Mindful Media/E+ via Getty Images

Investment Thesis

TravelCenters of America (NASDAQ:TA) positively surprised investors with its very strong topline results that percolated all the way through to its financials so that its bottom line adjusted EPS numbers were up 133% y/y.

Keep in mind the fact that favorable fuel purchasing conditions were in part responsible for its abnormally strong growth in EPS. This obviously begs the question as to the sustainability is this EPS figure?

That being said, by my estimates, the stock is priced at 5x earnings. This strikes me as cheap enough, despite some uncertainty, such as a potentially slowing economy.

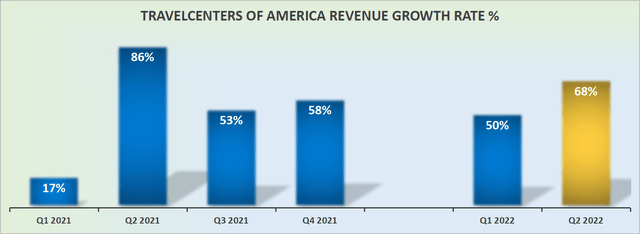

TravelCenters’ Revenue Growth Rates Impress

TA revenue growth rates

As you can see above, Q2 2022 reported 68% y/y of revenue growth rate. This is despite not only the tough macro environment of high inflation, and a slowing economy, not to mention the seriously tough comparison with last year’s Q2 period.

Near-Term Prospects

TravelCenters of America operates or franchises travel centers and standalone truck service facilities, primarily along the U.S. interstate highway.

TravelCenters of America believes that some of its competitive advantage relative to its peers stems from its larger size which facilitates more truck parking spaces, with around 200 spaces compared with approximately 85 spaces for its next biggest competitor.

This increased size lends itself to increased customer volume, which allows TravelCenters of America to offer alternative energy options to customers as well as more amenities than competitor sites.

The company has been operating under a new management team for a few quarters now, with a focus on site-level refresh and improving its IT systems, to drive efficiency and performance. This has now led to TravelCenters’ eighth consecutive quarter of improved y/y adjusted EBITDA.

Looking ahead, TravelCenter is eager to seek outgrowth opportunities with a focus on site refreshes, technology improvements, and network expansion, as well as, growing through acquisitions.

That being said, TravelCenter did acknowledge that its results benefitted from extraordinarily favorable fuel purchasing conditions. This will be something to watch out for going ahead.

Profitability Profile Shines

TravelCenters’ operating margin reached 3.1%, up 400 basis points from 2.7% reported in the same period a year ago. Accordingly, not only did the quarter see strong topline growth, but its operating margins actually improved, despite the seriously tough environment plagued by high inflationary pressures and volatility in supply markets.

This strong bottom line profitability aided its balance sheet’s improvement from net neutral in Q1 2022, where its cash and debt balanced each other, to a slightly net positive position, with approximately $20 million of net cash.

Indeed, by my estimations, I’m inclined to believe that TravelCenters’ EBITDA could reach $350 million in 2022. Here is my maths. For its trailing twelve months, TravelCenters’ EBITDA reached $341 million. And this is a very clean EBITDA profile, without many add-backs.

Accordingly, if TravelCenter simply continues to tick along on this path, it won’t be too difficult to increase its EBITDA from $341 million to $350 million. Some could argue that this figure could even prove conservative, after all this quarter alone saw $128 million of EBITDA.

TA Stock Valuation – 5x Adjusted EPS

For the first half of 2022, TravelCenters’ adjusted EPS reached $5.41, if analysts are even vaguely right that the second half of 2022 would reach $1.90 of adjusted EPS, that means that for 2022 as a whole, TravelCenter would report approximately $9.21.

This would put the stock priced at 5x earnings. Even if we were to assume that in a slowing economy the need for trucking services would reduce going into 2023, I’m still inclined to believe that paying 5x this year’s EPS is a very fair multiple for the stock.

The Bottom Line

TravelCenter of America reported a very strong result. Even though the stock is up 10% after hours, one could argue that the market has underreacted to this strong set of results.

With its market cap at $625 million and the company on a path to $350 million of adjusted EBITDA, I believe that this stock is cheap enough for investors.

Be the first to comment