Khaosai Wongnatthakan

The following data is derived from trading activity on the Tradeweb Markets institutional European- and U.S.-listed ETF platforms.

European-Listed ETFs

Total traded volume

Trading activity on the Tradeweb European ETF marketplace reached EUR 47.4 billion in August, while the proportion of transactions processed via Tradeweb’s Automated Intelligent Execution (AiEX) tool was 82.3%.

Adam Gould, head of equities at Tradeweb, said: “The traditional August slowdown didn’t seem to impact trading activity on our European ETF platform, which saw a 61% increase in notional volume year-over-year. This is largely driven by continued adoption of the request-for-quote (RFQ) protocol by institutional investors, as well as sustained market volatility.”

Volume breakdown

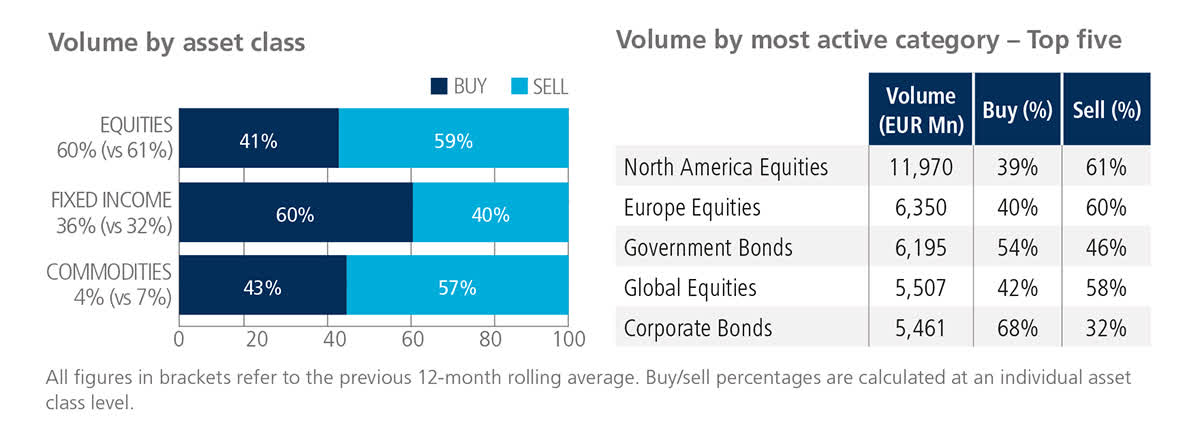

In contrast to their equity and commodity-based counterparts, fixed income ETFs saw net buying for the fourth consecutive month, with ‘buys’ in the asset class beating ‘sells’ by 20 percentage points. While the top three ETF categories by notional volume remained unchanged in August, Global Equities overtook Corporate Bonds to claim fourth place.

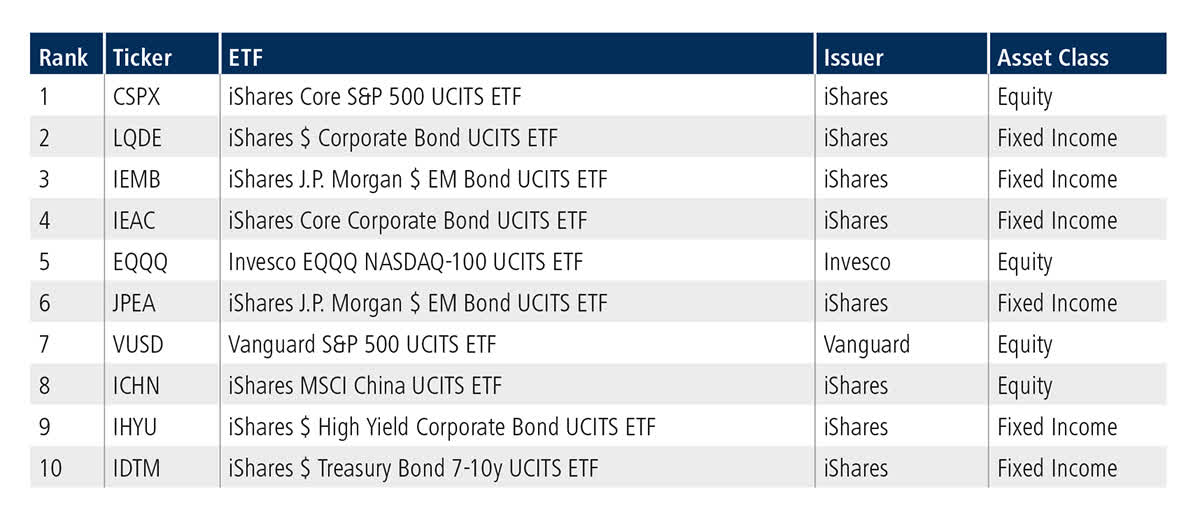

Top ten by traded notional volume

Three of the four shares-based ETFs featured in August’s top ten list by traded notional volume list offer investment exposure to U.S. equities. For the fourth month in a row, the most actively-traded product on the Tradeweb European ETF platform was the iShares Core S&P 500 UCITS ETF.

U.S.-Listed ETFs

Total traded volume

Total consolidated U.S. ETF notional value traded in August 2022 amounted to USD 49.3 billion.

Volume breakdown

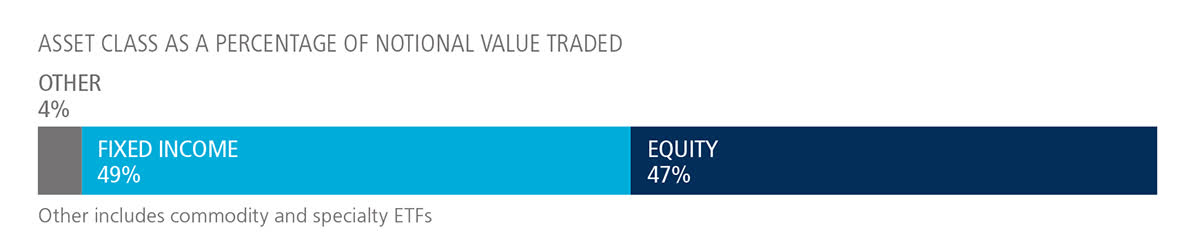

As a percentage of total notional value, equities accounted for 47% and fixed income for 49%, with the remainder comprising commodity and specialty ETFs.

Adam Gould, head of equities at Tradeweb, said: “Fixed income was the word in U.S. ETF markets throughout August. The asset class saw the most notional volume on our platform and dominated our top ten list for the month. Time after time, bond-based ETFs have demonstrated their resilience during tough market conditions and August was no exception.”

Top ten by traded notional volume

During August, 1,869 unique tickers traded on the Tradeweb U.S. ETF marketplace. The Vanguard Total Bond Market Index Fund ETF (BND) moved up seven places from July to become the month’s most heavily-traded fund.

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Be the first to comment