Solskin

The Tekla Healthcare Opportunities Fund (NYSE:THQ) is a closed-end fund aimed at generating income and capital gains by investing in the healthcare sector. The fund pays a generous 6.8% distribution yield that appears sustainable relative to the fund’s long-term average returns. For investors willing to make a trade-off between current yield vs. higher total returns, the THQ fund looks like a decent option.

Fund Overview

The Tekla Healthcare Opportunities Fund is a healthcare-sector focused closed-end fund (“CEF”) with over $900 million in assets. The fund seeks to generate current income and long-term capital gains through investments in healthcare companies. THQ charges a 1.87% expense ratio.

Strategy

The THQ fund invests in both equity and debt of healthcare companies across all healthcare subsectors. The THQ fund aims to benefit from the earnings growth of the healthcare industry while capturing income from dividends and interest payments of the securities held.

Allocation between the various healthcare sub-sectors can vary significantly, especially as the fund utilizes call-writing strategies on individual companies to generate additional income. The fund may invest up to 25% of managed assets in healthcare REITs and up to 30% in convertible securities.

The THQ fund also has significant exposure to the biotech subsector (often 15-30% of net assets), including investments in private biotech companies. This potentially increases the risk profile of the fund’s holdings.

The fund may employ up to 20% leverage to enhance returns.

Management Team

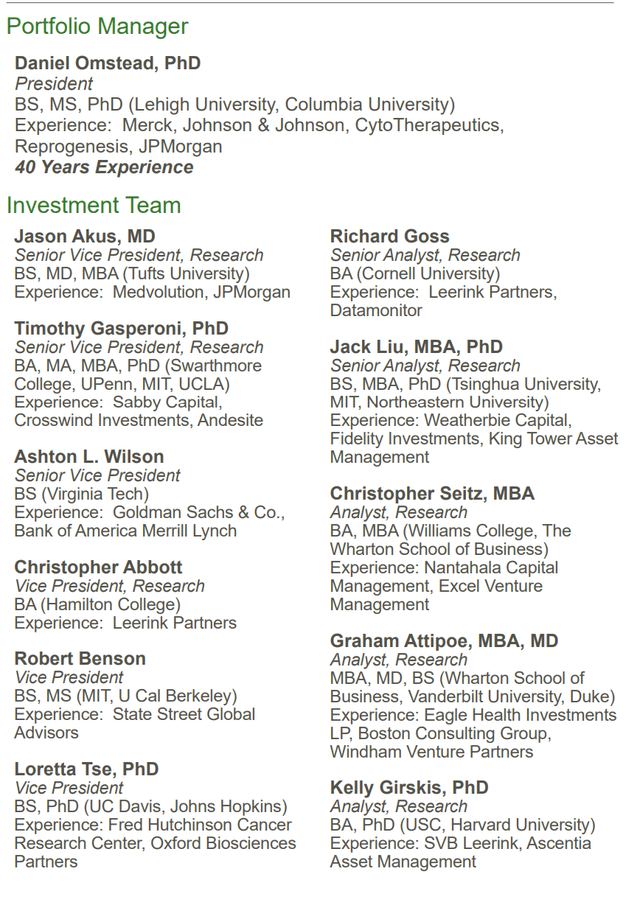

Tekla is led by Dr. Daniel Omstead, formerly President and CEO of Reprogenesis, Inc., a development stage biotech company that was merged into Curis, Inc. (CRIS) in 2000.

In addition to Dr. Omstead, the investment team of THQ includes two medical doctors and four PhDs (Figure 1).

Figure 1 – THQ management team (THQ factsheet)

Portfolio Holdings

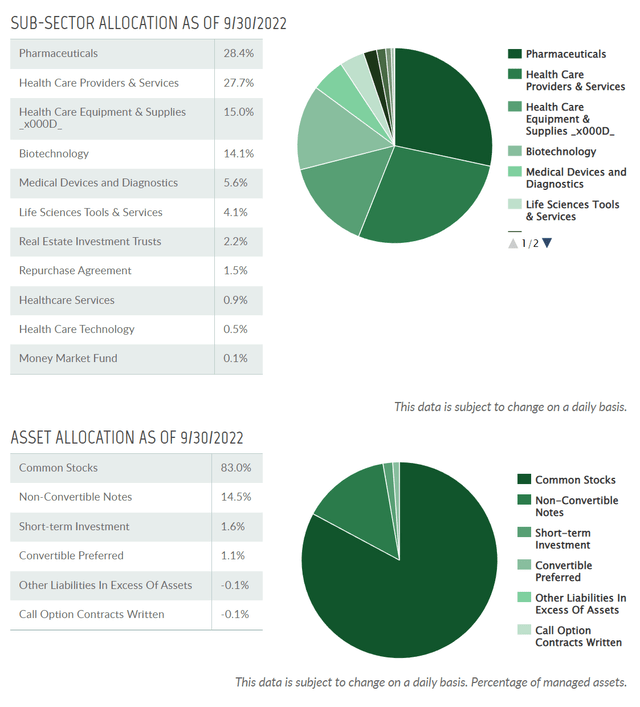

Figure 2 shows THQ’s asset allocation and subsector allocation as of September 30, 2022. The vast majority of the fund’s assets are invested in common stocks, with 14.5% invested in bonds.

Figure 2 – THQ asset and subsector allocation (teklacap.com)

Within subsectors, the fund has 28.4% of the portfolio invested in Pharmaceuticals, 27.7% invested in Healthcare Providers, and 15.0% invested in Healthcare Equipment and Supplies. Biotech represents 14.1% of the fund.

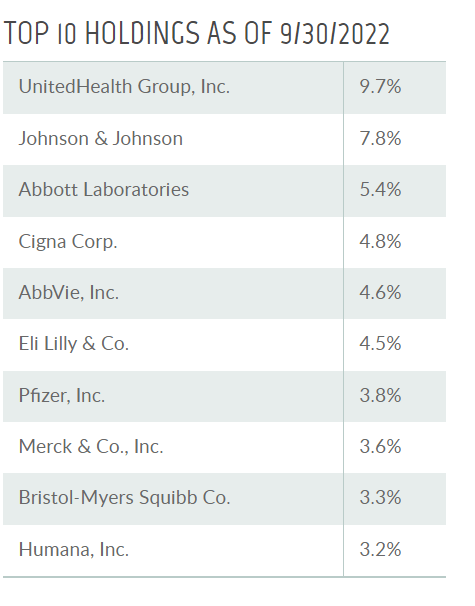

Figure 3 shows the fund’s top 10 holdings, which account for 50.7% of the fund.

Figure 3 – THQ top 10 holdings (teklacap.com)

Returns

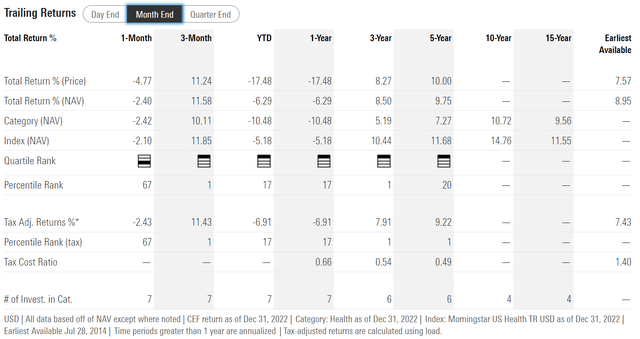

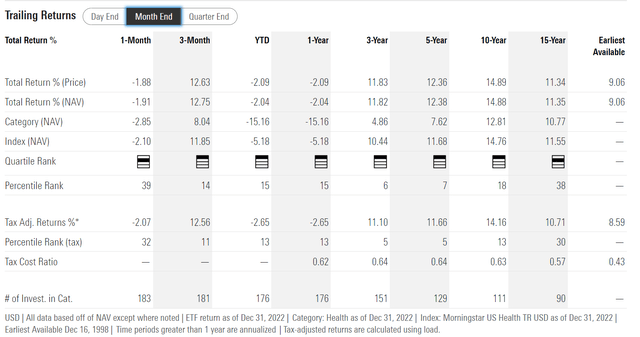

Figure 4 shows the THQ fund’s historical returns performance. THQ has delivered solid long-term returns, with 3 and 5Yr average annual returns of 8.5% and 9.8% respectively to December 31, 2022.

Figure 4 – THQ historical returns (morningstar.com)

However, investors should note that the THQ fund has lagged the healthcare sector in general, as represented by the Health Care Select Sector SPDR Fund (XLV). XLV has returned 11.8% and 12.4% respectively, on the same timeframes (Figure 5).

Figure 5 – XLV historical returns (morningstar.com)

THQ’s underperformance relative to the XLV may be due to the strategies employed by THQ to generate income. For example, call-writing strategies may cause the THQ fund to lag during bullish markets, as the fund has sold the ‘upside’.

Distribution & Yield

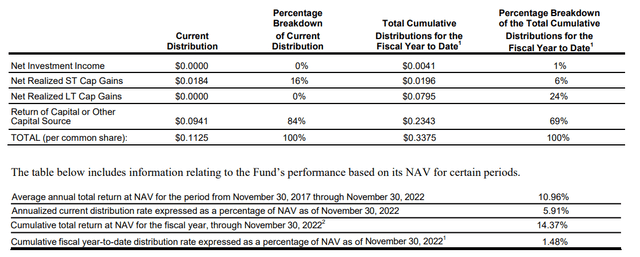

One of the main selling feature of the THQ fund is its high distribution yield. The THQ fund currently pays a monthly distribution rate of $0.1125 / share or 6.8% current yield. On NAV, THQ’s distribution rate is 6.1%.

Investors should note that THQ’s distribution is not fully funded by net investment income (“NII”). As shown in figure 6, approximately 69% of the distribution in the fiscal year-to-date has been funded by return of capital (“ROC”).

Figure 6 – THQ distribution funded partly through return of captial (THQ December 2022 19a notice)

However, return of capital is an accounting concept. In my opinion, as long as the fund earns a sufficient level of economic returns, either through investment income or capital gains, it should not matter to investors how the distributions are funded (aside from tax considerations). The key test is whether a fund’s NAV grows over time. A growing NAV means there are more assets to fund future distributions. This is the opposite of a return-of-principal fund that I have been writing about in recent articles.

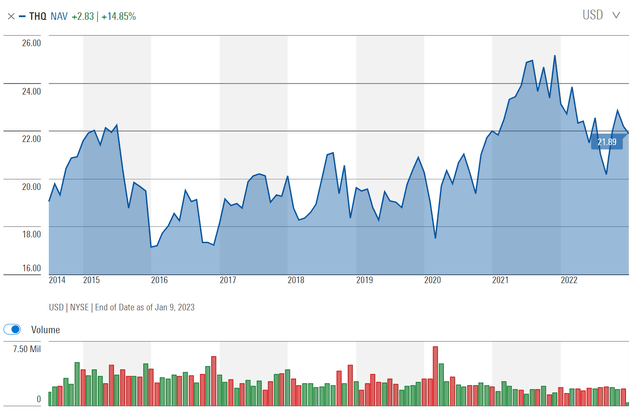

Since inception, THQ’s NAV has grown from $19 to almost $22 recently (Figure 7). Meanwhile, THQ’s distribution has remained steady at $0.1125/month.

Figure 7 – THQ has grown its NAV over time (morningstar.com)

THQ Trades At A Steep Discount

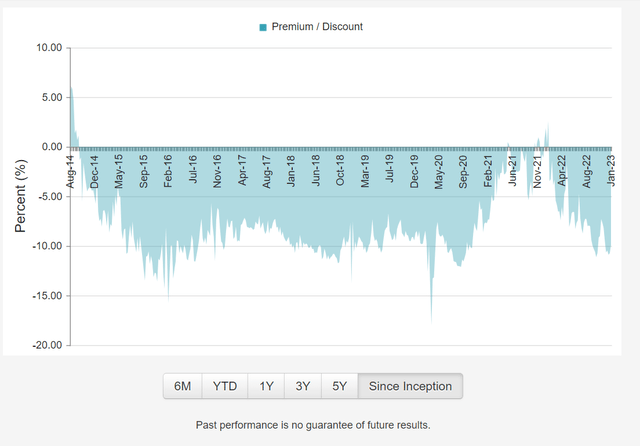

The THQ fund is currently trading at a 9.9% discount to its NAV (Figure 8).

Figure 8 – THQ discount to NAV (cefconnect.com)

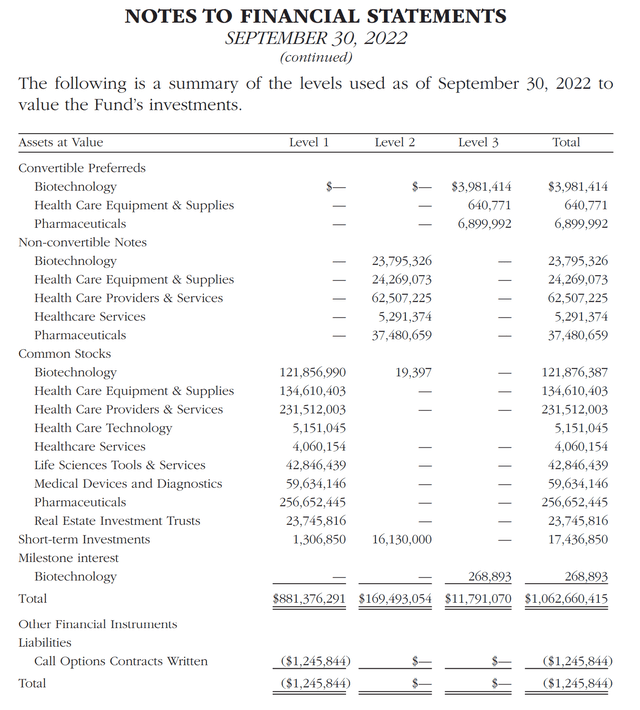

A wide discount to NAV could indicate investors are worried about the fund’s prospects, or the accuracy of its NAV, if there are a lot of private companies. In this respect, the THQ fund’s NAV looks fine, as it only had $11.8 million in Level 3 assets (Level 3 assets’ fair values are determined using significant unobservable inputs including the fund’s own assumptions, i.e. private companies), or ~1% of the fund’s assets (Figure 9).

Figure 9 – THQ Level 3 assets represent only 1% of total assets (THQ 2022 annual report)

I think THQ’s wide NAV discount simply represents poor investment performance in 2022 and general risk-off sentiment in the market place.

Key Risks

The biggest risk for a high-yielding fund like THQ is a potential cut to the fund’s distribution. In my opinion, this risk is low, as THQ has earned long-term average annual returns higher than its distribution yield.

A bigger risk to THQ is its single sector focus. As healthcare is generally defensive, this risk is somewhat mitigated. However, it does expose investors to idiosyncratic sector risks, for example, potential healthcare reform.

Conclusion

In summary, the Tekla Healthcare Opportunities Fund is a closed-end fund aimed at generating high income and capital gains by investing in the healthcare sector. The fund pays a generous 6.8% distribution yield that appears sustainable relative to the fund’s long-term average returns.

For investors willing to make a trade-off between current yield and higher total returns, the THQ fund looks like a decent option. For me personally, I prefer higher total returns so I would choose XLV over THQ.

Be the first to comment