Jaap2/iStock Unreleased via Getty Images

The stock market fears that Toyota Motor Corporation (NYSE:TM) may fall behind in the electric vehicle race. Toyota is down 20% in the past year compared to 16% for the Vanguard S&P 500 Index ETF (VOO). But, as automakers ramp up electric vehicle production, raw material shortages, battery cost increases, and vehicle price increases may soon put a damper on electric vehicle sales. Toyota has wisely spread its bets across hybrid, battery electric, and hydrogen fuel-cell vehicles.

Toyota leads in automobile manufacturing, quality, and profitability. Electric vehicles, as the future of automobiles, are still being settled. It could take well over a decade or more to realize an electric vehicle future, even assuming that electric vehicles are the future of transportation. This sell-off allows investors to buy the best automaker in the world at a reduced valuation and own it in a long-term portfolio.

Electric Vehicle Batteries Remain a Work-in-Progress

It is no secret that raw materials used in making batteries are in short supply across the globe. The Economist recently noted that the prices for battery metals have spiked and have pushed up the battery costs in 2022 for the first time in over a decade. Battery manufacturing remains a challenge, given the current lack of battery plants. Auto manufacturers and their battery partners have drawn up plans to build battery manufacturing capacity, which could take years to operate at total capacity.

Car manufacturers across the globe have yet to have a guaranteed supply of battery materials. Recently, Ford (F) and Hyundai have been looking to Indonesia for nickel supplies. This short supply of battery materials has increased the cost of batteries and the cost of electric vehicles, thus pushing out the year in which the price of an electric car would attain parity with those powered by internal combustion engines. General Motors (GM) recently reduced its electric vehicle sales targets for 2023 due to challenges in ramping up battery production. The company had initially projected to sell 400,000 electric vehicles between early 2022 and the end of 2023.

Electric Vehicle Prices Make it a Luxury Product

The shortage of battery raw materials, the high cost, and the lack of manufacturing capacity have forced automakers to increase the prices of the models they sell. Tesla (TSLA) recently increased the prices of some of its models by as much as $6,000. Ford increased the price of its F-150 Lightning by $5,000, and Lucid Group (LCID) increased the price of its Lucid Air by $10,000 to $15,000.

The increased cost of batteries has turned electric vehicles into luxury automobiles. Automakers understand that they cannot make a profit by pricing an E.V. below $50,000. General Motors’ E.V. line-up consists of mostly high-end vehicles – Hummer, Cadillac Lyriq, and Chevrolet Silverado – which would sell for $50,000 or more. The company’s Chevrolet Blazer EV has an estimated starting MSRP of $44,995. Even after Federal tax credits in the U.S., the upfront cost of owning an E.V. may be more than the traditional internal combustion vehicle or a hybrid. A hybrid vehicle typically adds $3,000 to the price of a car.

For example, the 2023 Toyota RAV4 starts at $27,575, and the RAV4 hybrid starts at $30,225 – a price difference of $2,652. The hybrid is about 9.6% more expensive than the one purely powered by an internal combustion engine. Still, the hybrid version increases the mileage in city driving by 51% and reduces emissions – 27 mpg for the internal combustion engine vs. 41 mpg for the hybrid version.

Questionable Green Credentials of Electric Vehicles

Battery electric vehicles are not entirely green, given that mining and manufacturing processes produce a lot of emissions and pollution. Since the U.S. produces 60.8% of its electricity from fossil fuels, fossil fuels power most electric vehicles. According to Toyota, the company has sold 18.1 million hybrid electric cars as of July 2021. The reduction in emissions from its sales of these hybrid electric vehicles is equivalent to reductions from 5.5 million battery electric vehicles.

Lithium-ion battery technology has come a long way. For example, the volumetric energy density of lithium-ion batteries increased by more than 8x between 2008 and 2020. But, electric vehicles continue to need large battery packs to compensate for the lower energy density of batteries compared to gasoline. The large battery packs make an electric vehicle heavier than a gasoline one. The Ford F-150 lightning is 1,600 pounds heavier than a similar gas-powered truck. More battery technology advancements are needed to provide a similar driving range as gasoline-powered vehicles. Solid-state batteries may be safer and offer higher output, a more extended cruising range, and shorter charging times. But, Toyota points out that it is conducting more research on solid-state batteries to make them long-lasting.

The world cannot take the transition to electric vehicles for granted. Toyota understands this and wisely spreads its bets across battery electric vehicles [BEV], hybrid, and hydrogen fuel-cell vehicles. In 2021, Toyota boosted its sales targets for BEV in 2030 from 2 million to 3.5 million.

Tax Credits Prop-up Electric Vehicle Sales

Governments have propped up the global electric vehicle industry with tax credits and tax breaks. Those tax breaks will have to continue for many more years, given the increasing cost of owning an electric vehicle compared to internal combustion ones. Norway is an example of a country where most of the cars sold are electric. But, Norway does not impose a tax on electric vehicles and has seen a sizable dent in its annual tax revenues. In Norway, the owners of electric cars do not pay any road toll or annual ownership tax either. The country’s politicians have started debating when to begin weaning the country from these expensive tax breaks. What would happen to electric vehicle sales when taxes breaks are removed?

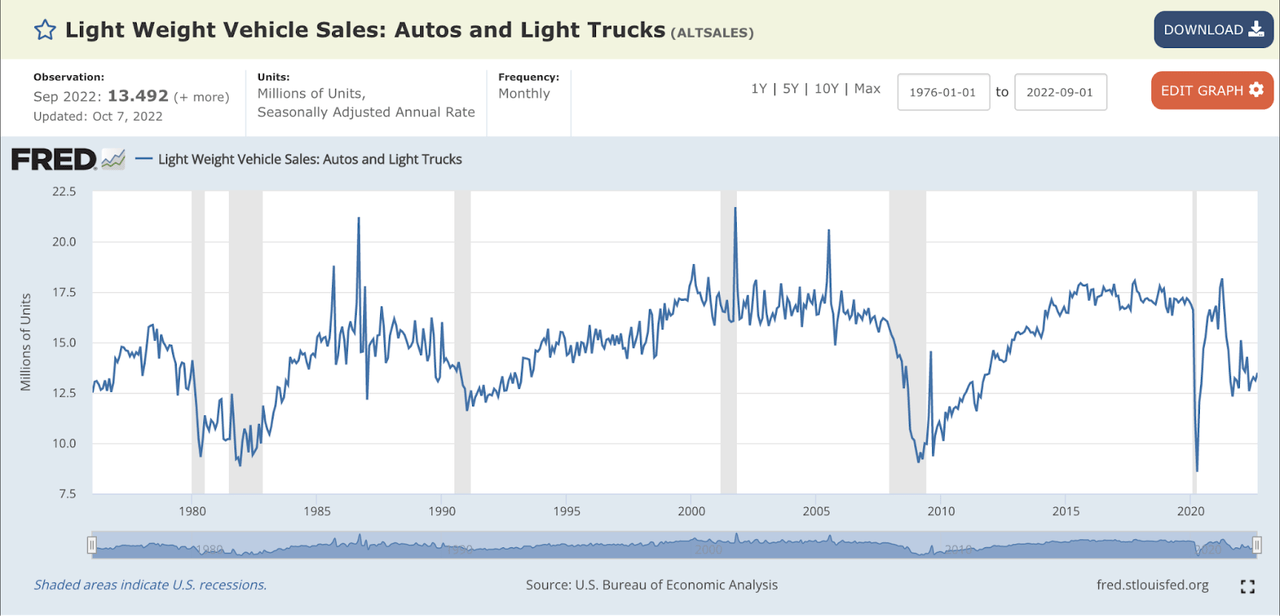

The average selling price of a new car in the U.S. has been increasing over the last few years. The average new car price is approaching an unsustainable $50,000 level. In December 2015, the average transaction price for light vehicles in the United States was $34,428. That was a record average transaction price at that time. But prices kept climbing to new records each year, and now, finally, prices have reached levels where demand destruction has begun. From 2015 to 2019, more than 17 million new light vehicles were sold in the United States annually [Exhibit 1]. As of September 2022, the new light vehicle sales stand at 13.492 million Seasonally Adjusted Annual Rate [SAAR]. That is a loss in sales of 3.5 million vehicles compared to the 17 million annual rates.

Exhibit 1: Light-weight Vehicle Sales in the U.S.

Light-weight Vehicle Sales in the U.S. (St. Louis Federal Reserve)

Some would argue that the increase in new car prices and the drop in annual new light vehicle sales was due to supply chain challenges; that argument may have been valid in 2021 and the early part of 2022. But nearly 14% of car buyers are now paying over $1,000 a month in car payments, and rising interest rates have dampened demand for new homes to new cars.

While automakers and dealers are selling new cars at record prices, the used car market may already be in a deep recession. Given that many auto buyers are stretching their budgets to buy a car, it is no surprise that net charge-off rates are increasing among auto lenders. Ally Financial (ALLY) – a significant lender to auto buyers – increased its net charge-off rate by 30 basis points compared to 2019 to 1.6% in Q3 2022. Ally Financial is trading near a 52-week low and now offers a 4.5% dividend yield.

With the semiconductor supply chain challenges easing and the cost of metals coming down, the supply of cars will probably increase in 2023. This increase in supply could lead to more discounting and lower profits for most automakers. But, Toyota has a long track record of thriving profitably in various demand and supply environments. Since the annual U.S. light vehicle sales are at such low levels, there is a massive pent-up demand for new cars, which may materialize beginning in the second half of 2023. This pent-up demand may be good news for Toyota, independent of high-priced electric vehicles, to make a good profit. The U.S. auto market can get up to 16 million new vehicle sales annually for years to come, given the age of the current fleet of vehicles in the country. The average age of vehicles in the U.S. now stands at 12.2 years.

Design Simplicity and Few Models Drive Tesla’s Success

Tesla’s success thus far can be attributed to a few things, such as a lack of model diversity, simplicity and similarity in design across its models, and limited options. If the market forces Tesla to increase the number of models, offer varying designs, or provide more options, the complexity and cost will increase for its manufacturing line. Tesla has to prove that it can provide a wide range of models while booking profit margins similar to Toyota’s. On the other hand, Toyota generates enormous profits while offering over a dozen cars and minivan models, three truck models, and over ten crossovers and SUVs. Toyota generates consistent earnings while providing the market with gasoline, hybrid, and electric vehicle choices.

Customers who pay $100,000 or more for a car expect it to be a unique prestige symbol. A car’s design needs to be unlike any other model in the marketplace. Unfortunately, Tesla’s Model S Plaid (starting price $127,590) looks very similar in styling and design to its entry-level model, the Model 3 (starting price $40,390). It is often said that beauty is in the eye of the beholder, and in Tesla’s case, buyers have voted with their money so far. But do not expect Tesla’s run to last. Most customers cannot articulate their needs. When an automaker offers models, styling, and options that customers love, they will quickly switch allegiance. Steve Jobs summarized this sentiment about the customer in this quote:

“Some people say, “Give the customers what they want.” But that’s not my approach. Our job is to figure out what they’re going to want before they do. I think Henry Ford once said, “If I’d asked customers what they wanted, they would have told me, ‘A faster horse!'” People don’t know what they want until you show it to them. That’s why I never rely on market research. Our task is to read things that are not yet on the page.”

There are numerous car makers across the globe vying to show the customer models they would want. Toyota is one of those automakers who will continue enticing customers with various models and options. Toyota’s styling and design may not be considered revolutionary, but the company sells many models well below the price of a Tesla. Manufacturing products is hard; manufacturing cars may be more complex still. Elon Musk acknowledged the difficulty of manufacturing a product in a Tweet in 2021 [Exhibit 2].

Exhibit 2: Elon Musk on Difficulty in Manufacturing Products

Elon Musk on Difficulty in Manufacturing Products (Twitter)

Making high-quality cars at scale may take much work. Still, Toyota has mastered the art and science of designing and manufacturing multiple models with numerous options.

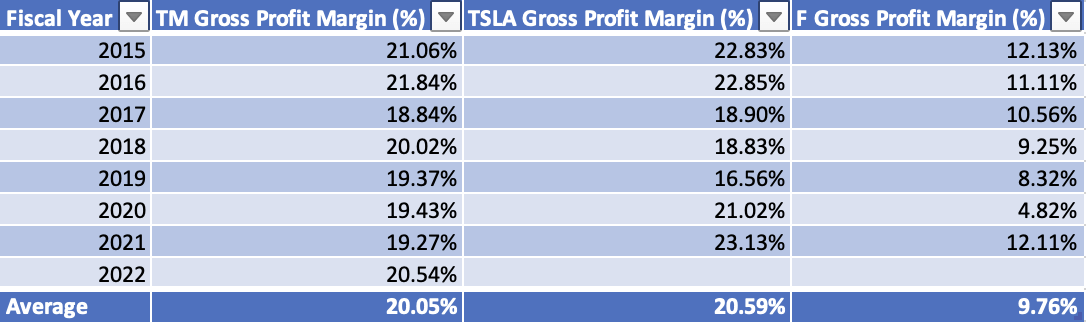

Toyota’s World-leading Profit Margins

Toyota can manufacture cars while maintaining one of the highest gross profit margins in the industry. The company’s gross margins average 20%, while Tesla, with much fewer models and a lesser track record, averages slightly better at 20.5% [Exhibit 3]. Ford has an average gross margin of 9.76%.

Exhibit 3: Gross Profit Margins of Toyota, Tesla, and Ford

Gross Margins of Toyota, Tesla, and Ford (Seeking Alpha, Author Calculations)

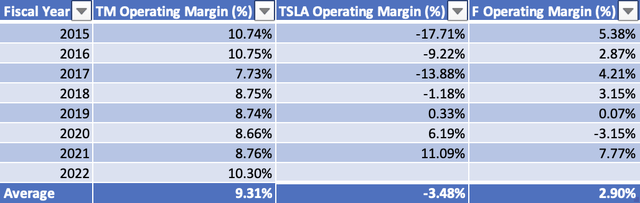

Toyota has best-in-class average operating margins of 9.7% compared to Ford’s 2.9% [Exhibit 4].

Exhibit 4: Operating Profit Margins for Toyota, Tesla, and Ford

Operating Profit Margins for Toyota, Tesla, and Ford (Seeking Alpha, Author Calculations)

Toyota’s Reputation for Quality

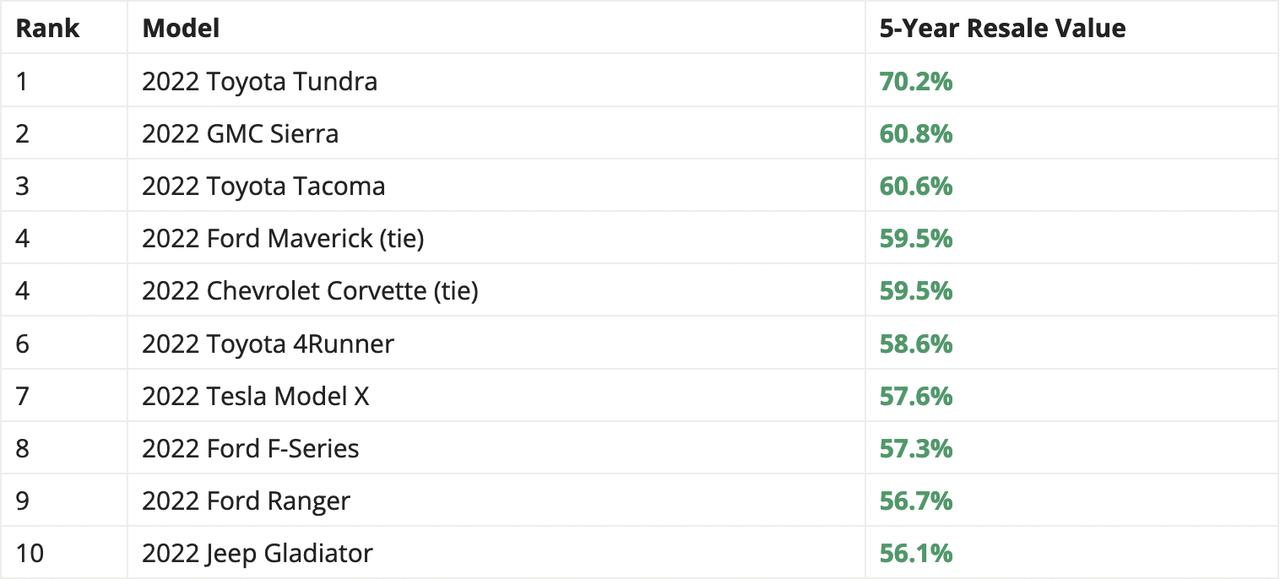

Toyota has a long reputation for quality. Its cars and truck garner excellent resale prices in the used car market. According to KBB.com, Toyota’s automobiles took three spots in the top 10 vehicles with the highest retained value after 60 months. Toyota is the only automaker to garner two places in the top three, with the 2022 Toyota Tundra expected to retain 70% and the Toyota Tacoma expected to maintain 60% of its value in five years. Toyota 4Runner SUV is the third model, expected to keep 58% of its value in five years.

Exhibit 5: Toyota’s Quality Reflected in Resale Prices

Toyota’s Quality Reflected in Resale Prices (kbb.com)

Risk of Spreading Too Thin

Toyota may spread itself too thin with bets across multiple powertrain options such as hybrid, hydrogen fuel-cell, and battery electric vehicles. Every business has limited resources, and management has to deploy them wisely. That is the main task of any management. Tesla, Ford, and General Motors are racing the capture mindshare with consumers concerning electric vehicles. Toyota has already fallen behind. If electric cars come down in price much quicker than anticipated, the transition from internal combustion engine technology may be swift. It may be too late for Toyota to catch up if the electric vehicle revolution gains traction. This uncertainty in the auto market’s direction may be why Toyota is suddenly showing urgency and is considering a sharp increase in mass-market battery electric vehicles from 2025. Toyota’s management understands the stakes here. The company’s viability depends on correctly predicting the future of the automobile.

Conclusion

Toyota’s valuation is very compelling at current prices. Toyota is trading at a price-to-sales ratio of 0.76x. It sells at 5.5x forward price to cash flow and a forward EV to EBITDA multiple of 11.9x. Ford trades at a forward EV to EBITDA multiple of 9.8x. But Ford has a much lower profit profile than that Toyota. Tesla is trading at a stratospheric valuation of 32x EV to EBITDA multiple.

Toyota is the best automaker in the world in my opinion. The market is doubting its greatness today, but I think the company will prevail in the long run and deliver great financial returns for the patient investor.

“Editor’s Note: This article was submitted as part of Seeking Alpha’s Top Ex-US Stock Pick competition, which runs through November 7. This competition is open to all users and contributors; click here to find out more and submit your article today!”

Be the first to comment