Larry Crain

Investment Thesis

Thor Industries, Inc. (NYSE:THO) is a manufacturer and distributor of recreational vehicles (RVs) which has invested in Dragonfly Energy for innovative storage technologies. I believe this investment might increase the efficiency of products and customer satisfaction, which can result in revenue growth in the coming years.

About Thor Industries

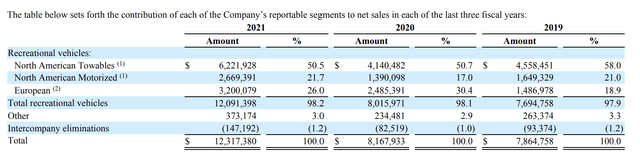

The Elkhart, Indiana-based Thor Industries, Inc. creates, produces, and markets RVs and ancillary components in the United States, Canada, and Europe. Travel trailers, traditional travel trailers, luxurious fifth wheels, motor caravans, caravans, campervans, and urban vehicles are all offered by the company. North American Towable Recreational Vehicles, North American Motorized Recreational Vehicles, and European Recreational Vehicles are the three reportable segments for the company. The company earns 50.5% of revenue from North American Towables, North American Motorized contributes 21.7% to the total sales, and the European segment forms 26% of the revenue. The other non-reportable segments, such as the sale of aluminum extrusions and specialized component products, generate 3% of the total revenue.

Revenue Segmentation (FY2021 Annual Report)

The company’s management believes it has a significant growth opportunity in the next five years. They estimate the total addressable market to be more than $5 billion, and with currently available resources and product portfolio, it can target more than $2 billion. It has already surpassed the 2025 goals in April 2022, which were announced in 2019. The company’s estimated revenue for FY2025 was $14 billion with a 16% gross margin, and as of the last quarter, it has already reached revenue levels of $16.1 billion with a 17% gross margin. The current backlog, while still elevated, indicates healthy long-term demand and organic growth for RV products. The company also focuses on inorganic growth by acquiring or investing in a business that aligns with the current business. It has recently announced a strategic partnership with Dragonfly Energy.

Partnership with Dragonfly Energy

Recently, the company has made a strategic investment of $15 million in Dragonfly Energy. It is a deep-cycle lithium-ion battery manufacturer for the RV industry. THO is entering this partnership specifically for Dragonfly’s innovative storage technologies. Its energy storage products and technologies include battery packs, energy systems, and cell manufacturing technologies. The partnership benefits Keystone RV, a THOR operating company that benefits the North American RV companies.

This partnership is very important for the company’s product line evolution as it will increase the efficiency of the product, which can increase the demand for the RVs. Since Dragonfly’s proprietary all-solid-state cell technology is positioned to enable a more dependable and sustainable smart energy system, the collaboration also strengthens Thor’s ESG commitment. The equity investment from THOR was completed and made before Dragonfly and Chardan NexTech Acquisition 2 Corp. combined their businesses. Energy Impact Partners is the main organizer for a $75 million senior secured term loan that will be used to finance the business combination. Chardan NexTech Investments 2 LLC will also contribute $5 million of its stock in the transaction.

I believe this partnership might act as a prime growth factor as Dragonfly’s innovative storage technologies will increase the efficiency of the vehicles. It will also enhance customer satisfaction, which may increase the demand for the products of THO in the coming years.

2.04% Dividend Yield and $600 million Share Repurchase Authorization

The company currently pays $1.72 per annum, an annual dividend yield of 2.04%. It also has reaffirmed that the company is planning to utilize up to $250 million by December 21, 2024, and utilize up to an additional $448 million by July 31, 2025, which will give total repurchase authorization of $600 million. This is 15% of the current market capitalization. This capital distribution policy of the company is a stable return opportunity for the investors.

Bob Martin, President and CEO of THOR Industries, said:

We have been aggressively buying shares in the market since our share repurchase authorization was announced in December 2021 and have purchased more than one million THOR shares to date. We continue to believe that THOR shares present a compelling investment opportunity at current share prices, and we intend to continue to take advantage of this opportunity to create value by returning capital to shareholders through additional share purchases. Given the current stock price, we believe purchasing THOR shares represents the best risk-adjusted return for our cash.

What is the Main Risk Faced by THO?

Limited Suppliers and Product Shortage

THO depends on limited suppliers for the procurement of some of the most important RV components. The motorized chassis is one of the key components in RV production, and the automotive industry, in general, has faced a shortage of motorized chassis supply. The shortage of semiconductors due to supply chain constraints has primarily caused the chassis supply deficit. Apart from the chassis, towable frames and slide-out mechanisms, axles, upholstered furniture, and windows and doors are mainly procured by the company from LCI Industries. This high dependency on one supplier is a major risk factor for THO.

Technical Analysis and Fundamental Valuation

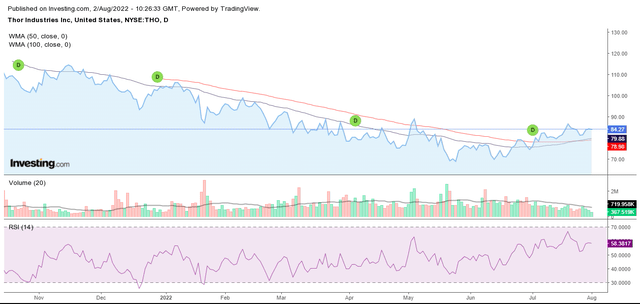

Technical Analysis Chart (Investing.com)

THO has positive technical indicators currently. The stock is trading above its 50-day, and 100-day weighted moving average (WMA). The 50-day moving average has recently crossed the 100-day moving average, which could result in a fresh momentum in the stock, and we can see a tremendous upside from the current stock price. The WMA indicator suggests a buy from current price levels. The RSI indicator has no significant divergence, but the stock is trading in the buy zone. The stock is consolidating in the 55-65 RSI band range and could soon test the 70-band levels. I believe the technical indicators are in favor of a buy for THO.

The company has seen a 29% decline in the last one year and is currently trading at $84.28. The recreational vehicle sales slump was the main reason behind this fall. I believe this decline has made the company very attractive in terms of valuation, and the recent investment in the dragonfly company is expected to drive growth for the company. THO is trading at a P/E multiple of 4.35x with FY22 EPS estimates of $19.36. I believe the company will trade at a higher valuation due to its growth factors, and I think a P/E multiple of 6.5x is justified for the company. This gives us a target price of $125.84, a 49% upside from current price levels.

Conclusion

THO can experience increased customer satisfaction with improved product efficiency. The strategic investment in dragonfly is expected to be a primary growth factor for the company. THO is trading at an attractive valuation at current price levels, and we can see a significant upside in the share price. The technical indicators are very positive for the company and reflect a buying momentum. I assign a buy rating for THO after analyzing all these factors.

Be the first to comment