Fokusiert

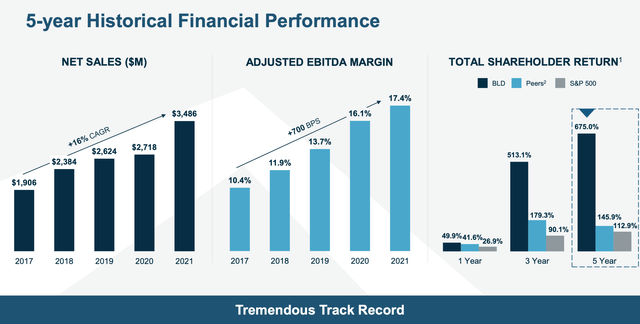

Since being spun-out of Masco (MAS) in 2015, TopBuild (NYSE:BLD) has an impressive track record of revenue, EBITDA, and free cash flow growth. TopBuild is the leading provider of outsourced insulation services to the homebuilding industry (also does commercial building installation) and as well as the #1 player in the distribution of insulation and complimentary products. The company has benefitted from a boom in housing starts and increased penetration of outsourced insulation installation. However, 2022 has seen housing starts plummet on the back of housing affordability declines as higher home prices and soaring interest rates cause buyers to balk.

Historical Track Record (TopBuild Investor Presentation)

Homebuilding conditions take a turn for the worse

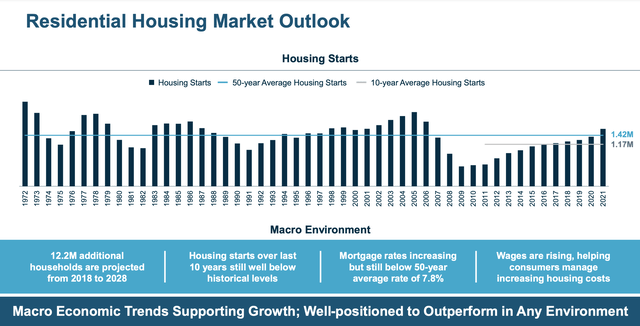

TopBuild’s tremendous performance has been achieved on the back of a steady increase in homebuilding culminating in the 2020-21 boom which pushed housing starts above the long-term average as shown below.

US Housing Starts (TopBuild Investor Presentation)

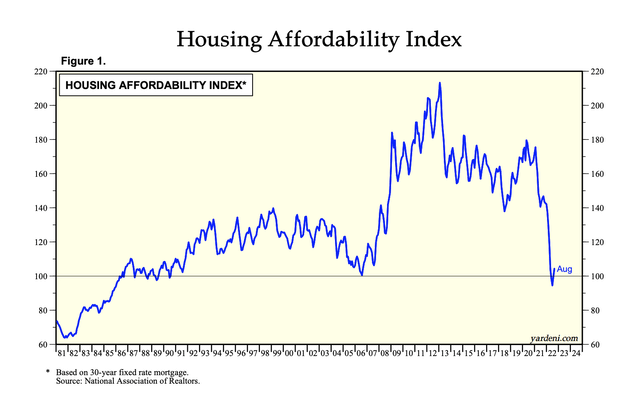

As you can see, housing starts have increased beyond long-term average figures (both 10 and 50 years). While TopBuild has been a beneficiary of the housing market boom, conditions in 2022 have changed dramatically as a massive rise in interest rates (coupled with all-time high home prices) has driven home affordability to multi-decade lows:

Housing Market Affordability (Yardeni/National Association of Realtors)

This has led housing starts to turn negative. With significantly higher mortgage rates, I expect this trend to persist and imagine we could see housing start numbers come in well below long-term averages for the foreseeable future.

What might TopBuild’s financial performance look like in a more difficult environment?

Insulation installation takes place late in the homebuilding process after the foundation is poured, and the house is framed (late-cycle). This provides TopBuild some near-term cushion in its financial results as homes which have been started in 1H22 (when interest rates were lower and the market was stronger) will be completed in 2H. However, looking into 2023 and beyond, I expect the difficult external environment will have a significant negative impact on TopBuild’s results.

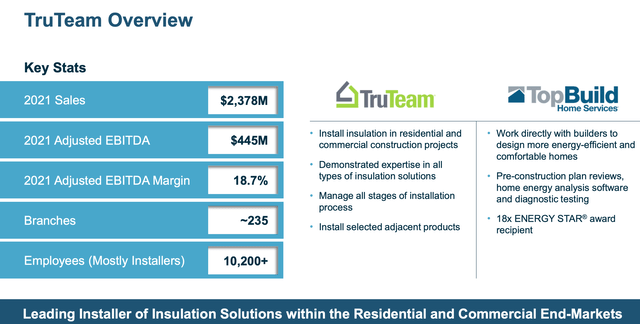

True Team Since 2017 (TopBuild Investor Presentation)

To estimate normal results for the TruTeam segment, I assume that housing starts decline by 20-25% versus 2022 run-rate levels. A 20-25% fall in housing starts would result in housing starts about 5-10% below 10-year average figures, though the fall in affordability suggests starts could fall much more than this.

I further assume that operating margins contract to the ~13% level achieved in 2019. Operating margins are likely to decline as costs tend to be stickier than revenue in a downturn – in particular, labor costs are unlikely to decline in line with revenue given overall labor market tightness. This results in a segment profit of $270 million. This might be too generous given that 2019 was a fairly strong year for housing – TruTeam segment margins were 10-12% in 2016-18.

Similarly, I expect that the rise in interest rates and decline in the overall economy will have a commensurate negative impact on TopBuild’s Specialty Distribution segment, which is on track to do a little over $2 billion in revenue (taking into account TopBuild’s acquisition of Distribution International) and 15% operating margins in 2022. This gets me to $250 million in operating profit.

Taking the two businesses together, I get an estimated operating profit of $520 million, which is 32% below the expected record results for 2022 (show below – note that there is ~$120 million of D&A which must be deducted from EBITDA to get to operating profit). After taking into account interest expense and taxes, I arrive at an EPS of $10.50, below the consensus $15.70 estimate for 2023. On my numbers, TopBuild is at just under 16x EPS.

Historically, the company has traded between 9-20x forward EPS. The company has traded in the low-end of the range during periods where housing market optimism was low (early 2016 and 2H18). Were the stock to trade down to 10x my estimate of EPS, shares would sell for $100-105, implying a 35% downside from the current price.

Conclusion

At current levels, the market is expecting that either 1) TopBuild will somehow escape the housing market downturn unscathed or 2) that the downturn in housing will be quite short-lived. To the extent that an investor believes the downturn to be short-lived, I believe there are better prospects available, including Zillow (Z) which I recently wrote up favorably here on Seeking Alpha.

Be the first to comment