Bosca78

This article first appeared on Trend Investing on September 13, 2022, but has been updated for this article.

Demand for the magnet rare earths is set to soar due to the renewable energy and EV booms this decade. The best performing electric motors use permanent magnets known as NdFeB magnets containing neodymium (“Nd”), iron (“Fe”), and boron (“B”). Typically, these also contain praseodymium (“Pr”) plus some dysprosium (“Dy”). These permanent magnet motors are used in a large proportion of wind turbines and electric vehicles.

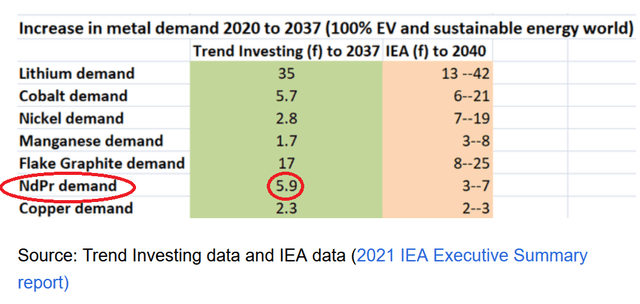

The chart below shows Trend Investing’s forecast for EV metals ‘increase in demand’ from 2020 to 2037. The NdPr demand surge will be the third largest (5.9x), following lithium (35x) and flake graphite (17x) and ahead of cobalt (5.7x), nickel (2.8x), copper (2.3x) and manganese (1.7x).

Neodymium/Praseodymium (“NdPr”) demand forecast to increase by 5.9x from 2020 to 2037(Trend Investing forecast based on our model)

Source: Trend Investing – Exclusive: Our Model For Total EV Metals Demand 2020-2037. What Metals Are Most Impacted?

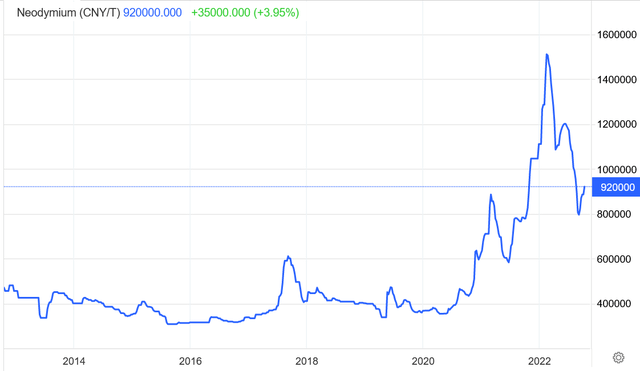

Neodymium 10 year price chart – prices have fallen heavily in 2022 giving investors a better initial entry point into the sector

Some reasons for the price fall are given on page 14 here.

Rare earths demand vs. supply forecasts

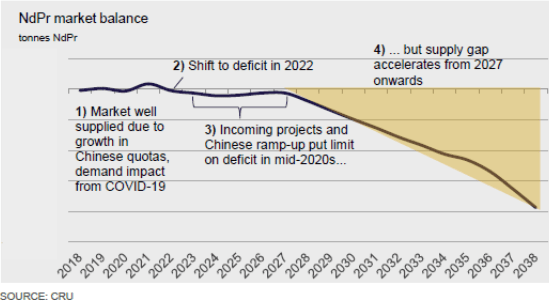

As shown below, analysts are forecasting increasing deficits of NdPr this decade. This is due to rising demand and constrained supply. Typically, quality rare earth projects are uncommon and take many years (10 years+) and large dollars [CapEx] to bring into production.

CRU forecast of increasing NdPr deficits from 2022, worse after 2027, unless significant new supply comes online

Hastings Technology Metals courtesy CRU

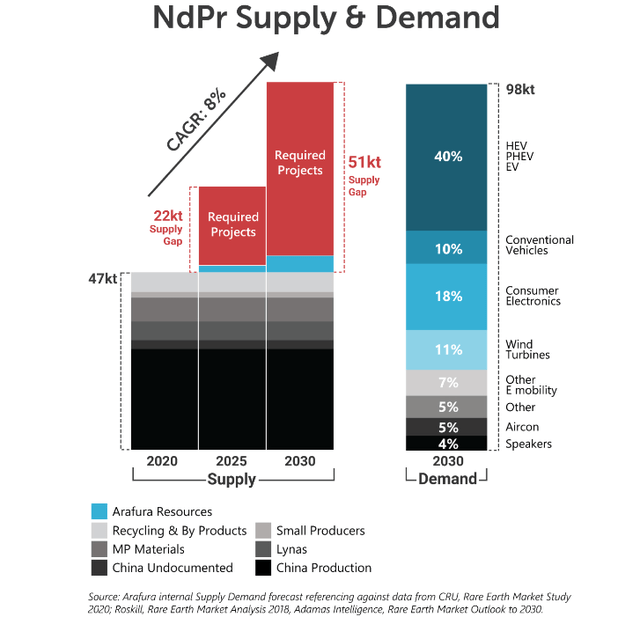

NdPr supply gap – 22ktpa NdPr by 2025 and 51ktpa by 2030 (assumes production of ~34 million EVs pa by 2030) – New projects will be needed

Arafura Resources courtesy Roskill

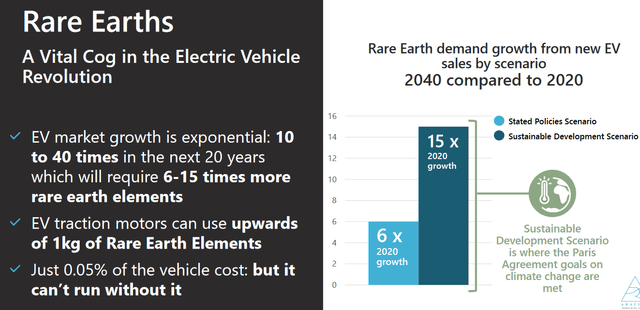

IEA forecasts 6-15x increase in demand for rare earths from the EV sector from 2020 to 2040

Arafura Resources courtesy IEA

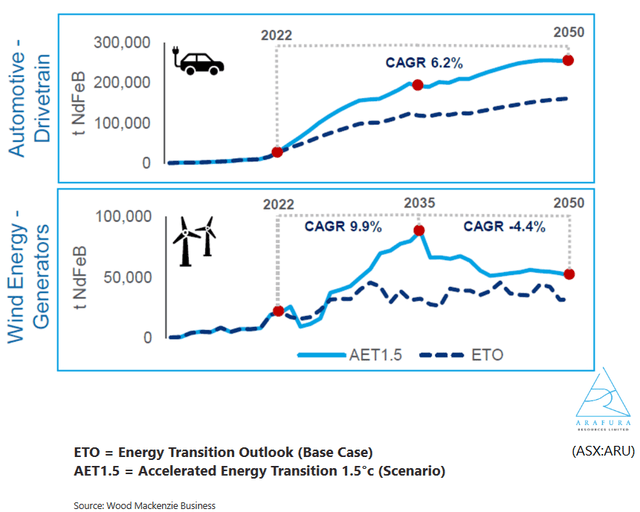

NdFeB demand set to soar from EVs and wind turbines

Arafura Resources courtesy Wood Mackenzie

Top 3 rare earths (NdPr) junior or near term producers to consider

Below we have chosen 1 new small rare earths (‘junior’) producer and our top 2 ‘near term’ rare earth producers.

The existing significant Western producers should also do very well this decade and include Lynas Rare Earths Limited [ASX:LYC] (OTCPK:LYSCF) and MP Materials Corp. (MP). Energy Fuels (UUUU) could also be added to this list, even they are more a rare earths concentrate processor rather than a rare earths miner.

1) Vital Metals [ASX:VML] (OTCQB:VTMXF) – Price = A$0.03

Vital Metals is relatively new small scale light rare earths ‘concentrate’ producer from their Nechalacho Mine in NWT, Canada. They are Canada’s first rare earths producer and North America’s second rare earths producer. They plan to process the ore further into rare earth oxide (“REO”) at their Saskatoon Rare Earths Extraction Plant, due to open in Q4, 2022.

Vital Metals 100% owns the Nechalacho’ Mine in Canada’s Northwest Territories (NWT). The Nechalacho Mine is a light rare earth (bastnaesite) project with a Total Resource (M& I, & Inferred) of 94.7Mt at 1.46% REO. Importantly the Resource has the North T Zone which hosts a high grade resource of 101,000 tons at 9.01% light REO (“LREO”) (2.2% NdPr) where Stage 1 production began from a starter pit in June 2021. Stage 2 will involve the development of the much larger, but lower grade, Tardiff deposit.

The Nechalacho Mine starter pit in NWT, Canada – Access to the mine is via ice roads

Vital Metals annual report Vital Metals annual report

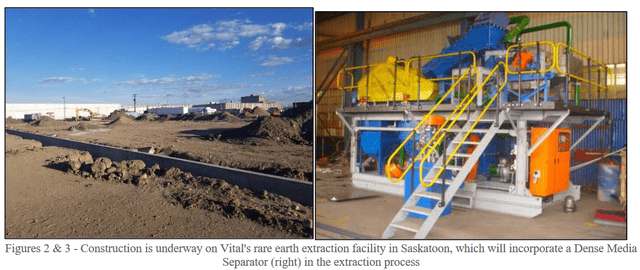

Further ore processing is to be done at Vital Metal’s, under construction, Saskatoon Rare Earths Extraction Plant. Vital Metal’s aims to produce a minimum of 5,000 tons of contained REO by 2025 from the Nechalacho Mine. The REO concentrate contains the valuable NdPr. In a September 9, 2022 market update the Company stated:

Construction and early commissioning activities continue as scheduled at Vitals’ Saskatoon Rare Earths Extraction Plant in Saskatchewan, Canada. The 3TQ product delivery remains on track for Q4 2022.

Vital Metal’s rare earth extraction facility under construction in Saskatoon, Canada set to begin REO production in Q4 2022

Vital Metals aims to be Europe’s first fully integrated non-Chinese supply of REO to European end-users

Vital Metals has a binding off-take agreement with Norwegian company REEtec for Stage 1 production. REEtec then plans to sell a final product to Schaeffler Group. The REEtec off-take is to supply up to 2,500t NdPr pa contained within ~6,800 tonnes TREO.

In the recent market update the Company stated:

Vital was selected as one of only five Canadian based mining companies to attend a recent Critical Mineral Round Table event attended by delegations of Chairpersons and CEOs from Germany’s leading companies, including Volkswagen, Siemens, Mercedes-Benz, K+S and BINZ automotive.

Note: Vital Metals also has a non-binding MOU with Ucore Rare Metals Inc. to supply a growing volume of rare earth oxide for their ALASKA2023 project.

Vital Metals trades on a market cap of A$157m.

Risks – Our only concern (in the shorter term) is an overhang of shares held by ex-Managing Director/CEO Geoff Atkins, who was abruptly terminated a few months ago. Records show his company Atkins Projects and Infrastructure Pty Ltd holds ~92m shares (1.3m sold on Sept. 1, 2022) and ~90m options or ~2.2% of the company. One can argue he would see the Company’s potential better than anyone so would choose to hold his shares. Another risk would be if Lionhead decided to sell down their dominant 12.8% stake in the Company. Finally, China may decide to flood the NdPr market to damage the competition, unlikely but possible.

Investing.com shows an analysts’ price target of A$0.11. A very good March 2022 broker report has a valuation of A$0.21 (noting Nd prices were higher then). Investors can also read the 2021 Annual report here.

We view Vital Metals as a well valued early stage rare earths producer and rate the company as a strong accumulate/buy (safer in stages, see risks above), suitable for a 5 year plus time frame.

Summary of Vital Metals (Source: Broker report)

2) Arafura Resources [ASX:ARU] [GR:REB] (OTCPK:ARAFF) (“Arafura”) – Price = AUD 0.287

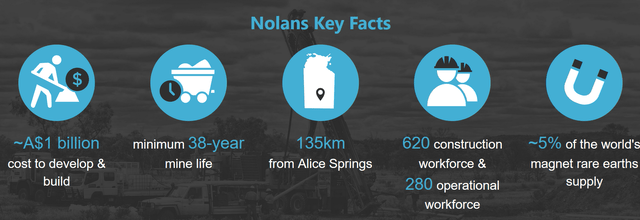

Arafura 100% owns the Nolans rare earth Project 135kms from Alice Springs in the Northern Territory, Australia. The Project is shovel ready and just needs initial project funding to be finalized. The plan is to build a fully integrated mine to rare earth oxide project on a single site. A Final Investment Decision (“FID”) is expected in December 2022 and all going to plan commissioning and production in 2025.

Nolans is a world class project planning to produce 4,440tpa of NdPr oxide over a 38 year mine life. The extraction plant will produce 144,000 tonnes of fertilizer grade (54%) phosphoric acid each year as a by-product. Arafura states that “the Nolans project contains one of the world’s largest neodymium and praseodymium deposits.”

The JORC 2012-compliant Mineral Resources consists of 56 million tonnes at an average grade of 2.6% total rare earth oxides (TREO) and 11% phosphate (P2O5) that extends to 215 metres below the surface. 26.4% of the mix is represented by NdPr.

The 2021 updated DFS resulted in a post-tax NPV8% of A$1.4b, post-tax IRR of 18.1% and average EBITDA of A$354m per annum based on a LOM of 38 years. CapEx is estimated at A$1.056b (~$US768M) with an estimated OpEx of US$24.76/kg NdPr net of P2O5 credit.

All environmental approvals, Native Title Agreement, and the Project’s Mineral Leases have all been secured.

Arafura has a non-binding MoU with Hyundai Motor for 1,000tpa NdPr oxide with ability to secure an additional 500tpa. Also, an MOU with GE Renewable Energy. Arafura state: “Arafura is in discussions with more than 10 parties for >260% of Planned Production1 with a view to secure 85% as binding offtake.”

Arafura has secured conditional letters of support for A$300m from NAIF & EFA towards Project debt funding. It may be possible for the U.S government to also get involved with initial project funding. More details on funding here on page 19.

Arafura trades on a market cap of A$495m. Analyst price target is A$0.56, representing 93% potential upside.

We rate Arafura Resources as a good spec buy, suitable for long term investors. Initial project CapEx (~A$1b) looks to be the biggest challenge.

Investors can view the latest company presentation here and 2022 Annual Report here.

Arafura Resources Nolan’s Project summary – A massive 38 year project life

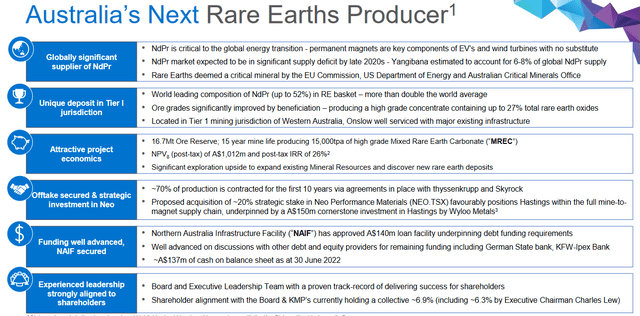

3) Hastings Technology Metals [ASX:HAS] (OTCPK:HSRMF)(“Hastings”) – Price = A$3.35

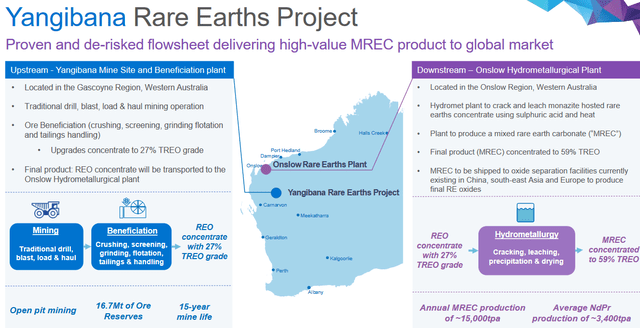

Hastings call themselves “Australia’s next rare earths producer“. Hastings controls two rare earth projects in Western Australia, the Yangibana Project (more advanced stage) and the Brockman Project.

At the Yangibana Project, Hastings plans to build a mine and beneficiation plant, and a hydrometallurgical plant in nearby Onslow, so as to produce 8,500 tpa TREO production and 3,400tpa NdPr.

Hastings’ Yangibana Rare Earths Project and their planned Onslow hydrometallurgical plant in Western Australia

Hastings Technology Metals company presentation

The Yangibana Project Proven & Probable Reserve is 16.7Mt at 0.95% TREO (0.35% NdPr oxide) for a total contained 158,419t TREO. The Total Mineral Resource has a contained TREO of 266,417t (at 0.97% TREO). What is notable is that Yangibana’s ore has 37% NdPr content, which is double the world average.

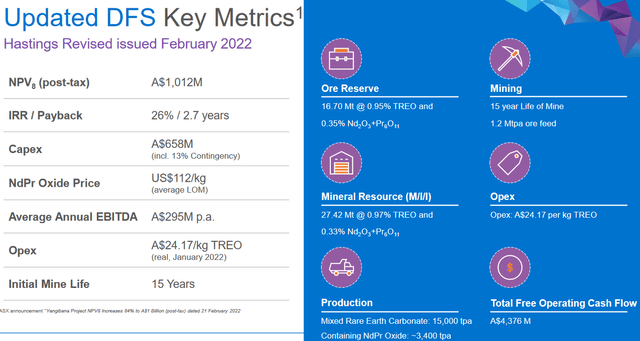

The Yangibana Project revised Feb. 2022 DFS resulted in a post-tax NPV8% of A$1.012b and a post-tax IRR of 26%. The revised CapEx is estimated at A$582m (including contingency is A$658 million). The Project is to have a 1.2Mtpa ore throughput, a 15 year mine life, ~15,000 tpa of MREC production, ~8,500 tpa TREO production and 3,400tpa NdPr production.

Updated DFS key metrics for the Yangibana Project

Hastings Technology Metals presentation Sept. 2022

Hastings has 10 year supply offtake agreements in place, with German Tier 1 companies, Schaeffler and Thyssenkrupp. These off-takes account for ~70% of planned production.

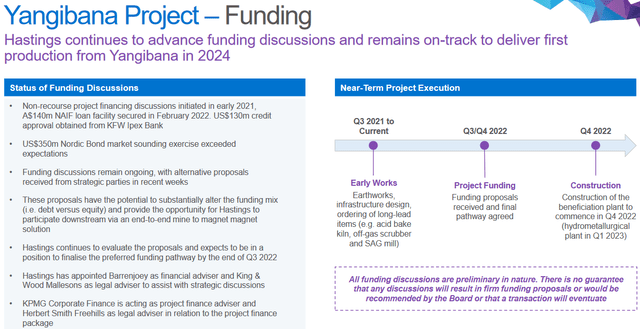

On the February 2, 2022 Hastings announced: “NAIF approves $140 million loan for Yangibana Rare Earths Project… NAIF loan forms part of A$300-400 million of total debt financing required for Yangibana.”

Hastings plans to achieve funding in H2 2022 then start construction late 2022 and first production in 2024

Hastings Resources company presentation

A A$20 million early works program to deliver the core site infrastructure at Yangibana is well underway. Production start is targeted for 2024 (subject to final project funding).

Interestingly Hastings recently invested into Canadian magnet materials maker Neo Performance Materials [TSX:NEO] (OTCPK:NOPMF) as you can read in the link below. This opens up a potential mine to magnet material off-take arrangement or JV.

Hastings stated:

Funding discussions remain ongoing, with alternative proposals received from strategic parties in recent weeks…. These proposals have the potential to substantially alter the funding mix (i.e., debt versus equity) and provide the opportunity for Hastings to participate downstream via an end-to end mine to magnet solution.

Hastings trades on a market cap of A$390m. As of June 30, 2022 Hastings had A$137m of cash. An additional ~A$150m raising from Wyloo Metals (backed by Australian billionaire Andrew Forrest) to fund the Neo purchase is discussed here.

Analyst recommendation is a ‘buy’ with a price target of A$6.45, representing 91% upside.

Looks promising and on track to be a potential 2024/25 NdPr producer. We rate Hastings Technology Metals as a good spec buy, suitable for long term investors.

Hastings Technology Metals investment highlights

Hastings Technology Metals company presentation.

Others (in alphabetical order)

Of the list of others below Appia Rare Earths & Uranium looks to be one of the best due to their very high grades and low market cap. The Project is still at an early stage. You can read more about Appia here and here.

- American Rare Earths Limited [ASX:ARR] (OTCQB:ARRNF) (“ARR”)

- Appia Rare Earths & Uranium [CSE:API] (OTCQX:APAAF) (“Appia”)

- Avalon Advanced Materials Inc. [TSX:AVL] (OTCQX:AVLNF)

- Australian Strategic Materials [ASX:ASM] – The Dubbo Project and a Korea Metals Plant.

- Dreadnought Resources Limited [ASX:DRE] – The Mangaroon Project in Western Australia. Some details here and here.

- Greenland Mineral Resources [ASX:GGG](OTCPK:GDLNF)

- Krakatoa Resources [ASX:KTA] – 100% owned Mt Clere Rare Earth Project in Western Australia.

- Leading Edge Materials [TSXV:LEM][GR:7FL] (LEMIF) – 100% own the Norra Kärr rare earths project (dysprosium, terbium, and neodymium/praseodymium (NdPr)) in Sweden. Also, a graphite project. You can read our article here.

- Mkango Resources [TSXV:MKA]

- Northern Minerals Limited [ASX:NTU]

- Peak Rare Earths Limited [ASX:PEK] – Ngualla Tanzania Rare Earth Project and a planned UK refinery. Details here.

- Pensana Plc [LON:PRE] – Good asset at the Longonjo Mine, but it is in Angola so high sovereign risk. Also have a planned UK rare earth separation facility to produce 12,500tpa of rare earth oxides (includes 4,500t NdPr pa) by 2024.

- Rainbow Rare Earths [LON:RBW] – World’s highest grade project by far (TREO grade by weight 55%) and low market cap; but very high sovereign risk with the project in Burundi, East Africa.

- Rare Element Resources [GR:R8V](OTCQB:REEMF)

- Ucore Rare Metals Inc. [TSXV:UCU] (OTCQX:UURAF)

Western companies who do rare earths processing

- Energy Fuels (UUUU) – InvestorIntel article here.

- Neo Performance Materials [TSX:NEO] (OTCPK:NOPMF) – Focus is on making rare earth magnet powders. InvestorIntel article here.

Risks

- Rare earth (NdPr) prices may fall. Competition from China (42 key rare earth projects are under construction in China), who dominate global rare earths production.

- Rare earths are not rare; however, because of their geochemical properties it is difficult to find them in sufficient concentrations where they can be profitably mined and processed.

- Technology change – Electric vehicle manufacturers may opt for cheaper lower performance induction electric motors, not requiring the valuable magnet rare earths (NdPr). Currently some less powerful electric car motors and wind turbines don’t use rare earths. Tesla (TSLA) and most others are now using permanent magnet motors as they are the most powerful and efficient, thereby maximizing range for a given battery. New rules in China are pushing towards more efficient motors with permanent magnets.

- The usual mining risks. Permitting. Environmental issues. Production and processing risks. Rare earth projects often require high upfront CapEx leading to funding difficulties.

- Environmental risk – The processing or rare earths is difficult and involves acids that can then cause environmental damage if not properly contained.

- Company risks (Management, currency, solvency etc).

- Stock market risks – Liquidity (best to buy on local exchange), sentiment.

Further reading

Conclusion

There are currently only 4 main companies (MP Materials, Lynas Rare Earths, Energy Fuels (processing only), Vital Metals (REO concentrate mining and soon REO processing) producing light rare earths with NdPr in the West, as the sector is heavily dominated by Chinese miners and processors. Investors should consider these four as well as look towards the most promising and better valued near term producers in a safe location.

Our top 3 are:

- Vital Metals – New small scale Canadian REO concentrate producer with REO processing soon and expansion plans.

- Arafura Resources – A shovel ready Australian (Northern Territory) junior with a huge long life project (Nolans). Nolans plans to produce 4,440tpa of NdPr oxide over a 38 year mine life. Possible 2025 producer, subject to funding.

- Hastings Technology Metals – A Western Australian junior with a shovel ready project (Yangibana) and a second project (Brockman). Yangibana plans to produce 3,400tpa NdPr oxide over a 15 year mine life. Possible 2024/2025 producer, subject to funding.

Risks revolve around production and processing REO and in the case of Arafura and Hastings, funding risk. Please read the risks section.

As usual, all comments are welcome.

Be the first to comment