Enes Evren

Macro

The sharp increase in the target rate has significantly changed the current environment in the banking sector. The period of free money is over, and companies need to adapt to new financial conditions.

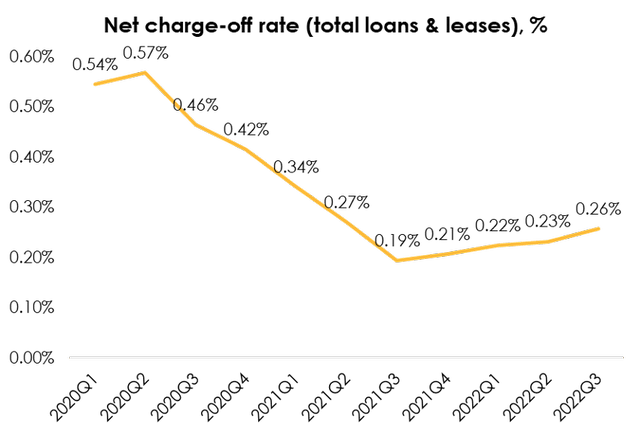

The key issue now is the deterioration of customers’ creditworthiness. While in the beginning of the year banks earned good profit due to a small number of overdue loans, in the second half of the year the trend reversed, and the share of such loans started to grow. We believe that the trend will persist in the medium term, affecting the banks’ margin.

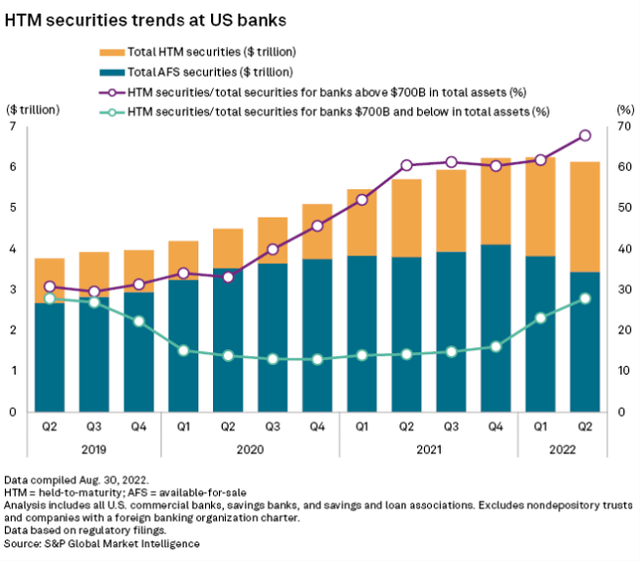

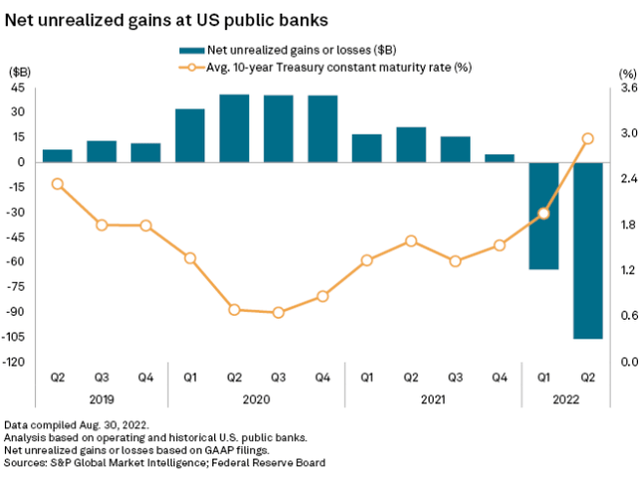

Besides, the rate growth had a negative impact not only on banks’ loan portfolios, but also on the quality of their assets. Bond portfolios of financial institutions also were affected due to rising yields on debt markets, according to the S&P Global. In turn, the managers are planning to wait out the expansion stage, which will limit the sector in liquidity.

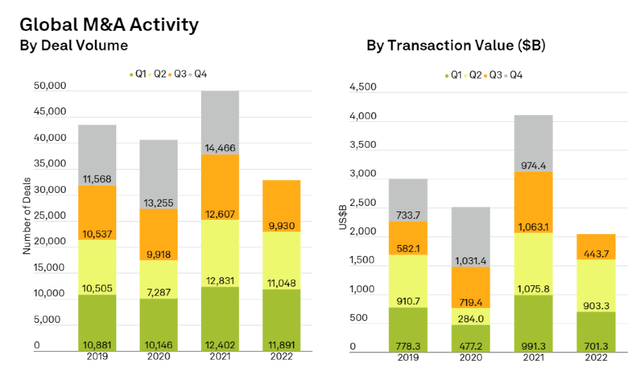

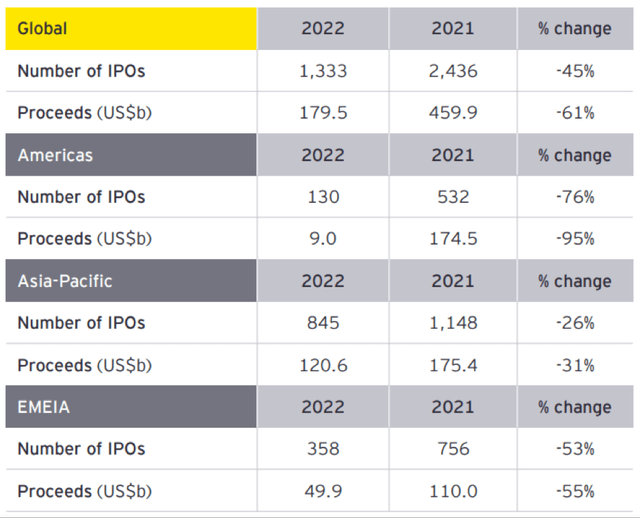

Investment banking sector is affected more than others. Raising funds, both in debt and capital markets, has become much more challenging amid soaring rates, so demand for IB services, underwriting, etc. has fallen substantially. We do not expect a reversal in the sector until the Fed continues to raise rates. Therefore, transaction volumes will remain low, limiting the earning power of investment houses.

Top 5 banks under risk

We see strongly increased risks in the banking sector, which are likely to continue growing due to the ongoing liquidity outflow from the economy and deteriorating creditworthiness of the population. Although we do not expect a collapse of the financial system and a series of bankruptcies of financial institutions, we believe that the banking sector is likely to show a period of deteriorating profits in the medium term, which will be perceived by the market as a reason to sell shares. Below we have listed 5 major U.S. banks with description of their prospects and risks.

1. Bank of America (BAC) – the largest U.S. bank holding company by assets. The company provides a wide range of financial services to both individuals and businesses and has four main divisions:

– Consumer Banking (depository activities and retail consumer lending, including credit cards, as well as retail depository services). The company’s business continues to grow organically despite its size: in 2022 the company increased the number of checking accounts by 1 million, and the number of retail investment accounts grew by 3.5 million.

– Global Banking (providing services to large corporations – loans, underwriting, consulting). The number of loans and leasing liabilities increased by 14% YoY, while the revenue from transactional business went up by 38% YoY.

– Global Wealth & Investment Management (customers’ assets management). By the end of the year the company opened more than 119 thousand accounts and increased its network of connections by more than 28 thousand.

– Global Markets (trading on currency, stock, and commodity exchanges).

BofA’s Q4 report was slightly better than analysts’ expectations – revenue was 24.66 billion versus expectations of 24.33 million, and EPS was $0.85 compared to expectations of $0.77.

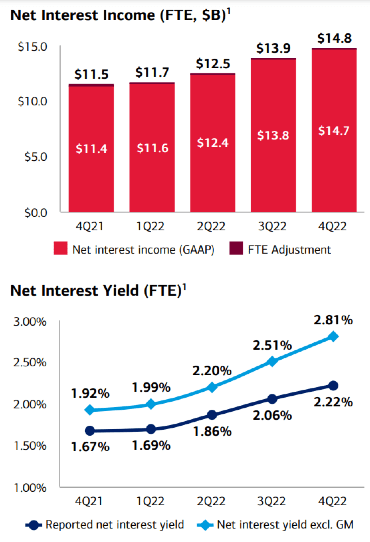

Net interest income was a strong driver in Q4, largely supported by higher interest rates, as well as by growth in credit card income. Nevertheless, provisioning of the loan portfolio continues to put pressure on the bank’s margin. The management announced that it expected a moderate recession in the year to come. Overall, the bank should have confidence to go through a difficult period. At the end of 2022, the Common Equity Tier 1 ratio was 11.2%, giving the company a large buffer over the regulatory requirements of 9.2%.

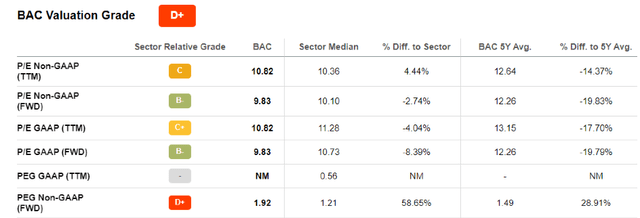

Bank of America

In terms of valuation, BofA looks slightly cheaper than its peers, being traded at 9.83 FWD P/E and 1.05 FWD P/B, but this is not a significant discount to valuation. Overall, the company’s market valuation is fair, we see no attractive potential for a reduction in market multiples.

BAC could play on a relatively good loan portfolio and credit card revenue growth: the company continues to increase the number of open accounts at a high rate (1.1 million open accounts in Q4), while the average credit score of borrowers remains fairly high (the average FICO score for credit cards is 772, for housing mortgage loans – 768).

The investment banking segment is likely to continue to be a low-performing division of the holding next year. In addition, there are risks of a further economic slowdown and a greater decline in the creditworthiness of the population than currently anticipated.

To summarize, we believe that BAC is not the best option to buy now, but we don’t see strong negative factors for the stock either. The company’s valuation is fair in terms of multiples, so investors can hold it in the portfolio to get dividend payout (~2.7% yield) or as a diversifying asset. HOLD.

2. Citigroup (C) also is of the US “big four”, the third largest bank in the country. Its divisions include:

– Global Consumer Banking (retail banking, credit, and debit card services). The company is also represented in Canada, Latin America, and Asia. In Q4, it demonstrated strong growth, especially in Branded Cards segment – revenue went up 15% YoY, driven by more than 1 million new accounts and a 9% YoY increase in TPV.

– Institutional Clients Group (provides services to large corporations and governments). The segment’s performance was not very positive in 4Q: the number of clients increased by only 1% YoY, while investment banking income dropped significantly (-62% YoY) and profit margin decreased due to growth in reserves and transformation expenses.

– Personal Banking & Wealth Management (customers’ asset management). Although interest income increased, other bank profit fell due to lower income from investment products (non-interest revenues -34% YoY).

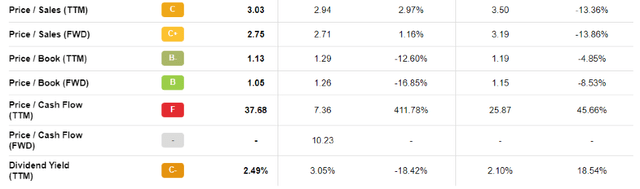

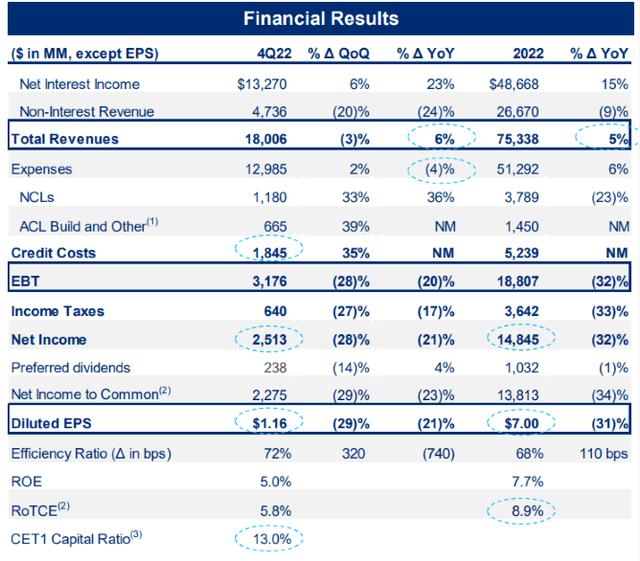

The Q4 Citi report was below expectations in terms of income, but above them in terms of revenue (RUB 18.01 bn vs RUB 17.9 bn), and EPS amounted to $1.10 vs expectations of $1.14 due to higher reserves for possible losses (RUB 1.85 bn vs expectations of RUB 1.79 bn). However, following the report the investors’ sentiment was modestly positive amid higher-than-expected fixed-income trading profit.

At the end of the quarter, the management stated its expectations of further growth in loan reserves, even after they went up by 35% QoQ to 1.85 billion. Reserves were hit hard by an increase in unsecured loans in the PB segment, which forced the bank to make additional reserves of $640 million. The management also noted a decline in housing mortgage volumes, which reduced Retail banking revenue by 3% YoY.

Citi updated its 2023 outlook and also, like BAC, expects a moderate recession, slower revenue growth and rising credit losses. The company now forecasts revenue of $78-79 billion next year (+3.6% – +4.9% YoY) and cost growth of ~5.3% YoY. The CET1 ratio is 13.0%, well above regulatory requirements and ahead of the industry.

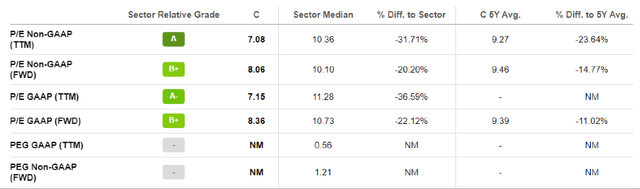

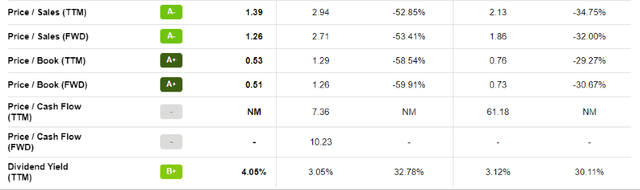

In terms of valuation, Citi offers a significant discount relative to peers, trading at 8.06 FWD P/E and just 0.51 FWD P/B. In addition, the company offers a dividend yield of ~4.2% at current prices, so the company looks quite attractive compared to its peers.

The growth of Citi’s stock price can be supported by attractive dividend yield and lower multiples discount relative to peers. As with BAC, the upward trend in credit card spending could provide additional support for Citi stock.

As with the entire industry, Citi’s investment banking will remain under pressure over the medium term. The growth of unsecured loans in the bank’s asset structure amid current macro conditions could continue to negatively impact the company’s margin, which would be detrimental to the stock’s price.

We believe that today Citi is one of the best options in the sector due to cheap price and high dividend yield.

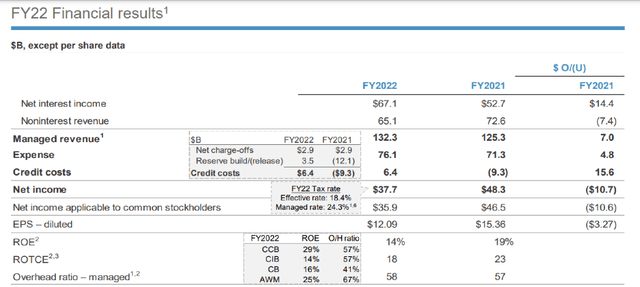

3. JPMorgan Chase Co. (JPM) The main areas of the bank are investment banking, financial services to retail and small businesses, asset management and financial transactions. It has the following structure:

– Consumer & Community Banking (provides services to individuals and small businesses through the network of branches and ATMs). At the end of Q4 the number of deposits increased by 3% YoY, but the customers’ investment assets decreased by 10% YoY. Similarly, to the sector, the volume of credit and debit card payments increased by ~9% YoY.

– Corporate & Investment Banking. Although the company ranked #1 in fees, the overall market has shrunk, which is especially prominent in equity markets (total markets revenue +7% YoY, equity markets -1% YoY).

– Commercial Banking (providing services to corporations and financial institutions). Although the average number of loans increased by 14% YoY, the volume of deposits decreased by 14% YoY. In addition, revenue from investment banking fell by 52% YoY.

– Assets & Wealth Management (customers’ asset management). The company recorded an outflow of customers’ assets: total AUM decreased by 11% YoY, deposits by 10% YoY, and loans slightly increased by 2% YoY.

Although JPM Q4 report was slightly worse in terms of revenue, net profit margin was above expectations (revenue totaled 33.57 billion vs. forecast of 34.3 billion, EPS – $3.57 vs. forecast of $3.07). The company’s core business (IB, CIB, AWM segments) remains under pressure. The growth of financial results was mainly due to higher rates and growth of the loan portfolio. However, the deterioration of loan quality had a significant impact on the company’s profit – provisions amounted to 2.3 billion (+49% QoQ) vs. expectations of 1.9 billion.

Management presented rather modest expectations for the next year – the company now expects interest income to amount to 73 billion, which supposes a decline from the current rates, as well as expenses growth by 6.7% YoY due to growth of salaries, labor engagement and investments in technologies. Like its peers, the company expects a mild recession next year with net charge-offs on credit cards returning to pre-pandemic levels. The CET1 ratio was 13.2%, giving a significant premium to the regulatory norm.

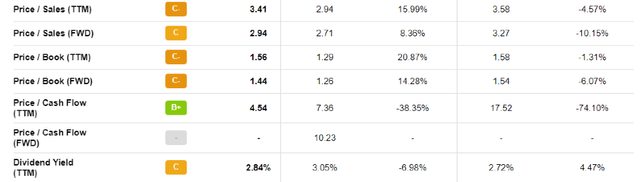

JPM is quite expensive relative to other banks with a forward P/E of 11.15 and P/B of 1.44. The company’s dividend yield gives just slightly less than 3%. Given all the potential difficulties of the banking sector and IB, we do not believe that such valuations are sufficient to buy the stock.

The trigger for JPM could be a sharp recovery in investment business, but we do not assume it as the main scenario. We believe that the current upward cycle will continue – there will be an outflow of cash from funds, the number of placements and M&A will remain subdued, that is, IB will be under pressure.

There are more factors behind the drop in JPM prices. First, the prolonged deterioration in financial results in the CIB, CB and AWM segments is likely to be negatively perceived by investors, and increased exposure to the credit business will continue to put pressure on the company’s income given the growing reserves.

From our point of view, JPM is not the right choice to buy at current prices. It remains expensive, offers investors modest yields, and there are no signs of a significant reversal in operating activities soon. On the other hand, the market has already included this negative trend in the bank’s investment business, so we also suggest HOLD.

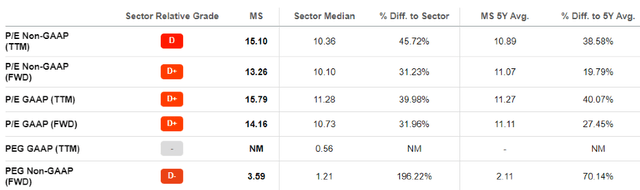

4. Morgan Stanley (MS). As compared to the previous companies, a rather small, but also systemically important bank focused on the investment business.

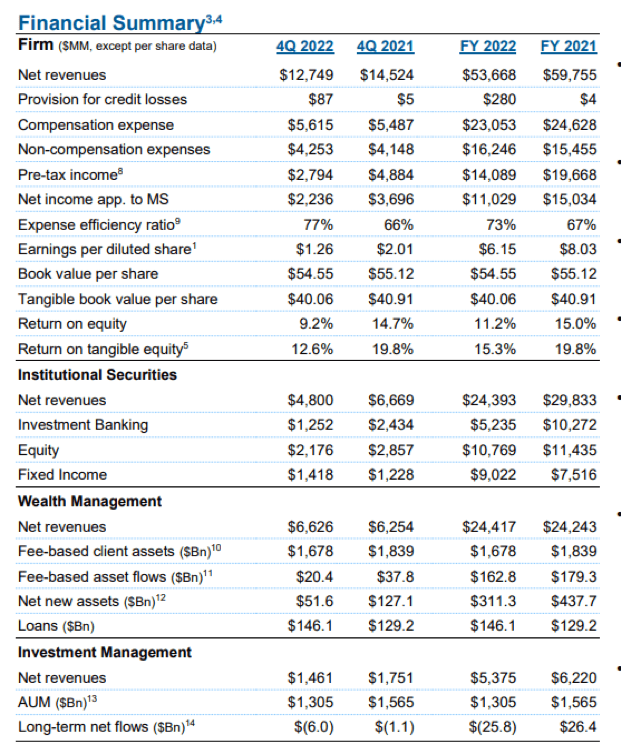

– Institutional Securities Group (underwriting, consulting, stock exchange activities, etc.). The segment’s revenue fell by 28% YoY, with investment banking especially suffering (-49% YoY). The company is affected by difficult macroeconomic situations, a drop in the number of M&A deals and IPOs.

– Wealth Management (works with wealthy investors). Here the company significantly exceeded analysts’ expectations, which was a strong trigger for prices. Revenue increased by 6% YoY, driven by growth in interest income and fixed-income trading profit.

– Commercial Banking (providing services to corporations and financial institutions). Although the average number of loans increased by 14% YoY, the volume of deposits declined by 14% YoY. In addition, revenue from investment banking fell by 52% YoY.

– Investment Management (customer’s asset management). As in the sector, the company recorded a 16.6% YoY decline in AUM with net outflow of $6 billion.

The Q4 report was slightly above the analysts’ expectations as the company exceeded revenue expectations ($12.75 billion against a forecast of $12.64 billion), while EPS amounted to $1.26 against a forecast of $1.19. A decline in M&A deals and IPOs is putting pressure on revenue, while profit margin also remains affected due to higher wages (despite a 2% of layoffs in December) and increased loan loss reserves.

Morgan Stanley

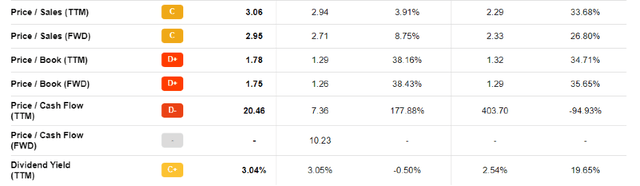

Due to the specific nature of the business, MS is expensive relative to the market, and the premium was expanded significantly over the last year. The company trades at forward P/E of 13.3 and P/B of 1.75, although a rapid recovery of the sector is unlikely. The stock’s dividend yield at current prices is ~3.3%.

Due to the narrow specifics of MS business, we believe that in the mid-term the triggers for price growth can be either a reversal in retail investments and inflow of cash into the funds, or growth of demand for IB services from the institutional players, which is very unlikely during the rate hike cycle.

However, factors in favor of the decline are much more likely to take place – further liquidity outflow, unsatisfactory investment banking dynamics and growth of reserves for losses.

In our view, MS does not yet look attractive for long-term investors. The company’s status is HOLD. IB market recovery will take time, and the looming recession will continue to negatively affect the company’s entire business.

5. Wells Fargo (WFC). A large U.S. holding company providing banking and insurance services. Together with BAC, JPM and Citi, it is one of the “big four” banks.

– Consumer Banking & Lending (retail lending). Total revenue increased 8% YoY but showed mixed dynamics within the subsegments: while Consumer & Small Business Banking shows growth due to rate hikes, housing mortgage revenue fell by 57% YoY due to lower real estate sales and added value of contracts.

– Commercial Banking (financial services for legal entities). Revenues increased by 38% YoY, the number of loans is growing as well as their yields, but the number of deposits is decreasing. Financial leasing income fell by 4% YoY.

– Corporate & Investment Banking. Revenue surged by 18% due to strong results in the treasury, commercial real estate, and trading segments.

– Wealth & Investment Management (customers´ assets management). Revenues went up 1% YoY mainly due to growth in interest income. The division saw an outflow of deposits, as the bank’s customers are looking for more profitable instruments.

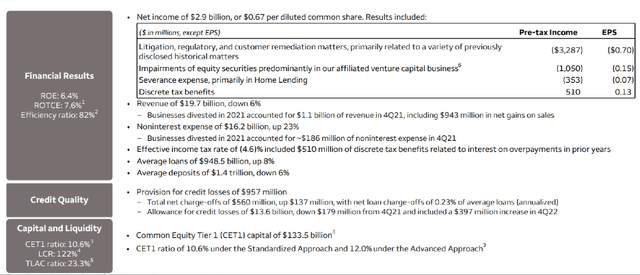

The Q4 report, in contrast to other banks, was slightly below analysts’ expectations. Revenue reached $19.66 billion against a forecast of $19.95 billion, while EPS was 0.67 against a forecast of 0.61. The bank reported reserves of $957 million versus a forecast of $860 million. Litigation costs of $2.8 billion also affected the profit margin. WFC continues to be one of the most dependent banks on the housing mortgage market in the U.S.

Meanwhile, among peers, WFC has fallen to a record low CAR – CET1 was only 10.6% as per the standardized approach.

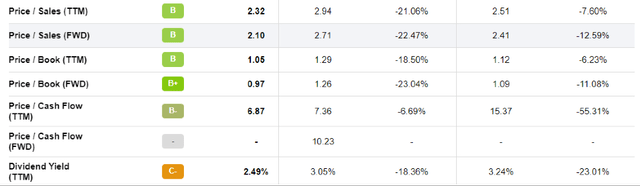

In terms of valuation, the performance of WFC looks quite moderate in comparison to other banks. Despite small discounts in terms of multiples (FWD P/E 9.25, P/B 0.97), the company’s valuation is fair relative to the market. Dividend yields are also in line with the sector (~3% fwd).

A recovery in the U.S. real estate market because of the company’s high exposure to the mortgage market could be a positive factor for WFC. However, given the deteriorating macro conditions and rising rates, it is unlikely to happen very quickly.

That said, the company’s profit will continue to be squeezed by rising loan reserves, which in turn could cause negative sentiment in the market. Besides, the recession as such has not started yet, and with the market now being rather optimistic about future economic difficulties and the Fed’s actions, further deterioration of the macroeconomic situation could affect both the bank’s operations and the company’s market valuations.

We do not see any strong drivers for WFC stock right now, and current valuations do not offer significant upside. We maintain HOLD status.

Conclusion

Q4 reports of banks were not homogeneous – we observe stable growth of TPV on credit cards and increase of interest income on loans, but the quality of the latter is deteriorating, which will put pressure on banks’ profit margin in the medium term. Investment banking, in turn, suffers more than other sectors due to falling demand for underwriting, consulting and M&A services. Most companies’ management is expecting a mild recession and many have lowered expectations for the year to come. Now we maintain a neutral view of the banking sector and will wait for further developments, follow the dynamics of creditworthiness of both retail and corporate segments, as well as the regulator’s actions. Among all banks, we are most impressed with Citi because of its cheap prices and attractive dividend yield.

Be the first to comment