kmatija/E+ via Getty Images

Price Action Thesis

We discuss Tilray Brands, Inc. (NASDAQ:TLRY) stock detailed price action in this article to help investors visualize its critical support and resistance levels better. TLRY stock price structures are simple to understand. Because the most distinct structures are a series of astute bull traps set up by the market to draw in unsuspicious buyers.

Subsequently, those momentum spikes were digested significantly, as the market taught investors never to chase unprofitable stocks like TLRY. As growth investors, we have our fair share of mistakes. Therefore, we want to help investors understand some of the mistakes we made to avoid repeating them.

Our valuation analysis suggests TLRY stock is still overvalued even at the current levels. Our price action analysis indicates that investors should do well simply by avoiding TLRY stock.

As such, we reiterate our Hold rating on Tilray stock.

It’s Easy To Recognize Those Bull Traps

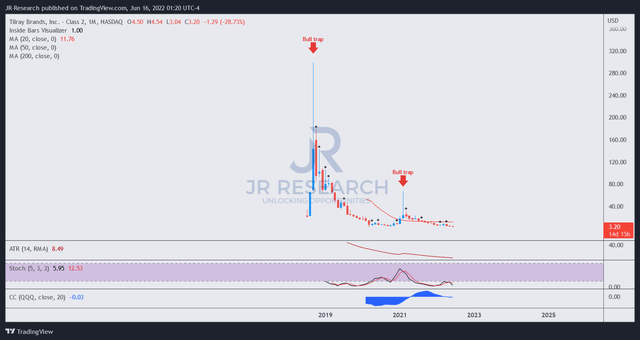

TLRY price chart (monthly) (TradingView)

TLRY stock does not have a secular long-term uptrend. Therefore, it should immediately inform investors that they are fighting against the market if they buy the “dips.”

Furthermore, the prominent bull traps should also indicate the market’s aversion whenever TLRY stock had significant momentum spikes. The last noteworthy momentum spike in TLRY stock in early 2021 was a clear rejection by the market over greedy buyers chasing its momentum.

We urge investors to steer clear of such stocks with a marked long-term downtrend bias and several significant bull traps.

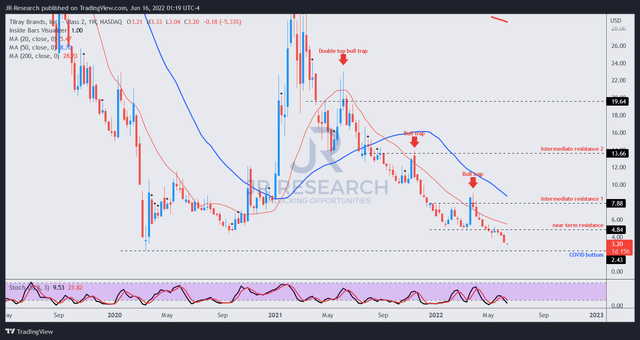

TLRY price chart (weekly) (TradingView)

Going closer to its weekly chart, we can visualize several of those medium-term bull traps, as seen above. The most significant one occurred in June 2021, which we usually define as a double top bull trap. Such traps must be respected because they often portend a substantial reversal in trend.

That was exactly what happened to TLRY stock, as it fell deeply into bearish momentum by September. A series of bull traps seen in November 2021 and March 2022 helped entrench TLRY stock in its dominant bearish bias. Those momentum spikes were excellent opportunities for investors to cut exposure and not “buy the dip!” Don’t fight against the market.

Furthermore, we have not observed a significant price action trigger that could forestall a continuation in its bearish momentum, helping stanch its decay. Therefore, investors should avoid buying any dip unless they are experienced speculative traders with excellent counter-trending trading skills. New investors should also not think about TLRY stock altogether.

Tilray – Unprofitability Makes Fundamental Valuation Challenging

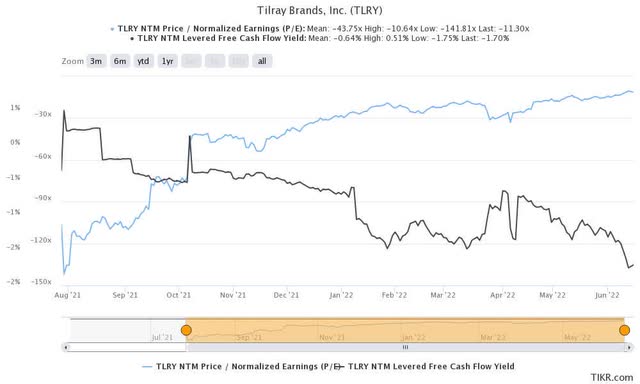

With negative NTM adjusted EPS and negative free cash flow (FCF), we believe valuing TLRY stock with a measure of confidence is challenging.

Using the Street’s preferred revenue multiples metrics is not advisable. Investors must understand that the quality of revenue growth is different between companies. Therefore, we must always focus on valuing companies on EPS or FCF and nothing less.

Focusing on other metrics requires a significant amount of guesswork, as the quality of revenue growth is obviously much poorer for companies with negative earnings.

| Stock | TLRY |

| Current market cap | $1.43B |

| Hurdle rate (CAGR) | 30% |

| Projection through | CQ2’26 |

| Required FCF yield in CQ2’26 | 2.5% |

| Assumed FCF margin in CQ2’26 | 3% |

| Implied TTM revenue by CQ2’26 | $3.4B |

TLRY stock reverse cash flow valuation model. Data source: S&P Cap IQ, author

Investors are encouraged to keep their investment decision-making simple. Don’t over-analyze, as there’s an “efficient frontier” to analysis. Loup Ventures’ Doug Clinton aptly articulated (edited):

Knowledge about an investment opportunity lives on an efficient frontier. You want to take your knowledge out to the point where returns to incremental knowledge diminish. Often this point will mean you know more than most other investors, but that shouldn’t be the point of research. Not only is excess information useless, it can be harmful by making you overweight unimportant things. Also, the deeper you go into a research process, the deeper your commitment. If you’re predisposed to liking a company, the more work you do on that company will only serve to reinforce that view. (Doug Clinton’s Substack)

Therefore, it’s clear to us that TLRY is not a worthwhile investment to consider at the current levels, as it’s not likely to meet our required TTM revenue target by CQ2’26. Consider a lower hurdle rate for TLRY? We would instead move to another investment opportunity.

Is TLRY Stock A Buy, Sell, Or Hold?

Given the company’s negative profitability on adjusted EPS and FCF, it’s challenging for investors to consider an investment opportunity in TLRY stock. How do investors value its stock if it has questionable FCF metrics? Furthermore, its forward FCF margins are estimated to be on the lower end.

Therefore, we urge investors to use a speculative framework to valuing TLRY stock. As a result, they should base their “investing” decision solely on price action analysis to consider an opportunity.

However, our analysis indicates there’s nothing to suggest that buying the dip now would be worth considering.

Accordingly, we reiterate our Hold rating on TLRY stock.

Be the first to comment