Oat_Phawat

Introduction

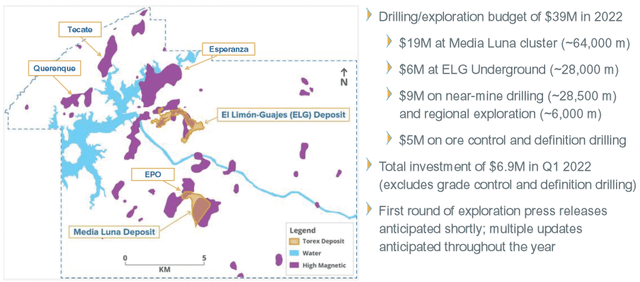

The Toronto-based Torex Gold Resources Inc. (OTCPK:TORXF) owns the Morelos Gold property in Southern Mexico, comprising its El Limon Guajes mining complex – ELG for short – and the Media Luna deposit, where it holds 100% interest. It is called the Morelos Complex.

Note: This article is a quarterly update of my preceding article published on July 2, 2022. I have followed TORXF on Seeking Alpha since March 2021.

TORXF Map Presentation (Torex Gold)

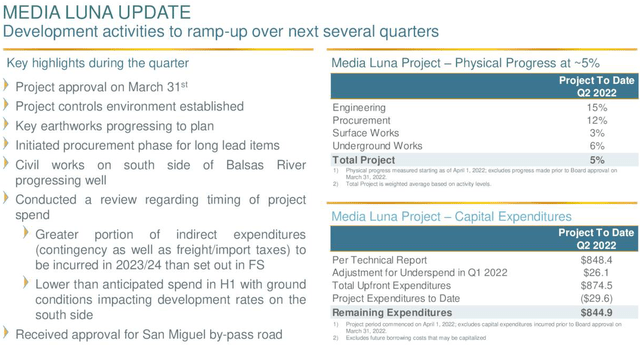

Note: The Media Luna deposit is one substantial ongoing expansion for the company. The remaining CapEx is now $844.9 million. The Media Luna’s first production is expected in 2024. This production will be added to the 2024 outlook after the company released the Media Luna Technical Report, which tripled the LOM to 11.75 years.

As indicated previously, Torex Gold hedged about 25% of the production between October 2020 and December 2023 through forwarding sales after the release of the technical report. The hedging production could be extended into 2024 to minimize the price risk during this sensitive period with significant CapEx. The goal is to finance the development of Media Luna and ongoing exploration CapEx while maintaining minimum cash of $100 million on the balance sheet.

In the conference call:

The one area of change to our guidance is at Media Luna where non-sustaining CapEx is now guided at $172 million to $210 million versus original guidance at $220 million to $270 million.

TORXF Media Luna update 2Q22 (Torex Gold )

Note: The Morelos complex holds a reserve proven and probable of 5.123 Moz AuEq in 2021.

1 – 2Q ’22 Results Snapshot

On August 6, 2022, the company released its second-quarter 2022 results.

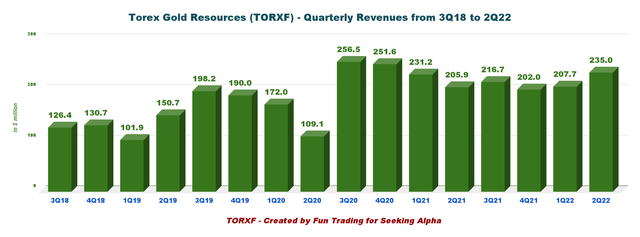

The company posted revenue of $235.0 million, up 14.1% compared to the same quarter a year ago, with an income of $70.3 million or $0.80 per diluted share. The adjusted net earnings of $57.0 million or $0.66 per share on a diluted basis.

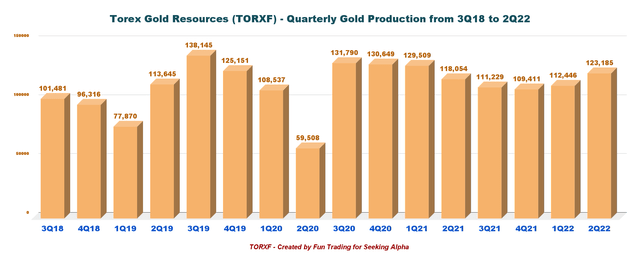

Torex Gold produced 123,185 Au ounces in the quarter, thanks to superior grade in the open pit, higher than planned tonnes from high-grade ELG underground, and slightly higher recoveries as ESG transitioned out of a pocket of lower recovery ore in the Guajes Pit. The underground did well this quarter with record average mining rates of 1,580 tonnes per day. The company expects to maintain this rate through H2 2022.

CEO Jody Kuzenko said in the conference call:

we had a very strong second quarter which sets us up nicely to deliver on guidance for the fourth year running. From an operational perspective, production came in slightly ahead of plan due to higher grades in the open pit and record underground mining rates with an ELG Underground. And the team at ELG continues to do an excellent job in keeping control on costs despite the challenging inflationary environment.

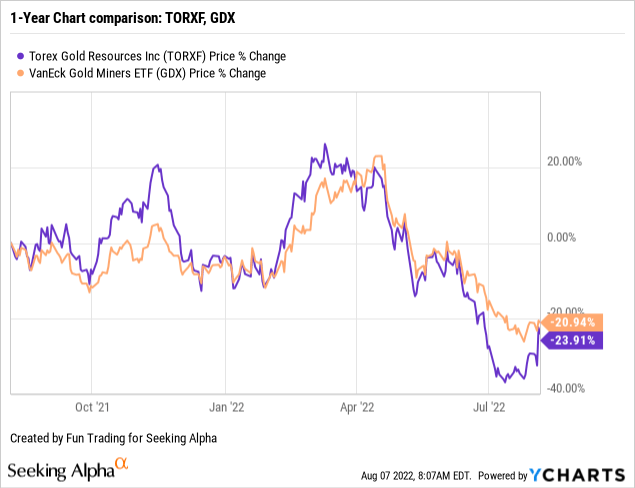

2 – Stock Performance

The company’s performance continues to be weak on a one-year basis, and the stock is down 24%, underperforming the VanEck Vectors Gold Miners ETF (GDX) slightly, as we can see below.

TORXF – Financial Snapshot 2Q22 and Gold production: The Raw Numbers

| Torex Gold | 2Q21 | 3Q21 | 4Q21 | 1Q22 | 2Q22 |

| Total Revenues $ million | 205.9 | 216.7 | 202.0 | 207.7 | 235.0 |

| Quarterly Earnings $ million | 60.7 | 36.5 | -0.5 | 40.0 | 70.3 |

| EBITDA $ million | 126.8 | 119.7 | 61.5 | 102.8 | 156.3 |

| EPS (diluted) $ per share | 0.69 | 0.41 | -0.01 | 0.46 | 0.80 |

| Operating Cash Flow $ million | 82.4 | 87.8 | 94.6 | 46.7 | 126.9 |

| CapEx in $ | 60.3 | 58.0 | 56.9 | 65.3 | 52.5 |

| Free Cash Flow in $million | 22.1 | 29.8 | 37.7 | -18.6 | 74.4 |

| Total Cash in $ million | 196.0 | 221.6 | 255.7 | 237.0 | 310.7 |

| Total LT Debt in $ million | 0 | 0 | 0 | 0 | 0 |

| Shares Outstanding (diluted) in million | 86.2 | 86.0 | 86.2 | 86.09 | 86.12 |

| TORXF Production | 2Q21 | 3Q21 | 4Q21 | 1Q22 | 2Q22 |

| Quarterly Production Oz | 118,054 | 111,229 | 109,411 | 112,446 | 123,185 |

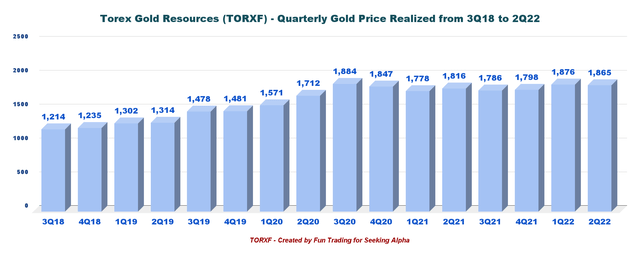

| Gold Price in $/Oz | 1,816 | 1,786 | 1,798 | 1,876 | 1,865 |

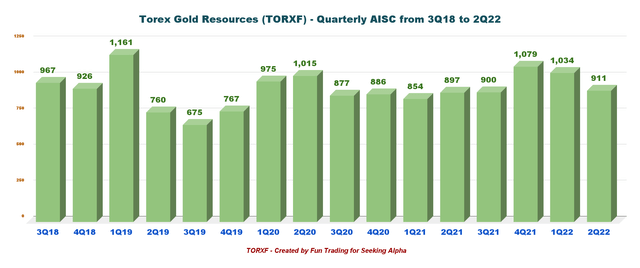

| AISC in $/Oz | 897 | 900 | 1,079 | 1,034 | 911 |

Source: Company filing

Torex Gold Resources – Gold production and balance sheet details

1 – Revenues and Trends: Revenues were $207.7 million in 2Q22

TORXF Quarterly Revenues history (Fun Trading) Torex Gold posted $235.0 million in revenues this quarter, well above the $205.9 million indicated in 2Q21. The net income was $70.3 million this quarter from an income of $60.7 million last year. TORXF posted adjusted net earnings of $57.0 million or $0.66 per share on a diluted basis. The Net earnings include an unrealized derivative loss of $8.2 million related to gold price contracts entered into during 1Q22 to reduce downside price risk during the construction of the Media Luna Project. Net income includes an unrealized derivative gain of $17.0 million (YTD – $8.8 million) related to gold forward contracts entered into during 1Q22 to lower downside price risk during the construction of the Media Luna Project.

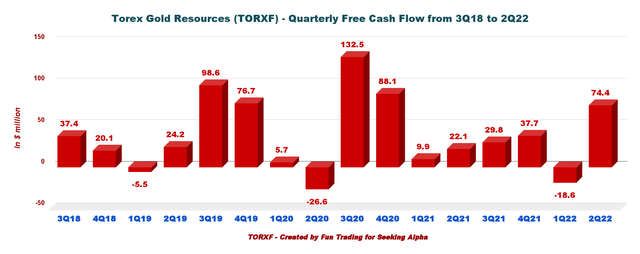

2 – Free cash flow was $74.4 million in 2Q ’22

TORXF Quarterly Free cash flow history (Fun Trading) Note: Generic free cash flow is the Cash from operations minus CapEx. Torex has a slightly different calculation and deducts the interest paid.

Trailing 12-month free cash flow was $123.3 million, and the free cash flow for the second quarter was $74.4 million, contrasted with a loss of $18.6 million in the preceding quarter.

The company had a CapEx of $52.5 million in 2Q22.

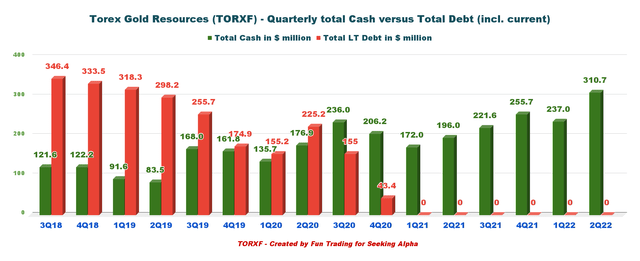

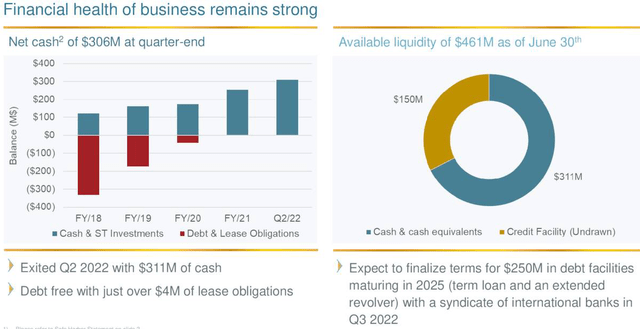

3 – Torex Gold’s excellent position. The company is net debt-free.

TORXF Quarterly Cash versus Debt history (Fun Trading) Total Cash was $310.7 million at the end of June 2022 compared to $196.0 million in the same quarter a year ago. Available liquidity is up from $387 million in 1Q22 to $461 million. The company is debt free, which is a great plus. However, the company expects to finalize terms for $250 million in debt facilities maturing in 2025 this coming quarter. It is expected to give additional financing to support the Media Luna project. TORXF Balance sheet Presentation (Torex Gold) TORXF Quarterly Gold Production history (Fun Trading) Solid Gold production this quarter with 123,185 Au Oz, up from 2Q21. The company sold 123,363 Au Oz at a gold price of $1,865 per ounce. Gold production is on track to meet full-year production guidance of 430K to 470K Au oz. TORXF Quarterly gold price history (Fun Trading) One extra positive is that the AISC per ounce sold dropped significantly sequentially. TORXF Quarterly AISC history (Fun Trading)

4 – Gold production details: TORXF produced 112,446 Au Oz and sold 108,012 Au Oz in 1Q22.

CFO Andrew Snowden said in the conference call:

Like our peers, there we are also seeing inflationary pressures in certain areas of our cost base, which furrows is primarily in ammonia-related inputs into our plant, particularly with cyanide prices. I will say, though, that to-date, we’ve been successful at actively managing these cost pressures through managing consumption rates, through blending, and the monitoring of discretionary spend.

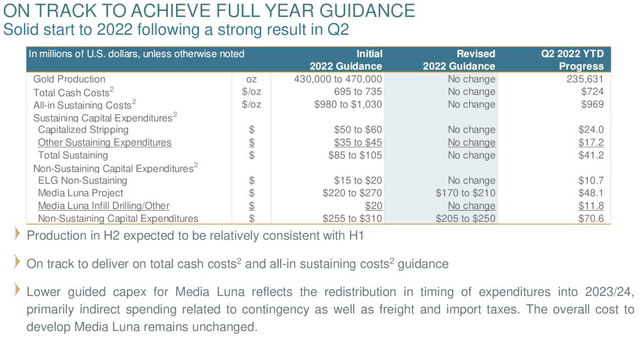

5 – 2022 Guidance unchanged sequentially

The company expects gold production of 430K to 470K AuEq ounces in 2022 at an AISC between $980 and $1,030 per ounce. The Media Luna project CapEx is $220 to $270 million in 2022 with $20.8 million.

TORXF 2022 Guidance Presentation (Torex Gold)

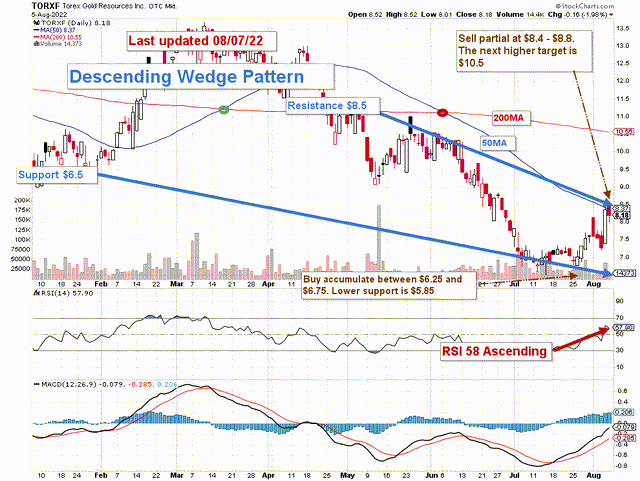

Technical Analysis (Short Term) And Commentary

TORXF TA Chart Short-term (Fun Trading StockCharts)

TORXF forms a descending wedge pattern with resistance at $8.5 and support at $6.5.

The strategy has not changed, and it is what I suggest in my marketplace, “The Gold and Oil corner.” The short-term trading strategy is to trade LIFO about 50%-60% of your position and keep a core long-term amount for a much higher payday at around $13.6-$14.

I suggest selling LIFO between $8.4 and $8.8 and waiting for a retracement at or below $6.5.

TORXF could experience a breakdown if the gold price loses momentum and cross the $1,690 per ounce support. In this case, TORXF could retest the lower support at around $5.85.

Conversely, if the gold price trades back above $1,800-$1,850 per ounce, TORXF could reach $10.55 (200MA) and eventually cross $14.

Watch the gold price like a hawk.

Note: The LIFO method is prohibited under International Financial Reporting Standards (IFRS), though it is permitted in the United States to generally accepted accounting principles (GAAP). Therefore, only US traders can apply this method. Those who cannot trade LIFO can use an alternative by setting two different accounts for the same stocks, one for the long term and one for short-term trading.

Warning: The TA chart must be updated frequently to be relevant. It is what I am doing in my stock tracker. The chart above has a possible validity of about a week. Remember, the TA chart is a tool only to help you adopt the right strategy. It is not a way to foresee the future. No one and nothing can.

Author’s note: If you find value in this article and would like to encourage such continued efforts, please click the “Like” button below as a vote of support. Thanks.

Be the first to comment