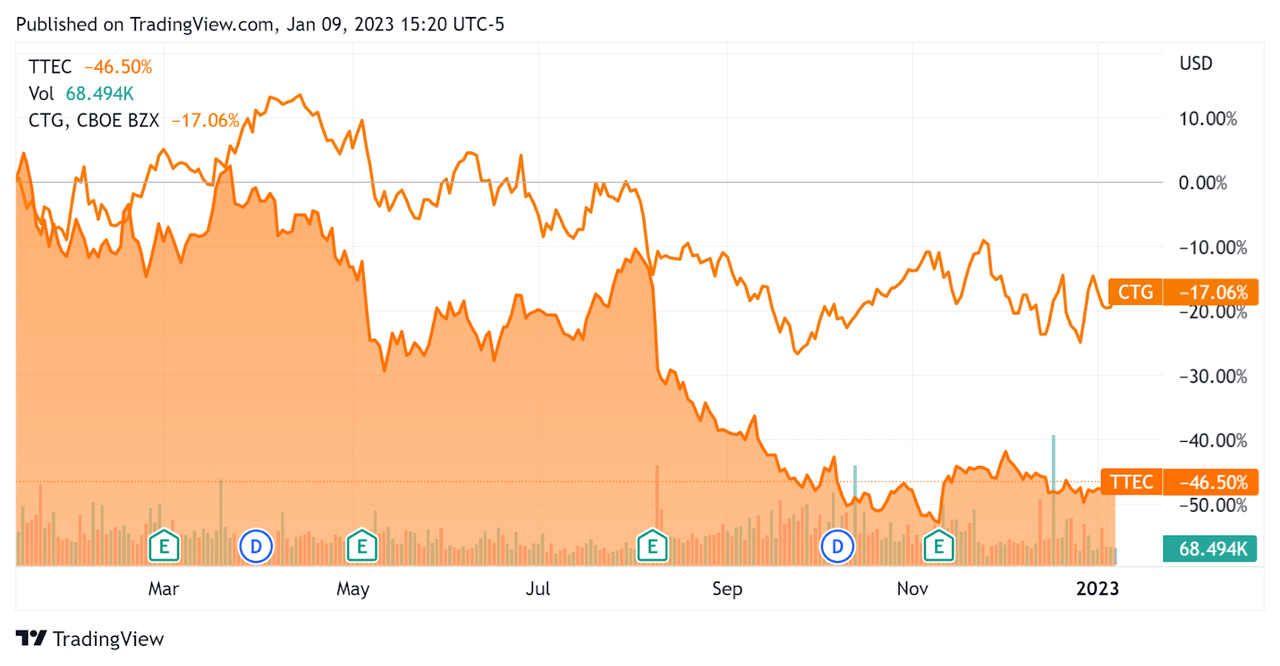

TTEC’s stock has substantially underperformed that of much smaller Computer Task Group over the past 12 months:

52-Week Stock Price Comparison (Seeking Alpha)

Valuation And Other Metrics For TTEC Holdings

Below is a table of relevant capitalization and valuation figures for the company:

|

Measure [TTM] |

Amount |

|

Enterprise Value / Sales |

1.3 |

|

Enterprise Value / EBITDA |

11.0 |

|

Revenue Growth Rate |

7.4% |

|

Net Income Margin |

4.6% |

|

GAAP EBITDA % |

11.4% |

|

Market Capitalization |

$2,112,600,448 |

|

Enterprise Value |

$3,002,954,180 |

|

Operating Cash Flow |

$195,047,000 |

|

Earnings Per Share (Fully Diluted) |

$2.32 |

(Source – Financial Modeling Prep)

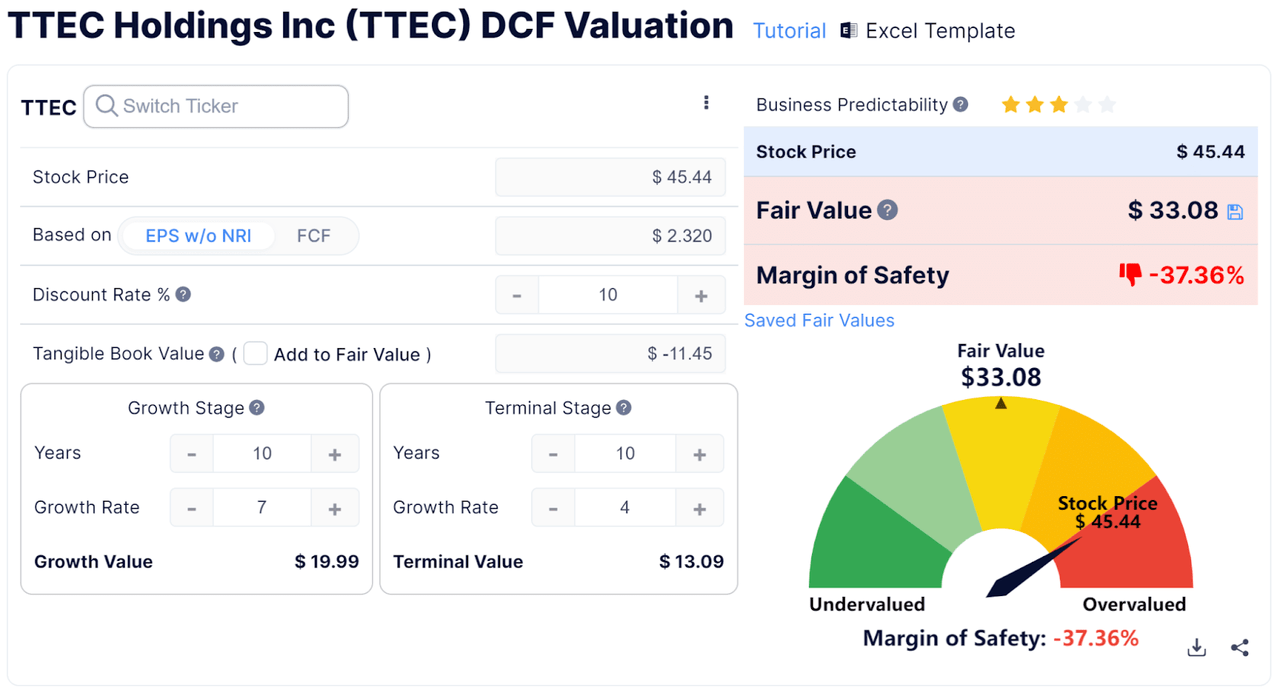

Below is an estimated DCF (Discounted Cash Flow) analysis of the firm’s projected growth and earnings:

Discounted Cash Flow Calculation (GuruFocus)

Assuming generous DCF parameters, the firm’s shares would be valued at approximately $33.08 versus the current price of $45.55, indicating they are potentially currently overvalued, with the given earnings, growth, and discount rate assumptions of the DCF.

Commentary On TTEC

In its last earnings call (Source – Seeking Alpha), covering Q3 2022’s results, management highlighted growth in bookings of 17% year-over-year.

However, management noted that the firm’s ‘clients are facing macroeconomic uncertainties in this highly dynamic environment.’

These challenges are showing up most in its technology-focused company vertical, while in other sectors such as ‘health care, banking, automotive and government, there is ongoing strength.’

In response, management has accelerated its diversification strategy in terms of geographic expansion, vertical breadth and increased collaboration efforts.

As to its financial results, total revenue rose 7% year-over-year on a constant currency basis, or 4.6% on an as-reported basis.

Gross profit margin dropped substantially in 2022 versus 2021, as has operating income and earnings per share.

For the balance sheet, the company ended the quarter with $172.3 million in cash and equivalents and $955 million in long-term debt.

Over the trailing twelve months, free cash flow was $110.9 million, of which capital expenditures accounted for $84.1 million. The company paid $17.7 million in stock-based compensation.

Looking ahead, management reaffirmed previous full-year 2022 guidance ‘and continues to reflect the uncertainty surrounding the global economy.’

In addition to soft demand from its technology vertical clients, the firm faces foreign exchange headwinds due to the strong US dollar, although the dollar has been giving back some of its gains more recently.

Regarding valuation, the market is valuing TTEC at an EV/EBITDA multiple of 11x.

My discounted cash flow calculation shown above suggests the stock may be overvalued at its current level.

Given management’s tepid forward guidance amid a macroeconomic picture of ‘uncertainty,’ my near-term outlook on TTEC is a Hold.

Be the first to comment