77DZIGN/iStock via Getty Images

By Anujeet Sareen, CFA

Several factors have been conspiring to keep the U.S. dollar elevated. In our recent podcast, “The U.S. Dollar Defies Gravity,” we discussed that one of the main drivers behind the dollar’s extraordinary strength and extended bull run has been the relative growth story favoring the U.S., the result of its technology leadership and manufacturing resurgence.

Another factor has been the flight from risk, which has supported the dollar’s haven status. Europe is facing elevated risks emanating from the Russia-Ukraine war. China is dealing with its own crises, including the ongoing property market crisis and the economic impact of its zero-COVID policies. Meanwhile, the U.S. has no specific stateside risk with which to contend.

Around the world, real and nominal rates are diverging more and more as central banks try to bring high inflation in check. How much is inflation driving the dollar relative to other currencies right now?

At face value, it appears that the Federal Reserve (Fed) has been more aggressive in raising interest rates than other developed markets. However, the U.S. also has higher inflation than some of these countries.

From a real, inflation-adjusted interest rate perspective, the current policy environment would not necessarily appear to be dollar bullish. However, the dollar has continued to strengthen in this environment.

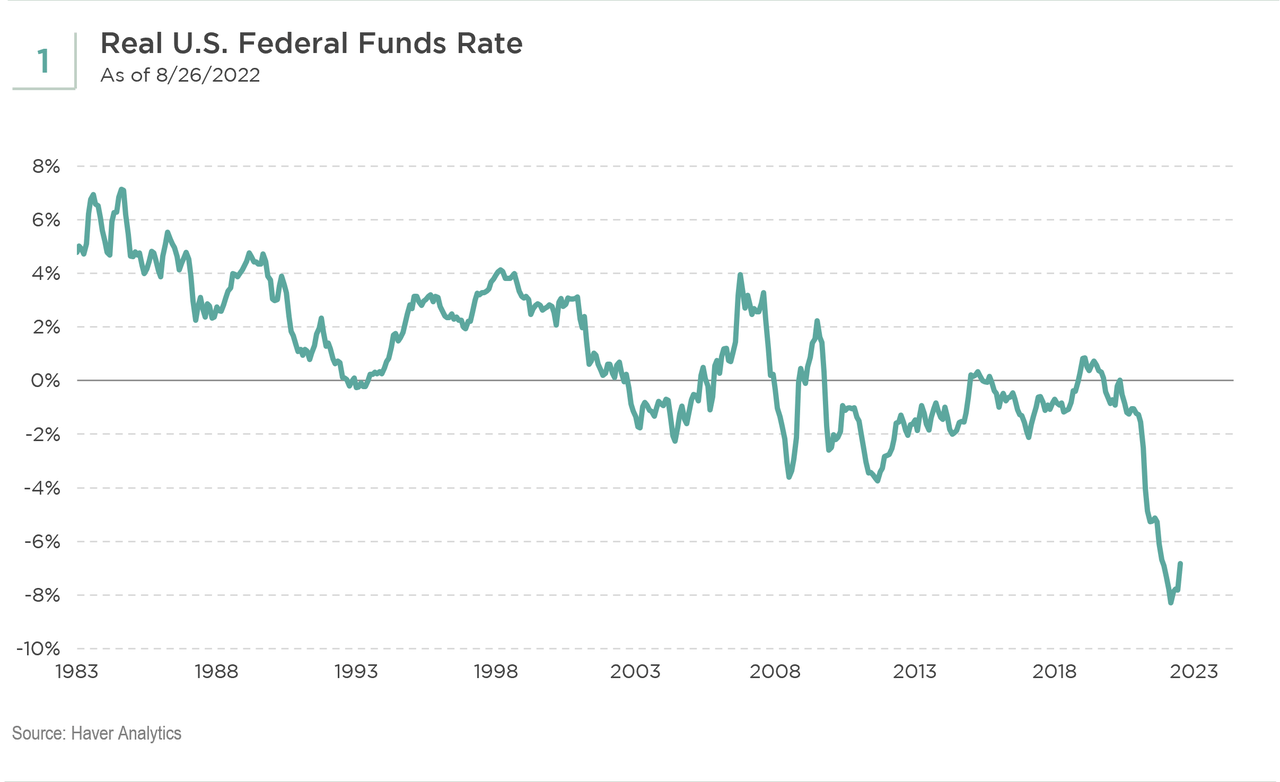

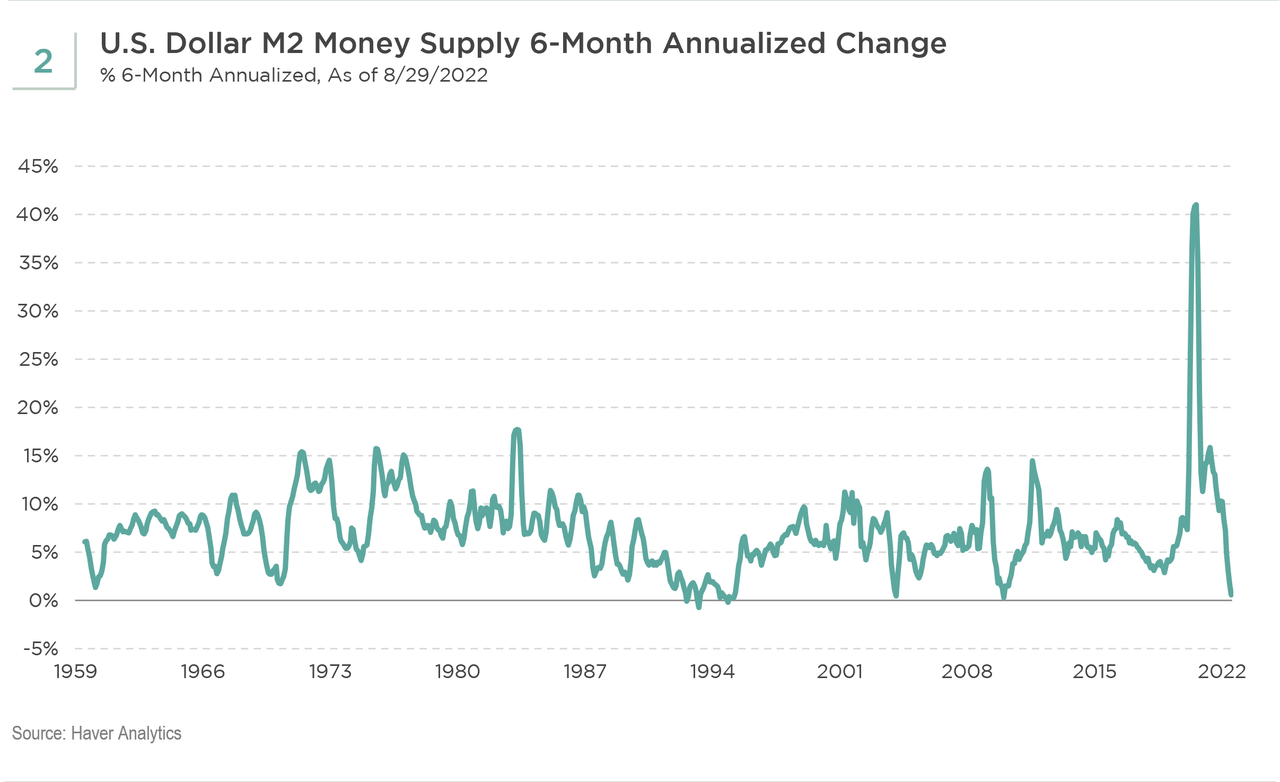

One reason could be that real interest rates currently are very backward-looking. Real interest rates on a trailing basis look quite low (see Figure 1). However, the state of monetary policy may be much more restrictive than the current rate environment would suggest, evidenced by the meaningful slowdown in money supply growth (see Figure 2) and collapse in the overall level of bank deposit growth this year.

Furthermore, the Fed also has started quantitative tightening, which will accelerate the tightening process. Certainly, the Fed’s ultra-hawkishness and willingness to raise rates aggressively have played an important role in the dollar’s performance this year.

However, from a pure dollar liquidity perspective, policy is likely much tighter than what inflation and real interest rates would indicate. If the Fed does pause and perhaps even miraculously engineers a softer landing for the economy, the market’s attention likely will shift to other factors, not just interest rate differentials.

As factors like growth opportunities and current account and balance of payments positions become a more prominent focus, attention could shift away from the dollar to other currencies, particularly in higher-yielding emerging market currencies.

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Be the first to comment