nensuria/iStock via Getty Images

Introduction

Two years ago, I first wrote an article about Trulieve Cannabis Corp. (OTCQX:TCNNF) titled Trulieve: Cannabis Best in Class. The share price at the time was $10.88. Earlier this month when I wrote a follow-up article titled Trulieve: Still Cannabis Best in Class, the price was $20.00. The price currently stands at $20.88.

The Q4 and full-year 2021 reports were released on March 30, 2022. This third article will discuss how these latest results do or do not support my long-time bullish position on the company.

My Number One Requirement for Success

My number one criterion for making any investment is superior management. Even in an industry with huge potential like cannabis, that is the thing that will enable a company to succeed, maximize potential, and overcome challenges large and small.

My Trulieve thesis was, and is, that from the beginning management has demonstrated excellence and is the type of organization that investors can confidently trust their money to. Admittedly, evaluating management is as much art as science. It involves factors such as

- how well the company meets business projections

- clearly articulated and executed business plans

- successful business execution

- being responsible with company money and assets

- taking care of shareholders

- transparency

- integrity and high ethical standards

- financial performance over time

Notably, the stock price is not on the list. If management does well on the criteria above, and in my judgement, they have done very well, over time the stock price will show it.

The Q4 and Year 2021 Report

Operational highlights

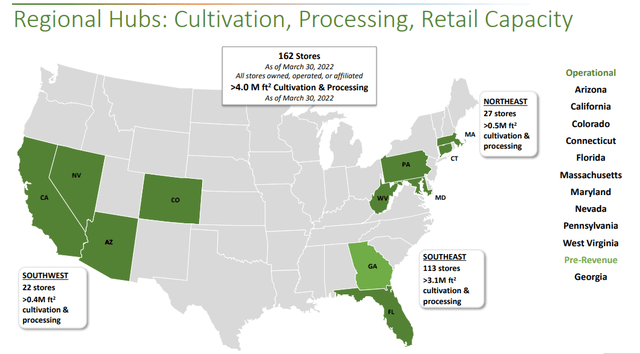

In 2021, Trulieve transitioned from being the largest and most successful operator in Florida to one of the largest and most successful operators nationwide. The transformation was powered by seven acquisitions valued at $1.5 billion, a 112% increase in retail locations to a total of 159 commencement of operations in West Virginia and Massachusetts bringing the footprint to 11 states, and an 89% increase in cultivation and processing capacity to 3.5 million square feet. A full 30% of locations are now outside of Florida. The full list of operational and financial highlights is in the Fourth Quarter 2021 Earnings Presentation.

Financial highlights

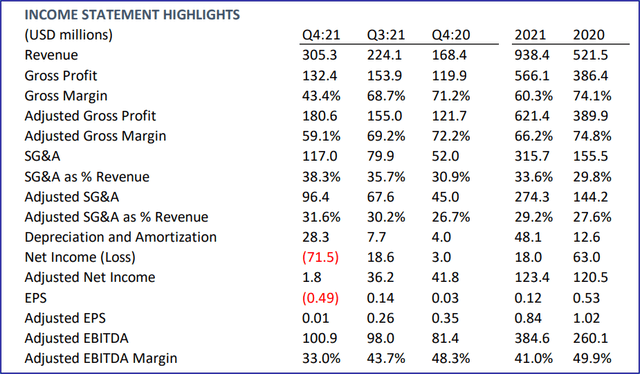

For the year, revenue increased 80% to $938 million. Gross profit increased 47% to $566 million, with gross profit margin dropping from 74% to 60%. Adjusted gross profit increased 59% to $621 million, with margin dropping from 75% to 66%. Net income dropped from $63 million to $18 million, and EPS dropped from $.53 to $.12. Adjusted EBITDA increased 48% to $385 million, with margin dropping from 50% to 41%. On a pro forma basis, combined company 2021 same-store sales increased 19%, but same-store sales for the legacy Trulieve portfolio declined by 1%.

Trulieve income statement highlights Q4 and year 2021 (Trulieve Fourth Quarter 2021 Earnings Presentation)

In terms of dollars, there were impressive increases year to year, but a number of annual and quarterly comparisons are negative. As management reported in both the Q4 press release and earnings call, many of the negative comparisons stem from the extensive growth strategy in 2021.

Net income took a big hit from $105 million in non-recurring charges mostly related to the Harvest acquisition – without those charges income would have been $123 million instead of $18 million. They have also said that the drops in gross margin, adjusted GM, and EBITDA margin are the result of strategic diversification into new lower margin markets and channels. In addition, 2021 saw considerable resources dedicated to non-acquisition-related growth in cultivation, processing, and retail capacity. These growth-related expenses show up on 2021 financials, but the resulting revenue won’t show up until well into 2022.

Outlook

The company is guiding for 2022 revenue of $1.3-1.4 billion, an increase of 44% at the midpoint, and $450-500 million of adjusted EBITDA, up 23% at the midpoint. Margins will stay at the lower levels of 2021, with gross margin around 60% and adjusted EBITDA margin around 40%. They say that the benefits of this year’s strategic initiatives won’t be fully realized until the second half of 2022, so investors need to summon that rarest of traits – patience.

Trulieve clearly sees expansion as its path to the future. There are 38 states with some form of legal cannabis, and Trulieve is in 11. They don’t yet have a presence in some large population states like New York, New Jersey, Virginia, and Illinois. In other states, like Massachusetts, Georgia, and West Virginia, they are still ramping up. The growth potential from a geographic point of view is very promising.

Trulieve geographic footprint (Trulieve Fourth Quarter 2021 Earnings Presentation)

The fact that they are only in 11 states reflects an important part of the company culture: A careful and relatively conservative approach to growth. In the early years, they liked to say that they didn’t open a new dispensary unless they had enough cultivation to support it and they didn’t expand cultivation until they had enough dispensary demand for it. For years they were criticized for limiting their business to Florida. But this seemingly slow pace enabled them to become dominant in one of the best cannabis markets in the country, and perfect the branding, merchandising and other business practices that will serve them well as they export their success around the country. Branding is so key that it appears in two of their four current strategic priorities, which are:

-

Deliver Exceptional Customer Experiences and Build Brand Loyalty

-

Expand through Hub Strategy

-

Distribute Branded Products through Branded Retail and Wholesale Channels

-

Focus on Profitable Growth and Create Shareholder Value

The conservative approach has also enabled them to execute expansion from perhaps the strongest financial position in the industry. They have $234 million in cash, positive cash flow (except for Q4 2021 as discussed above), and their last debt was obtained at an industry-best 8% interest rate.

Summing Up

2021 ended with financial results a bit rockier than the consistently excellent performance that Trulieve watchers have gotten used to. Important metrics such as revenue, gross profit and adjusted EBITDA continued their strong growth, but margins and earnings were down, and same-store sales growth was anemic in some areas. Divergences like these are not unusual for a rapidly growing company in a rapidly growing and changing industry. In the Q4 earnings presentation, management has guided for more of the same for 1H 2022 before their strategic initiatives take full effect in the second half of the year.

Investors should not assume that recent fluctuations in some financial measures are anything more than stresses expected in a rapidly growing company in a still new industry. There is nothing to be gained by assessing a company on short-term results when the appropriate investment horizon should be measured in years. Trulieve has been successful from its beginning and will continue to be so. They have exceptional management with a powerful collection of brands and a proven business model that will drive their future success. They are rapidly gaining momentum to tap the huge growth potential for US cannabis. Sentiment or the news cycle will bear on the stock price from time to time, but Trulieve has laid the foundation for rewarding investors in the long run.

Be the first to comment