andresr/E+ via Getty Images

Introduction

When I wrote an analysis of Trulieve Cannabis Corp. (OTCQX:TCNNF) five months ago called Trulieve Financials Show Stresses from Expansion I did not expect the title to have staying power, but here we are. Two quarters later, the 2Q 2022 earnings report released August 10 shows that stresses from expansion and have even proliferated. The title today might read “Financials Show Stresses from Expansion, Higher Interest Rates, Labor Shortages, Supply Chain Restraints, Inflation, Consumer Concerns, and Other.” Some stresses may be easing but the latest earning period began in March when all of them were raging. In this article we will look at the second quarter financial results and then discuss a big catalyst (no, not Federal legislation), that is coming for patient investors.

Trulieve store interior (Trulieve investor presentation August 2022)

Financials Review

The table below highlights significant numbers for the last five quarters. All numbers are in millions except per share data.

| Q2 2021 | Q3 2021 | Q4 2021 | Q1 20221 | Q2 2022 | |

| Revenue | 215 | 224 | 305 | 318 | 320 |

| Gross Profit | 144 | 154 | 173 | 178 | 182 |

| Net Income | 41 | 19 | -72 | -32 | -22 |

| EPS | 0.33 | 0.15 | -0.49 | -0.17 | -0.12 |

| EBITDA | 92 | 91 | 65 | 86 | 87 |

| Oper Cash Flow | -11 | 26 | -62 | 45 | -55 |

| Shares Outst | 133 | 137 | 147 | 187 | 187 |

Top line numbers like revenue and gross profit grew sequentially, as they have for years. Net income, which had been positive for seven quarters prior to 2022, went negative for the third straight quarter. Operating cash flow had been positive for six out of eight quarters, but was negative in two out of the last three. The data portrays a company whose performance has been slowing for the past three quarters, since Q4 2021.

Trulieve Cannabis Q2 Earnings call discussion and guidance

Trulieve has dedicated time in recent earnings calls to explaining the decline in performance. Beginning in Q4 2022 they reminded investors that expansion requires significant capital expenditure long before revenue is realized, and said that results from current investments would be manifested in 2H 2022. However, the company has a multi-year growth trajectory that will continue to require big capex. They spent $45 million in capex this quarter, plan the same for the next two. One might assume the performance drag will continue in out years.

Another reason given by management for the latest financials is the accumulation of charges related to acquisitions. In the $22.5 million net loss, there was $11.8 million of transaction/integration charges, $5.2 million in earn-out, $4.3 million for closing redundant facilities, and $700 thousand for repurposing a production site in Arizona. Without these charges the loss would have been reduced from $22.5 million to $1.1 million. However, given Trulieve’s ambitious growth plans, we can expect non-recurring charges like these to continue. For this reason, the larger unadjusted figures are probably a more accurate representation of total performance than the adjusted ones.

According to ,Trulieve generally negative economic conditions also contributed to the recent performance. These conditions, such as cost inflation, consumer weakness, supply chain constraints, and so on, are well known and are part of the quarterly reports of many companies across many industries.

These factors led Trulieve to reduce their 2022 revenue guidance 5% from $1.3-1.4 billion to $1.25-1.3 billion, and adjusted EBITDA from $450-500 million to $415-450 million. Revenue year-to-date is $638 million, so the new guidance suggests flat revenue for 2H 2022. Adjusted EBITDA year-to-date is $217 million, so it is also projected to be flat for 2H 2022.

Trulieve remains confident of the path they are taking. Although capex plans have been reduced by $50 million for 2022 in the interest of prudent cash management, they will still spend $90 million and express confidence the ROI will be high. The outlook for the industry as a whole, a 25% CAGR for most of the decade, is unchanged. Implementation and expansion of more legal cannabis regimes are scheduled in new states through 2024 and more states are likely to follow. However, the financial results reported by Trulieve and other companies for the last three quarters signal that progress may be slower than previously anticipated.

The Catalyst

Cannabis investors are anticipating numerous catalysts that would cause a significant increase in the value of their holdings. However, the timing and implementation odds for most of these catalysts is opaque and uncertain. One stands out, however. The Trulieve earnings call noted that there is now a campaign called Safe and Smart Florida, which

“…aims to legalize adult use marijuana in Florida through a ballot initiative in November 2024.”

This catalyst is different for two reasons.

-

It has a high likelihood of success. Florida is a cannabis-friendly state, with a robust medical cannabis environment. In addition, cannabis ballot initiatives have had a 100% success rate.

-

It has a specific timeline. Investors and companies are not subject to the vagaries of political processes that have bedeviled reforms in Congress, New Jersey, Virginia, Massachusetts, Illinois, and elsewhere.

Trulieve is the best positioned company to benefit from adult use in Florida by far. 69% of its stores are in Florida. According to Florida’s Office of Medical Marijuana Use, Trulieve has more than twice as many dispensing locations than Curaleaf (OTCPK:CURLF), its closest competitor (116 vs. 50), and dispenses three times as many THC grams. Its overall market share is 43%. Being number one in a market has important advantages, and Trulieve is continuing to expand in the state. They opened two new Florida dispensaries in Q2, and four more so far in Q3.

The impact of adult use in Florida can hardly be overstated. As Cannabis Growth Investor relates in his recent article on SA, the 736,212 current qualified patients represent 4% of the population, whereas 8.6% of Americans over 26 and 22.1% ages 18-25 report using it in the past month, according to the National Institute of Drug Abuse. Use by Floridians could easily double, and sales to tourists are added on top of that.

Each individual must make his or her own decision about the meaning of an event that will supercharge Trulieve shares but won’t happen for over two years. The gains in such a high beta stock could easily be 100% in my opinion, and 100% seems worth waiting for. But there is risk in waiting. Share prices will start to climb well in advance of the ballot initiative, and the occurrence of another catalyst between now and then could mean buying shares from a higher starting point.

Risks

The economic conditions that have made it difficult for Trulieve in recent quarters are real, and could continue to hinder performance for some time. They are evident across the industry, as recent results from Green Thumb (OTCQX:GTBIF), MariMed (OTCQX:MRMD) as others confirm. Trulieve also has company-specific risks. It’s concentration in Florida means it is dependent on developments there. It’s unknown whether its relatively late foray nationally will see a repeat of the success they have had in Florida, and unfortunately they don’t break out their results by state. Finally, while the catalyst of adult use in Florida appears to have a high probability of success, cannabis investors know that nothing is certain.

Trulieve Stock Recommendations

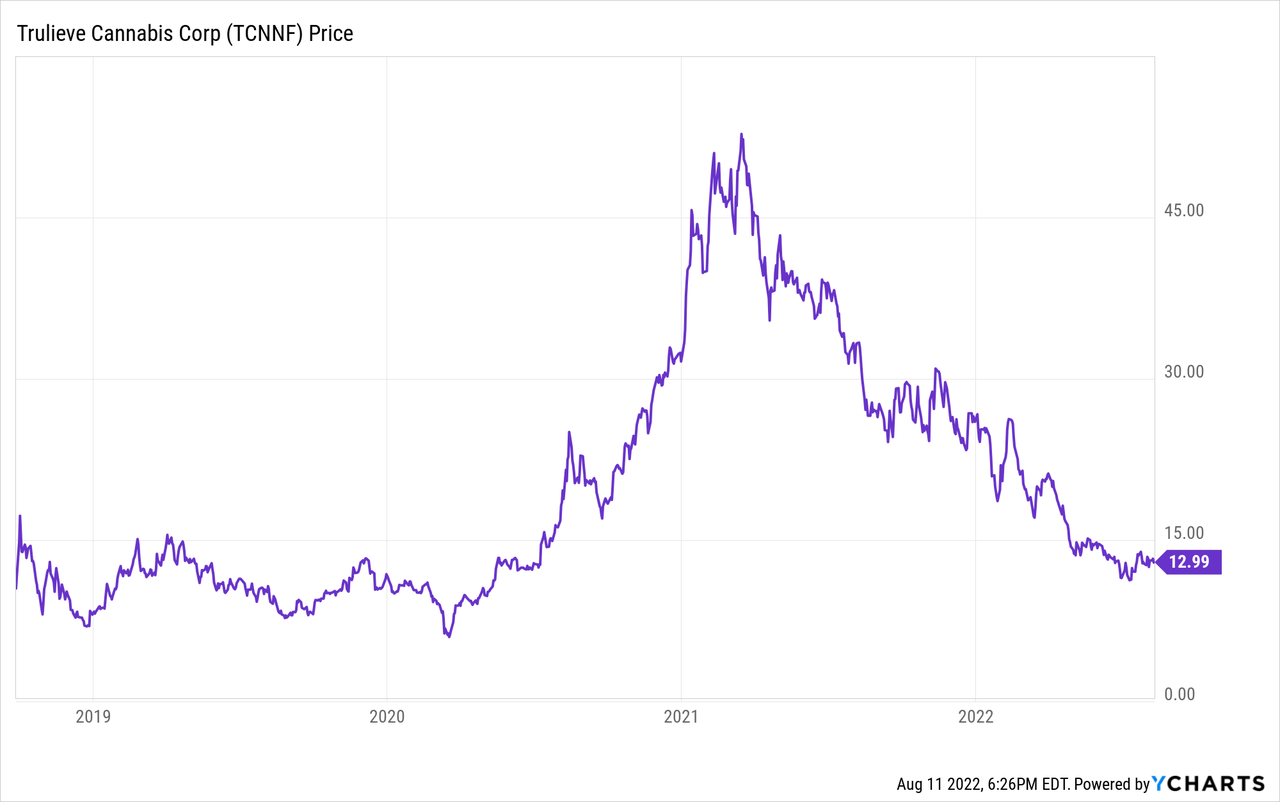

It’s popular nowadays to summarize a stock like Trulieve as one that has declined 74%, as though it went public at its peak in March 2021. I do not find this useful. The chart shows a company that is sitting near its long term average in a new industry that is still finding its way.

The latest quarter shows the difficulty of implementing a rapid growth strategy under difficult economic conditions. Trulieve’s growth trajectory has flattened somewhat, but the long term growth of the company and the industry is still intact. I give Trulieve a Buy recommendation. This recommendation is not dependent on adult use in Florida, but the ballot initiative is an additional incentive for long term investors.

Be the first to comment