hapabapa/iStock Editorial via Getty Images

If you are drawn to cryptocurrencies and the idea of digital money, why not just buy the leading online money changer that actually earns decent and rising profits? The PayPal (NASDAQ:PYPL) stock price has declined a bone-crushing 75% from its all-time peak last year, and its valuation is beginning to make sound investment sense again. I wrote a bearish article on PayPal in August 2021 here with the quote at $275. I explained why both PYPL and Bitcoin (then priced around $45,000) were too expensive vs. high and rising inflation rates. However, after the crash in PYPL’s stock over the last 10 months, I am having a change of heart for prudent investors, especially as long-term growth trends appear to remain intact.

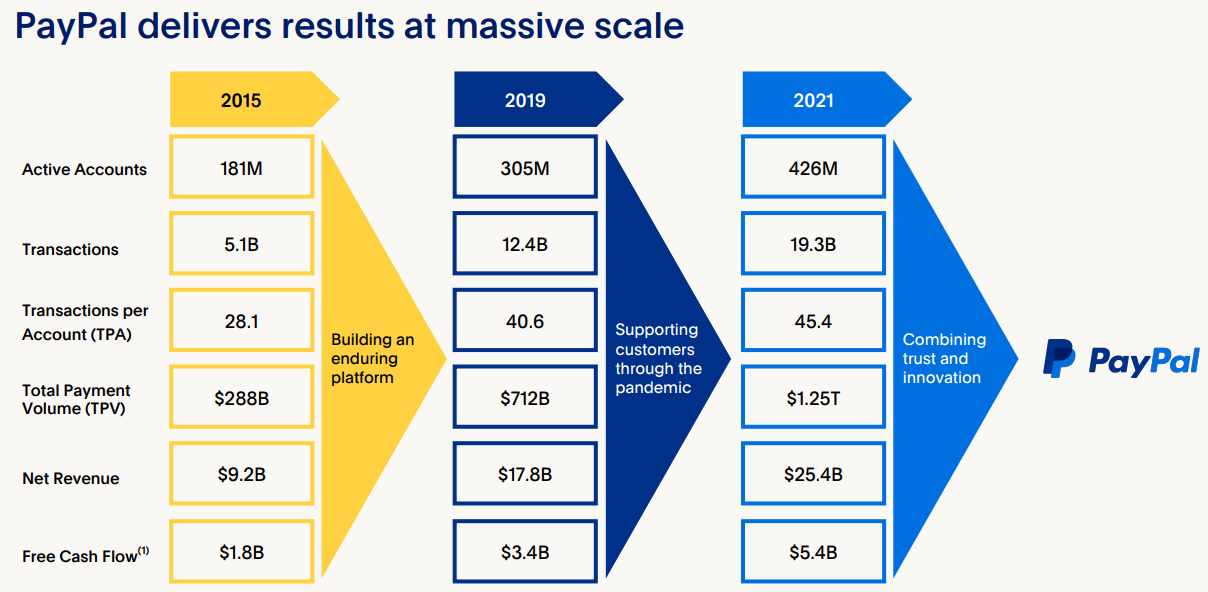

The inventor and processor for PayPal and Venmo money exchanges over the internet (among other brands), the company today has over 429 million active user accounts. Depending on which metric you review, the organization’s size, sales and profitability have risen between 200% and 300% since becoming an independent company in 2015, following the spin-off transaction from eBay (EBAY).

Q1 2022 Investor Update Q1 2022 Investor Update

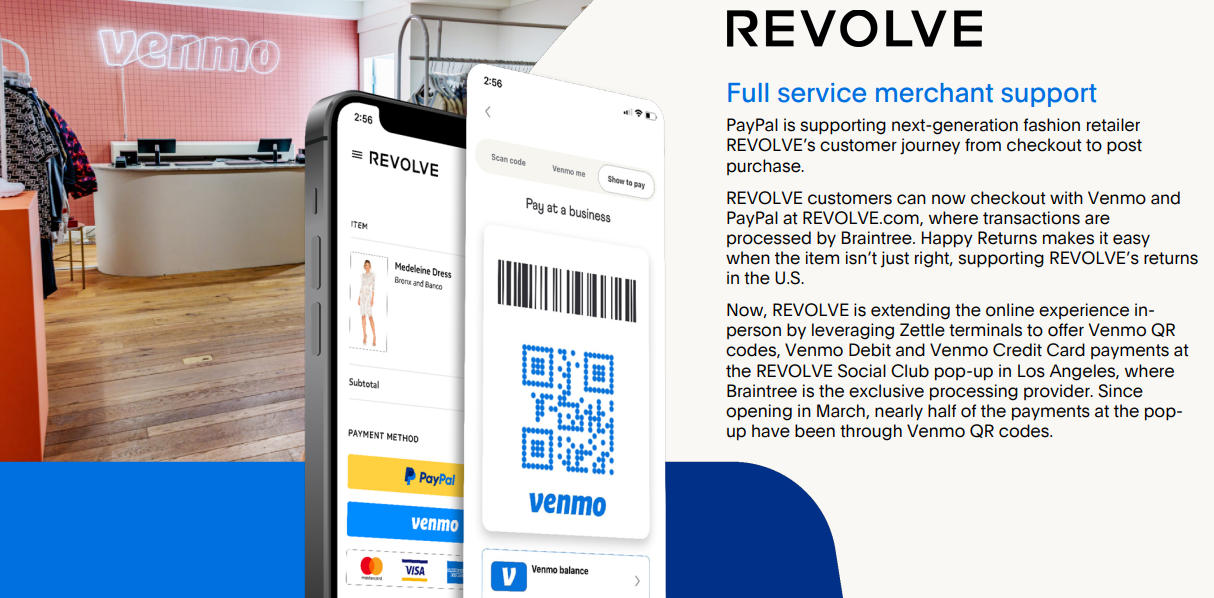

The company’s products are some of the easiest, lowest-cost avenues to transfer digital money to family/friends or merchants all over the world. New products include interest-free loans when using certain online retailers, with 4 easy installment payments. And, the company is rolling out a cryptocurrency transfer and payment option this month, to make new-age money more accessible to both billions of consumers and millions of merchants selling goods/services.

In terms of digital money and its usefulness in cross-border transactions, outside of usual banking system and government controls, PayPal and Venmo are leading the way for average citizens.

PayPal Website PayPal Website PayPal Website PayPal Website PayPal Website

2022 Slowdown Could Be Opportunity Knocking

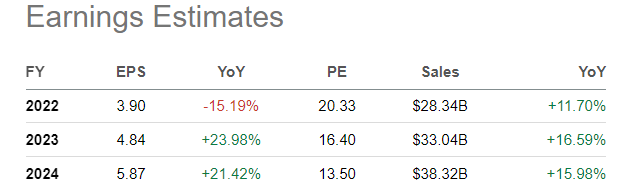

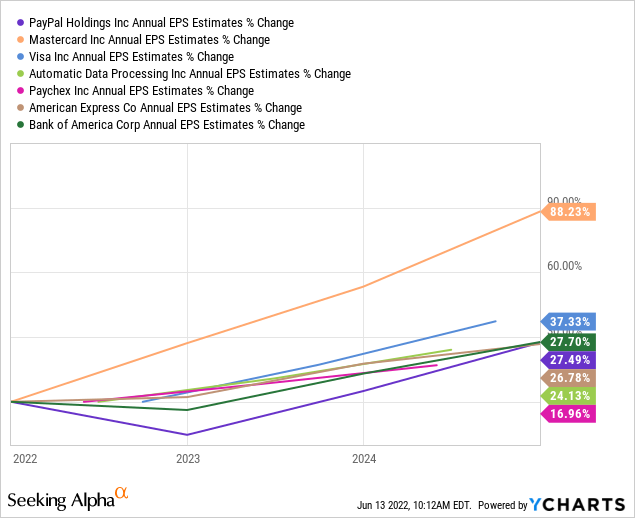

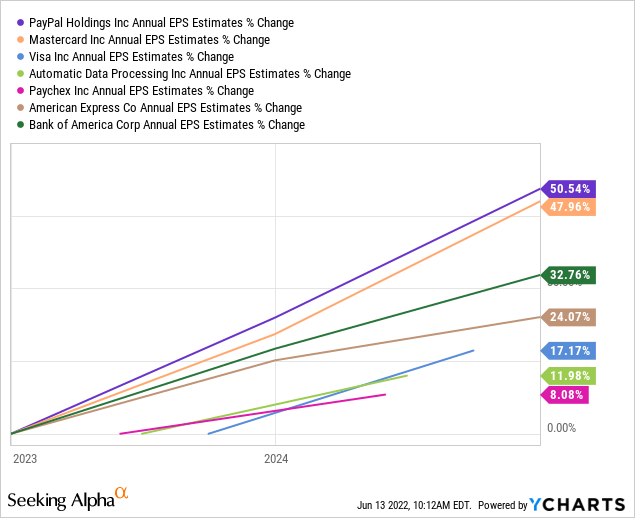

Management has been downgrading expectations for business results during 2022, largely a consequence of the world moving shopping trends back toward stores and physical locations vs. the heavy growth in online purchases during the pandemic-influenced years of 2020-21. As the company invests in new products and upgrades the experience using existing brands, earnings are expected to suffer this year, analysts are now calling for limited GAAP EPS progress to $3.90. In addition, slower revenue gains closer to +12% are projected (vs. +18% in 2021 and +21% in 2020), honestly not much better than the current inflation rate of 8% on the CPI measure. The good news is a rebound toward more normal expansion rates in sales above +15% annually and EPS gains of 20%+ are forecast again in future years past 2022.

Seeking Alpha Table – June 12th, 2022 Analyst Estimates

Using forward estimates, PayPal may in fact turn out to be a bargain situation under $80 in June 2022. I can easily argue PayPal is today trading at its cheapest valuation since breaking off eBay and forming a separate company for investors.

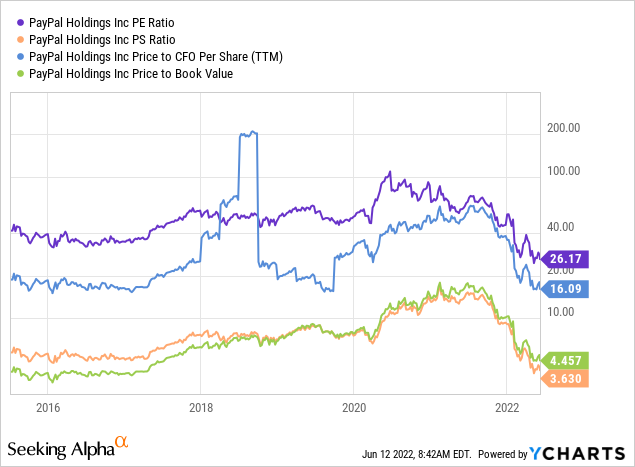

On price to trailing metrics like earnings, sales, cash flow, and book value, PYPL is selling for less than HALF its 7-year average underlying valuation. You can visualize this setup below.

YCharts

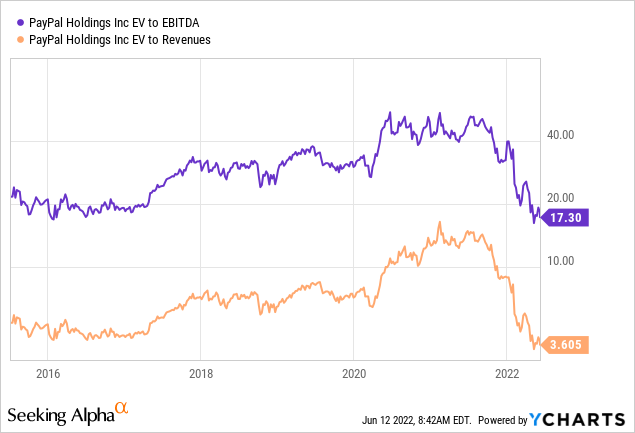

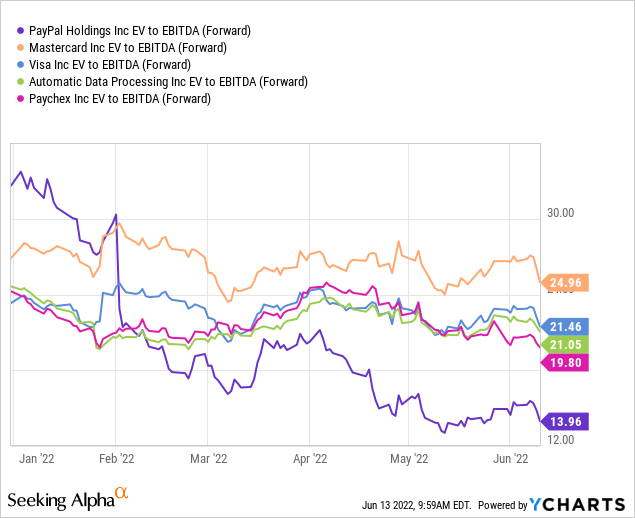

Management has also smartly kept debt levels under control the last few years, especially in relation to rising income and revenues. The enterprise value [EV] calculation of total equity plus debt vs. cash earnings like EBITDA (earnings before interest, taxes, depreciation and amortization) is clearly at its lowest point ever as an independent company. EV to sales is equally something of a bargain. Believe it or not, PYPL’s EV to trailing EBITDA multiple of 17x is not far above the equivalent S&P 500 blue-chip average of 15x today. Plus, EV to sales of 3.6x is hovering near S&P 500-like numbers around 3.5x.

YCharts

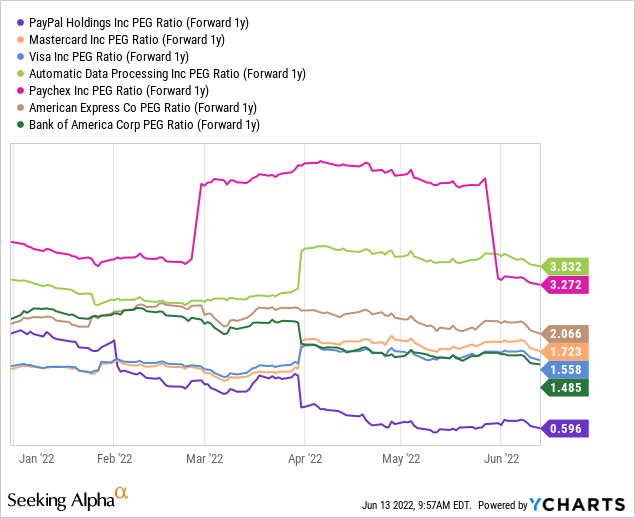

The truly bullish news revolves around future growth after 2022, expected to be quite positive and far stronger than S&P 500 corporations as a whole, or financial money exchanging peers. Below is a graph of the forward 1-year PEG ratio, a measurement comparing the current P/E ratio vs. future growth rates. Numbers under 1.0x are considered an intelligent area to accumulate shares, for most equities traditionally in security analysis.

I am comparing PayPal to the closest large-cap peers in electronic money exchanges and tracking for consumers and workers. The group includes Mastercard (MA), Visa (V), Automatic Data Processing (ADP), Paychex (PAYX), plus consumer-heavy banks American Express (AXP) and Bank of America (BAC). [Note: it is very hard to find a large direct competing comp focused on online money transfers only. Apple (AAPL) Pay and Google (GOOGL) (GOOG) Pay are other direct competitors, but this part of each business model represents only a small fraction of company operating results. So, I am not including them in this story. However, PYPL looks quite cheap against either, if you include whole company valuations today.]

YCharts

Again, PayPal looks like a weak choice based on 2022 projected results. But, if operating growth reappears next year, the stock is incredibly undervalued today. Below are different starting dates for EPS growth to ponder, one measured from January 1st, 2022, the other from January 1st, 2023.

YCharts YCharts

If you can ignore the hiccup in operating results this year, forward valuations look very promising for new investment. EV to EBITDA forward 1-year is dramatically less expensive than the non-bank peers. Amazingly, PayPal can be purchased at 70% less than the ratio of six months ago from a combination of the technology bust hitting Big Tech and short-term company issues encouraging shareholders to hit the sell button.

YCharts

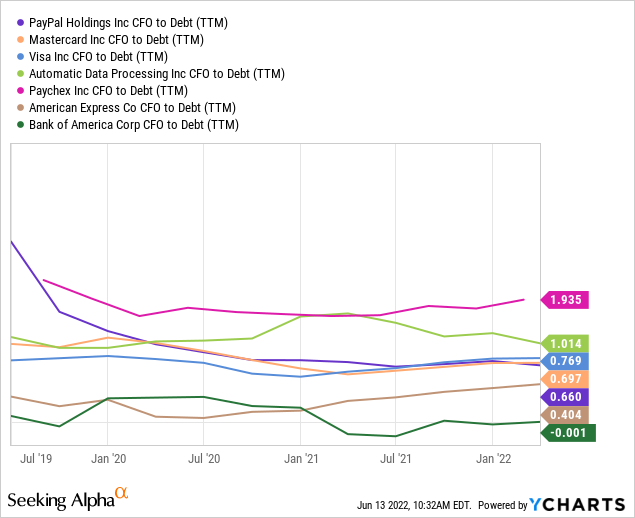

Background Financial Review

PayPal’s basic operating foundation has improved over the last three years. For starters, at the end of Q1 in March, the company held $52 billion in current assets like cash and receivables vs. $55 in total liabilities. This design is extremely conservative, giving management all kinds of financial flexibility to run the business day-to-day, purchase small bolt-on ideas invented by others, pay down $10 billion in debt, start a cash dividend and/or buy back shares. Cash flow to debt is in the middle of the peer group and stands at half the ratio of early 2019. The company could theoretically pay off all debt with just eight months of cash flow coming in the door.

YCharts

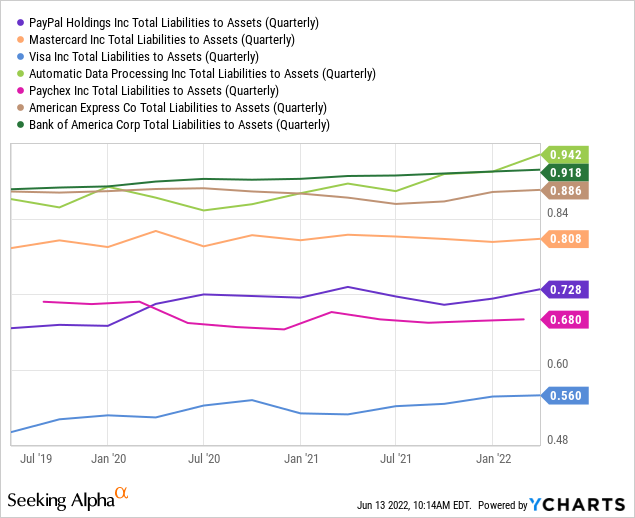

Total liabilities vs. assets is likewise in a constructive to conversative position vs. peers, although this financial health ratio could be lowered for greater shareholder safety, in my opinion.

YCharts

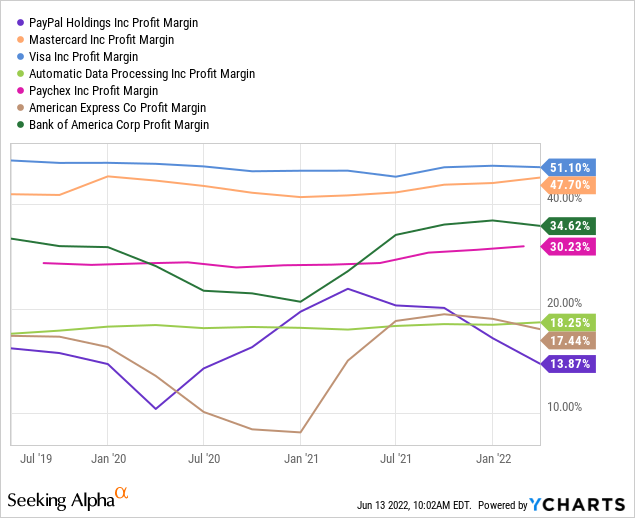

The area where improvement would be welcome news to support a higher valuation story is net profit margins. While it’s hard to argue final profit margins on revenue in the 11% to 21% range are weak over the past three years, against the peer group of major financial concerns doing electronic money exchanges, the company’s sales-growth first approach could be tweaked.

YCharts

Technical Turnaround Approaching?

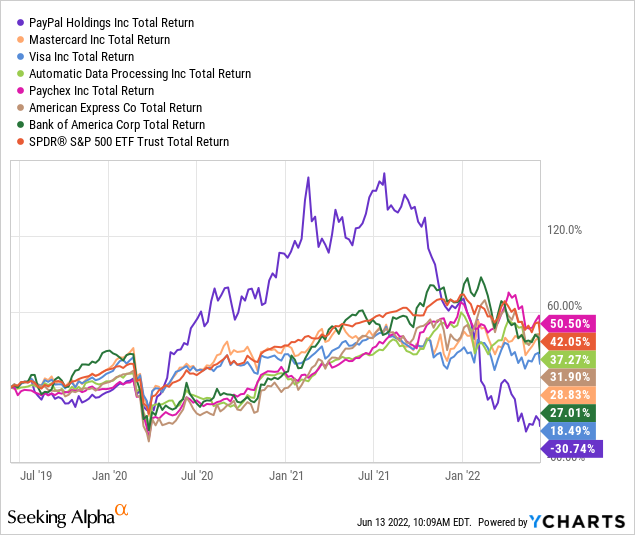

Below you can review the wild swings in company operations and investor interest during and after the worst of the COVID-19 economic shutdown. On a 3-year graph, total returns moved into a leading position vs. the financial/bank peer group and the S&P 500 into the middle of 2021. Then, a monster reversal lower in price followed, driving share returns into last place, and today’s ultra-low historical valuation.

YCharts

Unfortunately, my upgraded view of the stock is based more on the valuation story, than a concrete momentum turn in trading. On the 18-month chart below of daily price and volume changes, little good news can be found to pinpoint a bottom has been reached.

PayPal has essentially traded below its 50-day moving average since September. So, a rebound above the 50-day will be the first step to indicate massive selling pressure is ebbing. The most bullish signal I can find is showing up in the basic 14-day Money Flow Index. MFI’s move above 80 a few days ago, circled in green, was the strongest accumulation setting since February 2021.

I am also anticipating the Negative Volume Index and On Balance Volume indicators will begin acting better soon. There have been minor positive changes in these two important momentum calculations since the middle of May.

18-Month Chart, Daily Changes, Author Reference Point – StockCharts.com

Final Thoughts

If you want to wait for some sort of momentum upturn and price rise above the 50-day moving average before buying PayPal, I completely understand. Trying to predict PayPal’s bottom has been a fool’s errand in 2022. On the other hand, purchasing a small starter position makes sense under $80 a share, just in case the quote is done falling. At this late stage of the PYPL decline, you can cost average into a full position, with 3 or 4 regular monthly buys spaced out to lower your entry risk.

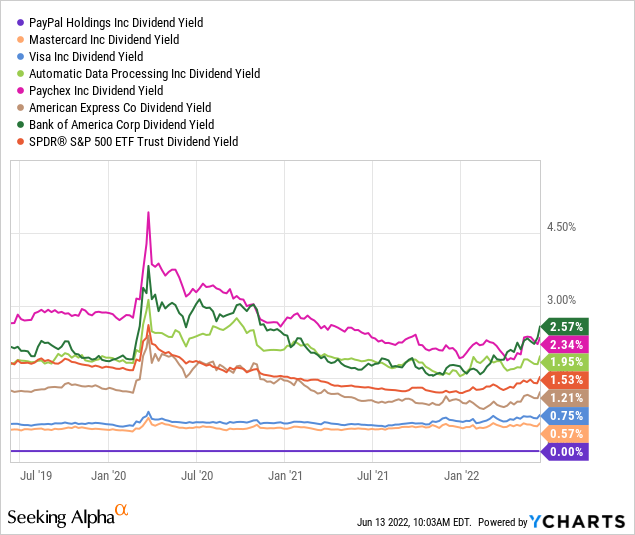

The single suggestion I have for management is to please start paying a dividend. PayPal is the only company in the large-cap financial and bank peer group that does not send out regular distribution checks to shareholders. Even a small dividend of $1.00 annually per share would equal a decent 1.3% yield, close to market index averages while representing just 25% of earnings generation (20% of cash flow). If investors could look forward to rising dividend checks to offset inflation in the macroeconomy, literally hundreds of thousands of investors would be more willing to invest in the company. Such would definitely add to the underlying worth of its stock, with higher multiples on operating results the likely outcome.

YCharts

What are the downside risks to owning PayPal in the summer of 2022? I would say competition from alternative money handlers is key. The company has a leading position in the markets served, but other Big Tech offerings, new bank inventions, and the cryptocurrency revolution could dent growth rates. Secondly, a major recession could slow transaction volumes for a spell and keep total income under current projections for 2022-23. Absolutely, these are risks to ponder and watch into year’s end. My current worst-case scenario is PYPL’s share quote declines to $60 in a deep recession with inflation remaining stubbornly high.

In the end, I am confident the low valuation setup today will support price. I am modeling a 12 to 18 month price target of $120, assuming current analyst forecasts prove correct. A weakening global economy should allow inflation rates to cool from YoY CPI of 8%+ currently in the U.S., to a range of 5% to 6% by early 2023. Better company growth and lower inflation numbers should encourage much-improved valuation multiples into 2023. I am upgrading my rating of PayPal from Sell to Buy.

Thanks for reading. Please consider this article a first step in your due diligence process. Consulting with a registered and experienced investment advisor is recommended before making any trade.

Be the first to comment