Chip Somodevilla/Getty Images News

In a tumultuous year for retailers, TJX Companies (NYSE:TJX) has been a port in the storm with shares off less than 5% year-to-date. While off price peers Ross Stores (ROST) and Burlington (BURL) have seen their stock prices plummet as comparable sales have turned sharply negative, TJX results have been resilient thus far in 2022.

More resilient customer Base

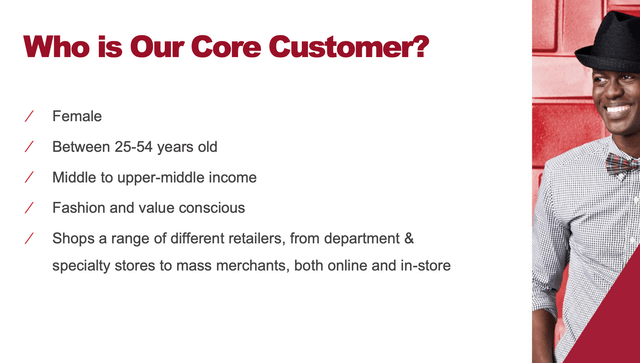

Customer Profile (TJX Investor Presentation)

Thus far in 2022, TJX fellow off-price retailers, Ross Stores and Burlington have seen significant same-store sales declines as lower income consumers are being more heavily impacted by inflationary pressure. In 2Q22, Ross saw a comparable sales decline of 7% year-over-year while Burlington experienced a whopping 17% decline. By contrast TJX saw its comparable sales slip just 2% in its Marmaxx (TJ Maxx & Marshall’s) division.

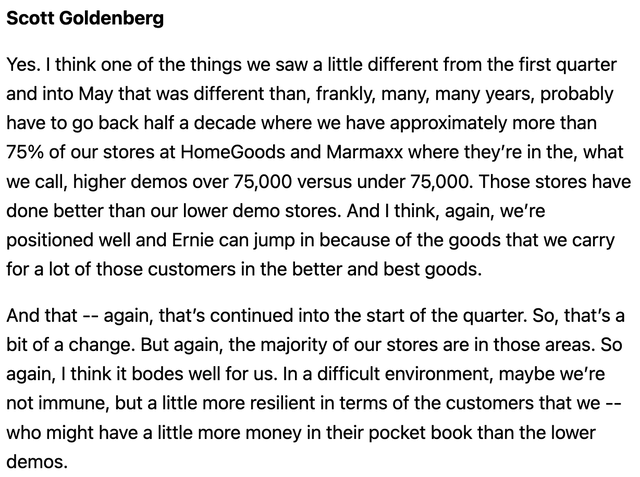

On its 1Q22 conference call, management acknowledged the benefits of more resilient spending habits of its relatively affluent customer base.

Affluent customers drive strength (1Q22 Conference Call Transcript from Seeking Alpha)

By contrast Ross and Burlington cater to lower-income households (annual household income of $60k or below). Lower income households spend a larger share of income on necessities (rent, gas, food -all of which have seen significant inflation), leaving less disposable income for purchases of apparel.

Favorable outlook in the near term

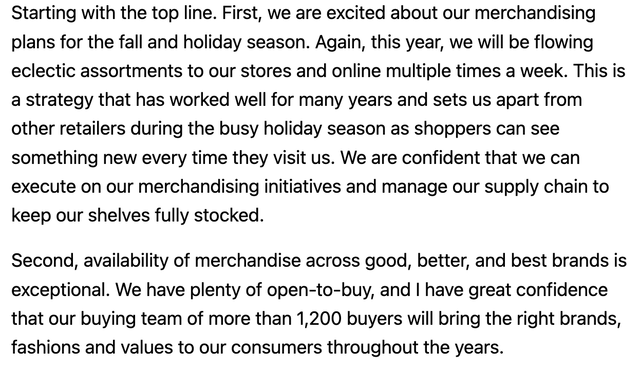

Plunging consumer confidence has created opportunity for off-price retailers like TJX. Suppliers and retailers have accumulated excess inventories as supply chain difficulties have waned while consumer demand has decreased. This has created

2Q22 TJX Management commentary on Buying Environment (Seeking Alpha Transcripts)

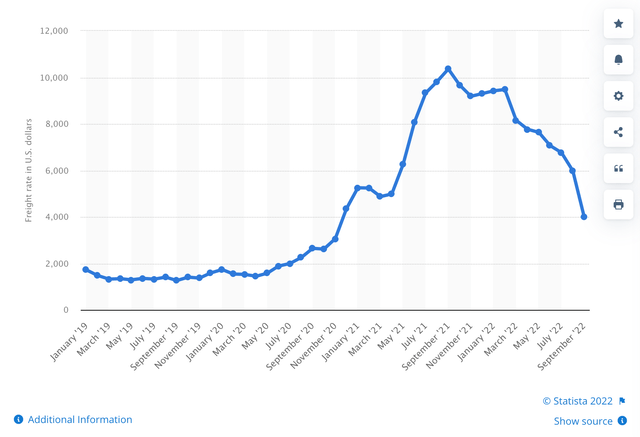

TJX should benefit from another meaningful near-term tailwind as global freight rates have come back to earth during 2022. What has been a massive profitability headwind for the past 12-18 months (shaving ~2% from operating margins) has now become a tailwind which will drive margin expansion going forward.

Global Container Freight Rate (Statista)

Long-term outlook remains solid

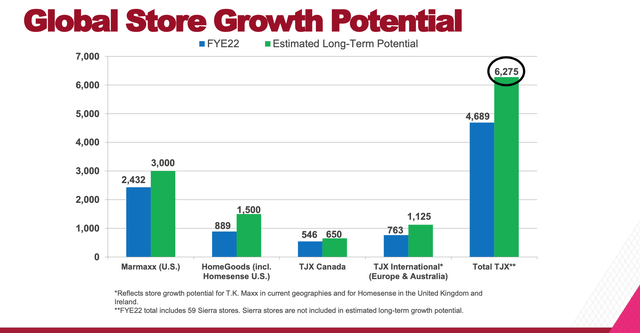

Despite having ~$50 billion in annual sales, TJX has ample store growth opportunities both domestically and abroad. As show below, TJX believes it can nearly double its store count in its under-penetrated Homegoods business and increase its Marmaxx locations by about 25%.

Store Growth Potential (TJX Investor Presentation)

TJX purchases nearly $40 billion worth of goods annually which provides a key competitive advantage as it is able to not only source goods at a lower cost but has a large, experienced team of merchandise buyers. This enables TJX to source a wide range of fresh product, creating its famed ‘never the same place twice’ slogan that drives repeat customer visits and increased same store sales.

Valuation and conclusion

While current results are strong and the long-term outlook is favorable, at $72 per share this is fully priced into the stock. TJX trades at 24x current year EPS estimates and just over 21x next year’s estimates. This is at the top end of the 16-22x P/E range the shares have traded in over the past decade. Looking out to 2025, TJX should be able to earn $4/share as it continues to drive 3-4% same store sales, grows its store count and sees margins expand from current levels (~9% OPMs) back to historical levels (10-11%). At today’s price TJX trades at 16x my estimate of 2025 EPS.

While TJX is a fantastic business which I have owned in the past (and would be excited to own again), I see limited upside at the current price.

Be the first to comment