piranka/E+ via Getty Images

Investment thesis

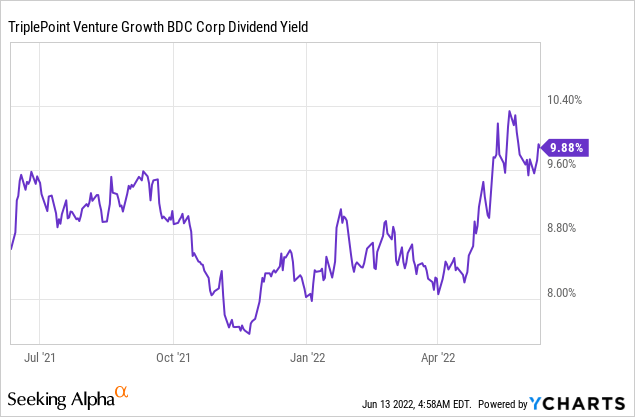

TriplePoint Venture Growth (NYSE:TPVG) could be a primary choice for income-seeking investors who want to get exposure to the high-growth tech sector but not deal with the extreme downturns of small-cap tech ETFs. The recession fears impact the current valuation of the company but the short-term turbulence will be outshined by the high-growth sectors TPVG invests in. 99% of its portfolio companies capitalize on the digital trends and all of the sectors TPVG invests in have at least 6.5-7% CAGR until 2025. The current dividend yield of 9.88% is not only a bargain but the long-term fundamentals, the coverage, and sustainability of the dividend are pleasant.

Direct Equity Investment Growth

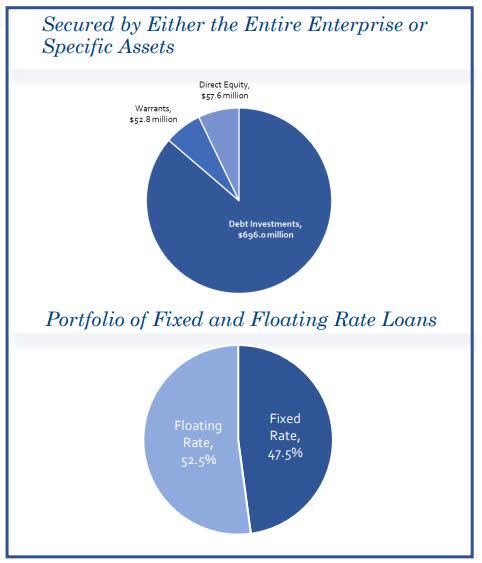

TPVG as a BDC invests in growth companies in high-growth sectors. The company has an investment portfolio of approximately $806.4 million. Interestingly, 8.3% of the portfolio is in direct equity, a higher number than the usual BDC sector average where most of the BDCs focus on their loan portfolio not to take too much risk with direct equity. TPVG almost doubled its direct equity investments in a year. In the first quarter of 2021, the company only had 4.5% of its portfolio in equity while by the end of Q1 2022 this figure grew to 8.3%. In addition, not the average deal size grew but the number of companies TPVG invested into. In Q1 2021 24 companies had direct equity investments from TPVG and in Q1 2022 this number was 42. I expect that the management will move further down this path and raise the share above 10% by the beginning of 2023.

Q1 Investor Presentation

External trends affecting TriplePoint Venture

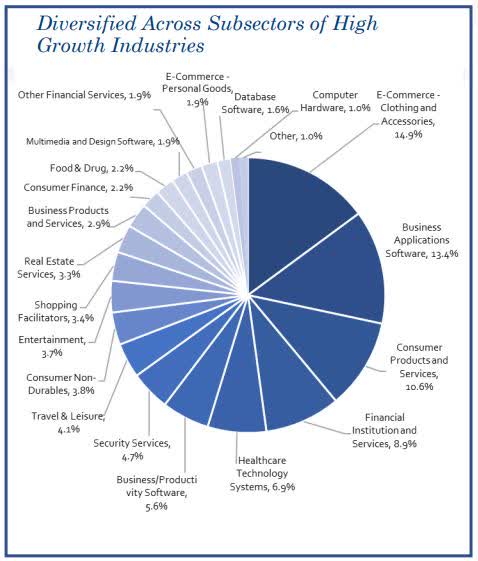

Approximately 39% of their portfolio is concentrated in 3 high-growth segments: E-commerce clothing and accessories, Business application software, and consumer products and services. We will take a look at the trends of these markets to determine the potential growth for TPVG in these sectors. The trends in these sectors are positive, the main question is: how these trends can transform into TPVG’s portfolio and eventually into investors’ pockets via price appreciation and dividends.

Q1 Investor Presentation

The E-commerce clothing industry is set for a 7.2% CAGR in the next 4 years and the online share of the clothing market will reach 25% of the total fashion market. The further gain of the different forms of metaverse will fuel the growth of the online platforms and e-commerce of clothing and accessories. The expectation is that in the future, every person will have a parallel digital identity with different clothes for different events which means fashion will no longer only be a physical appearance. This might look futuristic, but TPVG has a dept investment in a company called Trendly which heavily uses AR in its app which is the first step to the metaverse. TechStyle fits into the same box as well so this means that TPVG’s management is hand on the new trends and financing trending companies that will have a positive impact on the overall portfolio.

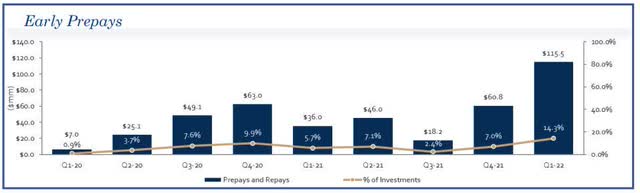

We can see similar trends in the business application software sector. Analysts expect a CAGR of 11.4% in the next 4 years. The growth will be accelerated by the companies moving to the cloud to increase their productivity, lower their costs and capitalize on AI. In the consumer products and services sector according to Deloitte: “Amid strong competition and ever-increasing customer expectations, retailers and consumer products companies also need to evolve their delivery models-namely, in the direct-to-consumer (DTC) space-as the “at home” economy grows.” 99% of TPVG’s portfolio companies are very strong in the DTC space and all of them capitalize on the ever-growing digitalization trends. So, I believe that is why TPVG could have had such a massive yield on its portfolio, approximately 14.5% in the last 2 years. Of course, part of this was due to strong prepayments but the core yield is still above 12% which is impressive in the BDC sector.

TPVG stock valuation

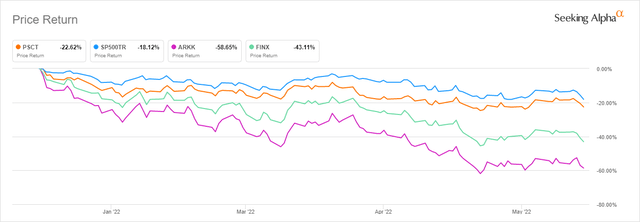

Based on P/B value TPVG trades at a premium, 1.05x its book value. However, it is not a surprise as most of the tech sector-related companies usually trade at a premium. But the current 1.05x is close to 2022’s low of 1.02x and far from 2022’s high of 1.29x. The YTD return is very similar to the general market return. (S&P 500 YTD: -18.12 vs. TPVG YTD: -18.47%). So, despite the premium TPVG trades at a fair price and its forward P/E is almost trading at its 5-year average of 9.11. In terms of dividend yield, the 9.88% is a great yield and the company was trading above the current yield only 4% of the time in the last 12 months. Taking a look at a wider timeframe the 5-year average yield is 10.93%. Although, the “real” average yield is lower because in the average the extreme COVID yields were included when the company traded above 20% for weeks. I believe that TPVG is fairly priced and mimics the movements of the general market and due to recent recession fears some downside momentum is possible in TPVG’s price but I do not think that the growth potential of the company is already priced in.

Company-specific Risks

There are 2 main risk factors worth noting in my opinion. The first one is the general market trend of the tech industry. I believe this is the less risky part for TPVG. The tech sector, in general, underperformed the S&P 500 in 2022 and there are no signs that this trend will change in the near future, especially with the recent fear of recession. Small-cap tech ETFs underperformed the market in which TPVG had equity or investments previously. Due to TPVG investing in companies in the venture growth stage aiming to go public soon the negative small-cap tech trend will not help these companies in general to have a high IPO price. It may eventually hit TPVG’s direct equity investments in the exit phase.

In the first quarter, the company reported an elevated percentage of prepayments. It was great news for the portfolio’s current yield but in the long term, such a high prepayment percentage can hurt the portfolio overall. The first-quarter results were due to some companies prepaying large sums of money and I expect that the prepayment rate will normalize from the second quarter however, I expect higher numbers than in 2021. This factor if not managed well can cause issues in the investment portfolio in the long term. If you look closely you can see that a lot of analysts asked the management about the prepayment and its risks in the Q1 earnings call.

My take on TPVG’s dividend

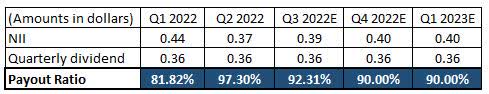

TPVG has a relatively boring dividend policy in the BDC sector which is good news. The company has been paying $0.36 quarterly for the last 7 years. Thus why, I am not expecting any dividend increases in 2022 and 2023, and neither do analysts. However, a special dividend of $0.1 at the end of the year is possible if the NII is higher than expected. The dividend is covered and the payout ratio is fine. I am glad that the management does not finance its operations by issuing shares like a lot of BDCs because the average number of shares outstanding has not changed in the last one and a half years.

The table is created by the author. All figures are from the company’s financial statements and SA Earnings Estimates.

Final thoughts

TPVG declined with the general market in 2022 producing similar price returns as the S&P 500 despite its heavy involvement in the tech sector. The increase in direct equity investment could be either a great or a bad management decision, only time will tell. However, what is certain is that the current yield is attractive and the dividend is well covered. The company is in a unique place in the BDC sector and income-seeking investors might want to capitalize on the opportunity the market offers them on TPVG.

Be the first to comment