Ranjit Talwar

This article is part of a series that provides an ongoing analysis of the changes made to Robert Karr’s 13F stock portfolio on a quarterly basis. It is based on Karr’s regulatory 13F Form filed on 8/12/2022. Please visit our Tracking Robert Karr’s Joho Capital Portfolio article for an idea on his investment philosophy and our last update for the fund’s moves during Q1 2022.

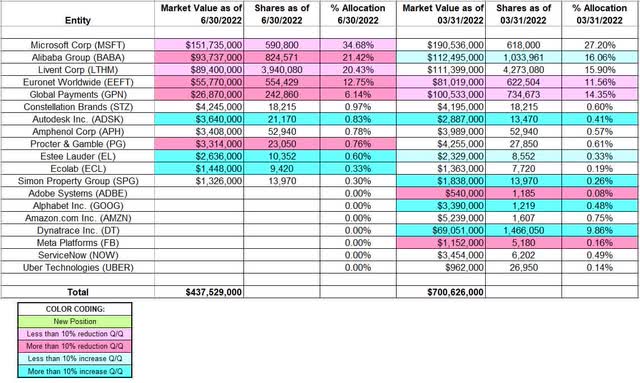

This quarter, Karr’s 13F stock portfolio value decreased ~38% from ~$701M to ~$438M. The number of holdings decreased from 19 to 12. The top three positions represent ~77% of the 13F assets: Microsoft, Alibaba Group Holdings, and Livent.

Robert Karr was one of the most successful among the “tiger cubs” (protégés of Julian Robertson & his legendary Tiger Fund). Although his main expertise is Asian equities, ~30% of the assets are typically in US listed 13F securities. The fund (1996 inception) closed to outside money and became a Family Office in 2014. To know more about Robert Karr and “tiger cubs”, check out the book Julian Robertson: A Tiger in the Land of Bulls and Bears.

New Stakes:

None.

Stake Disposals:

Dynatrace Inc. (DT): DT was a 9.30% of the portfolio position primarily built in Q1 2021 at prices between ~$40 and ~$56. There was a ~50% stake increase next quarter at prices between ~$45 and ~$61. Last quarter saw another one-third increase at prices between ~$38.50 and ~$59.30. The elimination this quarter was at prices between ~$30 and ~$49. The stock currently trades at $39.15.

Alphabet Inc. (GOOG), Adobe Inc. (ADBE), Amazon.com (AMZN), Meta Platforms (META) previously Facebook, ServiceNow (NOW), and Uber Technologies (UBER): These very small (less than ~0.75% of the portfolio each) stakes were dropped this quarter.

Stake Increases:

Autodesk Inc. (ADSK), Ecolab (ECL), and Estee Lauder (EL): These very small (less than ~1% of the portfolio each) stakes were increased during the quarter.

Stake Decreases:

Microsoft Corp (MSFT): MSFT is currently the largest position at ~35% of the portfolio. It was first purchased in Q1 2019 at prices between $97 and $120 and increased by ~90% next quarter at prices between $119 and $138. Q4 2021 saw a ~14% selling at prices between ~$282 and ~$343. The stock currently trades at ~$258. There was a ~4% trimming this quarter.

Alibaba Group ADR (BABA): BABA is Karr’s second-largest position at ~21% of the portfolio. It was established in Q2 2015 at prices between $79.50 and $94 and almost doubled the following quarter at prices between $57 and $84. Q1 2016 saw another ~50% increase at prices between $60.50 and $81.50. Since then, there had only been minor adjustments. Q1 2021 saw a ~25% selling at prices between ~$223 and ~$271. There was a two-thirds stake increase in Q3 2021 at prices between ~$140 and ~$222. This quarter saw a ~20% reduction at prices between ~$81 and ~$120. The stock currently trades at $90.60.

Livent Corp (LTHM): LTHM is a ~20% of the portfolio stake established in Q3 2019 at prices between $5.50 and $7.75 and increased by ~60% next quarter at prices between $6.45 and $8.95. There was a ~40% selling in Q2 2020 at prices between $4.60 and $8.75. Q4 2020 saw a two-thirds increase at prices between ~$9 and ~$19. The stock currently trades at $33.22. There was a ~8% trimming this quarter.

Note: Livent is a spinoff from FMC Corporation (FMC) that started trading in October 2018 at ~$16.25 per share.

Euronet Worldwide (EEFT): EEFT is a large (top five) 12.75% of the portfolio stake purchased in Q3 2020 at prices between ~$87 and ~$106. There was a ~60% stake increase in Q4 2020 at prices between ~$88 and ~$145. That was followed with a ~45% increase in Q4 2021 at prices between ~$101 and ~$135. The stock currently trades near the low end of their purchase prices ranges at ~$88. Last two quarters have seen a ~18% trimming.

Note: Euronet Worldwide has had a previous roundtrip in the portfolio. A small 0.93% of the portfolio position was purchased in Q1 2020 at prices between $69 and $167. It was disposed next quarter at prices between $73 and $121.

Global Payments (GPN): GPN is now a ~6% of the portfolio stake. It was first purchased in Q2 2019 at prices between $136 and $163 and increased by ~200% next quarter at prices between $154 and $175. The stake was sold down in H1 2020 at prices between $116 and $209. It was rebuilt during the five quarters through Q3 2021 at prices between ~$156 and ~$216. There was a two-thirds reduction this quarter at prices between ~$107 and ~$145. The stock currently trades at ~$130. They realized losses.

Procter & Gamble (PG): The very small 0.76% of the portfolio position in PG was reduced during the quarter.

Kept Steady:

Amphenol Corp (APH), Constellation Brands (STZ), and Simon Property Group (SPG): These very small (less than ~1% of the portfolio each) stakes were kept steady this quarter.

The spreadsheet below highlights changes to Karr’s 13F stock holdings in Q2 2022:

Robert Karr – Joho Capital’s Q2 2022 13F Report Q/Q Comparison (John Vincent (author))

Source: John Vincent. Data constructed from Joho Capital’s 13F filings for Q1 2022 and Q2 2022.

Be the first to comment