5 of the best REITs you’ll find on Seeking Alpha.

Surendra Sharma/iStock via Getty Images

Terrible title? Many corporations are well over 100-years-old. Our laws treat corporations as people (sometimes better than people), so this is fair game. Terrible, but still fair. Your next objection might be that a great investment is great regardless of the owner’s age. Good objection. I concur. The best REITs to own are the ones that deliver the best total returns while you own them. That should be your goal whether you’re 20 or 100. Therefore, you can take this as a list of five top REITs at current valuations.

I’ll include some honorable mentions as well. They are close enough that it’s a hard call for which ones to include in the top five.

The Criteria

We want REITs that meet the following criteria:

- Regularly growing AFFO per share, which is the primary REIT measure for cash flow.

- AFFO per share growth is not driven by accounting for expenses that pushes them outside of AFFO.

- Growth in AFFO per share is supported by growth in revenues.

- Growth in revenues is supported by same-property NOI and respectable (or excellent) leasing spreads.

- No terrible management.

- No excessive leverage that could derail the investment. We dislike risk.

The Picks

Each of these picks has excellent dividend coverage and runs with relatively low leverage. That goes without saying.

Sun Communities

I’m going to start with Sun Communities (SUI). SUI owns manufactured home parks, RV parks, marinas, and holiday parks in the UK. The best comparison for holiday parks within the US is the better MH parks. SUI is leveraging their expertise and business model with international growth, and they did it by purchasing one of the best and largest operators in the UK. SUI is trading at only $150.47. Great deal. Big discount to NAV. Lower than normal AFFO multiple. Strong growth in AFFO per share. Headwinds from higher fuel prices (hurts RV park occupancy) may be on the decline. Oil futures peaked at over $120 but are back down to $85.11. That’s less than 10% over the low for the year.

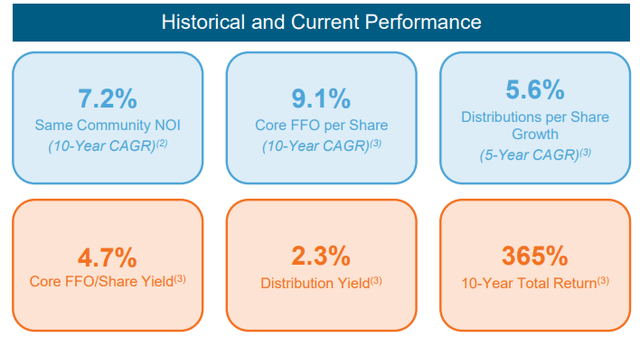

SUI has an outstanding history of delivering growth in same-property NOI (Net Operating Income), Core FFO per share, and total returns:

SUI

Think the dividend should have grown faster? Thanks to “only” growing the dividend at 5.6%, the payout ratio is down to 51%. That’s exceptionally low for a REIT and gives SUI ample room for dividend growth.

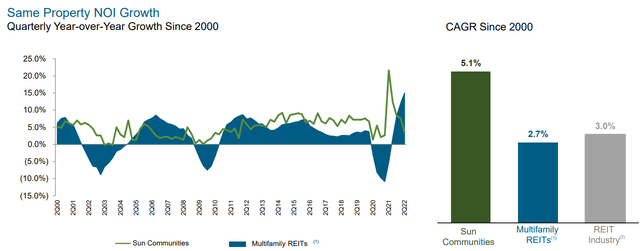

Even looking back to 2000, we can see same-property NOI growth for SUI has been excellent. That includes multiple recessions:

SUI

SUI is one of our larger positions. It represents 7.5% of my portfolio. For those who aren’t familiar with my work, I’m a REIT analyst. My portfolio should be mostly in REITs. Yes, that increases volatility compared to a more diversified portfolio. However, you need to be able to evaluate me based on my performance. The most transparent way to do that is for me to invest in the shares I cover and report all of my trades along with my performance on each trade and overall.

Terreno Realty

Terreno Realty (TRNO) comes next. At $58.06, shares are a great deal. For investors who are not familiar with industrial real estate the AFFO multiple may seem high (34.5x), but the rent increases are massive. No, if you don’t know industrial REITs, you’re not thinking massive enough. In Q2 2022, the cash rent on new and renewed leases increased by 55.4%. That isn’t straight lined. That’s the difference between the expiring rent and the new rent. When rents rise that fast, it drives massive growth in AFFO per share.

Evaluating them only off of the current AFFO per share is ignoring the absolutely massive increases in rental rates. When you have a building with market rent that is 50% higher than the current rent, the value of that building doesn’t skyrocket after you sign the new lease. The rental income roars higher, but if you were valuing real estate based on prior rent instead of future rent, you’d be buying up pathetic malls across the country.

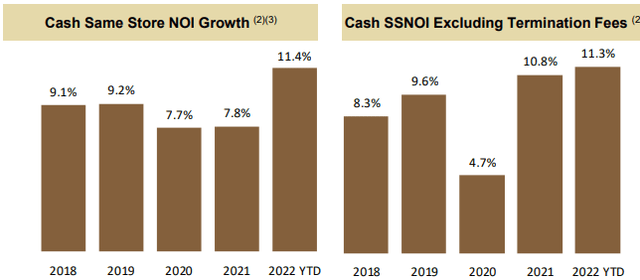

Expect TRNO to deliver massive growth in AFFO per share over the next several years. That 34.5x number doesn’t mean much when rents are rising that quickly. In our forward-looking analysis, we expect additional demand for industrial real estate to dramatically outpace new supply. The result is tenants fighting for space and driving rents higher. With higher rents, we see dramatic growth in same-property NOI:

TRNO

When cash same-property NOI is averaging growth rates near double digits, it leads to very strong growth in AFFO per share.

Because TRNO’s AFFO per share is growing so rapidly, the dividend payout ratio could fool investors. It looks high at 95%. However, the massive growth in AFFO per share means that ratio would be far lower a year from today unless TRNO raises the dividend substantially again.

Has TRNO raised the dividend substantially already? Absolutely.

Seeking Alpha

TRNO represents 4.7% of our portfolio today.

Crown Castle

Crown Castle (CCI) trades $162.60, which is 21.8x forward AFFO. That’s actually cheap for CCI over the last several years. CCI owns cell towers, small cells, and the fiber connecting their small cells into the network. They have enjoyed massive growth in AFFO per share over many years while paying out a respectable dividend yield.

How much do you use your cell phone now? How much did you use it five years ago? There’s a huge increase in mobile data. With better phones carrying higher resolutions and more customers wanting better data to support their phone, carriers need to continue investing in building out their network. They do that by leasing the space from tower REITs, like CCI.

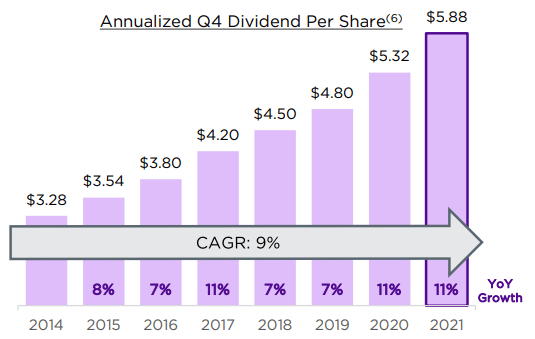

All that demand leads to high growth in AFFO per share and in dividends per share:

CCI

CCI is one of our very largest positions at 10.5%.

Prologis

Prologis (PLD) is another great industrial REIT. It’s the largest in the sector with a massive global footprint. PLD is raising rents rapidly and delivering monster growth in AFFO per share. Shares were punished severely year-to-date, which created opportunity. Shares were too expensive on the first of the year, but they are a nice bargain today. With an AFFO multiple of only 20.6x (at $112.51), PLD is a big bargain.

Their balance sheet is in excellent shape and gives them access to debt on favorable terms. Risk is well diversified. Their size gives them the scale needed to evaluate and invest in markets around the world.

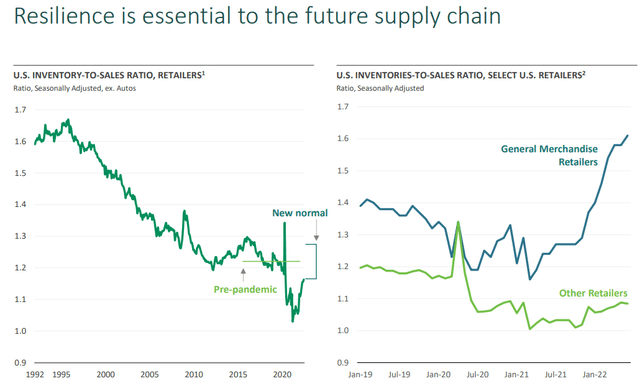

While general merchandise retailers have significantly increased their inventory to sales ratio, other retailers remain low. Overall, inventory levels remain a bit below pre-pandemic levels:

PLD

PLD represents 3.9% of our portfolio.

Essex Property Trust

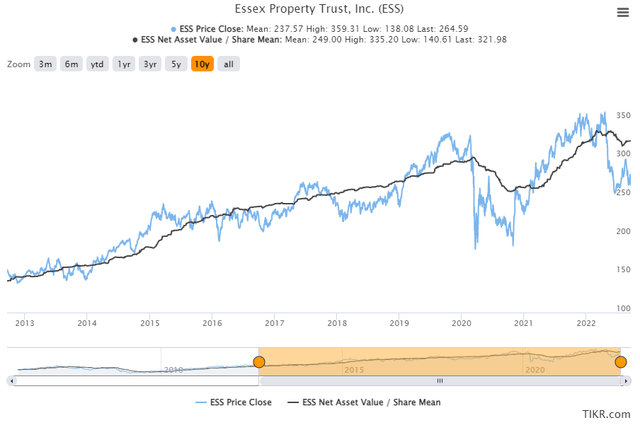

Essex Property Trust (ESS) is a dividend champion apartment REIT. Their portfolio is built in California and Seattle. They continue to generate significant growth in revenue as rental rates keep going up. ESS trades at $256.34, which is a 20% discount to consensus NAV of $321.98. That’s big by historical standards.

You can glance at the chart and recognize that this kind of discount is unusual:

TIKR.com

What happened in 2020? Well, there was the pandemic, the restrictions on evictions, and the BLM activities. Each of these was cited often by bears as reasons they wouldn’t buy to ESS until things cleared up. That fear caused them to miss out on a great opportunity. ESS recovered dramatically.

Shares are back to bargain precise again today. Now, someone might argue that shares of ESS are still trading above their prices from 2018 or before. However, ESS generates dramatically more cash flow now than they did back then.

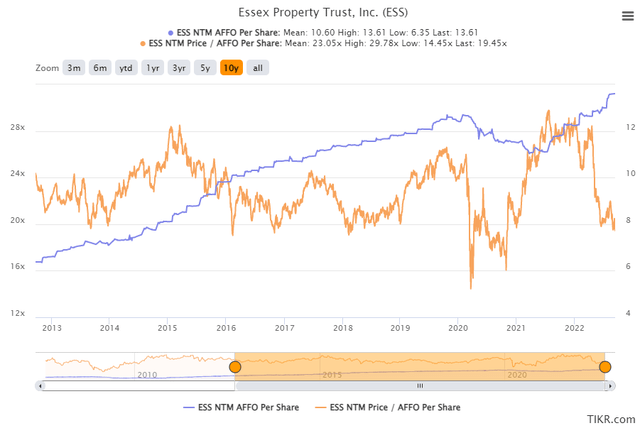

Forward estimates for AFFO per share are at all-time record highs (the purple line) while the AFFO multiple is on the low end the 10-year range:

TIKR.com

Growth in rental rates is “slowing,” but that doesn’t mean it’s dead. Apartment rents increased dramatically faster than incomes, which cannot continue forever. As it stands, rental rates are still increasing, and the cash flow already is excellent.

Leverage might look high if you look at the GAAP statements, but that’s only because the properties are recorded at historical cost minus depreciation. They’re not recorded at fair value. Do you think an apartment building in Los Angeles purchased a decade ago is worth more or less today? If you picked less, dollar cost into an index fund and forget the password. Seriously, for many investors that’s the right choice. Not for us though. We smashed the REIT indexes over our 6.7 years.

ESS represents a little over 2% of our portfolio.

Honorable Mentions

I made this a list of five to keep the length down. However, I think Equity Lifestyle (ELS), Camden Property Trust (CPT), Equinix (EQIX), Digital Realty (DLR), American Tower (AMT), SBA Communications (SBAC), Rexford (REXR), and Realty Income (O) are excellent choices also. I’m bullish on each of these shares.

Sure, the Federal Reserve may continue to jack up rates. They may intentionally push the economy into a recession (though I think we’re already there). However, these REITs will continue to grow. By the time the recession ends, AFFO per share will be even higher and we will have collected dividends along the way. I understand the idea of waiting for lower prices. Some investors who are long-term bulls are saying:

In a month or two, some dumb trader will dump shares to me at an even lower price.

That might happen. I’m not predicting that everything starts climbing up on 9/20/2022. Instead, I’m finding REITs with solid management, low debt levels, and an outstanding portfolio of assets available at attractive prices.

My Mindset

If shares decline further, so be it. I’m still getting a good price. If there’s a better price a month from now, I’ll look to add a bit more to the position. I won’t turn up my nose at good prices on great REITs in hopes that panic intensifies and offers me even lower prices. Sometimes you’ll get even better prices and sometimes you’ll miss out.

To be clear, I don’t want to buy great REITs at bad prices, and I don’t want to buy bad equity REITs at any price. Theoretically, there’s a price at which anything can be a good investment. However, I’m looking for shares where we can have a high degree of confidence that the REIT will deliver solid performance over the next decade.

Clarity

To be clear, it is no slight for a REIT to be left off this list. We don’t cover every REIT. We focus on knowing a chunk of the market well enough to make great picks. We cannot cover 200 different stocks and know them all that well. Not even close.

We want to focus in on a smaller pool of REITs so we can dive deeper into the fundamentals. This is how we pick stocks where the odds are strongly stacked in our favor.

These are equity REIT picks, so they don’t have massive yields. Equity REITs with massive yields are usually sucker yielders. To be fair, many high yield “investments” are sucker yields. We’re looking for equity REITs we can hold for a long time, so we need to focus on quality. These are all quality picks.

Ratings: Bullish on SUI, TRNO, CCI, PLD, ESS, ELS, CPT, EQIX, DLR, AMT, SBAC, REXR, O

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Be the first to comment