zoranm

Dear readers/Followers

The time has come for me to take deeper look at British stocks – and my coverage begins with some of the more qualitative businesses in conservative/staples. In this case, we’re going to take a look at Reckitt Benckiser Group PLC (OTCPK:RBGLY), more colloquially known as Reckitt, a giant in the consumer staples and household staples category.

Even if you might not know the name, you have without a doubt seen the company’s products.

Why?

Let me show you what this company is and does.

Introducing Reckitt Benckiser PLC

So, UK companies are becoming more interesting – and in the case of this company, we’re looking at a British multinational staples company that happens to be the world’s largest manufacturer and distributor of cleaning products.

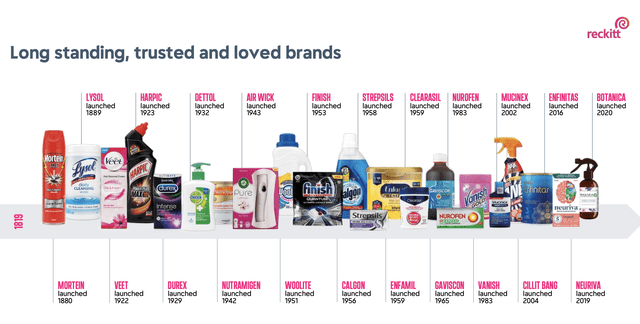

The company has an almost 210-year-old history, with components of Reckitt such as J&J Colman, Benckiser, and others starting up as early as 1814 and 1823. The company is named after some of the founders and is headquartered in Slough in Berkshire, England.

Reckitt has annual sales revenues of over £13B and employs over 43,000 people across the world. It owns several subsidiaries across multiple segments.

Its primary business is the manufacturing, distribution, and sales of cleaning agents, skincare, personal care, nutrition, and consumer healthcare.

The company splits these into Hygiene, Health, and Nutrition, which finds us looking at the following global brands.

Their hygiene products need no introduction, with several of them coming in at hundreds of millions in annual sales, but the company also owns brands in Nutrition and health such as:

- Clearasil

- Durex

- Strepsils

- Enfa

- Nutramigen

- Airborne

- Veet

- Neuriva

The company’s brands have been around for decades – some have been around for over 120 years.

To say that these brands are staples would be understating the case to a high extent, as i see it. The company employs over 3,0000 scientists, engineers and experts that develop new products, and 20,000,000 of the company’s products are sold on a daily basis, worldwide.

Physical operations are found in 60 countries across the world. Reckitt focuses on what it calls, protecting, healing, and nurturing through its 3 very attractive segments, which come in form of products for joint, brain, allergy, and infant supplements, lubes, antiseptics, medications, and depilatories, and various forms of cleaners and disinfectants & pest controls.

This isn’t the first time I review this sort of company. Cleaning and staple companies have a typical potential high-end growth potential of around 3-6% per year unless they’re a massive new entrant with significant new potential. This is not the case with Reckitt. It’s a slow-growing sort of company. Yes, health products can grow somewhat faster – but not by much – and personal care grows less.

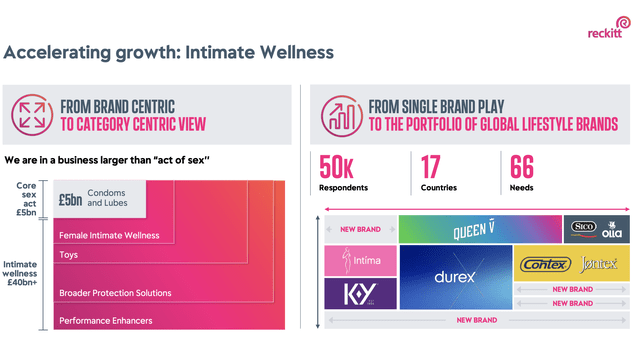

Where Reckitt has found some impressive growth is the area of intimate/sexual wellness, which has been exploding in tandem with increased awareness and interest. The company is acting on a £40B TAM, and it has some of the leading brands in this area.

Sexual and intimate wellness is a growing area for multiple companies – and this one has one of the “safest” avenues, I would say.

What Reckitt does is operate a high gross-margin business, but one that also comes with high costs. The company can expect mid-single-digit top-line growth, but no higher than that, I would say, and around 6-9% EPS growth, if things go well and at a constant FX.

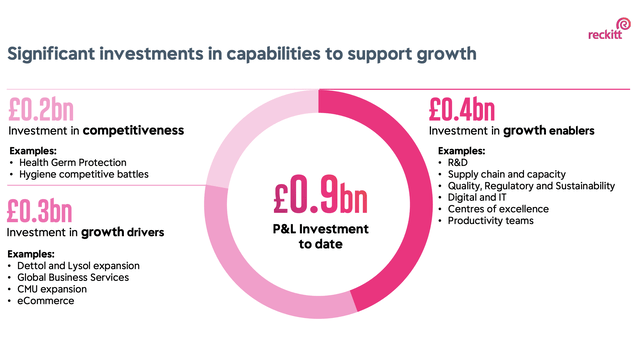

However, being a manufacturer, significant CapEx has to go into the company’s own operations, which is something we can confirm with the current CapEx trajectory just for this year.

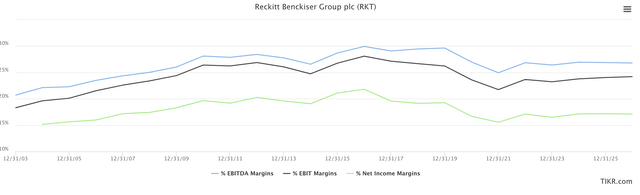

You might expect that a company like this is under significant margin pressure, and you would be right in assuming that margin pressure exists, but wrong in assuming that this has been destructive to the company’s bottom line, from a historical perspective. Take a look at EBIT, EBITDA and net income margins for Reckitt.

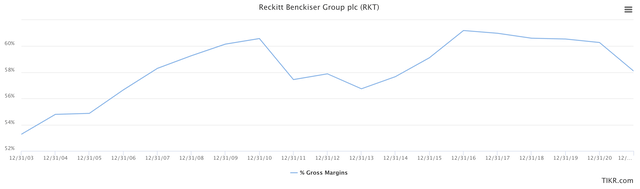

Then take a look at gross margins.

Reckitt Gross margins (TIKR.com)

These trends aren’t as complex as you might think. Yes, there’s some volatility baked into the P&L’s here, and into how these margins flow in times of heightened CapEx, but the bottom line is that over time, the company manages relatively stable margins, even if the annuals sometimes shift a bit. The operating margin has stayed stable in the mid-to-high 20%, which for a company like this is very impressive indeed.

You know that I as an investor am not big on the whole ESG thing. I care about it when it affects P&L, which many argue that it does today, and there is some truth to it. I place far less important than most do.

Still, it bears mentioning that Reckitt does what it can to “fit in” here, with 66% reduction in CO2 since 2015, 30% of revenues coming from Sustainable brands, and the company having impressive scores in things like “Sustainalytics” and MSCI giving the company AA. If you’re the sort of investor that bases investment decisions on this, you can also know that the company was awarded the Dow Jones Sustainability award, Gold Class, in 2022 and it manages a “Fairer Society Fight For Acess fund”.

A quick detour here.

Me, I’ve actually done some research on what constitutes ESG ratings – and the most accurate statement I can give on them is that I do not care about them because they are flawed, and I see them more as a marketing tool to get investors in than anything else. ESG is internally inconsistent and subjective. It looks at things like “how” a company manages supplier relationships and employee relationships, governance measures, and other things which are very much of a “ticking-boxes” approach.

To my mind, ESG is more harmful to investors than it is positive, the danger of so-called “greenwashing” is very high. I see it as often being politically motivated and benefitting the advocates of ESG as opposed to the shareholders of the actual company.

It’s not that I’m opposed to companies that do ESG – I just don’t take it into accounting as an advantage when I do analysis, and a disadvantage if it proves to be costly and unprofitable – and downright unecessary.

Still, Reckitt works with ESG.

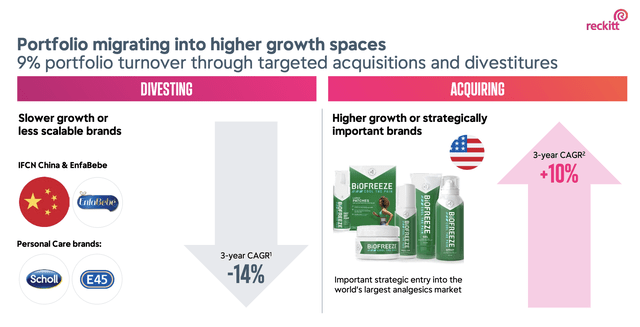

More importantly, it’s a profitable and growing business moving into higher spaces and areas. The company is actively divesting unprofitable brands, while at the same time working with higher-growth brands.

What’s more important, the company has reported consistent market share gains for key brands, higher household penetration, new places and nations for its products, and new spaces. It also works with its Global Business Solution segment to get its products into businesses like Uber (UBER), Hilton (HLT), and many others.

The company presents quarterly but does a smaller presentation outside of half-year results. The latest trading results are 3Q22, and the latest deep-dive into trends is 1H22. P&Ls for 3Q are solid – the revenue growth is 7.4% on a like-for-like YoY basis. The only business area that saw a decline was the COVID-19-sensitive hygiene area, and that decline was only 1.2% YoY. Health grew by 10.7%, and Nutrition grew by an impressive 24.7%, showcasing strong trends.

The company’s outlook for 2022 is fully intact, and the company now expects a high-end of 8% revenue growth and getting operating margins to a mid-20s level for the mid-2020 timeline.

This is impressive given the actual headwinds we’re seeing in the current market of combining shipping, wage, inflation, and input cost increase across the board. But it goes to show you that when you have quality, you don’t need to be as worried about where things are going – and this is of course a good thing.

I want to further highlight Reckitts impressive growth in market share, and its e-commerce growth of 25% YoY, as well as the company being ahead in its overall savings target, which tracks a 2025 target of over £1.5B.

Out of a revenue of close to £6.9B for 1H22, the company managed to squeeze a 25.6% operating margin, coming to an AOP of close to £1.8B. The reason things are going so well for Reckitt is productivity, pricing, favorable mix, leverage, and some non-recurring profits on sales – which means that the AOP margin is a bit elevated, and the company needs to work to get it up to that 25%-level on a non-recurring basis here.

The picture of Reckitt Benckiser that i want to give you in this article is that it is a class-leading hygiene company.

I want to showcase that at the right valuation and right multiples, this company is so much of a no-brainer that you’ll want to invest in it, and enjoy the stability and the excellent fundamentals that this company offers you.

Reckitt dividend isn’t the most impressive obviously – we’re talking hygiene company. For 2021, the company paid out £1.75 per share, which was a frozen dividend from the past 2 years. It’s expected to rice a few pence this year, but far less than inflation. Dividends aren’t why you buy the company, even if a current implied yield of around 3% isn’t exactly bad for this sort of business – it’s actually quite good.

Reckitt is further superbly rated. The company maintains ratings with both Moody’s and S&P Global, with A3 and A- long-term ratings respectively, both stable, and both confirmed less than 2 years ago.

With that, let’s move to valuation.

Reckitt Benckiser Valuation

The company’s trends in terms of valuation over the past 10 years haven’t been the most impressive, because as you might expect, this company tends to always come at a bit of a premium.

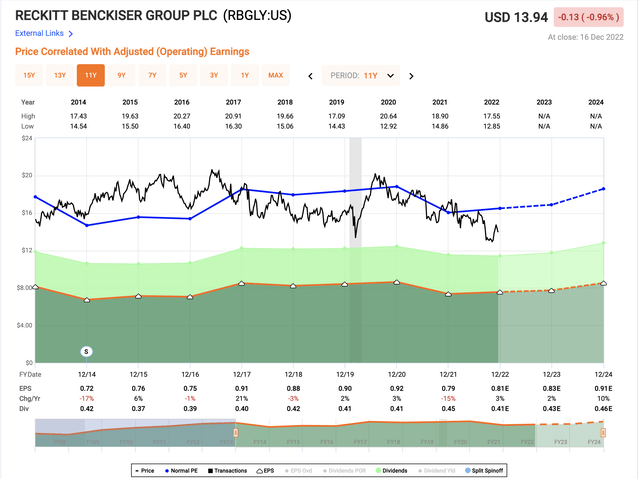

In this case, the relevant ADR you can look at is RBGLY. This ADR is a 0.2x ORd and it currently trades at a mixed P/E of 17.2x, with a 10-year average of around 20.5x.

This implies a decent amount of normalization potential – unfortunately the 2022-2023 estimates for EPS do not, at around 2-3%, even if 2024E is expected to come in far higher.

Reckitt Valuation (F.A.S.T graphs)

Historically speaking, whenever the company’s ADR has traded below 16-17x, the company has been an excellent longer-term investment – and we’re starting to skirt these levels at below $14/share.

For the native, the upside is even easier and clear to establish. The native RKT share, which is what I have bought in a small stake at this time, tends to be targeted between a £65-£75 average PT, with current ranges of as low as £50/share, and as high as $82/share with an average PT of around £69/share. The current native share price is £57.39, or 5739,41 GBX if you’re going by that sort of calculation. For that, we’re currently seeing an analyst-based upside for that average of around 20%.

And I more or less agree with the 12 out of 19 analysts giving this company this sort of average. There’s too much to like in this company, regardless of the momentary headwinds and current macro. Any conservative DCF calculation, even going as low as 2-3% EBITDA growth, would imply a share price above $60 on a conservative and realistic WACC – because this company is not in any way overleveraged or in debt.

So, the simple case here, dear readers,

I believe Reckitt Benckiser Group PLC to be an absolutely superb sort of conservative company. While it won’t turn your investment 10x in 5 years, your capital will be conservatively managed by an experienced team of managers, ensuring that it doesn’t erode very far compared to the broader market – at least if we look at it historically.

Here are my thesis specifics for the company as it stands today.

Thesis

- Reckitt Benckiser is a company with an absolutely solid sort of portfolio of consumer-oriented staple products which aren’t going anywhere. The company is very conservatively-managed, with superb credit rating and a competitive sort of yield for what is otherwise a very low-yield sort of segment.

- I view this company as a “Must-own” for a conservative dividend investor – and I think the company today is attractively valued, even though it’s not at a bottom-level.

- I think RKT stock at native ticker is attractively valued at this time, and i give it a price target of £63 native, or 6,300 GBX.

- RKT is a “BUY” here.

Remember, I’m all about:

- Buying undervalued – even if that undervaluation is slight and not mind-numbingly massive – companies at a discount, allowing them to normalize over time and harvesting capital gains and dividends in the meantime.

- If the company goes well beyond normalization and goes into overvaluation, I harvest gains and rotate my position into other undervalued stocks, repeating #1.

- If the company doesn’t go into overvaluation but hovers within a fair value, or goes back down to undervaluation, I buy more as time allows.

- I reinvest proceeds from dividends, savings from work, or other cash inflows as specified in #1.

Here are my criteria and how the company fulfills them (italicized).

- This company is overall qualitative.

- This company is fundamentally safe/conservative & well-run.

- This company pays a well-covered dividend.

- This company is currently cheap.

- This company has a realistic upside that is high enough, based on earnings growth or multiple expansion/reversion.

I wouldn’t call it “cheap”, but every other criteria is fulfilled at this point.

This one is one you can “BUY”.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Be the first to comment