Galeanu Mihai

Investment Summary

We’ve been impressed with the snapback rally of R1 RCM Inc. (NASDAQ:RCM) over the past month of trade, spurred on by its Q3 FY22 earnings. Growth was strong throughout the P&L and we see upside in the stock based on its growth percentages looking ahead. With the stock up 43% since November we decided to take a closer look. We noted a strong underlying market, robust growth forecast for FY22, adequate return on capital and good access to capital looking ahead. Rate buy. Note, we don’t discuss the new CEO, however, this could well be a positive factor looking ahead.

Q3 results very constructive by estimation

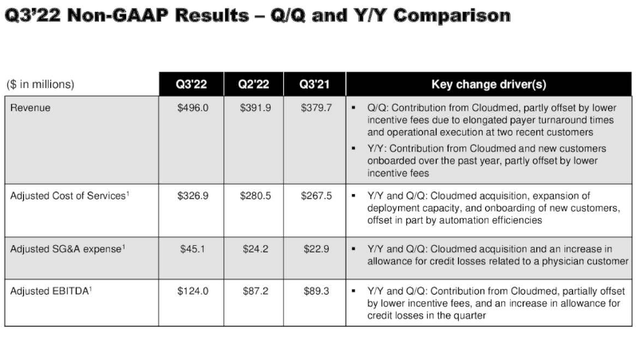

RCM reported in early November a good month ago. We’d note it was a reasonable period of growth for the company last quarter. Numbers wise, starting from the top, revenue reached $466mm, up 30.6% YoY, on adjusted EBITDA of 124mm – an increase of $34.7mm YoY. The growth was largely driven by the contribution from the acquisition of Cloudmed, as well as the inclusion of new end-to-end customers. Notably, incentive fees decreased by $9.1mm sequentially and $20.7mm on a YoY basis, landing at $20.8mm. We’d note it was largely due to payer dynamics and not a risk in our opinion.

With respect to capital budgeting, the company reported a net debt increase of $18mm quarter-over-quarter, bringing total net debt to $1.67Bn. Its net leverage ratio, as calculated under its credit agreement was 2.92x at the exit and is expected to remain <3x in the coming quarters.

Moreover, 30% of its floating rate exposure is currently hedged at a rate of 3.01%, and we saw the average interest expense across their debt portfolio was in-line with commercial industry rates in the 6%-6.5% range. Still, there’s risk it could tick higher with the remaining portion unhedged. Nevertheless, this all appears well covered with over $650mm of available liquidity and 1.5x cover of current assets over current liabilities.

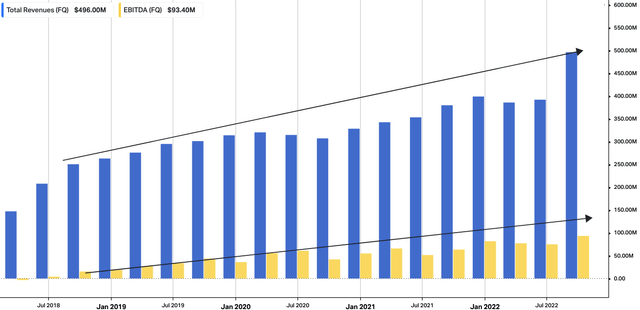

Exhibit 1. Sustained revenue growth, with latest clip above average run rate

Data: HBI, Refinitiv Eikon, Koyfin

Exhibit 2. Adjusted EBITDA growth a highlight

Image: RCM Q3 Investor Presentation

Another takeout was the Modular division with $151mm increased by $121.3mm over the prior year, again due to the contribution from Cloudmed. The cost of services in Q3 was $326.9mm. Automation and digitization efforts continued to offset the rise in cost of services, as technology is inherently deflationary. Note, the company remains on track to generate $45mm in cumulative cost savings by the end of 2022, which could be a tailwind.

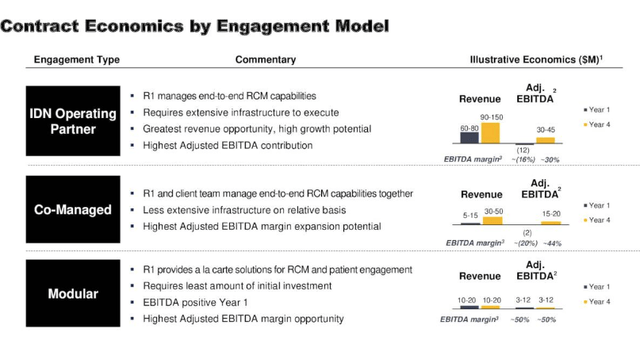

Exhibit 3.

Image: RCM Q3 FY22 Investor presentation

Additional findings add bullish weight to risk/reward symmetry

Here are the additional findings we uncovered when looking into RCM’s financials deeper, in addition to the market opportunity.

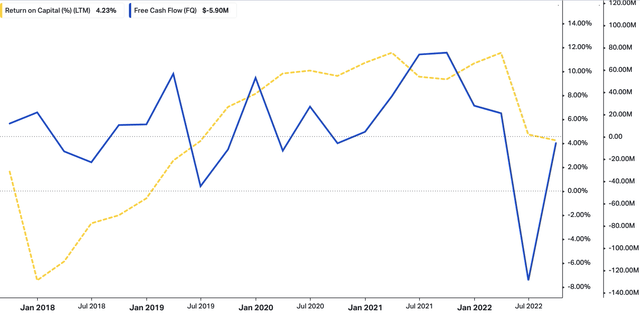

Return on capital: In our analysis of RCM, we have found that the company’s return on capital has been shifting higher as it effectively manages its cyclical cash flows. This suggests that cash is being invested into growth initiatives, which is a positive sign for management in our opinion. We will be closely watching to see how these initiatives translate into earnings growth.

Exhibit 4. Return on capital employed vs. free cash flow trends.

Data: HBI. Refinitiv Eikon, Koyfin

The underlying market: Revenue cycle management (“RCM”) is a business process that involves the management of claims processing, payment and revenue generation activities in healthcare. It is a profitable sector with interesting economics tied into the mix. It also provides billing software and other systems to make sure providers are paid.

The RCM market is growing as more healthcare organizations are looking to improve their revenue cycle processes in order to increase their revenue and reduce costs. The global RCM market is estimated to grow at a compound annual growth rate of 10.6% from 2021 to 2026, reaching $67.8Bn. The key differentiators within the market are as follows:

1. Automation: Revenue cycle management is becoming increasingly automated, allowing businesses to streamline processes and reduce costs. Automation technologies such as robotic process automation (RPA) and artificial intelligence, can help automate repetitive tasks such as eligibility and authorization checks, claims processing, and accounts receivable.

2. Predictive Analytics: Predictive analytics can help healthcare providers to identify and address potential issues in the revenue cycle before they occur. Predictive analytics can help healthcare providers to anticipate payer trends and optimize reimbursement opportunities.

3. Patient Engagement: Patient engagement technologies such as patient portals, online billing systems, and automated payment systems can help healthcare providers to improve patient experience and increase collections.

4. Cloud-Based Solutions: Cloud-based revenue cycle management solutions provide healthcare organizations with scalability, data security, and real-time insights into their financial operations. Cloud–based solutions can help healthcare providers to reduce costs and drive better patient outcomes.

5. Strategic Partnerships: Strategic partnerships with third-party vendors can help healthcare providers to reduce costs and increase efficiencies. Strategic partnerships can also help healthcare providers to gain access to cutting–edge technologies and innovative solutions.

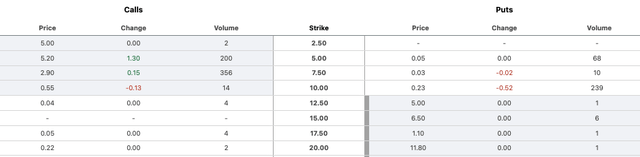

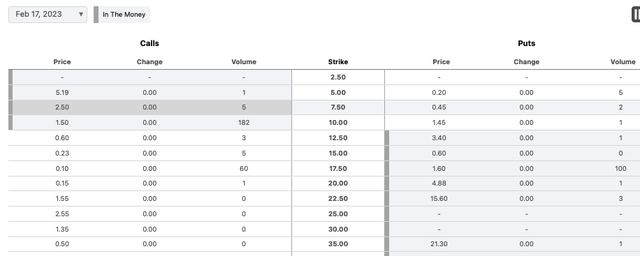

Market Positioning: In terms of market positioning, we have observed that the December 2022 expiry options chain for RCM is fairly evenly stacked on both sides [calls/puts], with shallow depth. However, when we look at the February 2023 expiry [Exhibit 6], we see that the market is speculating that the stock will push higher, with a deeper chain of calls down to $35. While there is no guarantee that the stock will reach this level, the market’s positioning indicates potential upside if exercised at the lower bounds. Overall, we believe that RCM is well-positioned for future growth.

Exhibit 5. December 2022 Options chain for RCM. Note, investors use derivatives to hedge against price fluctuations, or to speculate on them.

Data: Seeking Alpha, RCM Quote page, see “Options”

Exhibit 6. February 2023 Options chain for RCM

Data: Seeking Alpha, RCM Quote page, see “Options”

Valuation and conclusion

The company is valued in line with the sector median at 14.4x forward EBIDTA.

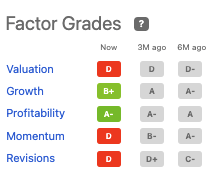

We’re happy with management’s forecast of $425mm at the upper end. At 14.4x this number represents a price target of $14.70. We believe this corroborates our buy thesis. One key risk would be that Seeking Alpha’s factor grades rate the stock a sell. You can see the gradings below. This should be taken into consideration. We lay good weight to these ratings, as they provide an objective viewpoint. Hence, considering these risks, we rate the stock a buy, with a price target $14.70.

Exhibit 7. Seeking Alpha factor grades, RCM.

Data: Seeking Alpha

Be the first to comment