wwing/E+ via Getty Images

The following segment was excerpted from this fund letter.

The Toro Company (NYSE:TTC)

The Toro Corporation has an illustrious history stretching back to its founding in 1914. Many of us first encountered The Toro Company in the rite of passage when our parents finally relented in allowing us to cut the grass for the first time when we were barely taller than the lawn mower handle. From the Company’s humble beginning building tractor engines for the Bull Tractor Company in Bloomington, Milwaukee, the Company has methodically grown into the diversified conglomerate of today that today possesses industry leading brand awareness, market share, technological prowess, and profitability.

We are always enamored with a company’s beginnings, so herewith is the short story of The Toro Corporation’s storied history. The “Toro” name was chosen given its first relationship with The Bull Tractor Company, which according to Company documents was the #1 brand of farm tractors in 1914. Shortly after, in 1919, the Company created the mechanized golf course equipment industry with their invention of The Toro Standard Golf Machine.

Golf course maintenance would prove to a boon for the Company. In 1922 the Company established the first nationwide network of golf course equipment distributors. The Company still boasts that a few of those early customers remain customers today. Innovation was key to the Company in their formative years, as it is today.

Such rapid product innovation propelled the Company to become the #1 manufacturer of golf maintenance and water irrigation in the world. An example of such, in 1924 the Company introduced the first mower called the Park Special. The Park Special would quickly become the industry standard and seller until the advent of rotary mowers in the late 1950s.

After World War II, the Company enhanced their in-house product development with acquisitions. The Company entered the rotary lawnmower business in 1948 with the acquisition of the Whirlwind Company of Milwaukee. Quickly by 1954 the Company captured the #1 market share in the power mower industry.

In 1951 the Company entered the home snow blower business. In 1962, Toro acquired Moist O’ Matic of Riverside California, a pioneer in plastic irrigation. By 1972 the Company was #1 in golf course irrigation. In 1997 the Company greatly expanded its presence in the landscape contractor business with the acquisition of Exmark Manufacturing of Beatrice, Nebraska. In 2014 the Company expanded into the professional snow and ice management business with the acquisition of BOSS Snowplow of Iron Mountain, Michigan.

By 2018 Toro had grown to $2.8 billion in revenues with locations in 125 countries. Given the Company’s size, their acquisition targets became increasing larger. In 2013 the Company entered the trenchless market with the acquisition of Astec’s horizontal directional drilling (HDD) smaller rig line.

Despite some notable internal new product development, the Company’s market share remained small and stalled – yet the trenchless market opportunity remained large. To remedy this problem and opportunity, Toro purchased Perry, Oklahoma based Charles Machine Works (CMW) for $700 million in cash. The industry leader, CMW manufactures and sells a plethora of underground trenching equipment which includes underground pipe and cable, HDD, trenchers, loaders, excavators and much more. CMW’s eponymous brand is Ditch Witch. At the time of this key acquisition CMW generated $725 million in revenues.

Acquisitions accelerated over the past two years – particularly into new technologies, including Venture Products (Ventrac brand in turf, landscape, snow and ice), TURFLYNX (pioneer in autonomous, all-electric golf fairway mowers), Left Hand Robotics (alternative power, smart-connected and autonomous), and Intimidator Group (Spartan Mowers zero turn mowers, with significant presence in the southern U.S.).

As the Company exits the pandemic era, three key elements dominate the Company’s business trajectory: supply shortages, the golf business, and zero emission products. On the supply front, shortages still exist in size – particularly in the Company’s professional line of equipment. Such equipment shares a significant number of internal parts shared by many other industries, such as, high horsepower engines, hydraulic systems, motors and pumps, plus a myriad of wire harnesses and related electrical parts.

The Company reports the nature of shortages has changed from those that stalled initial product manufacturing to those now that prohibit finished goods to be completed. The shortages are still most acute in the Company’s booming Ditch Witch business.

Speaking of booming, the Company’s key golf business is booming at unpresented levels. According to the Company, there are 30,000 golf courses around the world. Half of those are located in the U.S. The Company claims that it has a 50% market share across the globe. Importantly, Toro is the only company in the industry the has both golf equipment and golf irrigation.

The advent of and societal desires to embrace zero-emission products is, and will be, a signal transformation for The Toro Company. Circa-2022, the Company is agnostic whether a customer desires gas-powered or lithium battery operated equipment, but that will likely change in the years ahead as technological advancements continue apace with zero-emission equipment. Relatedly, the Company tracks an internal “Vitality Index” with the goal that at least 35% of sales must come from products introduced over the preceding two years. If this goal continues to be met it will most likely come from both zero-emission and robotic products.

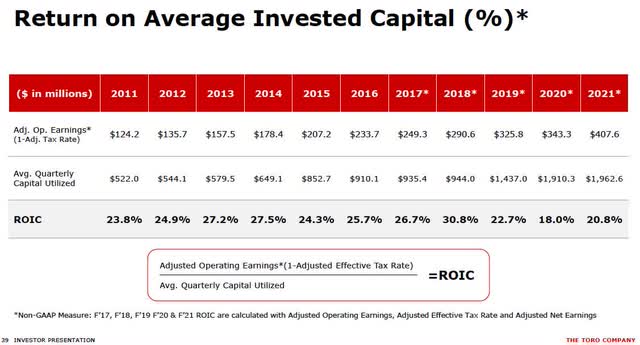

Toro contributed favorably to performance during the quarter. The Company benefitted from pricing actions it took earlier in the year, offsetting rising input cost inflation. An important proof-point we consider when evaluating the competitive advantage of any business is whether margins can be maintained (or expanded), especially during periods of inflation.

In addition, Toro continues to see robust demand for its professional and residential products. The Company has a backlog in its professional segment that is at its highest level since the year began, whereas residential products grew +7% on strong year and 2-year comparisons and despite many “home” categories across big-box retailers witnessing declines.

We applaud management’s capital allocation discipline and, yes, aggressiveness to position the Company in a continued leadership role as technological advancement sweeps across their markets.

|

The information and statistical data contained herein have been obtained from sources, which we believe to be reliable, but in no way are warranted by us to accuracy or completeness. We do not undertake to advise you as to any change in figures or our views. This is not a solicitation of any order to buy or sell. We, our affiliates and any officer, director or stockholder or any member of their families, may have a position in and may from time to time purchase or sell any of the above mentioned or related securities. Past results are no guarantee of future results. This report includes candid statements and observations regarding investment strategies, individual securities, and economic and market conditions; however, there is no guarantee that these statements, opinions or forecasts will prove to be correct. These comments may also include the expression of opinions that are speculative in nature and should not be relied on as statements of fact. Wedgewood Partners is committed to communicating with our investment partners as candidly as possible because we believe our investors benefit from understanding our investment philosophy, investment process, stock selection methodology and investor temperament. Our views and opinions include “forward-looking statements” which may or may not be accurate over the long term. Forward-looking statements can be identified by words like “believe,” “think,” “expect,” “anticipate,” or similar expressions. You should not place undue reliance on forward-looking statements, which are current as of the date of this report. We disclaim any obligation to update or alter any forward-looking statements, whether as a result of new information, future events or otherwise. While we believe we have a reasonable basis for our appraisals and we have confidence in our opinions, actual results may differ materially from those we anticipate. The information provided in this material should not be considered a recommendation to buy, sell or hold any particular security. |

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Be the first to comment