yrabota/iStock via Getty Images

The downside about figuring out new things is how stupid this often makes you feel. This article shares one of those for me; perhaps it can save some of you that same feeling.

I cannot resist sharing an aside about feeling stupid. In school and through a Masters degree, successful engineering and science students get to feel smart a lot. They excel at finding the answer in the back of the book.

But if they go further, in education or career, they get a new experience. Research reliably makes you feel stupid.

When solving problems for which there is no book, we all fail to grasp what later seems obvious. Those students who can’t cope with feeling stupid in those moments end up leaving research.

After a long career in science, feeling stupid is very familiar. So here we go again.

Many Exchanges

We often have investors come into our chat room at High Yield Landlord who lack experience on the details of buying and selling stocks. One of them has to do with stock exchanges.

If you trade only US stocks of large corporations with a common broker, then you don’t need to understand exchanges.

But if you start trading stocks in non-US companies, or tiny companies, this changes. Stocks well known in the USA trade on the NYSE or the NASDAQ exchanges. But you don’t need to know that, and trading on those two has become more integrated anyway.

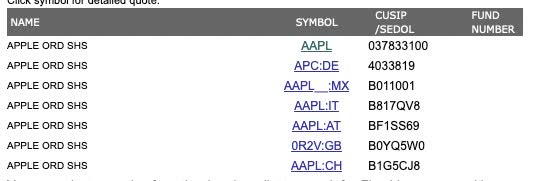

In fact, there are many more exchanges where you could trade such stocks. Here is the listing from Fidelity (my broker) for Apple (AAPL):

Fidelity

The extra codes are Fidelity’s designators and not always obvious. CH, for example, refers to Switzerland. Apple is listed on only a fraction of the exchanges available worldwide; there are many others.

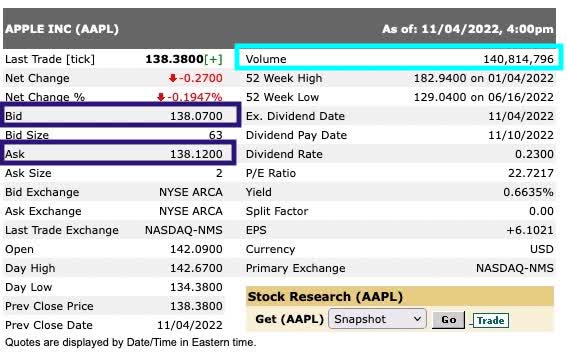

Large volumes of those large-cap stocks change hands every day. The spread between current bid prices and asking prices is generally small as a result. Here is the story for Apple:

Fidelity

Here you can see the 140M share volume traded last Friday, outlined in Cyan. Large volumes traded almost always mean that you can make purchases “at market value” with minimal risk of getting caught by a temporarily high asking price.

It is nonetheless good to check the spread by comparing bid and ask prices (outlined in blue here). In this case they differ by much less than 1%.

Poking around those other exchanges for Apple, one finds much smaller volumes, larger bid-ask spreads, and sometimes no indication of any trades.

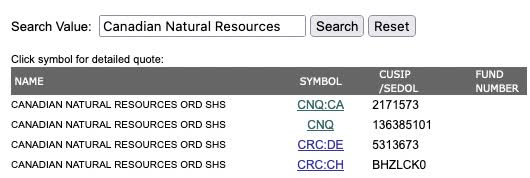

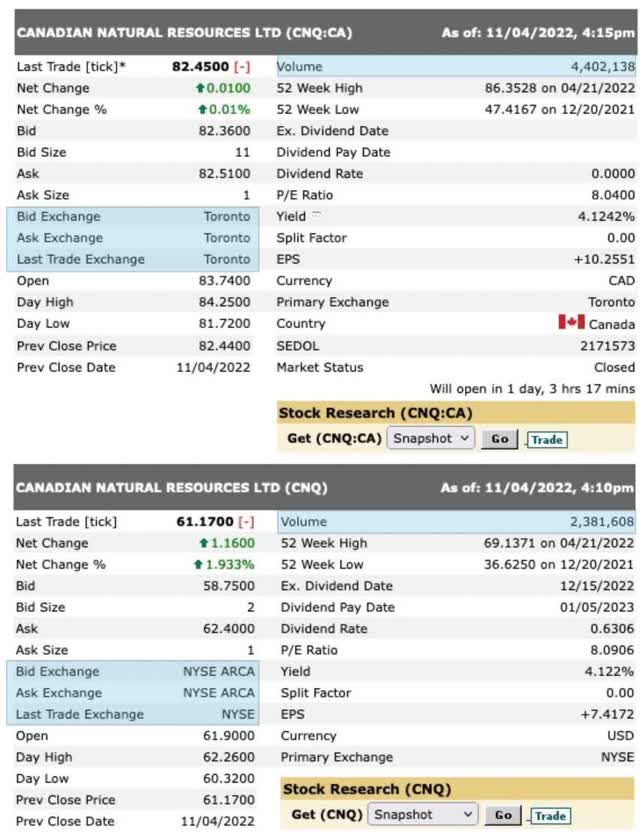

Occasionally a stock is traded at high volumes on more than one exchange. I own and have written about Canadian Natural Resources (CNQ). You can see here that it is listed on several exchanges, including the US and Canada (in Toronto on the TSX).

Fidelity

When we look at the first two, we find that either exchange gives good liquidity. Both have large traded volumes (shaded blue below), though these are much smaller than Apple’s.

Between these two exchanges, it really does not matter where you trade CNQ. CNQ, however, is unusual in my experience. More often, buying a non-US stock in the US requires buying on the pink sheets.

Buying on the Pink Sheets

Buying on the pink sheets is jargon for trading in the US in the OTC markets. Investopedia informs us that “The pink sheets name came about because the paper the quotes were printed on was pink.”

The pink sheets are often an option for trading a non-US stock listed on multiple exchanges. Sometimes this is no big deal.

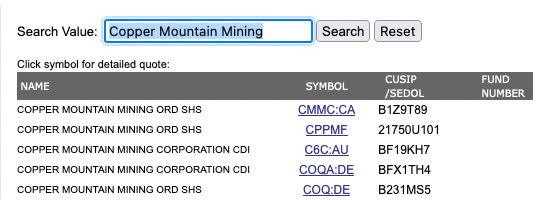

More common is what you find for Copper Mountain Mining (OTCPK:CPPMF) (CMMC:CA), which I also own and have written about. Copper Mountain is also listed on several exchanges:

Fidelity

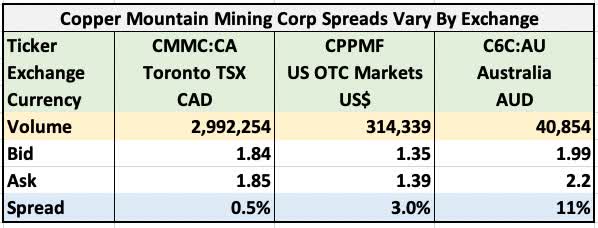

Here I’ve gathered key data from three of them:

RP Drake

The Bid/Ask spread varies on any given exchange but will be larger on average where smaller volumes are traded.

You can see one aspect of the decision to trade this stock on the smaller exchanges. If you buying it and then later sell it for a gain, you give up a few percent, or perhaps more than 10%, of your gains.

You also may find that your order to trade a stock via the pink sheets takes longer to execute. It may take time for someone to show up on the other side of the trade.

What Else Can Go Wrong

But losing a few percent net on the trade is not the worst that can happen. Suppose there is major bad news about a firm whose stock you bought on the pink sheets.

In such cases bids for the stock in low-volume exchanges can completely vanish. Or the spread can blow out so much that any bids are at prices far below what you could get in the primary markets.

You may be stuck unable or unwilling to sell when you want to. Or, if you were dumb enough to place a market order rather than a limit order, you might take a huge and unnecessary loss.

The issues just discussed are why any time this topic comes up, Michael Boyd says he never will buy on the pink sheets. I have a lot of respect for Michael and pretty much followed along, buying non-US stocks on their native exchanges using taxable funds.

Implications of Taxes

What makes me feel stupid is that I did not think through the implications of taxes in the context of my own options. I have not had to worry about taxes on my investment gains until this year, but could have done better preparing for the present.

I effectively inherited a whole bunch of tax losses from my parents. (This actually reflected the step up in basis upon death followed by other events.)

But my fortunate 2021, with great gains in both my taxable investments and from a private-equity payout, wiped out those tax losses. So now I’m stuck with the rest of you having to think about holding things for long-term capital gains, tax-loss selling, and such.

There are often reasons to sell investments within a year, so that any gain is a short-term capital gain. At times in recent years, this has been true with both REITs and energy investments. I’ve made a lot of money selling stocks that had moved toward fair value in order to buy stocks that had yet to move.

But my total gains would have been much smaller had those short-term gains been taxed at ordinary income rates on each stock sold. My tax rate will never drop much below 20% and getting there remains some years away.

I can avoid these taxes by holding the US listing of foreign stocks within my Roth, which holds most of my portfolio. Fidelity does not permit me to hold the foreign listings there. So consider the benefits and risks of putting foreign stocks in the Roth using the pink sheets.

For short-term gains, my tax rate (above to well above 20%) will be the percentage benefit of going through the pink sheets. The regular cost will be the increase in the bid-ask spread. The big risk will be the potential of getting trapped with a big loss, as described above.

Implications for Me and You

Whether holding stocks from the pink sheets in a Roth (or IRA) would be worth it for you depends on your investing style. If you are an investor in highly speculative stocks, whether from a momentum perspective or a deep value one, the risk from trading on the pink sheets is comparatively large. Big swings in price happen suddenly for those two groups, and you may want out in a hurry.

My own investments, in contrast, are focused on value opportunities in firms that are investment-grade or near it. These are not immune from big negative surprises, but such things do happen a lot less often for them. Holding few positions overall and following them closely also improves my odds.

Beyond that, I’m a big believer in Buffet’s Rule Number One: never lose principal. And in Rule Number Two: don’t forget Rule Number One. Unless my view becomes that a thesis is genuinely broken, I don’t tend to sell.

At the moment, for example, my holdings of Safehold (SAFE) are down more than 30%. But my opinion of their business model has not changed, so that stock is “in the icebox” until whenever selling it makes sense to me.

Considering how I invest, the odds of disaster are quite small from holding investments in my Roth bought on the pink sheets. In contrast, the savings in taxes are substantial and ever-present.

Over coming years, I expect to spend down my taxable holdings of non-US firms and replace them with investments within my Roth, buying on the pink sheets. You might consider whether this also makes sense for you.

Be the first to comment