yacobchuk

Yesterday ago I wrote my first article targeted at Gen Z investors in which I explained

“…according to Harvard University, I’m part of the Gen X group, who was born between 1965 and 1984, and researchers use the late 1990s as starting birth years and the early 2010s as ending birth years for Gen Z.

This means that Gen Zs are now between 12 and 24, and in the same age range as four out of five of my kids. Last week on Twitter I got a message in chat from a 20-year-old who asked me to list the top 10 REITs for a 20-year-old.”

Just after that comment on Twitter, I received a message from a follower who asked me to provide an article titled,

“Top 10 REITs A 70-Year-Old Should Hold Forever.”

I’m honored to see a diverse number of followers on Twitter, as well as on Seeking Alpha.

This tells me that my real estate investment trust (“REIT”) content is resonating and that investors from all generations are interested in building wealth using real estate stocks.

Specifically, I’m writing targeting my message today to the “baby boomer generation” – the “only” generation officially recognized by the U.S. Census Bureau – that began immediately after WW2 (people born in 1946) and ended in 1964.

These days these boomers are in their 60s to mid-70s, many are about to be or already are retired.

This article will serve as an interesting test, in which I can attempt to determine whether there are more Gen Zs or Baby Boomers on Seeking Alpha. I suspect there are more Baby Boomers, based upon the number of comments I have received over the last 12 years on Seeking Alpha.

However, I would not be surprised to see an equal balance, and, of course, let’s not forget these other classifications:

- Generation Jones: born 1955 to 1965

- Generation X: born 1965 to 1980

- Xennials: born 1977 to 1983

- Millennials: born 1981 to 1996

But today I’m going to focus on building a portfolio for my Twitter friend who also gave me a great shoutout for my new book, The Intelligent REIT Investor Guide.

Twitter (@rbradthomas)

So, without further ado, let’s get started on the “top 10 REITs a 70-year-old should hold forever.”

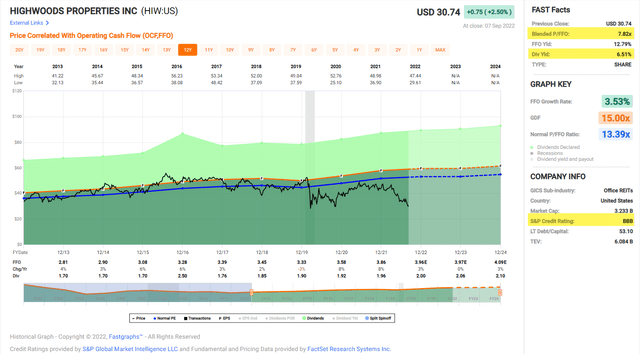

Baby Boomer Pick #1: Highwoods Properties, Inc. (HIW)

HIW is an office REIT that primarily focuses on the attractive southeast, with exposure in areas like Nashville, Atlanta, Raleigh, Tampa, and Orlando, which together account for around 80% of the company’s overall geographic mix of properties.

On a 2022 valuation basis looking at funds from operations (“FFO”) multiples, the company currently trades at a just-south-of-8x multiple. This is well below its 10-year or even 5-year average.

HIW has a 6.5% yield that’s covered at an almost 51% FFO payout ratio for the 2022E, and importantly, the dividend was not cut in the Great Recession or recent pandemic.

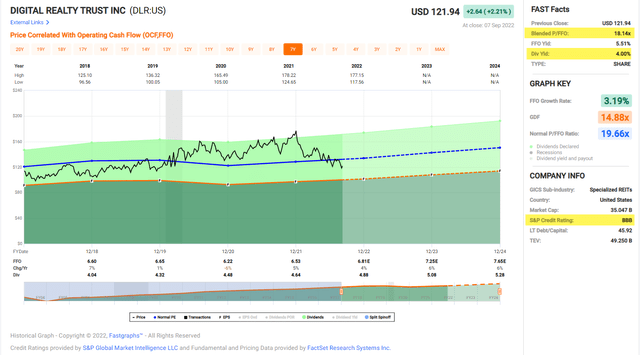

Baby Boomer Pick #2: Digital Realty Trust, Inc. (DLR)

DLR has a massive global footprint spanning over 4,000 customers in 50 different metro areas and the company is the 8th largest publicly traded U.S. REIT.

Their extensive development experience, economies of scale, and process-based approaches to design and construction have provided significant cost savings and added value to their customers.

Their extensive development experience, economies of scale, and process-based approaches to design and construction have provided significant cost savings and added value to their customers.

DLR is attractively priced, with a P/FFO of 18.1x, compared with the normal multiple of 19.0x. Analysts are forecasting adjusted FFO (“AFFO”) per share growth of 6% in 2022 and 2023. iREIT maintains a Strong Buy with a 12-month Total Return forecast of 20% to 25%.

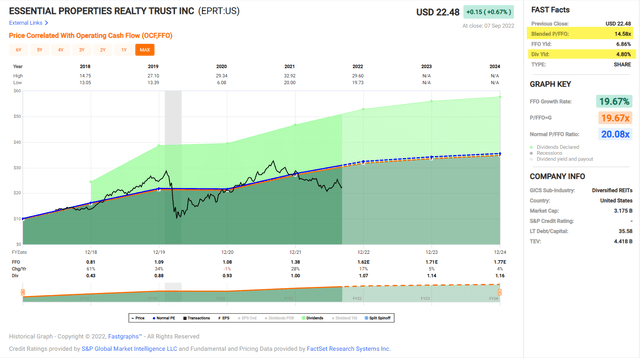

Baby Boomer Pick #3: Essential Properties Realty Trust, Inc. (EPRT)

EPRT is a net lease REIT that owns 1,545 free-standing properties in 46 states. The diverse portfolio includes 323 tenants with an average weighted remaining lease term of 13.9 years (longest in the peer group).

Around 62% of the portfolio is master-leased, and 99% of the tenants provide unit-level sales reports – see STORE Capital below. EPRT’s average investment per property is around $2.3 million, which makes the business model less reliant on its top tenants (19% of revenue is generated from the Top 10 tenants).

EPRT expects to grow AFFO per share by over 13% in 2022, and in June the company announced it had increased its dividend by ~4%, from $.26 per share to $.27. Analysts are expecting the company to grow by another 7% in 2023.

EPRT is trading at $22.48 per share with a P/AFFO of 15.x, below the normal range of 20.1x. The dividend yield is 4.8%, well-covered with a growing earnings stream. iREIT maintains a Strong Buy with a 12-month Total Return forecast of 20% to 25%.

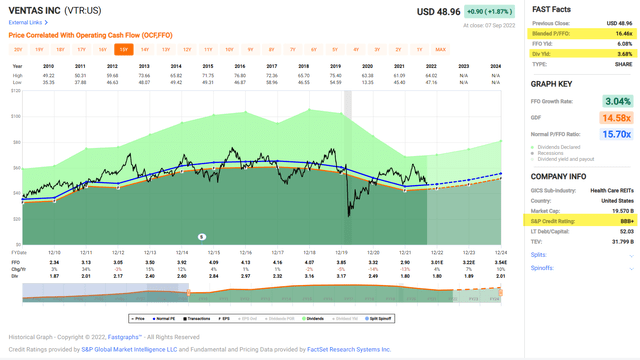

Baby Boomer Pick #4: Ventas, Inc. (VTR)

VTR is one of the most defensive healthcare picks, with a portfolio that consists of more than 1,200 properties buoyed by the demographic tailwind of a large and growing aging population. VTR owns senior living communities, life science, research & innovation properties, medical office & outpatient facilities, and other healthcare real estate.

VTR continues to find compelling investment opportunities, with $1.3B of investment activity year-to-date, consistent with capital allocation priorities. The company continues to expand its advantaged university-based R&I platform as well as its other senior housing and MOB investments.

Q3-22 earnings are expected to benefit from the outstanding year-over-year growth in the SHOP segment and from HHS grants received in the quarter.

VTR has BBB+ or equivalent ratings across all 3 rating agencies with $2.5B of quarter-end liquidity with a weighted average cost of debt of 3.5 (and total weighted average maturity of 6 years). Shares are trading at $48.96 with a P/FFO multiple of 16.5x and dividend yield of 3.7%. iREIT maintains a Buy with a 12-month Total Return forecast of 15% to 20%.

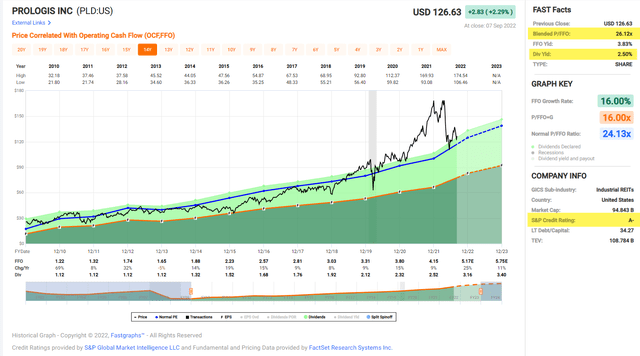

Baby Boomer Pick #5: Prologis, Inc. (PLD)

PLD global warehouse portfolio includes 3,230 buildings in the U.S., 314 buildings in “Other Americas,” 924 buildings in Europe, and 264 buildings in Asia. It also has over 10,000 acres of land and over $180 billion of Assets under Management.

In addition to scale advantage, PLD also has a significant “wide moat” cost of capital advantage, which is reflected in iREIT’s perfect “100” quality score and A-ratings from two agencies (Moody’s and S&P).

PLD’s balance sheet remains strong with 4.9x Debt/Adj. EBITDA excluding development gains (+20bps q/q). During Q2-22, PLD and its JVs issued $5.1B of debt at a weighted average interest rate of 1.4% ($4.0B refinancing/$1.1B new issuances) and the company has $5.2B in cash and availability.

Shares are now trading at $126.63 with a P/FFO of 26.1x and the dividend yield is 2.5% and well-covered. iREIT believes that shares could return 15% to 20% over the next 12 months.

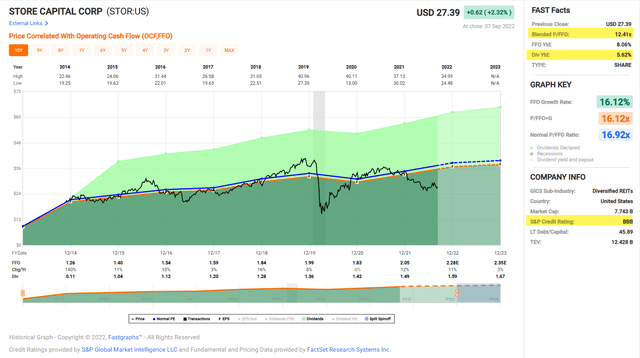

Baby Boomer Pick #6: STORE Capital Corporation (STOR)

STOR is a net lease REIT with a diversified portfolio of over 3,000 properties, which has grown 18% over the past two years as the company continues to expand. The portfolio is leased out to 579 different customers within 124 industries.

STOR recently reported their Q2 financials, which came in above analysts’ expectations. The company reported total revenues of $223.8 million, which was an increase of 16.5% from the same period a year ago. Through the first half of the year, revenues are up 19.1%.

AFFO for the quarter came in at $0.58 per share, an increase of 16% from prior year. The company continues to consistently increase its AFFO on an annual basis, which feeds into the growing dividend we will look at below.

Shares of STOR currently trade hands at a P/FFO 12.4x, which is well below their five-year average of 16.9x. The dividend is 5.6% and well-covered by AFFO. iREIT believes that shares could return 20% to 25% over the next 12 months.

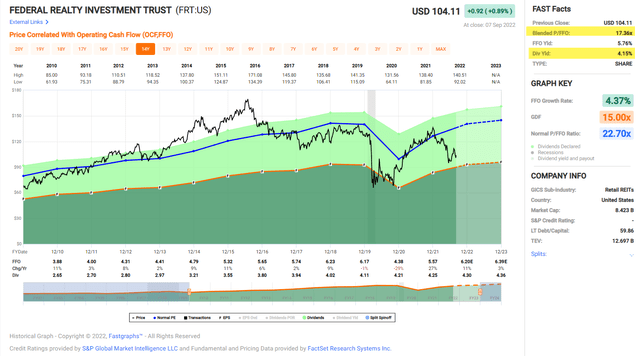

Baby Boomer Pick #7: Federal Realty Investment Trust (FRT)

FRT is a Dividend King (over 50 years in a row of dividend increases) that owns a portfolio that consists of 105 properties (3,100 tenants) and 25 million square feet with approximately 3,400 residential units.

During Q2, FRT generated FFO per share of $1.65, which was a 17% increase over the prior year. Comparable property operating income (POI) was up 8% as well, with the portfolio maintaining a 92.0% occupancy rate, which was up 240 basis points from prior year.

FRT has a BBB+/Baa1 credit rating. 93% of the company’s debt has a fixed interest rate, and free cash flow is expected to return to pre-pandemic levels in 2023, which will further help pay down its outstanding debt.

Shares of FRT currently traded at an FFO multiple of 22.1x, which is well below its five-year average of 26.5x. The dividend yield is 4.2% and well-covered. iREIT believes that shares could return 20% to 25% over the next 12 months.

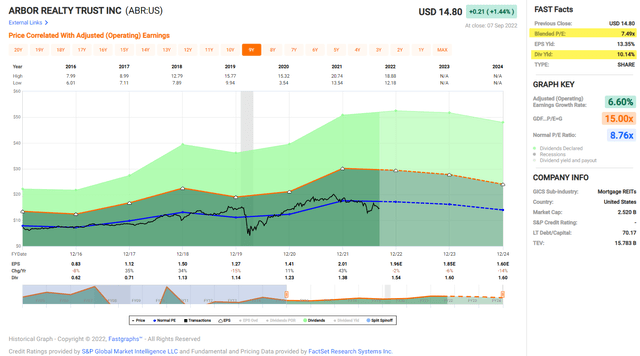

Baby Boomer Pick #8: Arbor Realty Trust, Inc. (ABR)

ABR is an internally managed mREIT focused on multifamily lending that benefits from a structural tailwind. The U.S. multifamily market was 10% owned by institutions 25 years ago.

That’s around 25% today. Also, the government subsidizes multifamily loans just like they do for single-family homes. This improves economics and makes deals easier to close.

93% of the portfolio are multifamily loans, 5% is self-storage, and ~1% each in several other property types. Geographic diversification is extremely good. Much of Arbor’s business looks and pays like an annuity as it builds income streams from its lending activity.

Loan originations in Q2 2022 were $1.27 billion, which is a lot, but pales in comparison to the $26.77 billion in loans that Arbor services. Distributable Earnings were $185.6 million in the first half of 2022 compared to $143.9 million last year. That’s 29.0% cash flow growth year-over-year at the firm level.

ABR remains extremely compelling below $16 per share and shares are now trading at $14.80 with a dividend yield of 10.1%. Shares are trading at a P/E multiple of 10.1x, and iREIT believes shares could return ~15% over the next 12 months.

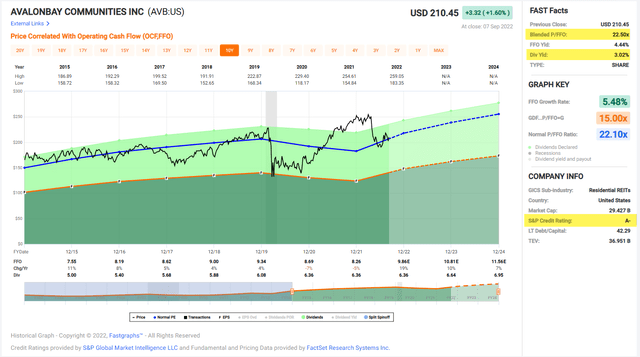

Baby Boomer Pick #9: AvalonBay Communities, Inc. (AVB)

AVB is a multifamily REIT that owns 299 apartment communities containing 89,037 apartment homes in 12 states and the District of Columbia, of which 17 communities were under development and two communities were under redevelopment.

The REIT has benefited greatly under recent inflationary market conditions. The demand for apartment rentals has increased driving up the price of rents.

During the company’s most recent quarter, AVB saw rental revenues for same-store communities rise 13%. Much of this was directly related to lease rates rising 7.6% during the quarter when compared to prior year. Net Operating Income was positively impacted as well, as NOI increased 17% year over year.

Occupancy during the quarter remained above 96%, ticking higher by 10 basis points over Q1. Turnover remained below historical norms and uncollectible leases remained very low, all pointing to a very strong tenant base as it currently stands.

AVB is not only one of the best apartment REITs you can buy, but they are also one of the highest quality REITs in general. In terms of valuation, AVB shares are trading at $210.45 with a P/FFO multiple of 22.5 and dividend yield of 3.0%. iREIT believes shares could return ~15% over the next 12 months.

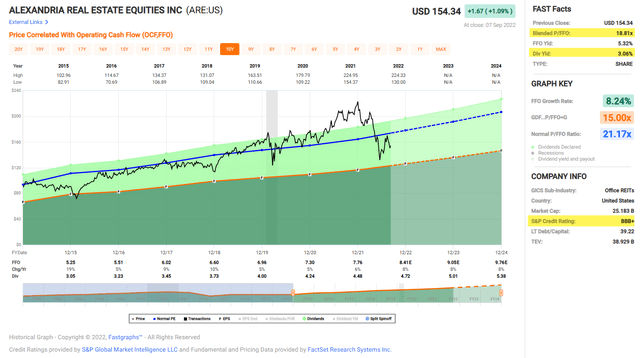

Baby Boomer Pick #10: Alexandria Real Estate Equities, Inc. (ARE)

ARE is a Life Science REIT that owns around 426 properties with GLA of 47.4M square feet, and the occupancy of this space at the latest quarter was 94.7%. The company has some extremely strong companies that aren’t going anywhere occupying the top of its ABR list. These include Bristol Myers Squibb (BMY), Moderna (MRNA), Eli Lilly (LLY), Sanofi (SNY), and Takeda Pharma (TAK).

ARE began by focusing only on life science and tech, and then further by leasing significant amounts to only the best in the business, and then even more by diversifying to where its top tenant, BMY, is less than 3.6% of the REITs total ABR.

ARE has an impressive balance sheet with $5.5 Billion in liquidity (as of Q2-22) and solid credit metrics including 5.1x Net Debt and Preferred to Adjusted EBITDA and no debt maturities until 2025. ARE also has strong credits ratings from Moody’s (Baa1) and S&P (BBB+).

ARE trades at $154.34 with a P/FFO of 26.3x (normal range is 27.5x). The dividend yield is 3.1% and well-covered (with a AFFO payout ratio of 70%). iREIT believes shares could return ~20% over the next 12 months.

In Closing…

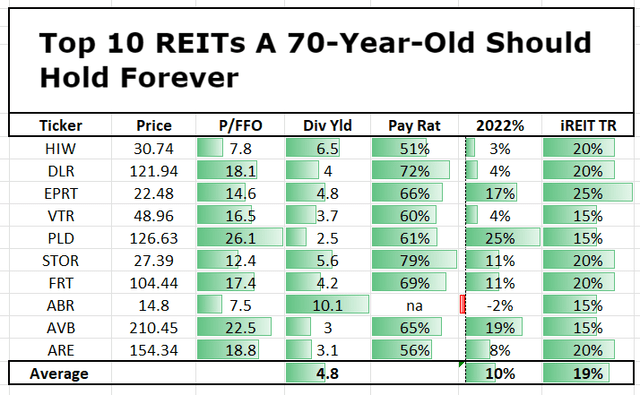

This Baby Boomer basket of REITs has an average dividend yield of 4.8%, compared with the average dividend yield of the Gen Z picks of 6.3%. All of the REITs on the Baby Boomer list are rated BBB or higher, with the exception of ABR.

Starting today, we will put together a portfolio for these various age-inspired picks so that we can compare results. I hope that you’re enjoying the series and my next list will be targeted to the Gen X crowd (that includes me).

As always, thank you for the opportunity to be of service.

Be the first to comment