cemagraphics

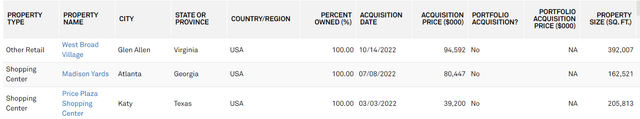

CTO Realty Growth (NYSE:CTO), a diversified REIT, recently issued 3.45 million shares, inclusive of underwriter’s greenshoe, to fund the purchase of West Broad Village, a $94 million mixed used property. Issuance funded acquisition is normal behavior for a REIT, but 2 aspects made this particular issuance notable:

- Timing

- Size

REIT equity issuance has slowed to a crawl in 2022 because the market is not receptive. This makes raising capital in general difficult, but the challenge was made even harder by CTO’s large issuance that was roughly 15% of its outstanding shares.

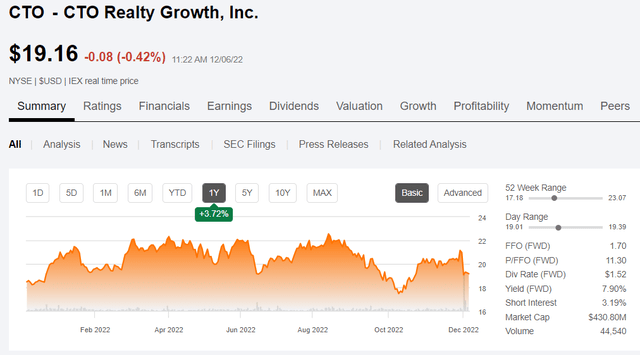

So, while a normal equity issuance would tend to take a stock down about 3%, the size and timing of this particular issuance knocked over 10% off the pre issuance $21.15 price of CTO down to the $19.00 issuance.

The trade

Such issuance dips are often a good entry point. The $19.00 price is not a measure of what the market actually thinks the company is worth, but rather a reflection of a momentary disconnect in the supply and demand of shares as the market was temporarily flooded.

Stocks will tend to rebound back toward the pre-issuance price plus or minus and net accretion/dilution from the offering making this a quick flip trade opportunity to potentially get a few percentage points.

Dilution or accretion?

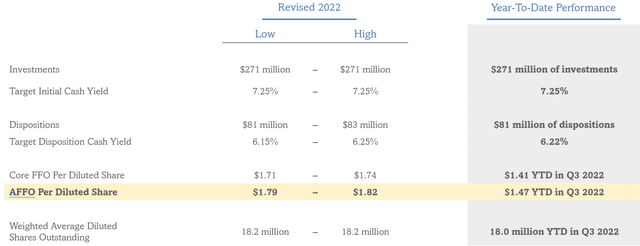

At $19.00 per share the offering came at a fairly high cost of equity capital based on CTO’s recently raised guidance.

With $1.80 per share of anticipated AFFO, that is a roughly 9.5% cost of equity. It was used to finance October’s acquisition of West Broad village with the company describing it as follows:

“CTO Realty Growth acquired West Broad Village, a 392,000 square foot mixed-use, grocery-anchored lifestyle property in the Short Pump submarket of Richmond, Virginia for $93.9 million. The price represents a going-in cap rate above the range of the company’s current guidance for initial cash yields.”

While the cap rate was not explicitly stated, the phrasing “above the range of guided initial cash yields” would imply somewhere in the 8% cap rate range given that 7.25% was the midpoint of guided range.

Debt cost of capital for a property like this would be around 6% in today’s environment so assuming a 50/50 debt to equity on the purchase the blended cost of capital would be 7.75%

That is quite close to the going in cash yield making the purchase approximately neutral to AFFO/share. It would be mildly accretive if the unstated cap rate is in the mid to high 8s.

Efficiently redeployed

One of the mistakes we frequently see REITs make is raising capital well in advance of it being deployed. The dilutive cost of equity raise starts immediately but then companies often take 6 months to a year to actually deploy the proceeds resulting in an awkward time period of reduced earnings.

CTO timed this issuance well in that it was after the acquisition was in place such that there will not be a gap of dilution without the fresh cashflows.

Given this timing and the neutral to slightly accretive spread, I think CTO is still worth roughly what it was before the equity issuance and would therefore anticipate the price recovering to pre-issuance levels.

Valuation

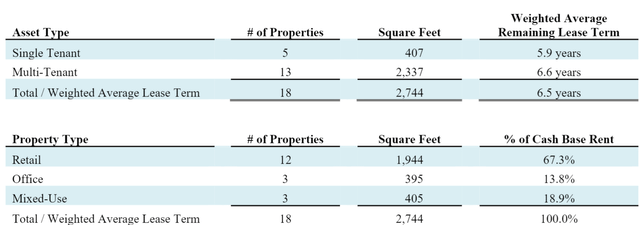

CTO is a net lease REIT with long lease terms but usually is not valued on the same scale as the others because it has multitenant properties. It is primarily retail but also has office and mixed use properties.

Further differentiating it from the group is its pace of change. Formerly known as Consolidated Tomoka it was a land bank company. Most of the land has now been sold off with some subsurface mineral rights remaining. These too are being sold to free up capital for more property acquisitions.

“the nine months ended September 30, 2022, the Company sold approximately 14,582 acres of subsurface oil, gas and mineral rights for $1.6 million, resulting in a gain on the sale of $1.5 million. As of September 30, 2022, the company owns full or fractional subsurface oil, gas, and mineral interests underlying approximately 355,000 “surface” acres of land owned by others in 19 counties in Florida.”

It is unclear whether the asset swap is accretive to NAV, but it is moving non-cashflowing assets into cashflowing assets so revenues are expanding rapidly.

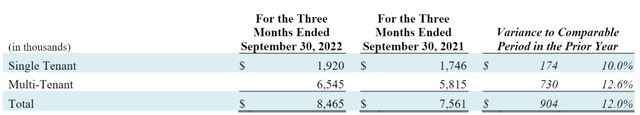

12% year over year growth is not a figure often seen in companies with long leases.

That said, the transformational AFFO growth is largely complete, leaving CTO as a more traditional rental property REIT and I would anticipate its growth coming more in-line with peers.

Given the amalgamation of asset types CTO would tend to trade at somewhere between 13X and 15X forward AFFO. However, there are a couple things which I think should deduct a little bit from the multiple.

- Small size

- A few bad tenants

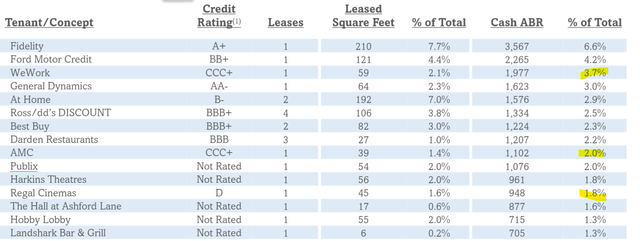

At less than $1B enterprise value, CTO should trade at a slight discount to its more established peers. I would further discount it for having 7.4% of its ABR come from a combination of WeWork (WE), AMC (AMC) and Regal.

On the conference call CTO discussed what strikes me as a reasonable plan to deal with these spaces given their strong locations so it is possible to maintain or even slightly increase rental revenues from these properties. Yet, it will be bumpy on the way so I would attribute a bit of discount to the multiple.

Unique aspects of CTO’s valuation

When looking at FFO or AFFO multiples for valuation, one should generally make adjustments for items that are not cashflowing the normal amount.

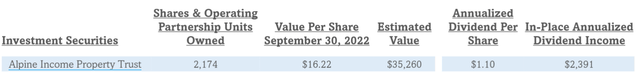

CTO owns about $35 million worth of Alpine Income Property Trust (PINE) which it externally manages.

While investments in other REITs are marked to market on a quarterly basis, the changes to market price are not counted toward AFFO. Only the dividend income from other stocks counts toward AFFO.

In this case, Pine has a dividend yield of 5.7% so its cashflows are slightly below what one would expect relative to the asset value. For instance, CTO could sell this stock and use the proceeds to buy properties at a 7% cap rate which would be accretive to AFFO/share.

Additionally, CTO had 3 fairly large acquisitions in 2022, the impact of which was only partially felt in 2022.

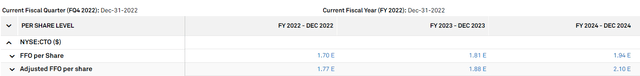

S&P Global Market Intelligence

As these begin to fully cashflow in 2023, CTO’s AFFO/share is anticipated to bump up nicely.

S&P Global Market Intelligence

All in, I think a roughly 12X multiple on forward AFFO is appropriate and that would take the stock price to around $22.50.

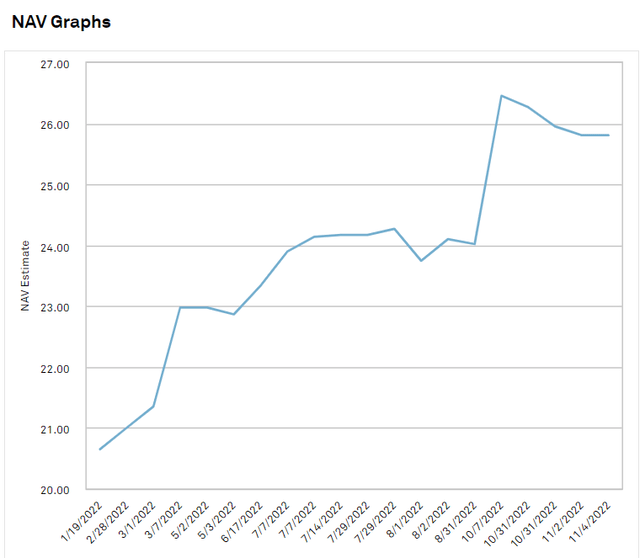

Consensus NAV for CTO is just under $26.

S&P Global Market Intelligence

Note, however, that REITs in general trade at a 10% to 15% discount to NAV so I don’t expect it to trade all the way up to NAV.

Quick trading opportunity

Retail is a deeply undervalued REIT sector right now which makes CTO a bit tougher to invest in due to the opportunity cost. So while it is undervalued relative to fair value, I don’t think it is quite as undervalued as certain other retail REITs.

As such, for a long term investment I would rather put the retail exposure of my portfolio in things like Whitestone (WSR), Kite Realty (KRG), or Simon Property Group (SPG).

That said, I do think the equity offering presents an interesting near term trading opportunity. I have been watching REIT equity issuance for many years and quite frequently they will trade back up to pre-offering price in a matter of a few weeks. Thus, for an adept trader CTO might be a good short term trade with the backup plan of its cashflow yield providing long term support in the event the market moves against you.

Be the first to comment