Phiromya Intawongpan/iStock via Getty Images

A Quick Take On Lizhi

Lizhi (NASDAQ:LIZI) went public in January 2020, raising approximately $45 million in gross proceeds from an IPO priced at $11.00 per share.

The firm operates an interactive audio entertainment and podcasting platform in China.

Given the recent stock delisting notice by Nasdaq and the firm’s need to cure that issue, I’m cautious about the firm’s future on a major exchange.

I’m on Hold for LIZI in the near term.

Lizhi Overview

Guangzhou, China-based Lizhi was founded in 2010 to develop a mobile audio platform for user-generated content that launched in 2013.

Management is headed by Founder, CEO, and Director, Jinnan (Marco) Lai, who was previously CEO at Shanghai Labox Information Technology.

Lizhi has developed a social audio platform for user-generated content that features tools that enable creators to create, edit, store, and share their audio content.

The firm’s platform offers podcasts across more than 27 categories, such as life and relationships, parenting, education, talk shows, and music radio, as well as dozens of sub-categories that include love and bedtime stories and family.

Lizhi also offers other types of audio media entertainment, including social, music, talk shows, animation, comics, and games, as well as audiobooks.

The firm markets its services primarily through advertising and brand marketing.

Lizhi’s Market

According to a 2021 market research report by The China Guys, the market for podcasting content in China produced an estimated $200 million in revenue in 2020 and is estimated to reach $700 million by the end of 2024.

Notably, the Chinese podcasting model relies heavily on ‘paid subscriptions, virtual gifts, and tipping to profit.’

This is in sharp contrast to the U.S. model of providing podcasts for free but including paid advertisements.

Another factor in China is that podcasting must compete with government-provided propaganda and face censorship efforts by media regulators, reducing the scope of freedom of action.

A final competitive element is the sharp growth of short-form video, which has produced outsized growth in recent years due to popular services such as TikTok from ByteDance.

Lizhi’s Recent Financial Performance

-

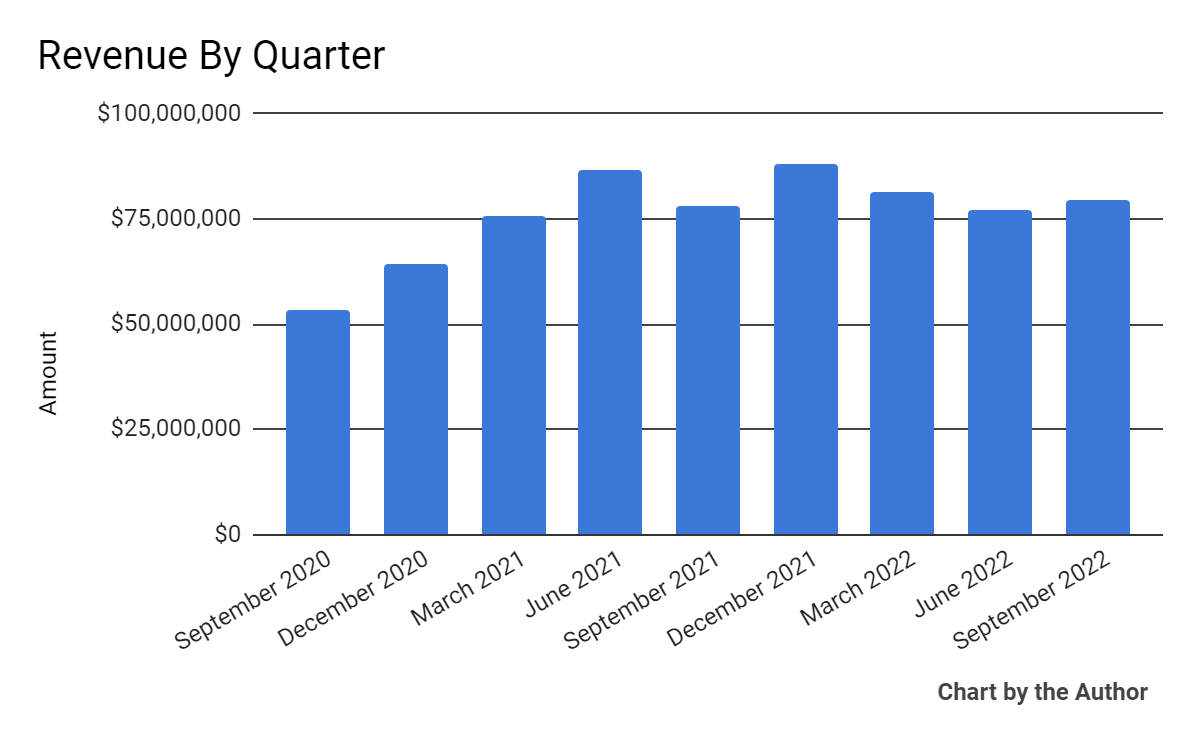

Total revenue by quarter has plateaued in recent quarters:

9 Quarter Total Revenue (Seeking Alpha)

-

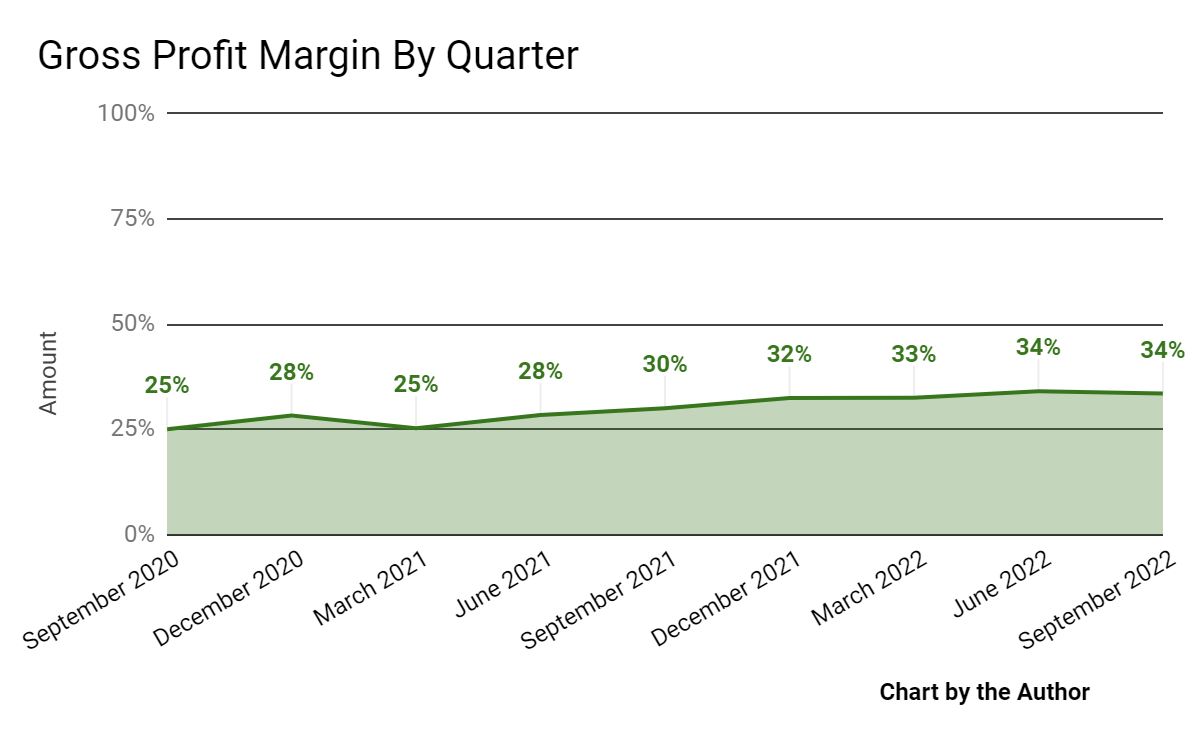

Gross profit margin by quarter also has flat-lined recently:

9 Quarter Gross Profit Margin (Seeking Alpha)

-

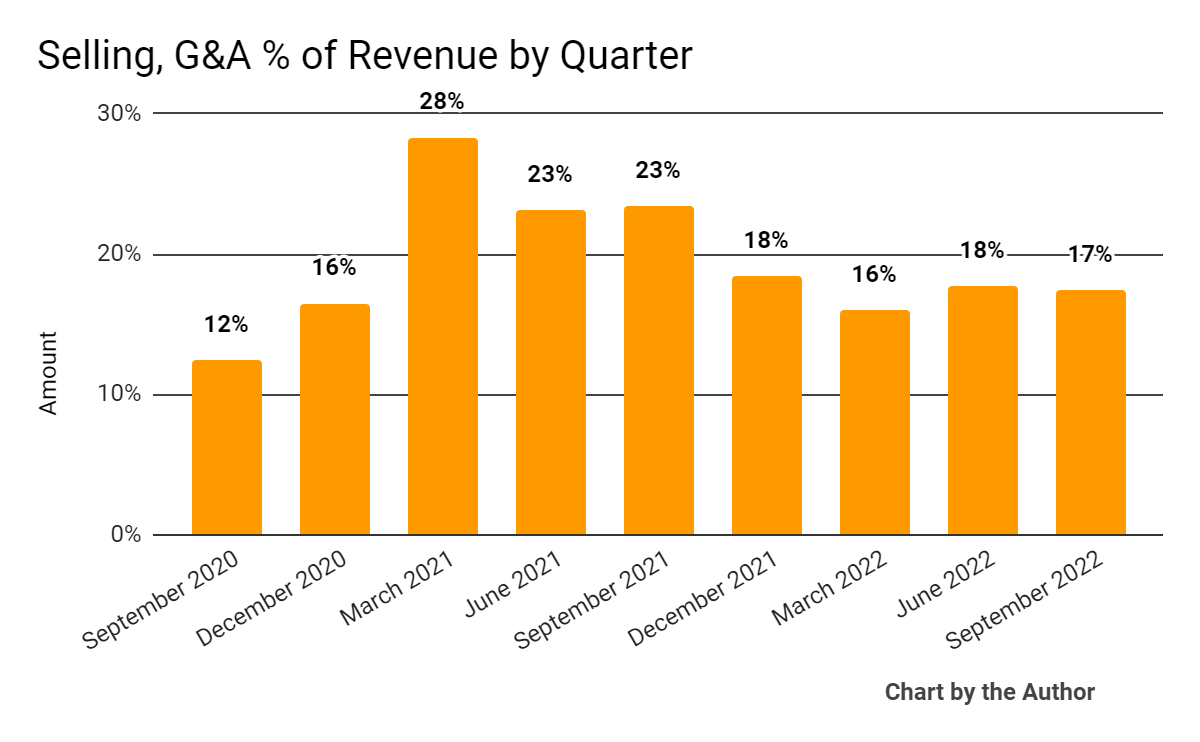

Selling, G&A expenses as a percentage of total revenue by quarter have trended lower in recent quarters:

9 Quarter Selling, G&A % Of Revenue (Seeking Alpha)

-

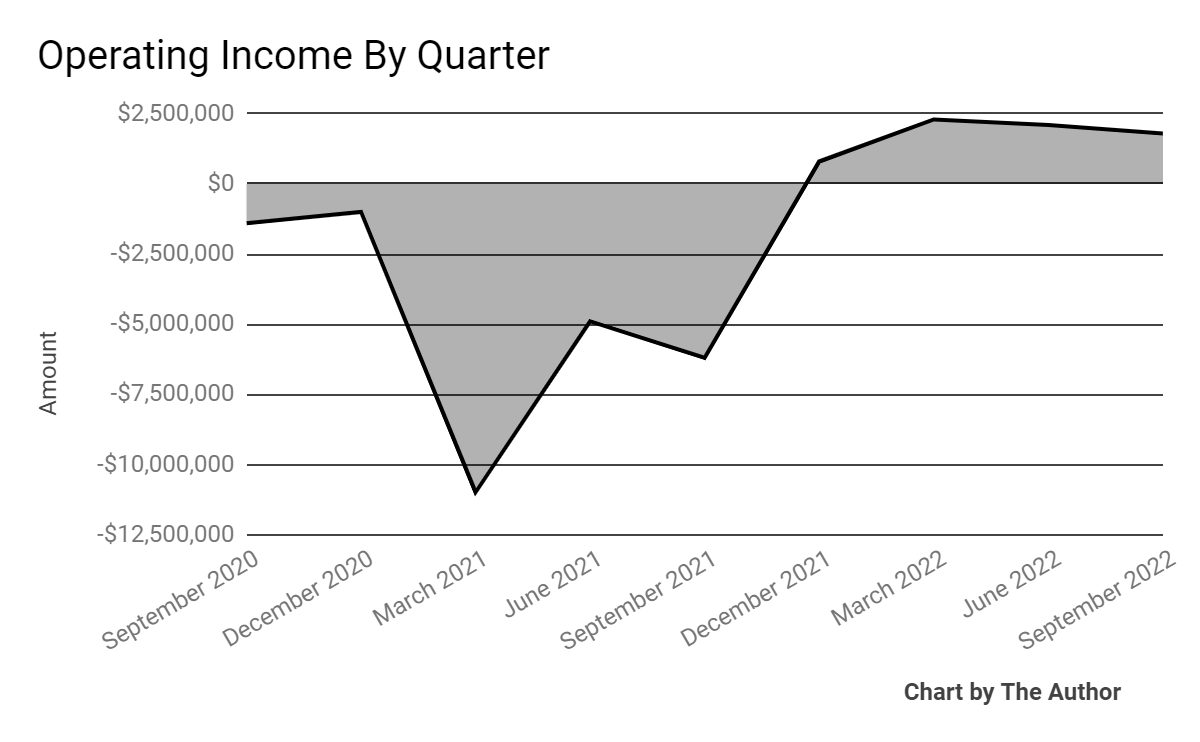

Operating income by quarter has turned positive in recent reporting periods:

9 Quarter Operating Income (Seeking Alpha)

-

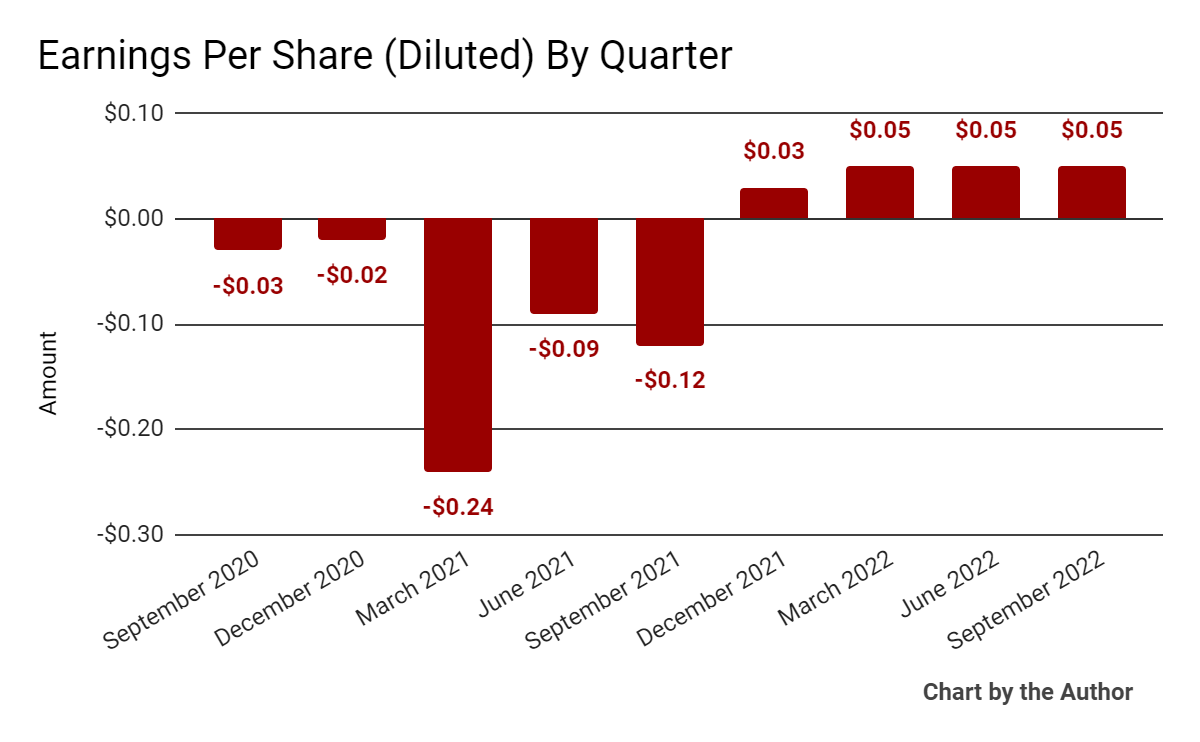

Earnings per share (Diluted) have also produced positive results in recent quarters:

9 Quarter Earnings Per Share (Seeking Alpha)

(All data in the above charts is GAAP)

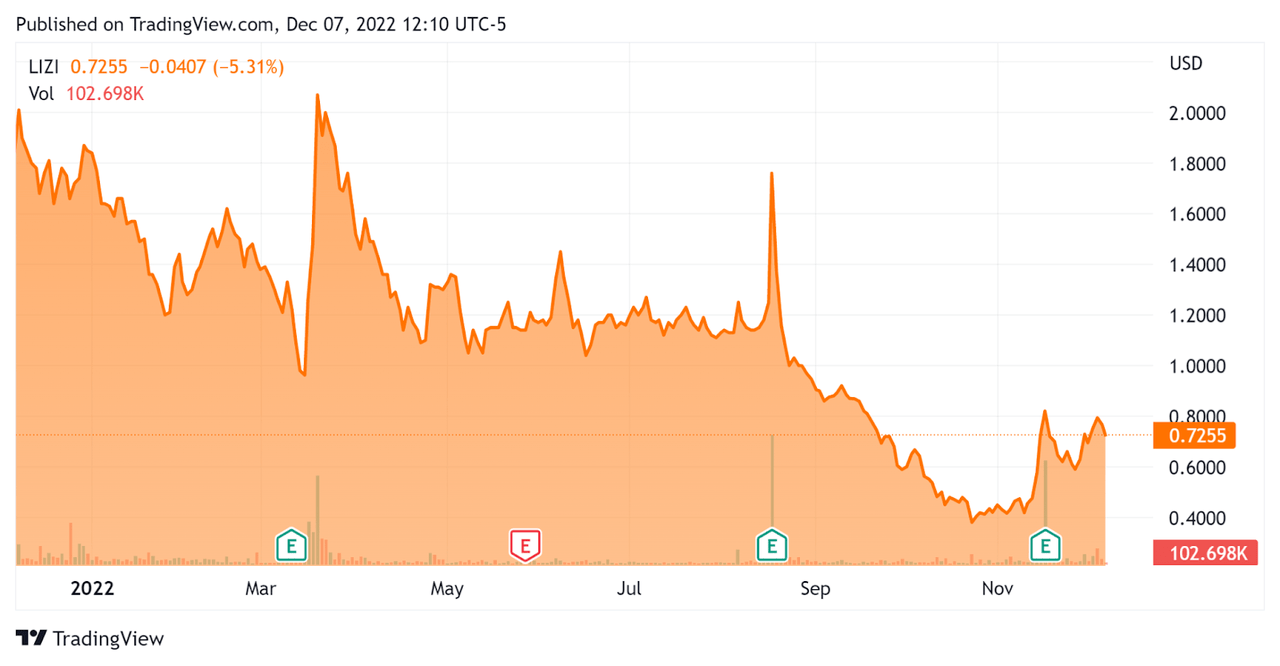

In the past 12 months, LIZI’s stock price has fallen 60.2% vs. the U.S. S&P 500 Index’s drop of around 16%, as the chart below indicates:

52 Week Stock Price (Seeking Alpha)

Valuation And Other Metrics For Lizhi

Below is a table of relevant capitalization and valuation figures for the company:

|

Measure (TTM) |

Amount |

|

Price/Sales |

0.13 |

|

Revenue Growth Rate |

9.0% |

|

Net Income Margin |

3.0% |

|

GAAP EBITDA % |

3.2% |

|

Market Capitalization |

$40,860,000 |

|

Enterprise Value |

-$36,080,000 |

|

Operating Cash Flow |

-$6,360,000 |

|

Earnings Per Share (Fully Diluted) |

$0.18 |

(Source – Seeking Alpha)

The Rule of 40 is a software industry rule of thumb that says that as long as the combined revenue growth rate and EBITDA percentage rate equal or exceed 40%, the firm is on an acceptable growth/EBITDA trajectory.

LIZI’s most recent GAAP Rule of 40 calculation was 12.2% as of Q3 2022, so the firm needs significant improvement in this regard, per the table below:

|

Rule of 40 – GAAP |

Calculation |

|

Recent Rev. Growth % |

9.0% |

|

GAAP EBITDA % |

3.2% |

|

Total |

12.2% |

(Source – Seeking Alpha)

Commentary On Lizhi

In its last earnings call (Source – Seeking Alpha), covering Q3 2022’s results, management highlighted its total average mobile MAUs (Monthly Average User) of 49.7 million.

Also, the average monthly paying users for the quarter was 477,000.

Management is focusing its efforts on ‘developing mid- and long-tail content creators’ likely to generate a wider variety of content options for users.

Also, the company is seeking to further its overseas expansion efforts.

As to its financial results, revenue rose 12% year-over-year and 10% quarter-over-quarter.

Management did not disclose any retention rate metrics, which are critical to understanding how well the firm is keeping its customer base.

The firm’s Rule of 40 results have been lackluster and in need of substantial improvement.

Gross profit margin has continued to trend upward while SG&A expenses as a percentage of total revenue have been dropping.

This has resulted in improved operating income results and positive earnings.

For the balance sheet, the firm finished the quarter with $86.8 million in cash, equivalents and short-term investments and $5.9 million in short-term borrowings.

The primary risk to the company stock’s outlook is its sub-$1.00 price and the recent Nasdaq delisting notice it has received.

A potential upside catalyst to the stock could include an announcement of a major international expansion initiative.

However, given the recent stock delisting notice by Nasdaq and the firm’s need to cure that issue, I’m cautious about the firm’s future on a major U.S. exchange.

I’m on Hold for LIZI for the near term.

Be the first to comment