Bryan Bedder/Getty Images Entertainment

Introduction

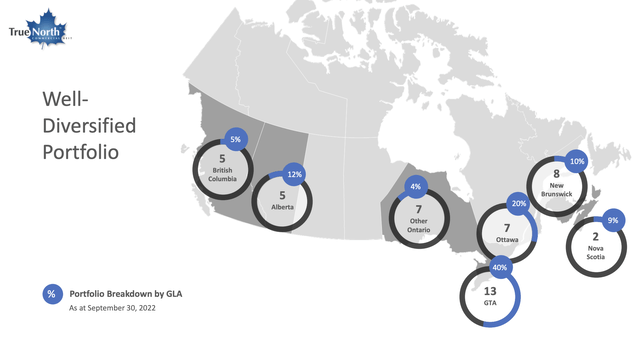

True North Commercial REIT (TSX:TNT.UN:CA) is one of the largest pure-play office REITs in Canada. It has a national footprint but 60% of properties are in Ontario and most properties are in Canada’s most urban centres.

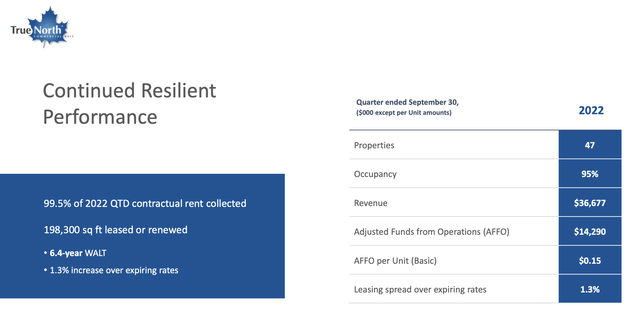

Q3 2022 Investor Presentation (True North Commercial REIT)

Q3 2022 Investor Presentation (True North Commercial REIT)

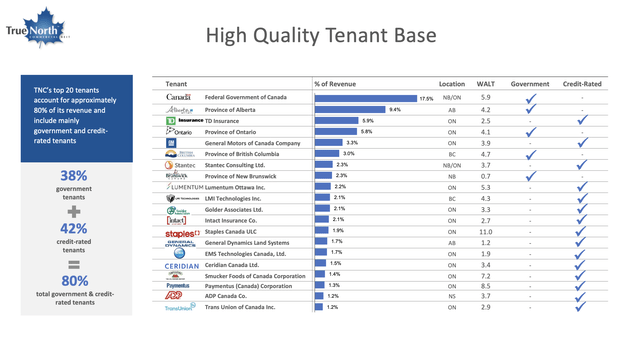

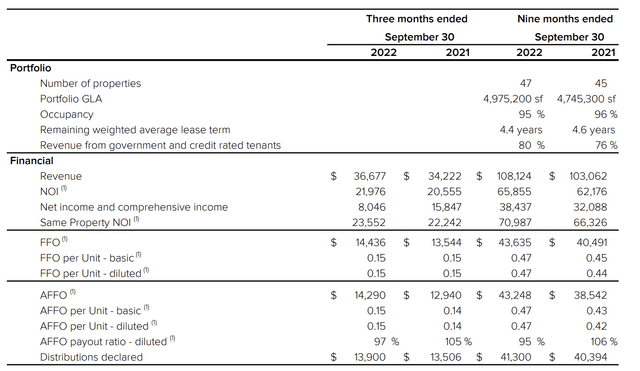

The REIT certainly doesn’t boast the tenant diversification I normally like to see with 39% of revenue coming from their top four tenants. In this case this could be overlooked with three of the top four being the Federal Government of Canada and the Provincial Governments of Alberta and Ontario. In fact, 80% of tenants are either government or credit rated tenants with 99.5% of contractual rents collected and an occupancy rate of 95% in Q3 2022. This is not half bad for a North American office REIT as many have struggled since the pandemic.

Q3 2022 Investor Presentation (True North Commercial REIT)

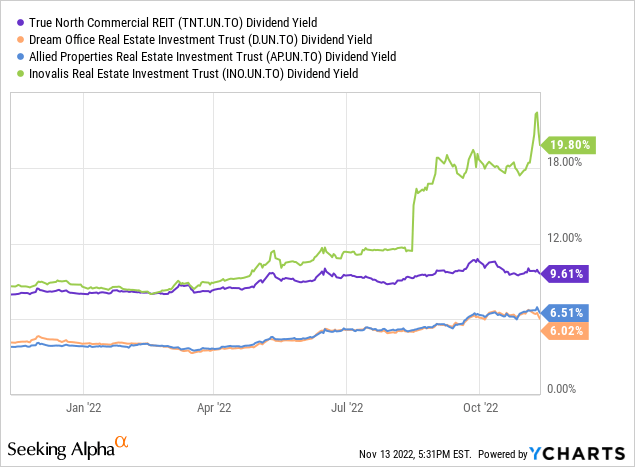

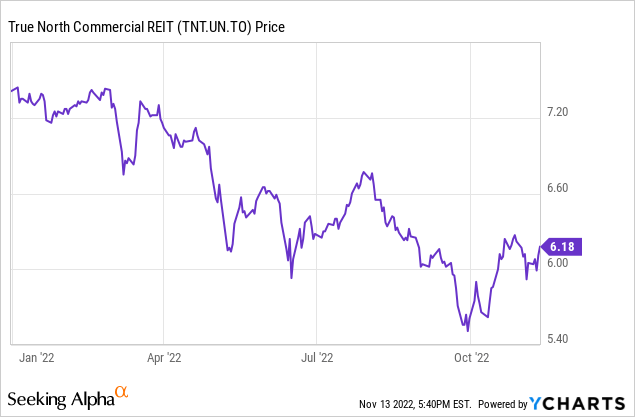

The REIT boasts a ~9.5% dividend yield at the current share price of $6.20 with a monthly dividend of $0.0495/share. Its yield is the second highest of all Canadian Office REITs. Inovalis (INO.UN:CA) actually has a yield of ~10% with its most recent dividend cut not ~19.80%.

The market seems to see this REIT as a safe haven to just sit back and collect the dividends, almost like a SWAN investment. This is evidenced by the fact that the REIT filed an At The Money (ATM) Program in April 2022 that allows the REIT to issue up to $50 million of Units to the public, at the REIT’s discretion.

The REIT has issued 1,450,800 Units for gross proceeds of $9,460 ($9,271 net of commissions) through the ATM Program in 2022. The average issuance price by month was as follows:

- 220,900 Units for an average issuance price of $7.3491 in the month of January 2022;

- 112,600 Units for an average issuance price of $6.3458 in the month of July 2022;

- 1,117,300 Units for an average issuance price of $6.3742 in the month of August 2022

The share price is down ~16% YTD but the market was more than happy to pay for these issuances at around the then current market prices. These issuances have not shown to be dilutive. The REIT did not cut the dividend through the pandemic after all, so why would they now that the pandemic is over?

Could hopeful investors be in for a rude awakening?

Outlook

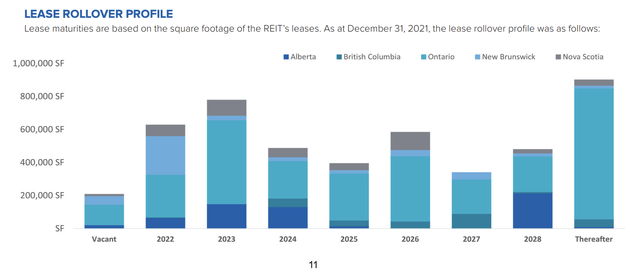

The main blemish that stands out like a sore thumb when you first open any investor presentation for TNT is the low weighted average lease term of 4.4 years and entered 2022 with over 600,000 SF and 12% of GLA set to expire in 2022.

2021 Annual Report (True North Commercial REIT)

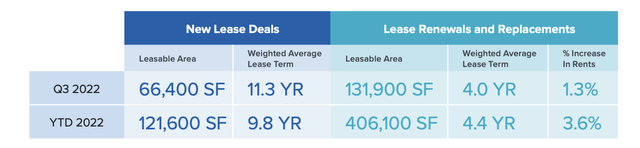

To TNT’s credit they have managed to improve leasing volume and terms to match the runoff. In Q3-2022, the REIT completed a total of 198,300 square feet of leasing transactions with a total weighted average lease term of 6.4. During Q3 2022, TNT completed 66,400 square feet of new lease deals with a weighted average lease term of 11.3 years. TNT also released 24,500 square feet of vacancy in Miramichi, New Brunswick to a federal government tenant for a ten-year term. The REIT’s YTD renewal activity saw a 3.6% increase in base rents over expiring rates and included 248,800 square feet of government tenancy renewals with a weighted average lease term of 4.2 years.

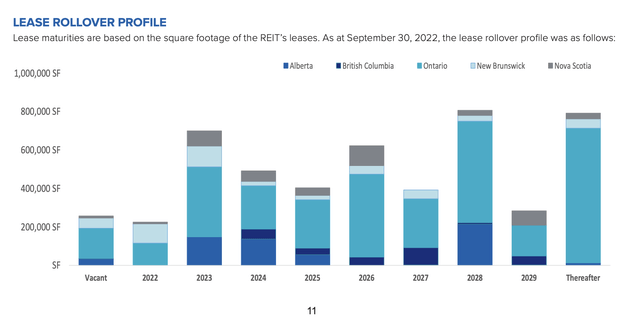

Q3 2022 Investor Presentation (True North Commercial REIT)

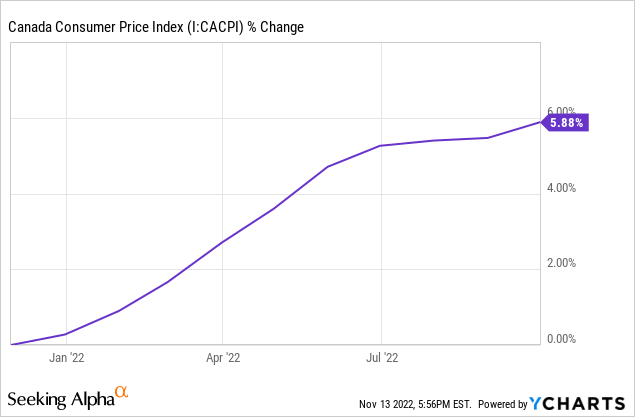

As of Q3 there is still 200,000 SF in leasable area set to expire and an additional ~700,000 in 2023 (16% of GLA). In a high inflationary environment this tends to bode well for REITs as they can typically realize on higher leasing spreads. That has not been the case thus far as the REIT renewed and replaced 131,900 square feet in Q3 2022 with a leasing spread of 1.3% which does not compare favourably with current inflation rates in Canada.

Q3 2022 Investor Presentation (True North Commercial REIT)

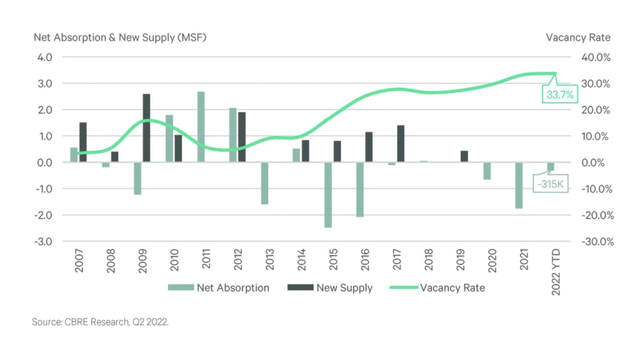

The low leasing spreads that have been realized are a result of the tough environment for office spaces and the challenges are only just beginning to be realized. Calgary is where 12% of revenue is generated and has ~25% of the SF expiring in 2023 and has been one of the toughest office rental markets since 2015 in Canada as a result of low oil and gas prices and massive layoffs in the sector. Despite being in one of the largest commodity bull markets as we have seen in 2021-2022, vacancy rates were at their highest levels in July 2022.

Downtown Calgary office vacancies hit new high — but it’s not all bad news (“CBC”)

Toronto and Ottawa account for 60% of revenues for the REIT and ~50% of expiring leases in 2023. Contrary to the Calgary market these markets have shown some rebound since the pandemic but vacancy rates are still at ~11% in those markets which are still among the highest in Canada.

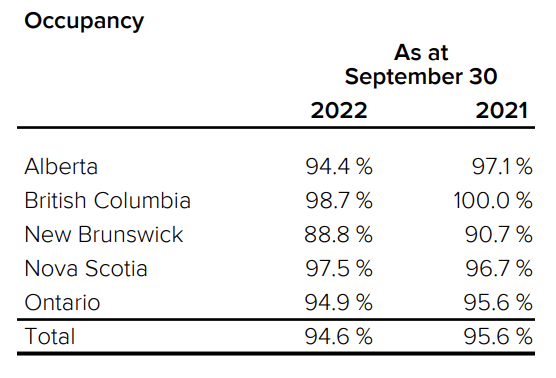

Although the YoY decline in occupancy has been small but we can already see Alberta and Ontario trending towards the vacancy rates of their respective markets.

Q3 2022 Report (True North Commercial REIT)

The Q3-2022 results would lead one to believe that despite operating in a tough environment, management is more than capable to withstand. Same-property NOI, AFFO/share, and FFO/share were all up YoY and QoQ and are the main numbers us REIT investors care about for valuation purposes.

Q3 2022 Report (True North Commercial REIT)

While I am not doubting management competence remember leasing spreads realized during the quarter were very paltry. You have to read the notes for additional context to see why the numbers look so rosy.

While occupancy has decreased in the REIT’s Ontario portfolio, Same Property NOI in Ontario increased by 10.6% mainly due to termination fees. Termination fees relate to a tenant in the REIT’s GTA portfolio that is downsizing a portion of their space effective December 2022, of which approximately 28% has been contractually re-leased.

Alberta Same Property NOI decreased due to termination fees received in Q3-2021. Same property occupancy in British Columbia decreased due to a lease expiry at the end of Q2-2022, NOI was positively impacted by contractual rent increases. New Brunswick Same Property NOI experienced a decline due to lower occupancy as certain tenants downsized on renewal. The REIT’s Miramichi property saw positive leasing activity this quarter with the completion of a 24,500 square feet lease with rent commencing in 2023. Same Property NOI in Nova Scotia increased due to a 3,200 square feet new lease that commenced in Q3-2021 and contractual rent step ups.

Q3-2022 FFO basic and diluted per Unit remained stable at $0.15. Q3-2022 AFFO basic and diluted per Unit increased $0.01 to $0.15. YTD-2022 FFO basic and diluted per Unit increased $0.02 and $0.03, respectively, to $0.47. YTD-2022 AFFO basic and diluted per Unit increased $0.04 and $0.05, respectively to $0.47. Excluding termination fees, Q3-2022 FFO and AFFO basic and diluted per Unit would be $0.13 and YTD-2022 FFO and AFFO basic and diluted per Unit would be $0.40. Q3-2022 AFFO diluted payout ratio would be 113% and YTD-2022 AFFO diluted payout ratio would be 112%.

Source: Q3 2022 MD&A

Unfortunately, filling the gap left by increased vacancies with termination fees can only be sustained for so long, especially if the vacancy rate continues to increase. It just goes to show how easily tenants can be wooed even in this market as it even makes more sense to pay the termination fees as it can be more than offset by favourable lease terms being offered by other landlords.

After excluding termination fees and annualizing YTD FFO the REIT would trade at 11.6x FFO which is not an outrageous valuation for a REIT. But the outlook only gets worse though when assessing the valuation and dividend sustainability when you look at the REIT’s debt.

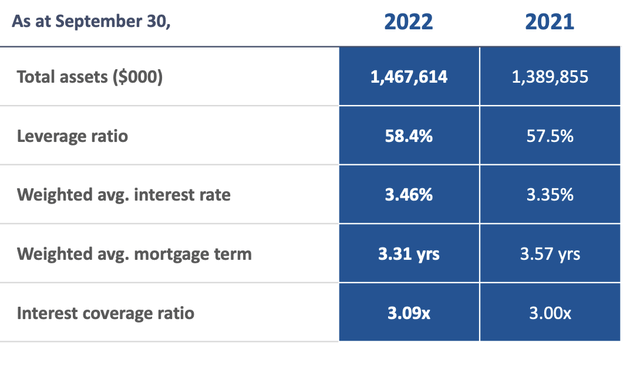

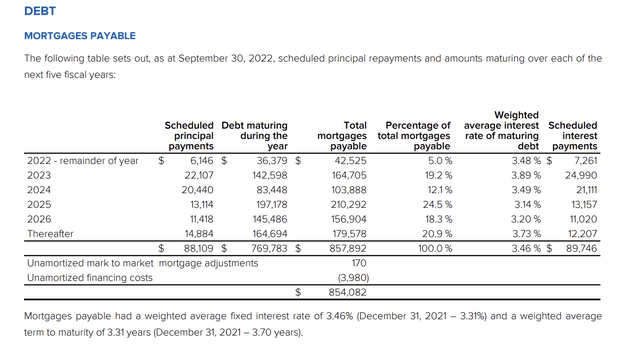

Rising rates are only beginning to eat into FFO margins and the REIT has 19% of mortgage debt due in 2023. The weighted average interest rate has increased 11 bps YoY. The REIT has recently refinanced $74 Million in mortgage at higher terms which will increase liquidity in the short-term but are seeing rate increases by as much as 184 basis points already.

During the quarter, the REIT refinanced a total of $51,250 (YTD-2022 – $82,820) of mortgages with a weighted average fixed interest rate of 4.68% (YTD-2022 – 4.16%) for one to five year terms (YTD-2022 – one to seven year terms), providing the REIT with additional liquidity of approximately $15,000 (YTD-2022 – $20,600). Subsequent to quarter end, the REIT refinanced $23,800 of mortgages with a weighted average fixed interest rate of 5.32% for a five year term, providing the REIT with additional liquidity of approximately $5,500.

True North Commercial REIT (Q3 2022 Investor Presentation)

Q3 2022 Report (True North Commercial REIT)

Valuation

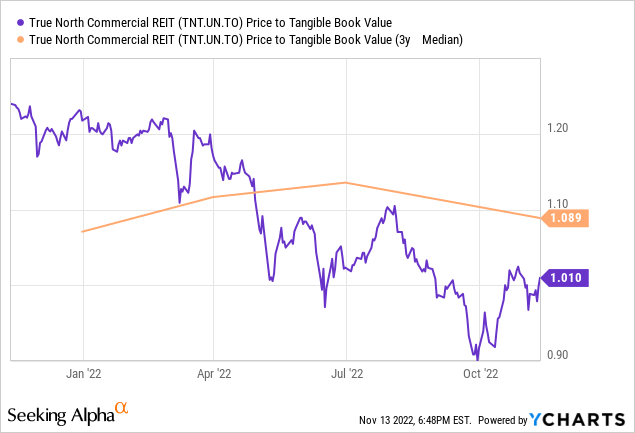

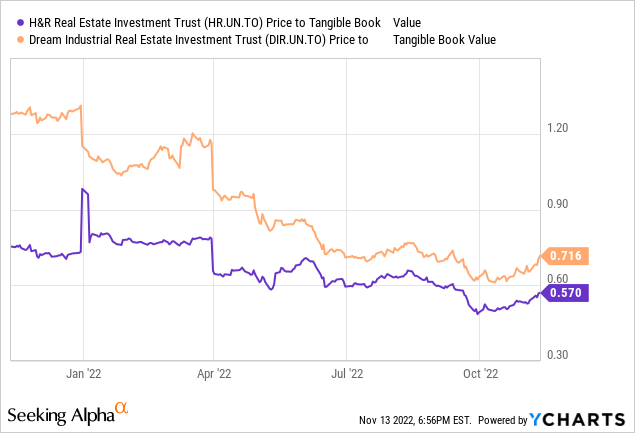

The REIT has traded at as little as 90% of NAV recently which is well below the three year median. There are however many good quality residential and industrial REITs in Canada that trade well below NAV and have been covered by myself like H&R REIT (HR.UN:CA) and Dream Industrial REIT (DIR.UN:CA).

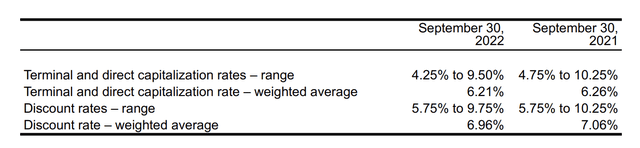

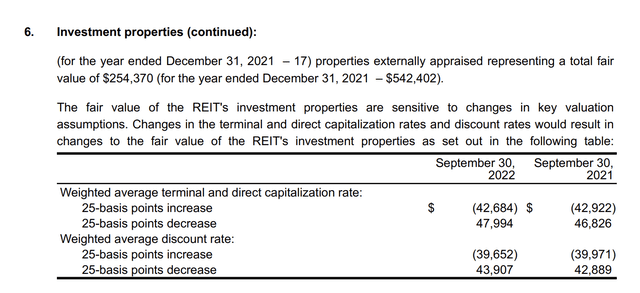

Furthermore, I see this valuation going well over 1:1 in the near term. First of all the higher that leverage is the more sensitive NAV is to your assumptions when valuing your assets and leverage on a debt to GBV basis at 58% is not the lowest in the REIT space. Discount and capitalization rates in the 6-7% are reasonable even for class B space in downtown Toronto or Calgary. However, an increase in rates of as little as 100 bps would wreak havoc on its NAV, making it drop as much as 31%. We are already halfway to 100 bps as the BoC already announced a 50 bps increase in the policy rate since TNT’s last reporting date in September 2022 as the announcement took place in October.

Q3 2022 Report (True North Commercial REIT)

Q3 2022 Report (True North Commercial REIT)

Unless we see some real wizardry from management in renewing or reassigning the 200,000 in SF expiring before 2022 YE it is likely NAV will decline further by 2022 YE.

Conclusion

The current share price is too rich for me given the headwinds as a result of the tough office rental environment and the likelihood of having to refinance a significant amount of debt over the next couple years into much higher interest rates. The buy zone for me would be below $4.50/share. Quite frankly if the stock rose to the levels that they issued shares at earlier this year I would consider a short position.

Be the first to comment