Editor’s note: Seeking Alpha is proud to welcome Freedom Finance Investments as a new contributor. It’s easy to become a Seeking Alpha contributor and earn money for your best investment ideas. Active contributors also get free access to SA Premium. Click here to find out more »

Khanchit Khirisutchalual

As fears of a recession loom, there is one industry and stock to consider investing in: real estate, primarily rental properties, with BRT Apartments Corp. (NYSE:BRT), as inflation should push rental prices higher as well.

BRT Apartments is a focused real estate investment trust company. They are specific about what they want to own and how much they want to invest. For instance, they seek out properties that have at least 200 units to rent with at least a $5M investment to be made.

In addition, BRT has an interesting approach where they have actually stayed away from the East and West coasts and have focused on the Sunbelt area, instead. They have significant properties in Alabama, Texas, and Tennessee. I think this bodes well, since valuations should not fluctuate as much as on the coasts, along with the potential of the up-and-coming areas – such as Texas and Tennessee. On top of that, rent has been increasing heavily in states such as Texas; Austin, specifically, is within the top 5 fastest in rental prices increasing. Even Tennessee is seeing above average rental price increases (usually 3-5%), with a 7% increase from 2020 to 2021.

Furthermore, they only choose properties with occupancies that are 90%+, which bodes well for a potential recession. Now, there could be additional risks involved with only focusing on these specific areas, such as saturation or possibly not diversifying the rental real estate locations.

BRT has been a very steady REIT, growing performance and their dividend throughout the last 5 years. On top of that, they’ve been able to raise rental rates per unit by 30% across 5 years, ensuring a growing top-line revenue. Given the expectations and evidence above, the rental rate increase per unit for 2022 and 2023 should be higher than the average of 6% (30%/5).

The goal here is to evaluate the REIT as a place to invest your hard-earned dollars, in light of the volatility of the cryptocurrency market with the recent news of FTX and of non-REIT stocks as well, especially in the tech sector in 2022. We will look at the balance sheet and financial performance, as well as other valuation metrics to see if this is a great stock to own now and for the long term.

Balance Sheet

According to their recent earnings release, BRT is sitting on $22 million of cash and equivalents at the moment. This is down from $32.3 million last year, but that could have to do with the significant growth. The risk here is liquidity, of course, and if a deep recession does hit, having a significant amount of cash on hand is better, especially if you have a large amount of debt on the balance sheet. However, debt is usually how real estate companies grow. They address this risk with having a $60 million credit facility on hand, as discussed in their earnings release.

Second, the growth I am referring to is in the real estate portfolio. Real estate is up $362 million compared to last year, with debt only increasing $219.3 million from last year. Investing and growing the real estate portfolio will increase the rental revenue, especially within the states discussed above as they have higher anticipated rental rate expectations.

Therefore, the balance sheet has definitely swelled up. This could lead to higher interest cost, but with an even higher revenue growth engine. This, in total and on an adjusted funds from operations (AFFO) basis, has led to strong financial performance.

Once we look at the financial performance, we can really see if investing in real estate by buying BRT Apartments Corp. could be great for an investor’s portfolio.

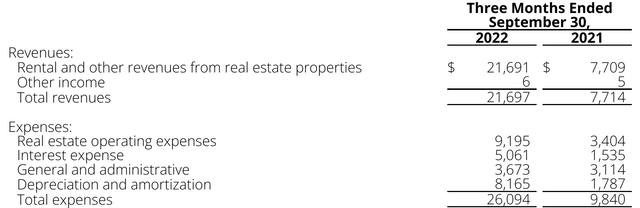

Financial Performance

BRT is firing on all cylinders. They earned almost $22 million in real estate revenue vs. $7.7 million last year. However, due to the partner buyouts and consolidation efforts, expenses increased, which had “inclusion of $14.3 million of expenses as a result of consolidation” per their earnings release statement.

Net earnings stood at $0.37 per share vs. $1.55 last year. For REITs, we need to really look at the adjusted funds from operations or AFFO ratio, to see the true performance. According to REIT.com, “AFFO is typically calculated by subtracting from Funds from Operations (FFO) both (1) normalized recurring expenditures that are capitalized by the REIT and then amortized.”

Therefore, the AFFO is $7.2 million in Q3 2022 vs. $5.7 million last year. Growth of $1.5 million is impressive year over year, at 26%. On a per share basis, the comparison is $0.38 vs. $0.31.

The one area I am concerned with is how debt will play out with properties over the next 6-9 months. With the Fed increasing interest rates and with plans of another more than likely 50 basis point increase next month, borrowing rates will increase and BRT will have to pass on further rental increases during a difficult economic time period. Another risk involved is carrying too much debt, which we have seen other REITs do in the past, and becoming over-levered. If there is a sudden deep recession, with a possible increase in evictions, this could decrease rental revenue and in turn could cause BRT to be delinquent on loan payments to where their loans are. Again, and fortunately, the $60M credit facility is there if needed.

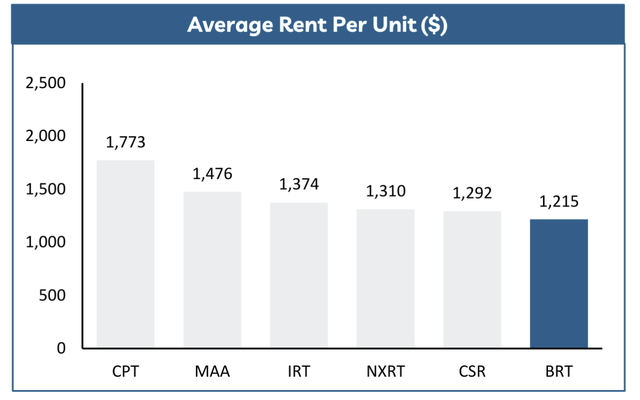

However, as discussed earlier, BRT Apartments has been successful in increasing rental unit rates and maintaining high occupancy rates, and compared with their peers, the average rent per unit has significant upside at the moment, as we see from their Investor Presentation:

Investor Presentation June 2022 (Investor Presentation)

What the chart is telling me is that there is room to grow the average rent per unit and still be better than their competition. Therefore, occupancy should remain high even with increases to offset future increases in costs, primarily associated with interest expense. In addition, based on recent moves the company has made in partner buyouts, they have been very successful in owning and divesting properties for the best value to stakeholders by performing 11 property transactions in Q1-2022 alone, in case the rental price per unit does not fit their strategy.

Now, as an investor, I’d like to buy a well-managed company. Especially if there is slight undervaluation with a dividend that pays me each year. I already know that this business is growing, with a focused strategy on the acquisition of properties. Time to see if I recommend a buy opportunity here.

Is BRT Undervalued?

Given that we know the AFFO is $0.38 per share, we can annualize that figure, which would represent $1.52 per share for the year. We all have heard of the price to earnings ratio, but here we will call it the price to AFFO ratio. This ratio will help tell us if there is value that is more favorable than the stock market. The stock market P/E ratio is 20.74 currently. The Price to AFFO ratio for BRT Apartments is 14.25. Fairly undervalued if you ask me.

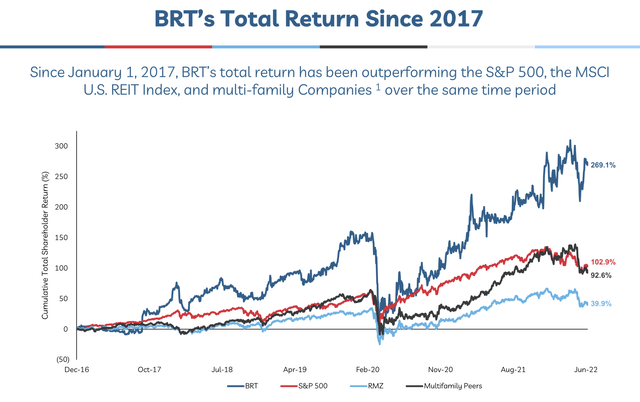

In addition, though the past performance is not indicative of future performance, since 1/1/2017, BRT has outperformed REITs and the S&P 500 over that time frame.

BRT Performance vs. Specific Markets (Investor Presentation)

Thus, BRT has been a strong performer. Given the upside with rentals and their ability to increase rentals, with a specific acquisition strategy and location of properties, I like where BRT is positioned.

Furthermore, their dividend is $0.25 per share, per quarter. This is well covered by earnings and AFFO per share. On top of that, they have been growing dividends steadily over the years and as an investor – and a passive landlord – you have to love a growing income stream. Based on the potential to increase rental unit prices, the ability to grow the dividend going forward should happen. In addition, given my banking industry background, most debt is fixed for years and if you are growing your rent and controlling/fixing your largest cost (debt), then profits should continue to rise.

In conclusion, BRT Apartments is a well-run, diversified real estate investment trust. Growing revenue and future earnings appear to be intact. In addition, there appears to be plenty of upside in continuously growing rental prices per units, as well as additional penetration into the growing real estate markets that are not on either coast of the United States.

At current prices, I would be a buyer of BRT Apartment stock. Of course, I recommend performing your own research as I am not an advisor. Thank you for reading and I look forward to your comments.

Be the first to comment