Thomas Barwick

trivago NV (NASDAQ:TRVG) is a leader in accommodation price comparison search serving as an advertising platform for all types of travel agencies. This is a segment that got crushed during the pandemic although the story over the past year has been an impressive recovery with climbing travel demand. On the other hand, macro headwinds amid rising interest rates and record inflation have pressured the stock. Shares are off more than 30% amid the broader market volatility with poor sentiment also related to softer trends in online advertising.

That being said, there’s a lot to like about TRVG which appears undervalued supported by strong fundamentals. The stock is well-positioned to rebound from a low base of expectations in a scenario where macro conditions improve going forward. Trivago is profitable and has a rock-solid balance sheet and several long-term growth drivers. Separately, we believe the recent weakness in the Dollar can continue, working as a tailwind for the stock into 2023 considering its large exposure to Europe and other international markets.

TRVG Key Metrics

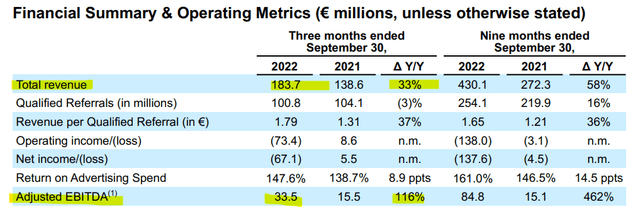

Trivago last reported its Q3 earnings on November 1st with the headline being revenue of EUR 184 million, up 33% from the period last year. The context here considers that in 2021 there were ongoing Covid travel restrictions worldwide in what was still the early stages of the pandemic recovery. By these measures, the theme now is an ongoing normalization of the business that includes ramped-up marketing spending to meet the higher level of demand.

Notably, the GAAP net income was reported as a loss of EUR -67 million although this includes a large impairment charge of EUR 100 million which management cited based on what it sees as a weaker macro backdrop impacting the value of intangible assets. In other words, adjusted EBITDA reaching EUR 33.5 million, up 116% y/y is a better measure of the underlying core profitability of the business.

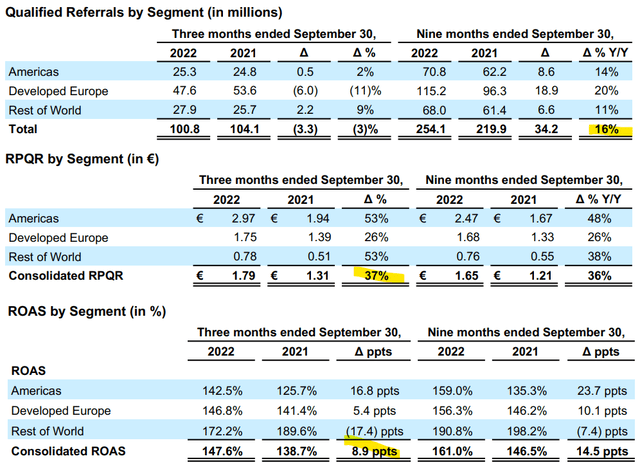

A key performance metric is the revenue per qualified referral (RPQR) at EUR 1.79, which increased by 37% from EUR 1.31 in Q3 2021. Here the indicator reflects how effectively Trivago is monetizing the referrals it provides to advertisers. Impressively, the measure is up from EUR 1.53 in Q3 2019 as a pre-pandemic benchmark. On that point, Trivago’s adjusted EBITDA this quarter was the highest in nearly a decade.

On the other hand, the one soft spot in this report was the qualified referrals, down -3% y/y to 100 million as a measure of unique visitors to the site per day that clicks on one of its advertised hotel or vacation rental quotes. Even as the total number is still up, 16% year-to-date, the weakness this quarter came from softer trends in Europe, in part related to the Russia-Ukraine conflict.

Qualified referrals are also below quarterly levels near 190 million back in 2018. This is in part based on increasing online competition with the emergence of different types of alternative price comparison tools and channels online. Nevertheless, the takeaway is that Trivago has managed to become more efficient and generate higher revenue and earnings through the RPQR despite decreased overall traffic to the platform.

This dynamic of efficiency is captured in the return on advertising spending (ROAS) metric which climbed by 8.9 percentage points to 147.6% in q3, and 161.0% through the first nine months of the year. The way to read this figure is that Trivago generates EUR 0.476 for every EUR 1.00 it spends on marketing to drive quality qualified referrals to the site. The measure compares to 122.9% in Q3 2021.

Moving onto the balance sheet, Trivago ended the quarter with EUR 232 million in cash and equivalents against zero financial debt. Positive and improving cash flows appear to have given it the confidence to move forward with its share buyback announcement, to repurchase 20,000,000 in Class A shares from founder Peter Vinnemeier for an aggregate price of $20.0 million. The deal retires 5.5% of the company’s total common shares outstanding, or 3.6% of the current TRVG market at approximately $550 million.

In terms of guidance, a theme during the conference call was the rising uncertainty in the macro outlook, particularly in Europe. That being said, one angle the company is running with is a view that a greater consumer focus on budgeting and affordability plays into Trivago’s strength where accommodation price comparison becomes more important than ever.

TRVG Stock Price Forecast

A bullish call on Trivago comes down to taking a positive outlook on global macro conditions. Signs suggesting inflation has peaked globally including the lower energy price, with interest rates stabilizing, and a pullback in the Dollar should be supportive of both global travel demand and risk sentiment. TRVG can lead the market higher as its operating trends and key metrics at least remain resilient beyond macro headwinds.

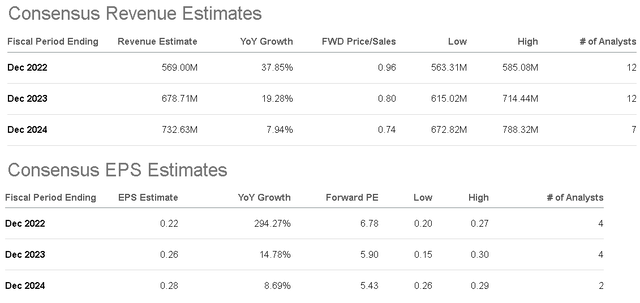

What we like about the stock is the tailwind for higher earnings. According to consensus, 2022 revenue is expected to reach $569 million, up 38% from 2021 while the trend remains positive in 2023 with another 19% upside. The EPS estimate at $0.22 has room to climb towards $0.26 in 2023, with the latest positive development being the easing of Covid zero policies in China that should accelerate travel trends in the broader Asia Pac region. We believe Trivago can outperform these estimates through higher operating margins.

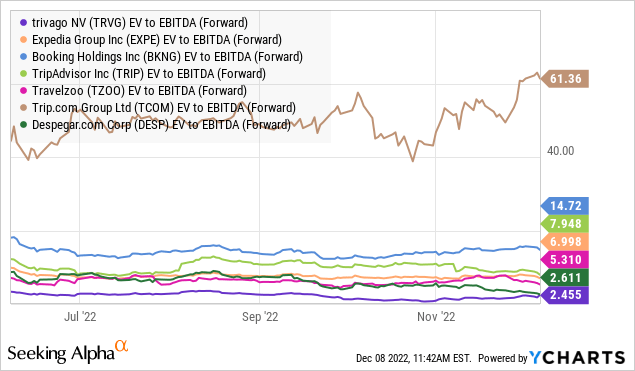

In terms of valuation, TRVG trades at a deep discount compared to nearly every other “travel services” stock across its sales multiple and growth premium. Considering it’s on track for around $100 million in adjusted EBITDA this year, shares are priced at an EV to forward EBTIDA multiple of just 2.5x which compares to benchmarks like its controlling parent Expedia Group Inc (EXPE) at 7x, or TripAdvisor Inc (TRIP) at 8x, Travelzoo (TZOO) at 5.3x, and the segment leader in Booking Holdings Inc (BKNG) at 15x. The spreads are similar in terms of the P/E ratio.

Part of the dynamic to explain the discount considers the corporate structure where Trivago is under the control of Expedia Group, which owns nearly 58% of shares, and the limited free float under 21%. There is also a sense that the business model has less of a moat compared to traditional travel agencies.

That being said, the argument we make is that the stock is simply cheap considering its financial trends with climbing earnings and overall fundamental quality. In our opinion, the globally recognized brand name of Trivago alone deserves a premium with all indications consumers continue to trust the site for travel planning. Strategically, one option the company could take to help realize its full valuation potential would be to consider a regular dividend initiation, which is at least feasible given the underlying cash flow trends.

In the near term, the good news is that the stock has rallied off its lows when shares briefly traded under $1.00 and has broken out of a long-running downtrend. We believe this momentum can continue and rate shares as a buy with an initial price target of $2.00 that goes back to a level last reached in Q2, representing a 9x P/E multiple on the current consensus EPS of $0.22 for 2022.

In terms of risks, a deeper deterioration in the global macro outlook would undermine the growth prospects. Monitoring points for the stock include indications of travel trends in key regions like Europe along with the metrics like RPQR and ROAS over the next few quarters.

Be the first to comment