metamorworks/iStock via Getty Images

Investment Thesis

The Trade Desk (NASDAQ:TTD) is an amazing ad tech company. I know this, you know this, and everybody knows this. Consequently, given that we all know this to be the case, this has left its stock richly valued.

Accordingly, The Trade Desk is priced at 80x this year’s EBITDA. While I recognize that everyone wants to be a ”growth at any cost” investor and buy terrific companies at fair value, I question whether that still makes sense?

What’s more, I suspect that investors are not giving enough consideration to events in Europe and the ramifications this could have on The Trade Desk, an ad tech company.

This is made starker given that stocks don’t trade in a vacuum. Many of its ad tech peers are priced at a fraction of the price of The Trade Desk.

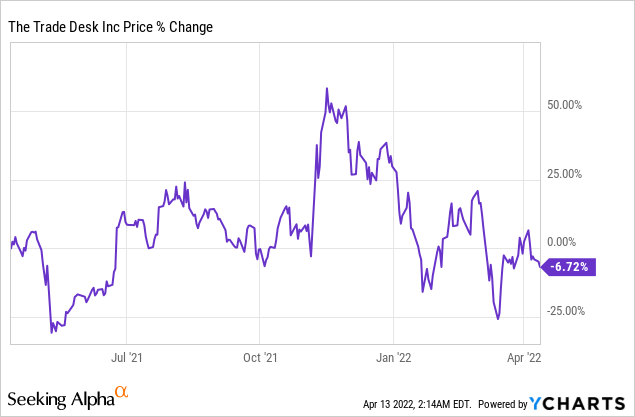

Investor Sentiment Fizzles Out of The Trade Desk

Three months ago I wrote,

The Trade Desk has been an investor darling for a long while and it mostly continues to be so. Even though many of its peers have sold off in the past several months, The Trade Desk hasn’t meaningfully lost any ground.

[…] new investors coming to the stock right now and having to pay up 23x this year’s revenues will struggle to find a particularly attractive return.

TTD author coverage

Consequently, in the past 3 months, the stock is now just over 9%. Not a disastrous 3-month performance, but not a positive return either.

On the other hand, as has always been the case with The Trade Desk, there are several good aspects to consider.

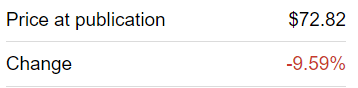

Trade Desk’s Revenue Growth Rates Remain Strong

The Trade Desk revenue growth rates, **guidance

What surprises me the most about The Trade Desk’s guidance is that Q1 2022 is pointing towards its revenues being up nearly 40% y/y.

That’s a tough hurdle to comp against Q1 of last year, and for The Trade Desk to still be printing these growth rates is nothing less than astonishing.

Indeed, think about this, The Trade Desk is already on a run rate of more than $1.7 billion. To be growing at more than 35% at this stage in the game is certainly astounding. And that fact, in and of itself, is impressive and puts The Trade Desk in a league of its own.

Now, the big uncertainty is really how does The Trade Desk’s guidance for Q2 2022 come out?

For perspective, consider that Perion (PERI) just preannounced its own Q1 2022 results last week, and its results were strong enough that it led to Perion upwards revising its guidance.

Consequently, there’s starting to be evidence that despite all the concerns about having to operate in a ”cookie-less world”, ad tech companies are finding ways to target users through other products.

Next, let’s discuss some bearish angles that investors need to consider.

Bearish Consideration to Think About

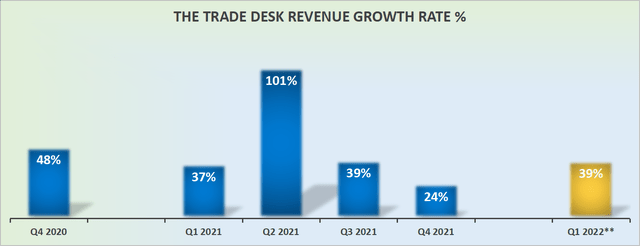

The Trade Desk investor presentation

The reason why the Trade Desk flourished so strongly in the past was that it became the go-to demand-side platform for digital advertising outside of the big walled gardens. It is an independent, demand-side platform.

It provides ad agencies with a highly scalable and measurable solution to buy digital advertising, on a global platform.

Now, my question is whether or not the impact of Europe going into a recession is going to have a knock-on impact on ad tech companies in the US?

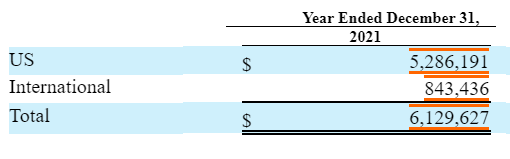

The Trade Desk 10-K

As you can see above, just over 13% of The Trade Desk’s gross billings come from its international exposure.

If this revenue stream was to slow down, I believe that it’s likely that this would temporarily cause The Trade Desk’s revenue growth rates to slow down and miss its analysts’ revenue estimates.

TTD Stock Valuation – Best Case, Fairly Valued

The Trade Desk’s Q1 guidance points to its EBITDA reaching around $95 million. Given that Q1 is typically the low season for ad tech companies, this means that for the year, it’s entirely possible that its EBITDA could reach $400 million.

This implies that The Trade Desk is priced at about 80x this year’s EBITDA profile.

While this isn’t a total shocking valuation, it is somewhat punchy for investors trying to capture meaningful upside.

Particularly when you consider that Perion has largely the same revenue growth rates in 2022 and its stock is priced at just 11x EBITDA.

The Bottom Line

The Trade Desk was an amazing investment in 2020. This led many investors to clamor for it as a “buy and hold” company. At all costs, buy and hold and dollar cost average into the stock.

Consequently, on the back of all that enthusiasm, together with the fact that even now, The Trade Desk has continued to flawlessly execute, has meant that its valuation hasn’t really meaningfully pulled back together with the rest of ad tech companies.

With all this in mind, despite fully understanding the allure of The Trade Desk, I’m struggling to compel myself to pay 80x this year’s EBITDA for the stock. Whatever you decide, good luck and happy investing.

Be the first to comment