Nattakorn Maneerat/iStock via Getty Images

Co-produced by Austin Rogers for High Yield Landlord

Most of people’s spending is concentrated in three broad areas:

- Housing: Everyone needs a roof over their heads.

- Energy: Everyone needs fuel for their vehicles, gas to heat their homes, and electricity to power nearly everything that occupies their time.

- Food: Everyone needs to eat.

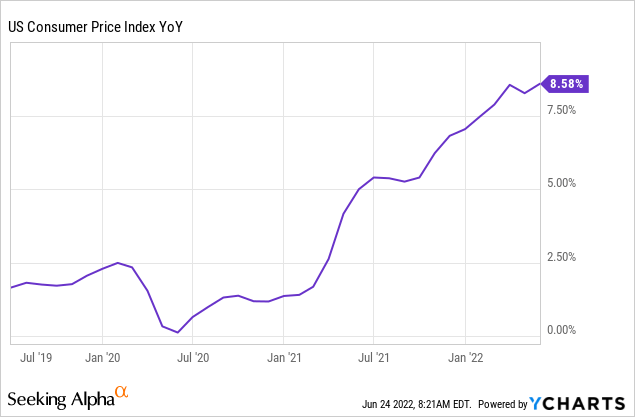

As we are all painfully aware, inflation is higher today than it has been in 40 years. By the official consumer price index (“CPI”) metric, year-over-year growth in consumer prices has reached 8.6% in recent months.

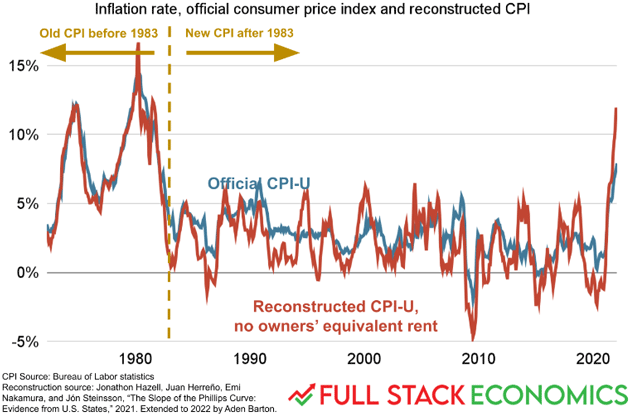

But this official statistic includes a controversial measurement of housing costs called “owner’s equivalent rent” (“OER”), which uses a survey of what homeowners say they would charge in rent for their home. This measurement notoriously lags and undershoots the rise in housing costs.

Before 1983, the Bureau of Labor Statistics used a different measurement of housing costs that came closer to actual rent and home price growth. Recently, economist Larry Summers put out a chart showing the difference over the decades between the old and new measurement of CPI. The old measurement, which arguably comes closer to reality, shows inflation reaching nearly the same heights as it did in the early 1980s.

Old CPI vs New CPI (Lawrence Summers via Mauldin Economics)

When you look at either home prices or rent rates, both have dramatically outpaced the OER recently. In April 2022, for instance, the OER registered a 4.8% YoY rise, while home prices rose 19% and apartment rents increased 15%.

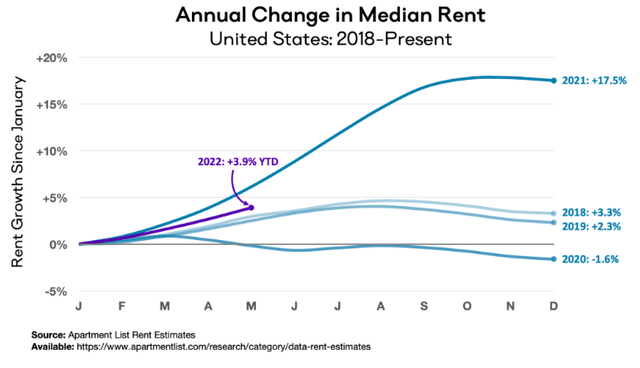

And while rent growth has not been as high this year as last year, it remains above its levels from recent, pre-pandemic years.

Apartment rent growth (Apartment List)

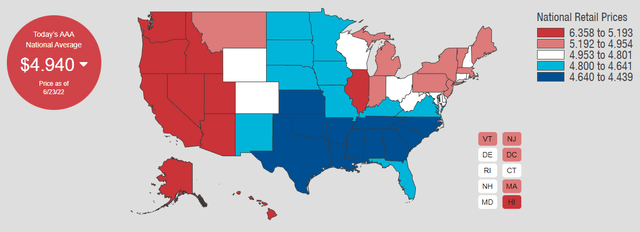

But housing is by no means the only thing getting more expensive. Let’s look at energy, namely gas prices.

In the middle of June, the nationwide average gasoline price per gallon hit $5, the highest amount that Americans have ever paid at the pump.

Gasoline prices per gallon (Exxon)

As of now, there’s little evidence that high gas prices have cut down on consumers’ traveling, but travel plans are made well in advance. As such, any slowdown in traveling to come from these high prices will probably come with a lag.

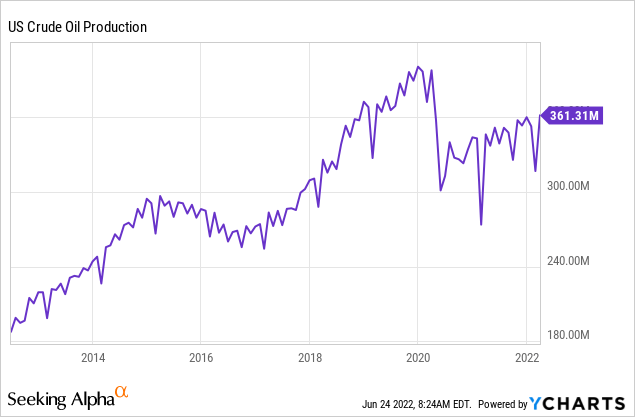

The problem is that even amid high consumer demand for goods, services, and traveling in the post-pandemic economy, oil production has not kept pace. It has not even come close to keeping pace. And U.S. producers have made clear they do not intend to dramatically ramp up the supply of oil through more costly and long-term drilling anytime soon.

After being vilified by a large segment of the population (and politicians), being starved for capital by the growing ESG movement, and hearing growing calls for shareholder returns over capex-heavy production growth, oil producers have gotten the message and turned off the taps.

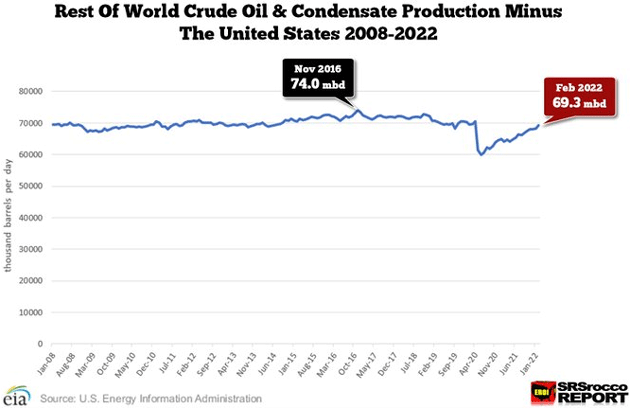

Unfortunately, producers across the rest of the world have not filled in the gaps. As of February 2022, the rest of the world’s oil production had not yet returned to the average from the last 14 years.

World oil production (SRSrocco Report via Mauldin Economics)

While U.S. oil majors are returning cash to shareholders, their European peers have been investing heavily into the energy transition, including hydrogen, renewables, and battery storage. As such, there’s little hope of supply catching up to elevated levels of demand anytime soon.

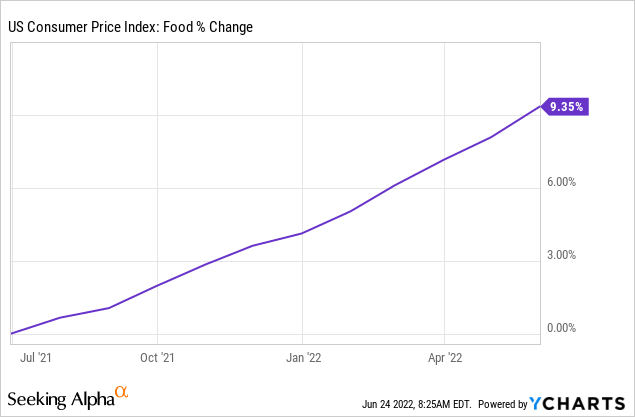

And then there’s food, which is heavily influenced by other prices in the economy, like gasoline. As soaring commodity prices and expensive gasoline has hit food producers, these pressures have bled through into rising prices for consumer food products.

Just in the last year, food inflation has hit over 9%.

With supply chains refusing to smooth out and prices everywhere continuing to go up, how does the economy get fixed?

The Painful Solution: Demand Destruction

The Federal Reserve has a way to deal with this problem, but it’s a blunt tool. In fact, the Fed has no precision tools. They have no scalpels, only mallets.

They have no way, for instance, to unkink supply chains or lift supply to be commensurate with demand. They only have the ability to crank up interest rates, which will affect the entire economy.

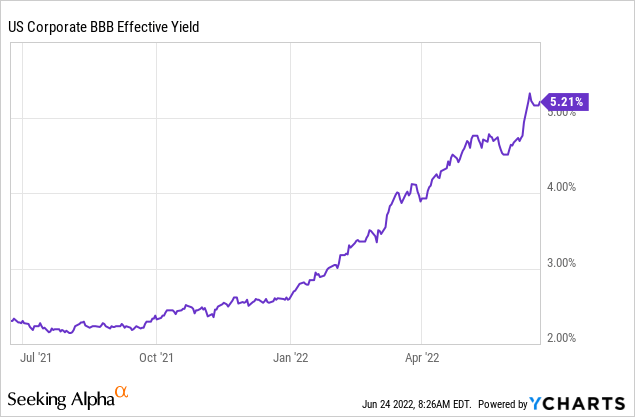

In the last year, for instance, we’ve seen BBB-rated corporate bond yields more than double.

This will inevitably dry up corporations’ desire to tap the credit markets, which will in turn slow corporate spending.

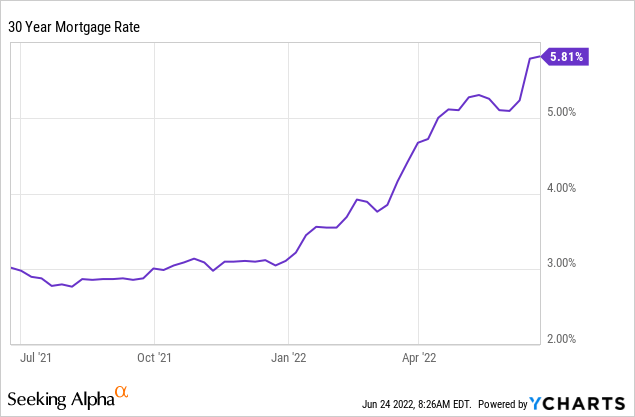

Likewise, the 30-year mortgage rate has nearly doubled in the last year.

This will have the same effect: diminish demand for homes from buyers.

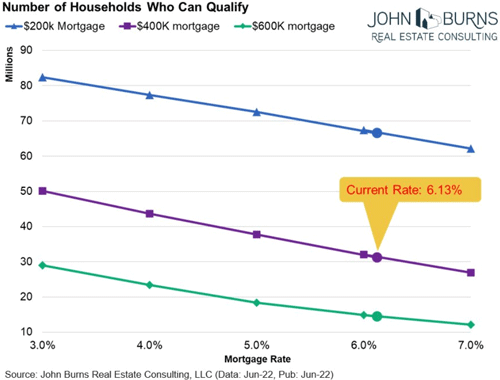

Because homebuyers almost never pay with cash nor even with substantial down payments, what people buy when they buy a home is a monthly payment. When the mortgage rate rises, the monthly payment rises. When the monthly payment rises but home prices do not, fewer and fewer people can afford homes.

Mortgage rate demand destruction (John Burns Real Estate Consulting)

This is called “demand destruction.” Sadly, it is the Fed’s only way to ease the inflation overheating the economy right now.

The hope is that the Fed would be able to engineer a “soft landing,” wherein they tighten monetary conditions just enough to ease inflation without causing a recession. But the Fed’s track record of achieving soft landings is very poor, especially after they have overshot so significantly to the other extreme.

The “solution” to the inflation problem, then, seems increasingly likely to be a recession.

Of course, it is always possible that the Fed could back down at the first sign of economic weakness and begin easing again too soon, thereby allowing inflation to remain high for longer. This is a risk that can’t be ignored.

As such, investors must prepare for three possible futures:

- Inflation remains high but a recession is avoided.

- Inflation cools down at the cost of a recession.

- Inflation remains high and the economy falls into a recession.

In such an uncertain environment, we at High Yield Landlord prefer to invest heavily in real estate investment trusts (“REITs”) that are both recession-resistant and inflation-protected. Fortunately, the recent selloff has irrationally discounted several high-quality REITs that feature both of these characteristics.

Here are three.

Alexandria Real Estate Equities, Inc. (ARE)

ARE has three interrelated business segments:

- Ownership and management of life science office/laboratory real estate properties.

- Ground-up development of life science properties.

- Venture capital investments in growing, innovative biotech companies.

The life science properties ARE owns are high-quality, Class A buildings primarily located in the main U.S. biotech clusters of San Francisco, Boston, San Diego, and Raleigh/Durham.

Life science building (Alexandria Real Estate)

These properties are leased to the world’s largest and strongest pharmaceutical companies with favorable terms like triple-net leases and 3% annual rent escalations. Plus, when leases expire, management is able to hike rents up to the market rate, which more than keeps pace with inflation. Its leases are way below market and the management expects 30-40% rent hikes on expiring leases this year.

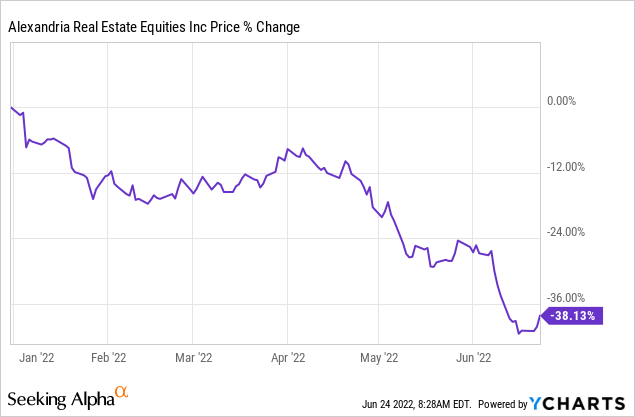

Despite top-notch real estate, a 12-year dividend growth streak, and a skilled management team led by CEO and company founder Joel Marcus, the market has indiscriminately dumped ARE shares this year.

But keep in mind that ARE’s drugmaker tenants have one of the most recession-resistant types of businesses, because people need medicine to treat illnesses in good economic times and bad. What’s more, drug prices typically keep pace with broader inflation, as government insurance reimbursement rates have been shown to rise faster than the CPI over long periods of time.

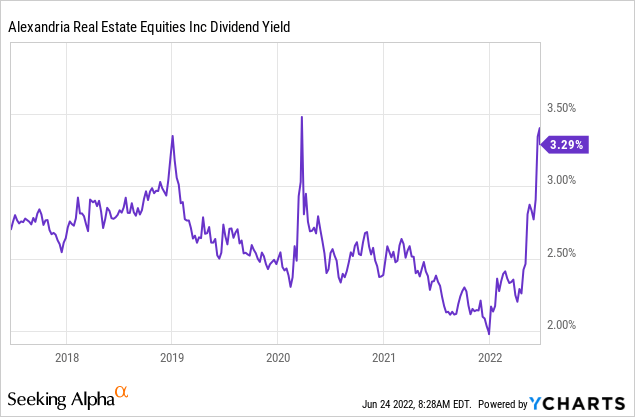

There are scarcely ever better times to buy ARE than today. The trailing 12-month dividend yield is near the highest end of its range over the last five years.

Including the most recent dividend raise, ARE actually yields closer to 3.5% right now.

Even assuming no valuation upside, we think ARE will deliver total returns over 10% when combining the yield and growth. But realistically, the stock price probably has 50% upside from here.

Camden Property Trust (CPT)

Sunbelt multifamily landlord CPT’s hand-picked markets across the South have enjoyed a huge boost from domestic migration during the pandemic as people in expensive coastal cities sought out lower-cost, lower-tax places to live.

The REIT owns a diversified portfolio of Class A and Class B apartment communities in urban as well as suburban areas. Here’s an example of a mid-rise apartment building in an urban area of Austin, Texas:

Camden Rainey Street, Austin TX (Camden Property Trust)

And here’s a garden-style apartment community in a more suburban area of Austin:

Camden Stoneleigh, Austin, TX (Camden Property Trust)

Rent has been soaring in CPT’s markets across the Sunbelt. In the first quarter, CPT’s blended (new and renewal leases) rent growth surged 15% lease-over-lease, and that rate slowed only barely to about 14% in April and May. Meanwhile, occupancy remains stubbornly high at around 97%, implying continued strong demand for CPT’s units and elevated rent growth still to come.

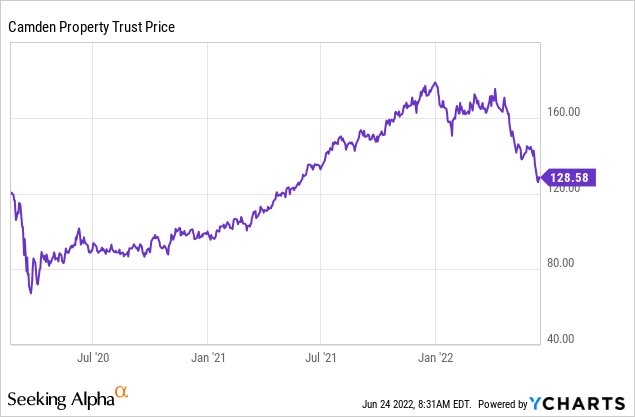

Amid this environment, CPT expects double-digit net operating income and FFO per share growth this year. And yet, despite strong growth for two years straight on top of a decent showing in 2020, CPT is trading near where it was prior to the pandemic:

This is after the stock price shed nearly 30% of its value year to date. Did the market get ahead of itself in late 2021? Perhaps. But now it appears as though the market has gone overboard in the other direction.

Apartments are typically quite recession-resistant, because renters usually find a way to pay rent even in difficult circumstances in order to avoid eviction. Plus, with unemployment ultra-low and job openings still high, it appears unlikely a wave of layoffs is going to threaten rent payments anytime soon.

Apartments are also inflation-protected, as we have witnessed over the last year or so with soaring rent and NOI outpacing the CPI by a significant margin.

Though CPT’s dividend yield is somewhat low at about 2.8%, the REIT is likely to deliver another few big dividend hikes in the coming years. We also believe it has at least 30% upside to fair value.

STAG Industrial, Inc. (STAG)

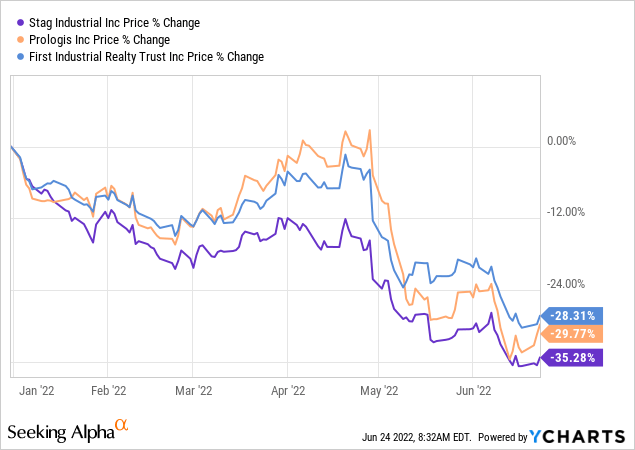

Industrial REITs generally have taken a tumble so far this year amid the broader stock market decline as well as news of Amazon’s (AMZN) pullback on its warehouse footprint, but STAG has suffered the worst punishment at a 35% decline.

The REIT is the value-play in the industrial real estate space, typically buying large, single-tenant properties in secondary or tertiary markets rather than the standard multi-tenant properties in primary markets owned by the other industrial REITs.

Stag Industrial Example Property (Stag Industrial)

But STAG’s fundamentals have never been stronger. In the first quarter, new lease rent rates grew an astounding 25% lease-over-lease, while blended (new and renewal) rent growth came in similarly strong at 15%. On a straight-line basis (including future contractual rent escalations), blended rent growth bounced a remarkable 25%. Same-property NOI grew 4.8% YoY in the first quarter, while FFO per share bounded 8.2%.

Plus, the REIT has steadily deleveraged its balance sheet to be in line with peers, which resulted in a recent credit upgrade to BBB.

Moreover, with a payout ratio of only 67%, STAG’s monthly paying dividend of nearly 5% is well-covered and buffered from whatever economic turmoil may come its way. We see STAG appreciating by about 25% in order to attain a valuation a little closer to that of its peers.

Bottom Line

Investing is hard enough as it is. Now add in generationally high inflation and a looming recession. That makes the current investing environment more difficult than it has been in a long time.

But at High Yield Landlord, we remain confident amid uncertainty because our portfolio is comprised largely of recession-resistant and inflation-protected REITs like these three.

Be the first to comment