Meowcyber/iStock via Getty Images

Introduction

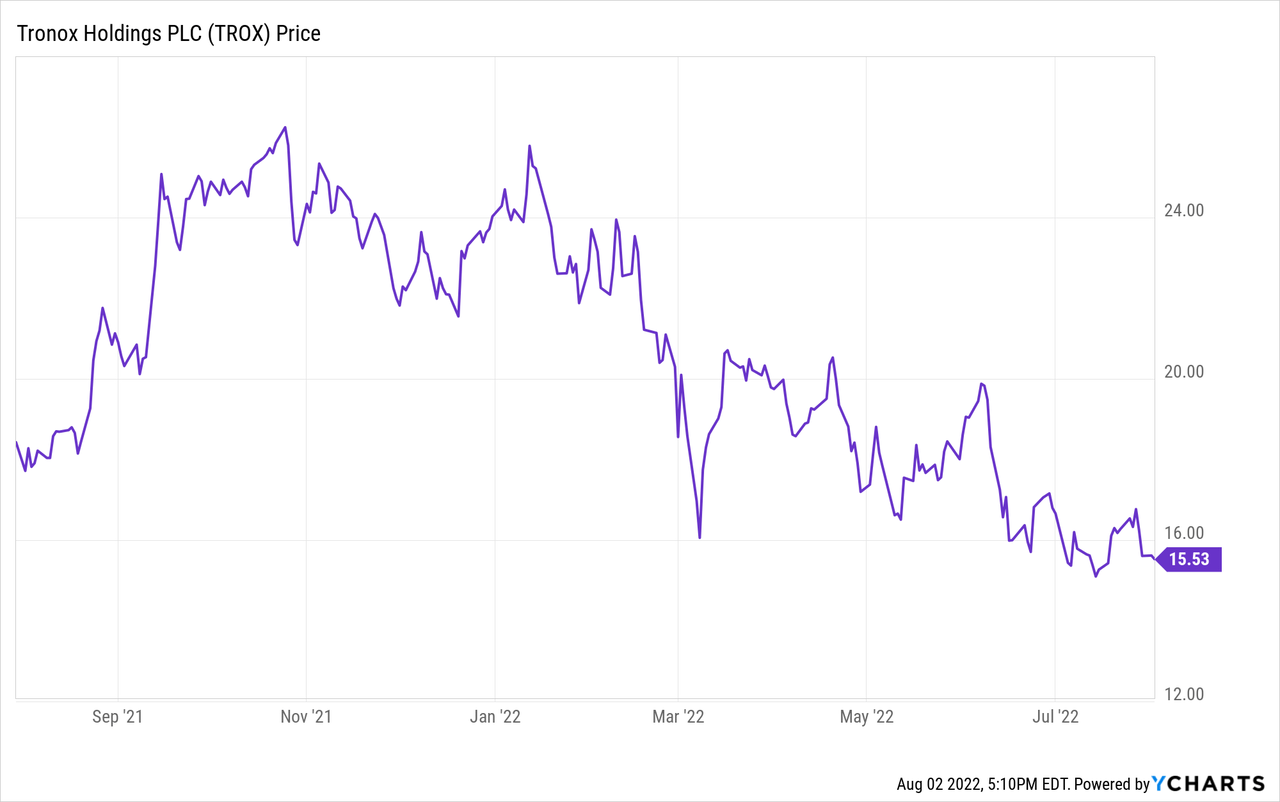

It has been several quarters since I last discussed Tronox Holdings (NYSE:TROX) and although I have been “playing” the stock by writing put options, it has been a while since I actually took a position. The share price has now fallen by almost 40% since my most recent article, and as the implied volatility has increased to the 45%-50% range, the climate to write additional put options is improving so I wanted to make sure my investment thesis was still intact. I’d recommend you to re-read my initial article on Tronox here (paywalled) to get a better understanding of what titanium dioxide is and how important it is to humanity on a daily basis.

A strong set of Q2 results makes the balance sheet safer

Tronox was digesting a large acquisition which was debt funded and this means the net debt spiked. The immediate consequence is that Tronox needs to generate strong free cash flows to immediately reduce not only its net debt level but also its gross debt level to reduce the net interest expenses. My previous investment theses were all based on this cash flow perspective and that will also be my main focus right now.

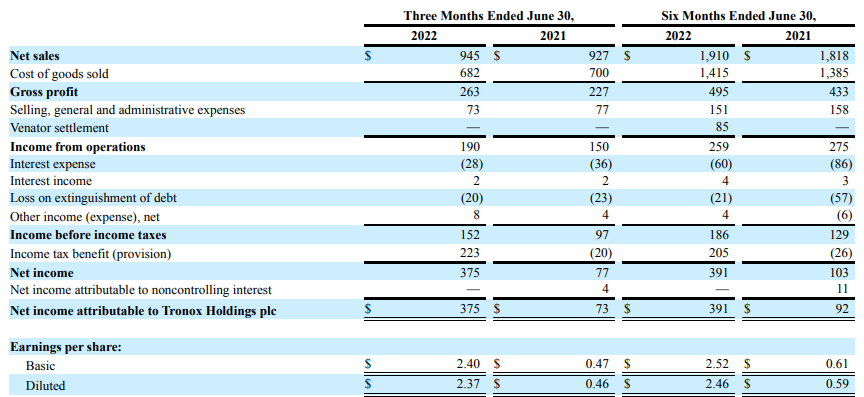

The total revenue in the second quarter came in at $945M. While slightly lower than the Q1 revenue, it was still about 2% higher than the revenue in Q2 2021 while the COGS decreased. This resulted in an increase with the gross profit of just over 15%. On top of that, Tronox saw its SG&A expenses decrease as well, leading to a 25%+ increase in the operating income which jumped to $190M.

Tronox Investor Relations

The pre-tax income increased by almost 60% to $152M while the net income came in at an amazing $375M or $2.40/share. But as you can see above, that net income was caused by a massive tax benefit to the tune of $223M. This tax benefit was related to a reversal of the valuation allowance in Australia which provided a $262M non-recurring relief. This means the normal tax bill would have been approximately $39M, resulting in a net income of $113M or $0.72/share on a normalized basis. A really good result for a stock trading at just around $15/share.

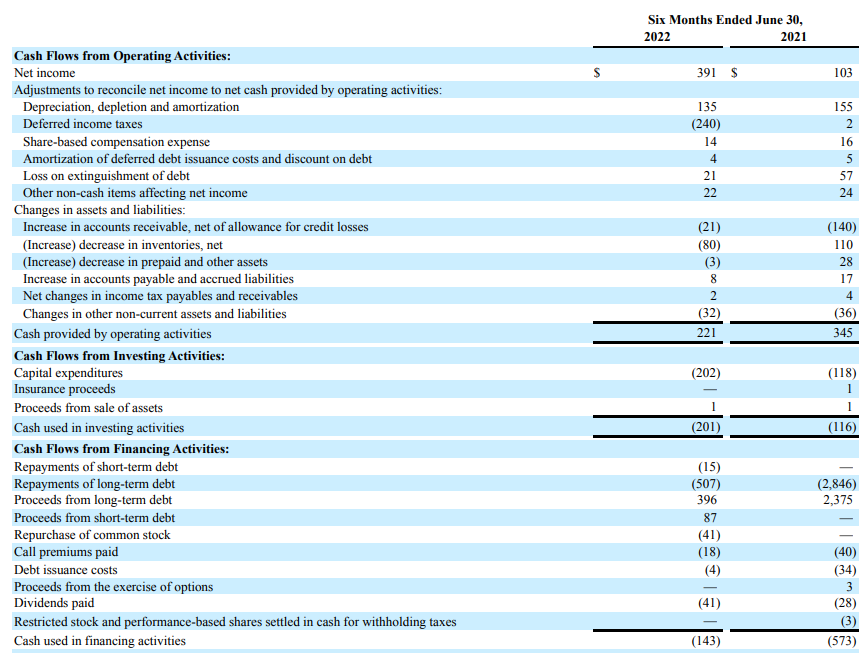

This income tax benefit also is filtered out of the cash flow statements. In the first half of the year, the reported operating cash flow was $221M but after adding back the $126M in working capital changes, the adjusted operating cash flow was approximately $347M. Plenty of cash to cover the $202M in capital expenditures which means the total free cash flow in the first half of the year was approximately $145M which is approximately $0.93/share.

Tronox Investor Relations

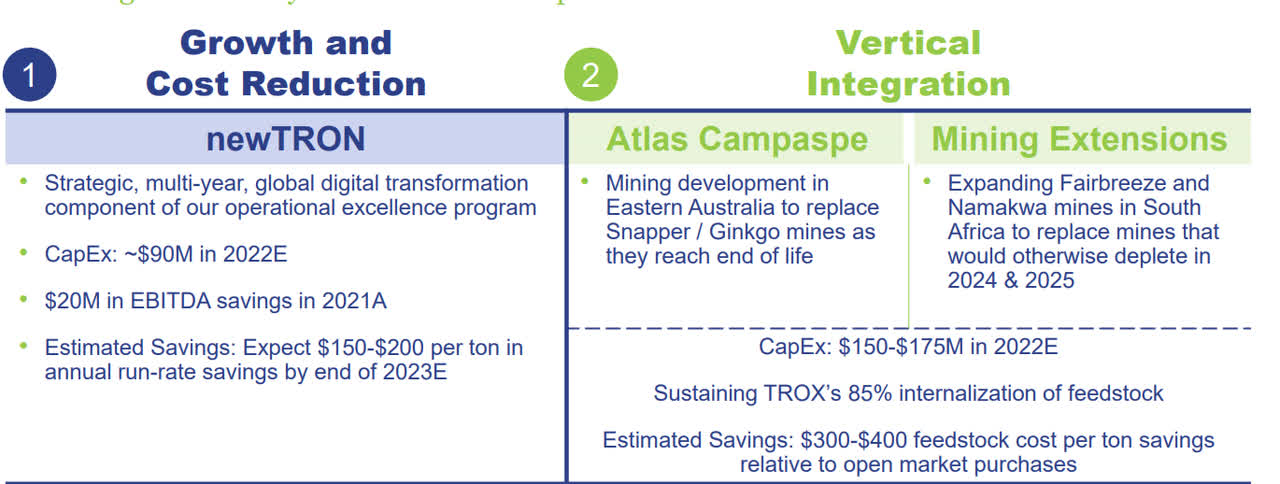

Again, not bad at all for a stock trading in the $15-16 range but keep in mind Tronox spent quite a bit of cash on additional growth initiatives: While the depreciation expenses during the first semester were just $135M, its total capex bill was about 50% higher. These investments were mainly related to growth as well as vertical integration which should result in substantial cost savings starting to be realized next year.

Tronox Investor Relations

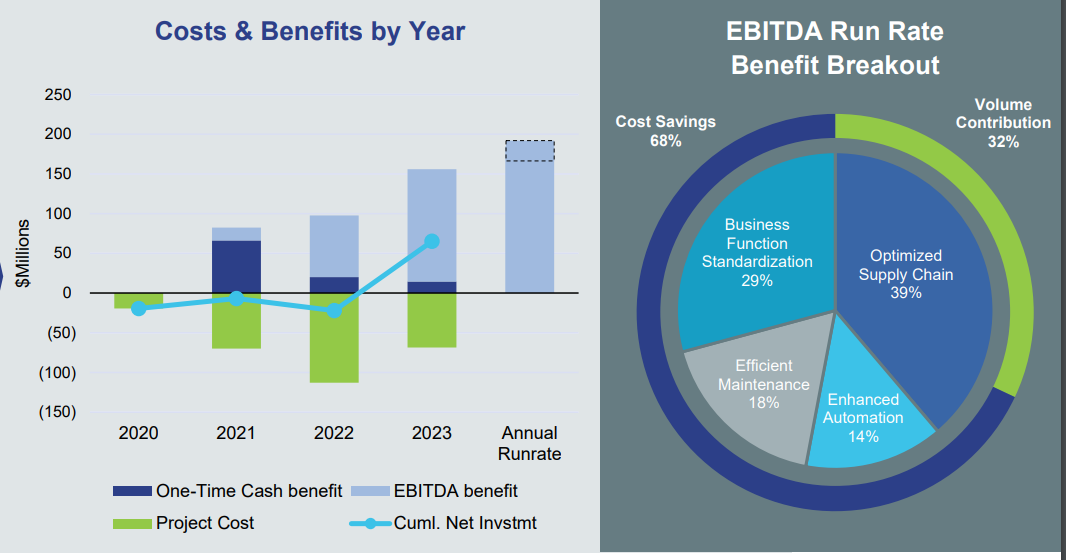

So while the free cash flow is somewhat disappointing (although, how disappointing can we really be with almost $1/share in free cash flow), Tronox is investing the cash wisely to make sure the company is ready for the future. Especially the “newTRON” investment should pay off very well with an ROI in the high double digits. As you can see below, the required investments will be particularly high this year before dropping down in 2023 wherein the cost savings should actually already outweigh the planned investments.

Tronox Investor Relations

The outlook is surprisingly strong

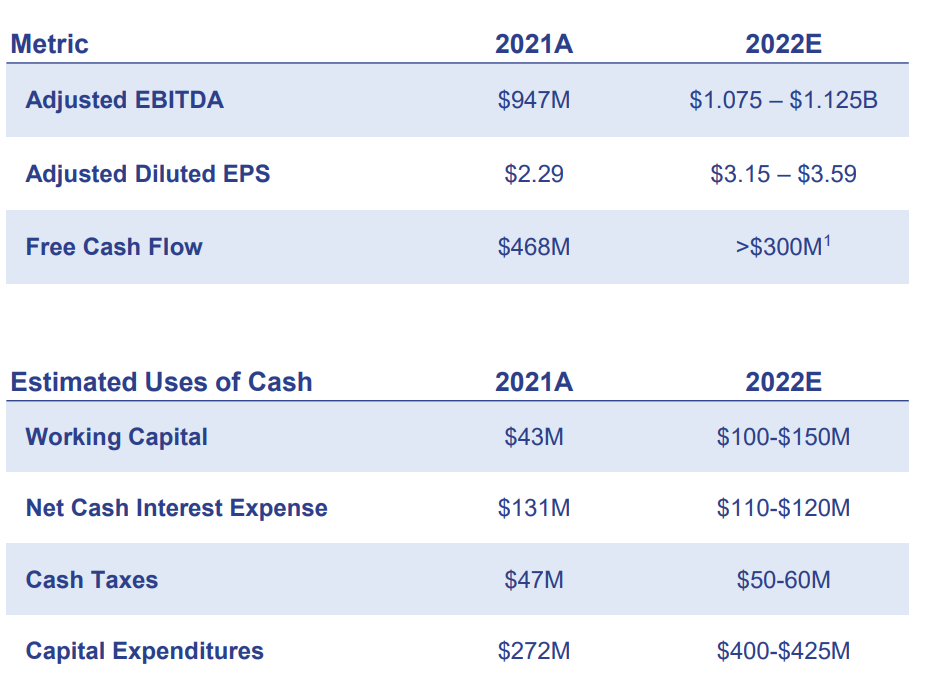

Tronox has provided a guidance for both Q3 as well as the full-year results. For the current quarter, Tronox anticipates to generate $275-295M in EBITDA which would exceed the $275M EBITDA generated in the second quarter. For the entire financial year, the EBITDA is now expected to exceed $1B with a mid-point of $1.1B.

The adjusted EPS will be $3.15-3.59 and for good measure that excludes the tax benefit. The math is pretty straightforward. From the $1.1B in EBITDA we should deduct the $275M in depreciation expenses and the approximately $110M in interest expenses. This would result in a taxable income of approximately $700M, and after applying a 20% corporate tax rate, the adjusted net income would be around $560M and divided over 156M shares outstanding the EPS will be $3.59.

Tronox Investor Relations

The free cash flow will be lower as the capex will be approximately $150M higher than the net income. But this means the free cash flow will still exceed $400M (excluding working capital changes) which makes Tronox’ own target of “greater than or equal to $300M” including working capital changes very feasible.

Investment thesis

And this makes Tronox very appealing again. While the use of titanium dioxide is strongly correlated to the health of the world economy (which explains why Tronox’ share price has been sliding), the company will generate about $2/share in free cash flow on a reported basis and likely in excess of $2.5/share on an underlying basis excluding changes in the working capital. From next year on, when the total capex should fall back to just the “normal” sustaining capex once the new TRON program has been finalized, the free cash flow per share will likely come very close to the adjusted EPS which makes Tronox quite cheap at a free cash flow yield of in excess of 20%.

The company has already reached its desired debt ratio of less than 2.5 times EBITDA, so Tronox will likely step up the capital allocated toward shareholder rewards. Of course, we should perhaps expect the free cash flow to decrease if/when the titanium dioxide prices decrease, but even when that happens, the stock should remain cash flow positive. That also makes the 2029 debt quite attractive. The 4.625% bond is currently trading below 88% of the par value, resulting in a YTM of in excess of 7%. While I’m mainly interested in the stock (and writing put options) I also will keep the 2029 bond high on my watch list as I think the risk/reward ratio is getting very interesting.

Be the first to comment