Leestat

Thesis

Since NYMEX natural gas futures (NG1:COM) staged their highs in August, natural gas bulls have been hammered. Accordingly, futures fell more than 50% to their October lows. However, with the rapid capitulation taking out the late buyers, NG1 has also been consolidating lately after its recent recovery.

However, Antero Resources Corporation (NYSE:AR) has demonstrated tremendous resilience despite the recent market volatility. In addition, the company’s commitment to debt reduction and an expanded stock repurchase program have helped lift buyer sentiments over AR.

Coupled with its low-cost inventory and ability to drive premium pricing against NYMEX, the company’s fundamentals seem favorable through FY23. The company also expects its free cash flow (FCF) to remain robust in FY23 as it focuses more on buying back stock moving forward.

Our analysis suggests that AR is attempting to consolidate above its September lows. AR’s momentum remains with the buyers as it’s still in a medium-term uptrend. However, we gleaned that sellers have also hindered upward momentum at a critical juncture in November, preventing buyers from retaking AR’s August highs.

Moreover, AR needs to overcome tougher comps from H2’23, which could impede its buying upside. Despite that, Antero’s profitability is expected to remain robust, given relatively low production growth through FY24.

However, we postulate that the risks for natural gas and NGLs remain skewed toward the downside if the demand outlook worsens more than expected.

While we believe the medium-term fundamentals in AR seem resilient, investors should note that the market has not re-rated AR despite its solid performance. We parse that the market could reflect uncertainties in the performance of Antero’s underlying markets in the medium-term, despite the company’s confidence.

With AR possibly re-testing its September lows, we urge investors to remain on the sidelines and let the market demonstrate whether buyers could hold on to its support zone decisively before adding exposure.

Maintain Hold.

Europe Seems To Have Averted A Natural Gas Crisis

We believe the market had correctly anticipated that the crisis in Europe’s natural gas situation might not pan out eventually. We cautioned in our previous article that Europe remains in control of its energy crisis, with the focus likely on demand destruction.

Bloomberg reported that Europe has managed to adequately fill up its storage reserves to lift the somber sentiments just three months back. Also, BloombergNEF’s research suggests prices could fall further, with weaker demand dimming prospects of another significant surge.

Also, European governments likely have the incentive to keep energy costs lower, helping to avoid a significant economic downturn. Therefore, their rush to build storage and capacity has been constructive in mitigating the energy crunch that could have decimated Europe’s economies.

As such, it could significantly limit the potential for natural gas prices to revisit the highs we saw in Q2/Q3FY22, as Bloomberg accentuated:

Much-higher-than-normal prices are likely to persist well into 2023 as countries rush to replenish storage among even tighter supplies, and we expect high energy bills to keep weighing on activity. Still, supply and demand are continuing to adjust—the planned expansion of LNG capacity, notably in Germany, is a case in point. Looking further ahead to winter 2023-24, we think this means that acute crises can be avoided. Over time, the drag from higher energy costs will gradually decrease. – Bloomberg

AR: Potentially Explains Why Re-rating Has Not Arrived

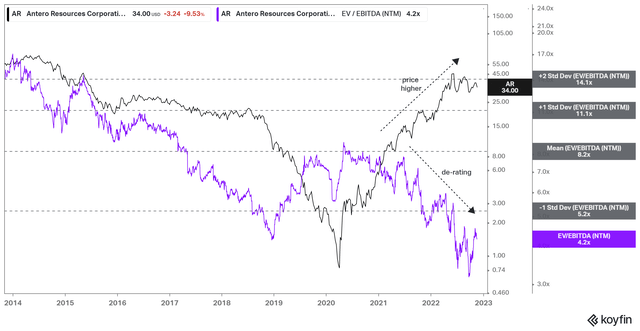

AR NTM EBITDA multiples valuation trend (koyfin)

As seen above, AR outperformed the S&P 500 (SP500) (SPX) significantly in 2022, posting a YTD total return of 95.3%. However, despite its robust operating performance, the market de-rated AR’s valuation.

Notwithstanding, it applies to AR and the broad energy sector. However, AR’s NTM EBITDA of 4.2x remains priced at a premium against its oil and gas peers’ median of 3.2x.

Therefore, we postulate that a broad sector re-rating is needed to lift AR’s valuation toward its mean.

However, investors also need to question whether Antero’s medium-term growth profile could continue to moderate through FY24.

Is AR Stock A Buy, Sell, Or Hold?

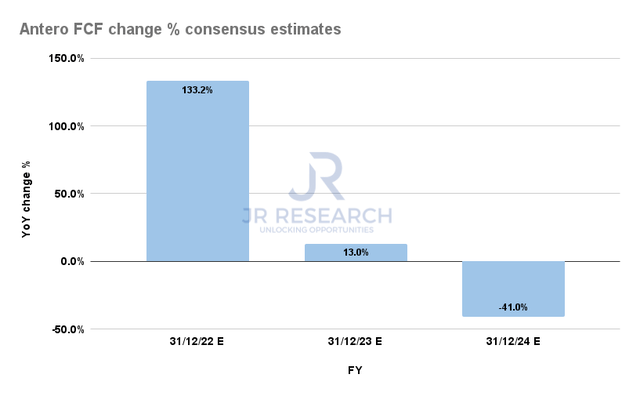

Antero FCF change % consensus estimates (S&P Cap IQ)

Antero provided guidance of $2B in FCF for FY22, with FY23’s metric likely in line. Street analysts are more optimistic, seeing 13% YoY growth in FY23. However, they also modeled a possible decline of 41% in FY24, potentially seeing pricing normalization in its underlying markets.

With Antero not expected to lift its production significantly through FY24, the company is susceptible to potentially lower prices moving ahead if prices moderate further.

Therefore, it could materially impact its ability to deliver its medium-term capital allocation, even as it lifted its stock repurchase by another $1B (50% of projected FCF).

Hence, we believe the market could have anticipated earnings/FCF growth uncertainties through FY24, behooving a de-rating to reflect such execution risks.

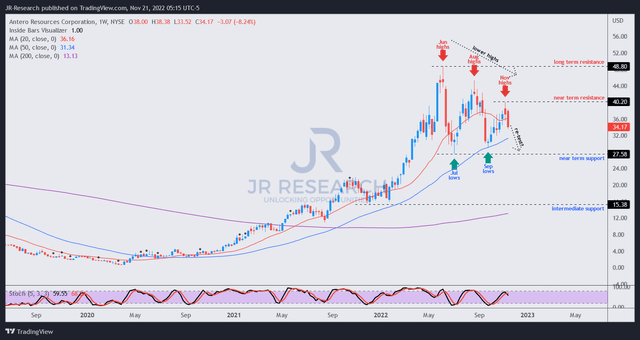

AR price chart (weekly) (TradingView)

Sellers rejected buying upside at AR’s November highs, denying the opportunity for buyers to retake its August highs.

As explained, we postulate the trends in the underlying markets could continue to soften, with Europe likely to avert another crisis in the near term.

Hence, it’s looking increasingly likely that a re-test of its September lows cannot be ruled out, which should proffer investors an opportunity to assess buyer conviction.

Hence, we urge investors to remain patient as the price action in AR has weakened. While buyers remain in decisive control, they have not been able to help AR regain upward momentum robustly.

Maintain Hold as we await the potential re-test.

Be the first to comment