Alex Wong

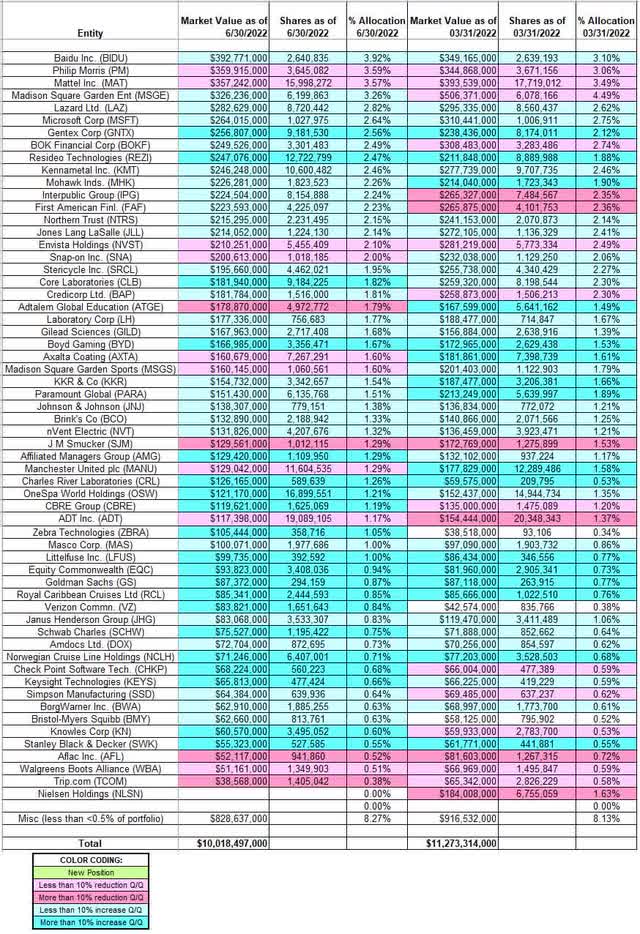

This article is part of a series that provides an ongoing analysis of the changes made to Ariel Investments’ 13F stock portfolio on a quarterly basis. It is based on Ariel Investments’ regulatory 13F Form filed on 8/12/2022. John Rogers’ 13F portfolio value decreased ~11% from $11.27B to $10.02B this quarter. The portfolio is diversified with recent 13F reports showing around 150 positions. There are 59 securities that are significantly large (more than ~0.5% of the portfolio each) and they are the focus of this article.

The largest five stakes are Baidu, Philip Morris, Mattel, Madison Square Garden Entertainment, and Lazard. They add up to ~17% of the portfolio. Please visit our Tracking John Rogers’ Ariel Investments Portfolio series to get an idea of their investment philosophy and our last update for the fund’s moves during Q1 2022.

Their flagship mutual fund is the Ariel Fund (MUTF:ARGFX) incepted in 1986. Ariel Fund has a lifetime annualized return of 10.57% compared to 10.25% for the Russell 2500 Index and 10.40% for the S&P 500 Index. In the most recent 10-year period, it has underperformed the S&P index: 10.70% vs 12.96%. The other mutual funds in the group are Ariel Appreciation Fund (MUTF:CAAPX), Ariel Focus Fund (MUTF:ARFFX), Ariel International Fund (MUTF:AINTX), and Ariel Global Fund (MUTF:AGLOX).

Note: Some of the top holdings in their International and Global funds are not in the 13F report as they are not 13F securities. They are Roche Holding AG (OTCQX:RHHBY), Deutsche Boerse AG (OTCPK:DBOEY), Endesa, S.A. (OTCPK:ELEZF), Michelin (OTCPK:MGDDY), Koninklijke Ahold Delhaize (OTCQX:ADRNY), and Snam S.p.A (OTCPK:SNMRY).

Stake Disposals:

Nielsen Holdings (NLSN): The 1.63% NLSN stake was purchased in 2017 at prices between ~$36 and ~$45. Next year saw a ~60% stake increase at prices between $22 and $37.50 and that was followed with a ~45% further increase in 2019 at prices between $19.50 and $27. Q4 2020 saw a similar increase at prices between ~$13.50 and ~$21. Last year had seen another ~50% increase at prices between ~$19.50 and ~$28. There was a ~60% selling last quarter at prices between ~$16.50 and ~$27. The disposal this quarter was at prices between ~$22 and ~$28. The stock currently trades at $27.87.

Note: In March, Nielsen Holdings entered into an agreement to be acquired by a consortium led by Evergreen and Brookfield for $28 per share cash. The transaction is expected to close next month.

Stake Increases:

Baidu, Inc. (BIDU): BIDU is currently the largest 13F position at ~4% of the portfolio. It was established in 2013 with the bulk of the current position purchased in 2015 at prices between ~$134 and ~$234. The interim years had seen minor buying and in 2018 there was a ~25% increase at prices between $157 and $273. Q1 to Q3 2019 saw another one-third increase at prices between ~$97 and ~$142. H1 2020 had seen a ~50% stake increase at prices between ~$84 and ~$145. Q1 2021 saw a ~18% selling at prices between ~$204 and ~$340 while in Q3 2021 there was a ~12% stake increase at prices between ~$137 and ~$202. The stock currently trades at ~$120. Last quarter saw a ~9% increase and that was followed with a marginal increase this quarter.

Madison Square Garden Entertainment (MSGE): MSGE is currently a large (top five) 13F stake at 3.26% of the portfolio. It was built over the seven quarters through Q4 2021 at prices between ~$64 and ~$116. The stock currently trades below that range at ~$50.25. There was a minor ~2% increase this quarter.

Note: Ariel Investments has a ~23% ownership stake in Madison Square Garden Entertainment.

Lazard Ltd. (LAZ): LAZ is a 2.82% of the portfolio position first purchased in 2009 at prices between ~$19 and ~$38. Next year saw a stake-tripling at prices between ~$25 and ~$36. The interim period saw further buying but in 2014 there was a ~25% selling at prices between ~$39 and ~$50. Recent activity follows. 2019 saw a ~15% increase at prices between ~$31 and ~$40.50. The three quarters through Q3 2021 saw another ~45% stake increase at prices between $38.70 and $48.75. The stock is now at $35.69. Last three quarters have also seen minor increases.

Note: Ariel Investments have a ~7% ownership stake in Lazard.

Microsoft Corp. (MSFT): MSFT is now at 2.64% of the 13F portfolio. It was a very small stake first purchased in 2010. The 2013-2015 timeframe saw a 2.2M share build-up at prices between ~$26 and ~$56. Recent activity follows: 2019 had seen a ~22% reduction at prices between ~$100 and $160. 2020 to 2021 time period saw another ~50% selling at prices between ~$137 and ~$343. The stock currently trades at ~$239. They are harvesting gains. There were minor increases in the last two quarters.

Gentex Corp. (GNTX): The 2.56% GNTX stake was purchased in Q3 2021 at prices between ~$27.50 and ~$38 and the stock currently trades at $25.45. There was a ~12% stake increase this quarter.

BOK Financial (BOKF): The 2.74% BOKF stake was built during the 2019 to 2021 timeframe at prices between ~$37 and ~$116. The stock currently trades at $92.40. There was a marginal increase this quarter.

Resideo Technologies (REZI): The 2.47% REZI stake was built during the last three quarters at prices between ~$19.50 and ~$28 and the stock currently trades at $20.12.

Kennametal Inc. (KMT): KMT is a 2.46% of the portfolio position. It was established in 2014 at prices between $34 and $52. The position had seen minor buying over the years. Q1 2020 saw a ~15% stake increase at prices between $15 and $37. The three quarters through Q3 2021 had seen another ~43% stake increase at prices between ~$33 and ~$42. The stock currently trades at $21.75. Last three quarters have also seen further buying.

Note: Ariel Investments has a ~12% ownership stake in Kennametal Inc.

Mohawk Industries (MHK): MHK is a 2.26% of the portfolio position built over the last three years at prices between ~$117 and ~$230 and it is now at $95.46. There was a ~6% stake increase this quarter.

Interpublic Group (IPG): The 2.24% IPG stake is a very long-term position that goes back almost two decades. It was first purchased in 2001 and the position was built to over 41M shares by 2005 at prices between $9 and $42. Recent activity follows: 2018 saw a ~20% selling at prices between $20 and $25 while next year saw a ~40% stake increase at prices between $19.50 and $24. There was a ~25% selling over the last three quarters at prices between ~$31 and ~$39.50. The stock currently trades at $26.57. This quarter saw a ~9% stake increase.

First American Financial (FAF): FAF is a 2.23% of the portfolio stake established in 2011 at prices between ~$11 and ~$17. 2013 also saw a ~25% stake increase at prices between ~$21 and ~$28. The position has seen consistent reductions since 2015. Recent activity follows: 2019 had seen a ~20% selling at prices between ~$45 and ~$64. There was a ~25% stake increase in Q4 2020 at prices between ~$44.50 and ~$54.50. That was followed with a similar increase in Q1 2021 at prices between ~$51 and ~$58. Last quarter saw a ~15% selling at prices between ~$64 and ~$81. The stock is now at $49.37. There was a minor ~3% stake increase this quarter.

Northern Trust (NTRS): NTRS is a 2.15% very long-term position first purchased in 2002. The 2002-2004 timeframe saw a ~10M share stake built at prices between ~$30 and ~$60. The position has since been sold down. The bulk of the selling was in the 2005-2007 timeframe at prices between ~$42 and ~$81. Last few quarters have seen incremental buying. The stock currently trades at $91.18.

Jones Lang LaSalle (JLL): The 2.14% JLL position is a very long-term stake first purchased in 2001. Next year saw a huge stake build-up at prices between ~$14.50 and ~$25. The position has seen selling since 2004. The bulk of the selling happened in 2006 at prices between ~$55 and ~$93. Most years since have also seen selling. H2 2020 saw a ~25% stake increase at prices between ~$90 and ~$154. The stock currently trades at ~$157. Last two quarters have seen incremental buying.

Affiliated Managers Group (AMG), Amdocs Ltd. (DOX), BorgWarner Inc. (BWA), Boyd Gaming (BYD), Brink’s Co. (BCO), Bristol-Myers Squibb (BMY), Check Point Software (CHKP), CBRE Group (CBRE), Charles River Laboratories (CRL), Charles Schwab (SCHW), Core Laboratories (CLB), Credicorp Ltd. (BAP), Equity Commonwealth (EQC), Goldman Sachs (GS), Gilead Sciences (GILD), Janus Henderson Group (JHG), Johnson & Johnson (JNJ), KKR & Company (KKR), Keysight Technologies (KEYS), Knowles Corp. (KN), Laboratory Corp. (LH), Littelfuse, Inc. (LFUS), Masco Corp. (MAS), nVent Electric (NVT), Norwegian Cruise Line Holdings (NCLH), OneSpaWorld Holdings (OSW), Paramount Global (PARA) previously ViacomCBS, Simpson Manufacturing (SSD), Stericycle Inc. (SRCL), Royal Caribbean Cruises Ltd. (RCL), Stanley Black & Decker (SWK), Verizon Communications (VZ), and Zebra Technologies (ZBRA): These small (less than ~2% of the portfolio each) stakes were increased during the quarter.

Note: Ariel Investments has significant ownership stakes in Knowles Corp and OneSpa World Holdings.

Stake Decreases:

Philip Morris (PM): A very small position in PM was first purchased in 2013. By 2017, the stake was built to a ~1M share stake. Next year saw the position increased by ~220% at prices between $66 and $110. 2019 had seen another ~20% stake increase at prices between $70 and $91. The three quarters through Q3 2020 had also seen a ~20% stake increase. Q1 2021 saw another ~15% stake increase at prices between ~$79 and ~$91 while next quarter there was a ~20% selling at prices between ~$88 and ~$101. The stock currently trades at $96.42, and it is currently a top three stake at 3.59% of the portfolio. Last four quarters have seen only minor adjustments.

Mattel, Inc. (MAT): The large (top three) 3.57% MAT position was first purchased in 2016 at prices between ~$25 and ~$34. Next year saw a stake doubling at prices between ~$13 and ~$30.50. 2018 also saw a one-third stake increase at prices between ~$9.50 and ~$18. Q1 2019 saw a ~12% trimming while the next two quarters saw a one-third increase at prices between ~$9.50 and ~$14.50. Q1 2020 saw another ~15% stake increase at prices between $7.25 and $14.75. H2 2021 had also seen a ~17% increase at prices between ~$18 and ~$23. Last two quarters saw a similar trimming. The stock currently trades at $20.96.

Note: They have ~4.5% ownership stake in the business.

Envista Holdings (NVST): The 2.10% NVST stake was purchased in Q1 2020 at prices between ~$12 and ~$33. There was a ~75% stake increase next quarter at prices between ~$13 and ~$24.50. The stock currently trades at $33.51. Last few quarters have seen minor trimming.

Snap-On Inc. (SNA): SNA is a ~2% of the portfolio stake purchased in 2012 at prices between ~$52 and ~$80. Next year saw a ~50% stake increase at prices between ~$80 and ~$110. The stock currently trades at ~$216. Last several years have seen only minor adjustments.

J. M. Smucker (SJM): SJM is a very long-term stake that has been in the portfolio for well over a decade. The original huge stake was sold down in 2008. Q1 2020 saw another ~30% selling at prices between ~$96 and ~$119. Q1 2021 saw a ~40% stake increase at prices between ~$111 and ~$131. Last two quarters saw a one-third reduction at prices between ~$119 and ~$145. The stock currently trades at ~$141 and the stake is at 1.29% of the portfolio.

ADT Inc. (ADT), Adtalem Global Education (ATGE), Aflac Inc. (AFL), Axalta Coating (AXTA), Madison Square Garden Sports (MSGS), Manchester United (MANU), Trip.com (TRIP), and Walgreens Boots Alliance (WBA): These small (less than ~2% of the portfolio each) stakes were reduced during the quarter.

Note: They have a ~23% ownership stake in Manchester United. They also have significant ownership stakes in Adtalem Global Education, Lindblad Expeditions Holdings (LIND), and Madison Square Garden Sports.

Below is a spreadsheet that shows the changes to John Rogers’ Ariel Investments 13F portfolio holdings as of Q2 2022:

John Rogers – Ariel Investments’ Q2 2022 13F Report Q/Q Comparison (John Vincent (author))

Be the first to comment