pabst_ell/iStock Unreleased via Getty Images

Note:

I have covered Transocean (NYSE:NYSE:RIG) previously, so investors should view this as an update to my earlier articles on the company.

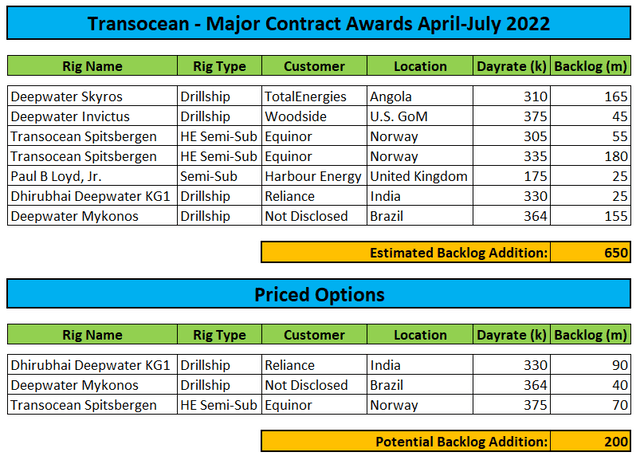

After Monday’s market close, leading offshore driller Transocean released its latest fleet status report. Contracting activity over the past three months has been decent with approximately $650 million in new work awarded by customers.

For the first time in many years (excluding acquisitions), the company recorded a sequential net backlog increase from $6.1 billion in April to $6.2 billion.

Fleet Status Report

Transocean bagged a number of long-term contracts offshore Angola, Norway and Brazil with additional short-term work awarded in the U.K. part of the North Sea, India and the U.S. Gulf of Mexico.

Even better, customers have returned to negotiating priced options at (mostly) escalating dayrates. If fully exercised, the company would add another $200 million in backlog.

In addition, Transocean has reportedly emerged as the front runner for a lucrative long-term contract with ONGC offshore India with an effective dayrate of close to $500,000.

As evidenced by improved dayrates and increased contract durations, the industry recovery is gaining steam across multiple regions which according to oil service industry leader Schlumberger (SLB) should continue in the second half of the year:

Looking more specifically at the second half of the year, we see very robust activity dynamics characterized by distinct acceleration of investments in the international basins and the continued strengthening of offshore activity as all operators, including IOCs, step-up spending. The energy security situation continues to drive structural activity increase, resulting from the increased focus on short-term production and the mid to long-term capacity expansion across oil and gas plays. In addition, we also expect further exploration and appraisal activity and the pricing dynamics experience so far to add further support to both the growth trajectory and the margins performance during the second half.

Recession fears have resulted in some major oil price volatility in recent weeks with industry stocks down between 30% and 50% from early June highs.

Transocean as the most leveraged player with the need to extend its revolving credit facility in the not-too-distant future has been hit particularly hard.

Adding insult to injury, S&P surprisingly downgraded the company’s debt earlier this month due to “unsustainable leverage“.

At the same time, Borr Drilling’s (BORR) creditors unexpectedly required a major capital raise as part of a comprehensive debt refinancing.

But with the industry recovery gaining further traction, I fully expect Transocean to succeed in extending its currently undrawn $1.3 billion revolving credit facility way ahead of its June 2023 maturity date.

At least in my view, investors should focus on the apparent strength of the ongoing industry recovery and use the recent weakness in industry stocks to build or increase positions.

Bottom Line:

Transocean provided a decent fleet status report with multiple long-term contract awards across major regions. As a result, total backlog increased sequentially for the first time in many years.

With offshore activity expected to increase further, the industry outlook remains positive.

Recent volatility in oil prices has resulted in offshore drilling stocks taking a major hit.

Investors should consider the setback as an opportunity to gain or increase industry exposure.

While the rising tide is likely to lift all rigs, I continue to prefer restructured competitors with clean balance sheets and decent liquidity like Noble Corporation (NE) and Valaris (VAL) over debt-laden players like Transocean and Borr.

But given the apparent strength of the industry recovery, I also expect Transocean’s shares to do quite well going forward.

Management will provide additional insights on the company’s third quarter conference call next week, so stay tuned for a near-term update.

Be the first to comment