God has made us to be conduits of his grace. The danger is in thinking the conduit should be lined with gold. It shouldn’t. Copper will do. – John Piper

Earlier this week, on the Seeking Alpha podcast, I mentioned that whilst the indicators I tracked on The Lead-Lag Report were largely risk-off, I also said, that I found it difficult to be subjectively convinced that we were either in a definite risk-on or risk-off environment. In the context of a somewhat nebulous risk environment, I’d like to make a bullish case for copper which is down by more than 20% from its Jan-2020 highs of $6,300 per tonne on the LME (YTD, prices are down c.18%). Whilst there is no guarantee that we may have yet seen the worst of the sell-off, more so, as industrial activity, the world over continues to be weak, I do think that conditions are beginning to coalesce to form a somewhat attractive risk-reward picture. Let me now outline some reasons why I think you should consider getting some Doctor Copper into your portfolio at this juncture.

Infrastructure Bill gaining fruition

My followers on Twitter will know how vocal I’ve been about a potential infrastructure bill and how it could be key to restarting things in our economy. Do consider that this is not something implausible and that there has been precedent for something like this in the previous recession, where the greater onus was given to infrastructure spending relative to other developed nations in the world and this helped speed up our recovery with c.2.3 million jobs being created in 2010 alone. Consider the wonders it did for the dire employment situation back then – we sure could do with another trip down that infrastructure stimulus road and help mitigate the unemployment crisis that has beset us via this coronavirus pandemic.

Sure, I can’t tell you with any certainty if the infrastructure bill could come through as phase 4 of the current coronavirus induced stimulus or under some other guise much later, but there is reason to believe we could have something concrete well before the election fever reaches the last lap, as politically- outlined in this piece – this could be a win-win for both parties. Seeking Alpha readers will note that I have been very critical of the Fed’s recent actions in propping up the economy. That said, I also suggested on the associated podcast this week, that a more productive route for the Fed to use its fire-fighting arsenal could be for it to provide support to the fiscal side by purchasing 100-year government bonds that could be used to fund this potential infrastructure bill. That would certainly be more in tune with the capitalistic morals of this country, rather than hand-holding sub-standard businesses with hitherto unfulfilled earnings potential and unhealthy propensities for buybacks.

The clean energy angle

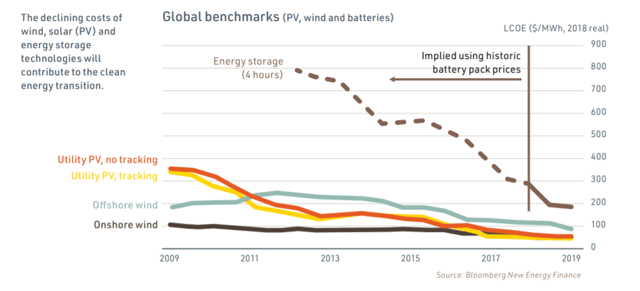

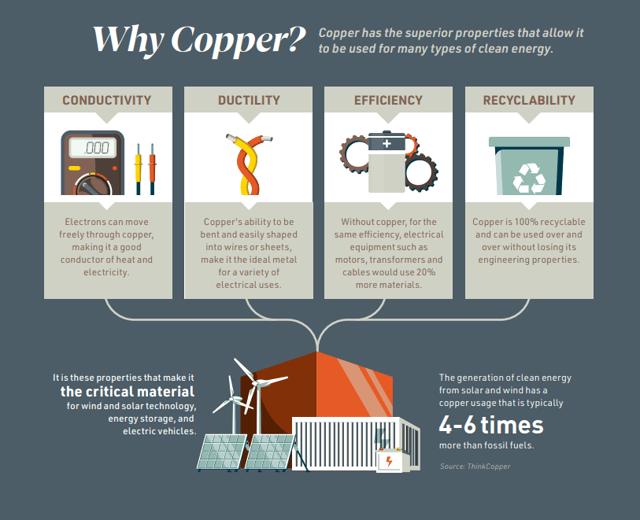

Given that China accounts for c.50% of the global refined copper demand, investors invariably tend to only look out for China’s economic conditions before making an investment case on copper. However, with this potential gigantic US infrastructure bill on the anvil, I do think we can afford to be somewhat less myopic about China alone when considering the prospects of copper. Notwithstanding the role that copper plays in conventional infrastructural builds, I do think it could take on added prominence as greater impetus is given to clean/renewable energy under this new infrastructure bill. This could provide further fillip to copper’s prospects as it is one of the key raw materials used in wind turbines, solar panels, and electric transportation infrastructure.

Source: Bloomberg New Energy Finance

Source: Copper Development Association

Chinese macro should pick up in H2 and 2021

I’ve mentioned above why one can’t disregard China when reviewing copper prospects. While Chinese GDP contracted by an unprecedented -6.8% in Q1-20, the PMI manufacturing index for March was a lot more encouraging, coming in at 52, higher than consensus expectations of 45 and the Feb reading of 35.7. I am not going to pretend to act like I know if the Q2 GDP and PMI numbers are going to get better or worse from here, but I think we’ve reached a point where investors are close to writing off H1-2020 on account of the pandemic and now interest will soon turn to late 2020 and the 2021 prospects which are looking a lot more encouraging. Economists polled by Reuters expect Chinese GDP to grow by 5.3% in Q3 and 6% in Q4. Buoyed by the low base effect, Q1 2021 is expected to be very strong at 15.8%, with growth for the whole year expected to be more than 9% according to the IMF; these are swelling numbers for copper enthusiasts.

Copper prices close to an inflection point

Source: Trading View

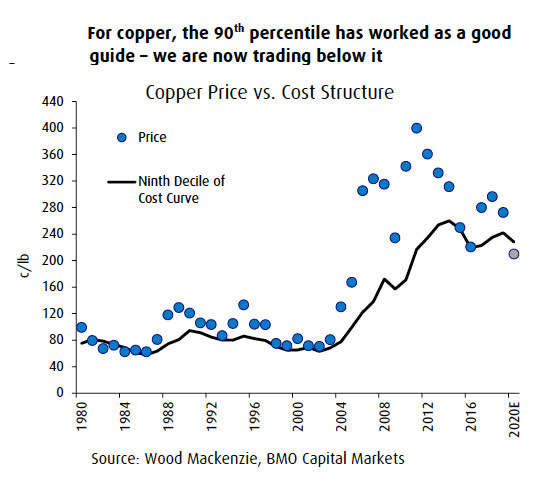

As you can see from the chart above, copper prices are currently trading close to the lower support channel and have reached the previous congestion zone where it had formed a bottom in 2016 before resuming its uptrend. This represents an ideal point for prospective investors to consider adding positions as a level below $2/lb won’t be sustainable for producers, from a going concern point of view. This should result in some supply-side contractions which will boost the price from here. Currently, it is estimated that close to 14% of copper operations are losing money at around current price levels which is below the global production cost curve.

Source: BMO Capital markets

Recent production cuts should help support price

On account of delay in production and coronavirus-induced lockdowns, one has seen news flow emergence of production cuts from key producers and key copper-producing nations. Worth noting that Chile and Peru – who have seen production halt on account of lockdowns – account for c.40% of global copper production. While we continue to wait for demand-side issues to perk up, it is encouraging to see the tide turning on the supply side.

Conclusion

I have said recently that we are not in an environment where traditional fundamental analysis or traditional wealth management is going to do an awful lot for you, where you spread your portfolio only between the two traditional asset classes of stocks and bonds. I think this is an environment that could reward tactical setups and one which embraces greater diversification in other asset classes. Given subdued industrial activity so far this year, it is understandable that non-ferrous metals have underperformed, but as I’ve highlighted above, I think conditions are moving favorably for a potential bounce in copper. The broad consensus is for the coronavirus to peak by the middle of the year and that should help the global economy re-open; expect copper to be of the key beneficiaries of any global revival, led by China. I also think a potential bipartisan infrastructure bill in the US could also swing fortunes significantly for this metal. The price has reached key congestion levels where you can consider building a position to profit from likely positive news flow in the future.

Like this article? Don’t forget to hit the Follow button above!

Subscribers warned to go risk-off Jan. 27. Now what?

Sometimes, you might not realize your biggest portfolio risks until it’s too late.

That’s why it’s important to pay attention to the right market data, analysis, and insights on a daily basis. Being a passive investor puts you at unnecessary risk. When you stay informed on key signals and indicators, you’ll take control of your financial future.

My award-winning market research gives you everything you need to know each day, so you can be ready to act when it matters most.

Click here to gain access and try the Lead-Lag Report FREE for 14 days.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: This writing is for informational purposes only and Lead-Lag Publishing, LLC undertakes no obligation to update this article even if the opinions expressed change. It does not constitute an offer to sell, a solicitation to buy, or a recommendation regarding any securities transaction. It also does not offer to provide advisory or other services in any jurisdiction. The information contained in this writing should not be construed as financial or investment advice on any subject matter. Lead-Lag Publishing, LLC expressly disclaims all liability in respect to actions taken based on any or all of the information on this writing.

Be the first to comment