hrui

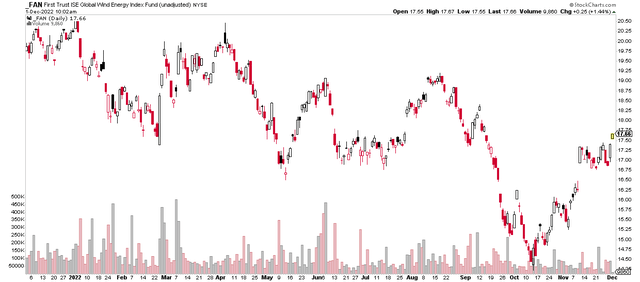

Keep your eye on stocks associated with wind energy. The First Trust Global Wind Energy ETF (FAN) has rallied to its highest level since early September despite weaker oil prices. With a breakout on Thursday, more upside could be on the way. One small Industrial sector stock has moved big in the last several weeks, and I see upside potential.

Wind Energy Shares Spinning Up Profits Recently

Stockcharts.com

According to Bank of America Global Research, TPI Composites (NASDAQ:TPIC) is an independent manufacturer of composite wind turbine blades. TPIC has sold over 65,000 wind blades to some of the largest wind turbine original equipment manufacturers (OEM), including Vestas, GE, Nordex, and Enercon. TPIC employs over 15,000 associates across 19 facilities in the US, China, Mexico, Turkey, Denmark, India, and Germany. TPIC has also begun applying its composite technology to the transportation market.

The Arizona-based $474 million market cap Electrical Equipment industry company within the Industrial sector has negative trailing 12-month GAAP earnings and does not pay a dividend, according to The Wall Street Journal.

After reporting a very disappointing Q3 report, missing on both the top and bottom lines, the stock has staged a rally. Boosting shares was news in October of an asset sale of its wind rights off the California coast.

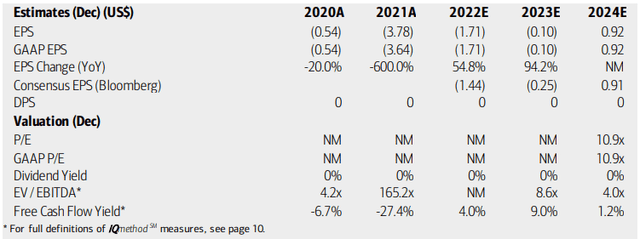

On valuation, analysts at BofA see earnings climbing back toward the flat line with per-share profits eventually turning positive by 2024. The Bloomberg consensus forecast is about in-line with what BofA sees. Dividends are not expected to be paid on shares in the coming years, however. What I like is that while TPI does not have profits, it is free cash flow positive, and the FCF yield is seen as improving in 2023 despite a tough macro environment.

The stock now trades just 0.3 times sales, below its 5-year average of 0.69, according to Seeking Alpha. Overall, there is high earnings uncertainty with the stock due to upcoming contract expirations, reduced wind turbine installations, and the risk that TPI cannot effectively pass on higher raw material costs.

TPIC: Earnings, Valuation, Free Cash Flow Forecasts

BofA Global Research

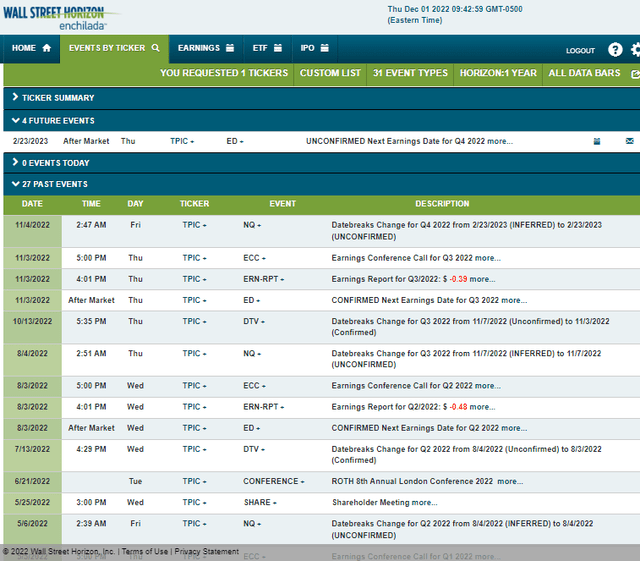

Looking ahead, corporate event data provided by Wall Street Horizon show an unconfirmed Q4 2022 earnings date of Thursday, February 23. The calendar is light until then, however.

Corporate Event Calendar

Wall Street Horizon

The Options Angle

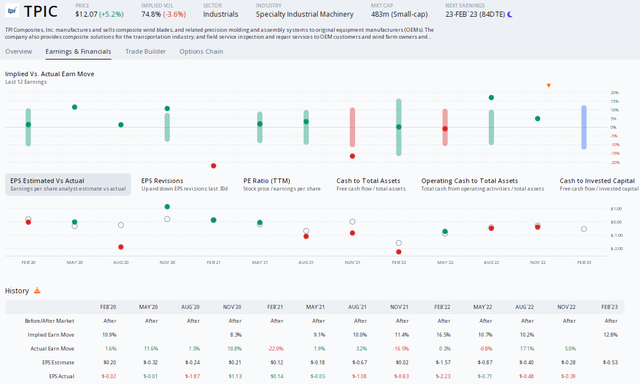

Data from Option Research & Technology Services (ORATS) show high implied volatility in shares of TPIC – 75%. Moreover, traders have priced in a high 12.8% earnings-related stock price swing following its upcoming Q4 report – that is after shares moved only 5% following the Q3 earnings release. Analysts expect a large $0.53 per-share profit decline, but that would be a substantial improvement from -$2.23 earned in the same quarter a year ago, per ORATS.

TPIC: A Smaller EPS Loss Seen, Volatility Persists

ORATS

The Technical Take

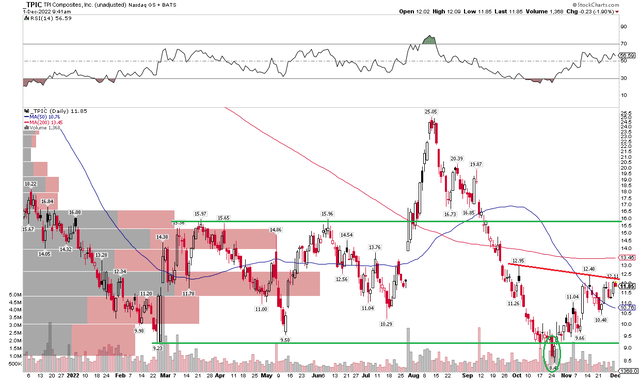

TPI has rallied big from its late October low under $9. A post-earnings spike to nearly $12.50 was finally the point of selling. At the moment, I see this current consolidation zone as important. A break above $12.50 would trigger a bullish price objective to near $16.50 based on a cup and handle breakout price target. That measured move has confluence with the March through June range highs as well as the August low.

Also notice how shares featured a bullish false breakdown back on October 25. That shakeout helped set up the rally. What could prove problematic, though, is TPIC’s flat 200-day moving average is near $13.50. Overall, while gains could be capped, I see some technical signs of life. A long position with a stop under the recent low under $10.48 makes sense.

TPIC: Shares Establishing A Bottom, Eyeing A Cup & Handle Breakout

Stockcharts.com

The Bottom Line

TPI Composites has improving earnings, positive free cash flow ahead, and trades at a historically low price-to-sales ratio. While macro headwinds persist, I think a lot of bearish news has been discounted. Meanwhile, the chart appears to have found a floor and is now consolidating after an impressive rally. I like this one as a speculative small-cap clean energy play.

Be the first to comment