Composite wood decking terrace Xenokratis Vartzikos/iStock via Getty Images

Trex (NYSE:TREX) has lost nearly 46% of its value in the past year and is one of the worst performers in the Vanguard Industrials ETF (VIS). Over the past decade, Trex has made tremendous progress in improving its profit margins and financial performance. But, the company remains heavily dependent on the home market and renovations. Consumers may begin to pull back on spending on their homes after two years of frantic spending. The high-interest rate environment and high inflation may take a bite out of consumer spending in the coming months. More importantly, there may have been a pull forward in demand during 2020 and 2021, which can further contribute to lowering sales in the short term. The company is fully priced or even a bit over-valued at current levels with a forward PE of 20x. The long-term prospects look bright for the company, but investors should expect further weakness in the stock in the short term.

A Great Turnaround Story

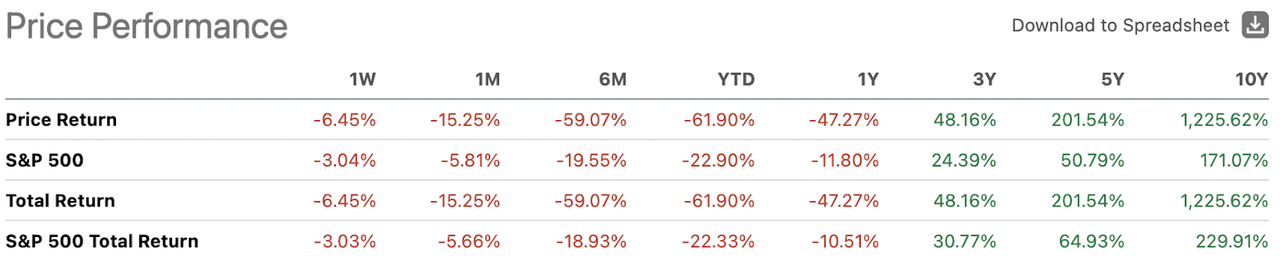

Fifteen years ago, I did not think there was any investor who predicted the turnaround at this company. In 2007, the company had booked a net loss of $65 million and an EBITDA loss of $57 million on $328.9 million in revenue. In 2007, the company had a meager gross margin of 11.9% [Exhibit 1]. But, by the following year, the company had improved its gross margin to 27%. In 2021, the company had a gross margin of 38.4%. Meanwhile, the company has grown its revenue from $328.9 million in 2007 to $1.196 billion in 2021. In the past few years, the company has grown revenues at a double-digit pace [Exhibit 2]. The company was able to turn around its operating margins too. Since 2016, the company has consistently maintained operating margins above 21%. It is no wonder that the company’s price return stands at over 1200% in ten years [Exhibit 3]. But, you cannot ignore the fact that the ultra-loose monetary policy of the U.S. Federal Reserve over the past ten years kept interest rates artificially low and thus aided the recovery of the housing market. Trex may have benefitted from the loose monetary policy.

Exhibit 1: Trex Revenue and Gross Margin [2007-2021]

Trex Revenue and Gross Margin [2007-2021] (SEC.GOV, Author Compilation)![Trex Revenue and Gross Margin [2007-2021]](https://static.seekingalpha.com/uploads/2022/6/23/saupload_NjDj_bIsPdQeejeb4iiqQ7XIF0cUwfMnNlH5itE8t0G8joFFN4CZY2uoxSIk__4FIk_N54F92PP60bfLMttQ5Km84KzbRivZix095LRfbXPPBxx2YBGkRCNME3FFF343_61RnSKjDzBeluJVDA.png)

Exhibit 2: Trex Year-over-Year Revenue Growth Rate [2017-2021]

Trex Year-over-Year Revenue Growth Rate [2017-2021] (SEC.GOV, Author Compilation)![Trex Year-over-Year Revenue Growth Rate [2017-2021]](https://static.seekingalpha.com/uploads/2022/6/23/28462683-16559917514914775.png)

Exhibit 3: Trex’s Price Return Over a 10-Year Period

Trex’s Price Return Over a 10-Year Period (Seeking Alpha)

The company continued to see strong growth in Q1 2022. Trex’s sales to the residential market increased by 40% year-over-year, led by double-digit gains in both volume and price. For the quarter ending March 31, 2022, the company increased sales by 38% compared to the same quarter in 2021. Total sales came in at $339.22 million in the quarter compared to $$245.52 million in the quarter ending March 2021. Gross margins stood at 39.7% in the quarter compared to 39.02% for the quarter ending March 2021 – a 68 basis point improvement.

Earnings per share increased by 47.6%. Share buybacks assisted EPS growth only slightly, reducing the diluted share count by 1.163 million. The company has shown impressive growth in EPS irrespective of the share buybacks. If the company had kept the diluted share count at the March 2021 level of 116.01 million, EPS would have been $0.613 compared to $0.62 based on the reduced count of diluted shares. The company has guided double-digit growth in 2022, driven by both price increases and more homeowners moving from wood to composite decks. Analysts estimate the company’s FY 2022 EPS to be $2.48. That would give the stock a PE multiple of 21x. I would invest money if Trex traded between 14x and 16x or at an EV to EBITDA multiple of between 9x and 11x. The past two decades, marked by low-interest rates and inflation, may be an aberration. We may have entered a tumultuous new phase in the global economy characterized by low growth rates and higher inflation compared to the past. The company does not offer a dividend. Investing might be easier if the company provided at least a 2% dividend. The company does not carry any debt. Currently, many uncertainties in the demand environment could hurt Trex.

Price Return Comparison

Given Trex’s products and end-markets, it is evident that the company aligns with the housing market than the industrial products market. Over the past year, the daily price returns of Trex have a positive correlation of 0.59 with the Vanguard Industrials ETF. Trex has a daily price return correlation of 0.73 and 0.7 with the SPDR Homebuilders ETF (XHB) and the iShares U.S. Home Construction ETF (ITB). But, the markets have battered Trex’s stock [down 45% in the past year] when compared to SPDR Homebuilders ETF [down 26.4%] and the iShares U.S. Home Construction ETF [down 26.9%]. Trex trades closely with the homebuilder’s ETF but is more volatile than those two ETFs at this time. The Vanguard Industrials ETF is only down 17.2% in the past year. Given such a lopsided performance of Trex, markets may be signaling that the company has to prove itself in the second half of the year by posting stellar performance when faced with high-interest rates. The markets may also be anticipating a steep drop-off in home remodeling efforts and a downward revision in earnings.

Selling a Cash-Secured Put

Investors may be able to take advantage of a cash-secured put strategy to generate income or acquire the shares. The July 15, ’22, $45 strike price put last sold for $0.75 [Exhibit 4]. The put premium amounts to a return of 1.6% and a more conservative strike of $40 traded at $0.53. There are 589 open contracts [open interest] at the $45 strike price. That is a return of 1.3%. The challenge for investors is that they will have to predict the housing market’s recovery, which is challenging in the current environment. It might be worthwhile to hold on to the stock at $40 if it offered a reasonable dividend yield above that of the S&P 500. In my view, even selling a cash-secured put may be risky at this time. The current volatility in the stock may be another reason not to sell a cash-secured put. But, it may be good to revisit this strategy if the stock drops close to $40 or $45 in future market turmoil.

Exhibit 4: Income Generation By Selling a Cash-Secured Put on Trex [June 22, ’22 Quotes]

Income Generation By Selling a Cash-Secured Put on Trex [June 22, ’22 Quotes] (E*Trade)![Income Generation By Selling a Cash-Secured Put on Trex [June 22, '22 Quotes]](https://static.seekingalpha.com/uploads/2022/6/23/saupload_HeTAyHq0pAX3YlMTHXh6eWltllSP2n_DFEWz_Iy2Jvc68I5b9GdFwfGKnv8fZI0fPRVvVUjb0VdlibqaraVFLVw-s0ehw_1QkM8TMcV0yDA50JND4UjdnRS8U1qUMUX22tA3c4gaBX2K9wsTPw_thumb1.png)

Conclusion

Trex has performed exceptionally well in the past decade and delivered a stellar Q1 FY 2022. But, we are entering a new era with higher interest rates. The demand for the company’s products may have pulled forward in 2021. It remains to be seen if the company can deliver in the face of such intense headwinds. Selling a cash-secured put may help generate an income. But, investors may want to consider that strategy as Trex’s price is closer to $45. It may be best to wait before buying Trex.

Be the first to comment