TJX Companies’ stock has dramatically underperformed Williams-Sonoma shares in recent years. Jhanggo/iStock Editorial via Getty Images

Investors saw a lot of retail companies’ stock prices rise dramatically after the COVID lockdowns and subsequent slow nationwide reopening; especially those who had already built out their ecommerce capabilities. It was the perfect storm for some retailers, as record government stimulus and changing consumer habits led the way for increasing sales and profits. There were losers to be sure, but American consumers helped retail in general as they shifted their spending towards physical items and away from services.

One of the other clear winners within retail was Williams-Sonoma (NYSE:WSM) which saw consumers clamoring for its higher-end goods as they sought to improve their living spaces while working from home and not traveling. The company’s focus on driving sales to their brands via ecommerce paid off, and in their most recent investor presentation, the company reports that ecommerce revenues made up 66% of total sales while physical storefronts delivered 34%. As impressive as the story has been over the last two years or so, we think that investors should look at a particular pair trade that has been working for about 8 months now.

The Trade

We think that investors might want to prepare for a potential recession by entering a pair trade where they go short Williams-Sonoma and go long The TJX Companies (NYSE:TJX). It is our belief that Williams-Sonoma will continue to retreat from its COVID highs while The TJX Companies’ stock will either continue to trade sideways or potentially move modestly higher.

Why We Like It

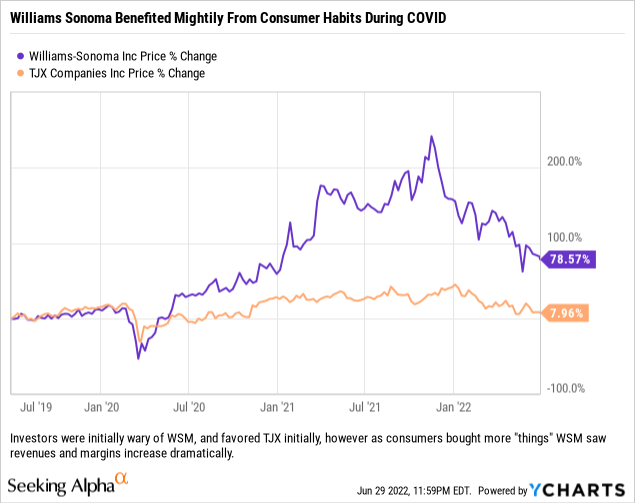

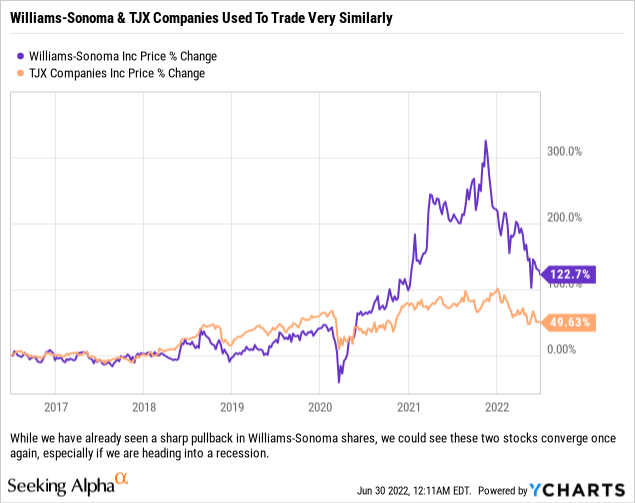

The charts below set the table for what we see with this trade:

What was a really good operating environment for Williams-Sonoma and its premium brands was actually not a great environment for The TJX Companies’ brands.

We do think that consumer spending habits will revert to historical norms and move back down the market as Americans deal with high inflation and a possible recession around the corner (not to mention spending a larger portion of their funds on services now). If we do see the consumer pull back on ‘splurges’ then we would expect Williams-Sonoma to be impacted rather significantly due to their up-market brands such as the namesake Williams-Sonoma, Pottery Barn and West Elm.

The TJX Companies on the other hand could very well benefit from the current environment as retailers have overstocked, and we are seeing more and more names within the retail sector discussing how they will lower inventory levels moving forward. Don’t take our word for it, the company included this quote from their last quarterly earnings release (found under the ‘Inventory’ section): “Overall availability of quality, branded merchandise in the marketplace remains excellent.”

It sounds boring, but TJ Maxx and Marshall’s could do quite well if we continue to see major retailers overorder and get stuck with quickly aging inventory. Target (TGT) has already raised alarms for investors, admitting that they did a poor job on inventory management and would have to utilize more sales to work that inventory down. Add in TJX Companies’ HomeGoods stores, and we think that investors could see the company benefit across its various brands from consumers who are still interested in purchasing items, while also looking for better deals. Generally speaking, one who shops at West Elm is not going to instead move their entire purchasing event to HomeGoods; however, we could see people continue to purchase larger items from higher-end stores (albeit at a slower pace) while buying accessories from places like HomeGoods.

Cracks have not shown up at Williams-Sonoma yet, but looking at RH (RH), formerly known as Restoration Hardware and a retailer which was also a big winner during the pandemic, we noticed that the company announced again last night bad news for investors. RH now sees FY2022 revenue down and told investors that they had not repurchased any shares since their announced $2 billion repurchase program. RH’s management is blaming the Federal Reserve’s tightening monetary policy and higher interest rates for the problems affecting their business, which might be indicating that consumers are pulling back in significant ways.

Something else to ponder, as it relates to Williams-Sonoma, is whether some of their outperformance coming out of the pandemic shutdowns was the result of competitors going out of business (yes, we are speaking about Pier1) and if those big earnings beats were fueled by low-hanging fruit.

Earnings

Below you will find the earnings history for TJX Companies:

TJX has had a rough go of it, but as more shoppers return to physical stores, and other retailers work off excess inventory, TJX could see a return to normal. (Seeking Alpha)

Like most companies without a lot of exposure to ecommerce in 2020, TJX Companies saw earnings go negative before coming back strongly in late 2020 and most of 2021.

The narrative for Williams-Sonoma earnings was much different:

WSM has had a great run of growth, and never saw earnings go negative during COVID. (Seeking Alpha)

Notice how earnings never went negative? Williams-Sonoma was ahead of the curve and benefited from new shopping patterns. While we do believe that the retail omnichannel is the future, we think that TJX Companies’ physical storefronts will be more important if we have a recession. Bargain shopping is always popular, but when in a recession, its value proposition goes up sharply.

We will admit that Williams-Sonoma appears more attractive on a forward P/E basis, but we think that their growth is slowing and that they could face some serious headwinds moving forward as consumers shift spending habits. So while the company currently sports an Estimated P/E just above 7, we still like the thesis behind TJX Companies and their Estimated P/E of just over 17.

Risks To This Trade

We have stated this before but will repeat it again. As it pertains to the trade, any time you go short a stock, there is now the risk of a meme-type short-squeeze occurring. With Williams-Sonoma, that might very well happen as the stock has 12.5 million shares short – which is just about 18.40% of the float and would take 9.4 days to cover (based off of the current daily average volume). Going short one stock, to then utilize those same funds to go long another name, can compound losses, especially if both sides of the trade move against you.

We think both of these companies are well-run retailers, which we cannot say for many retail names and while we do like Williams-Sonoma overall, we think that on a relative basis the stock has gotten ahead of itself, especially in relation to The TJX Companies’ share price. However, if Williams-Sonoma’s strong ecommerce business continues to perform because investors have changed how they shop, then we may not see a convergence between these two stocks for the first time in a few years.

While we doubt that the issues plaguing Bed Bath & Beyond (BBBY) will show up at TJX Companies, investors should keep an eye out on other retailers’ results because if all retailers (including discounters) are impacted, that would seriously impair the bull case side of this trade (and thus a large portion of the potential profits) as we are banking on discounters doing well in a recessionary environment.

Readers should also be aware of the dividends associated with this trade. The TJX Companies currently pays a dividend of 2.07% and Williams-Sonoma currently pays a dividend of 2.69% which means this trade will cost you about 62 basis points on the dividend as you have to pay the dividend for the WSM shares you are short.

Conclusion

While we really do like what Williams-Sonoma has achieved with their omnichannel offering, and we believe that will be key for the company moving forward, in the interim we see The TJX Companies outperforming on a relative basis if the economy continues to slow and becomes a recession.

Be the first to comment