sefa ozel

I am very bullish on the oil market. I am so bullish, it hurts. One of the obvious setups going forward is the incredible tightness we are about to witness in the distillate market heading into winter.

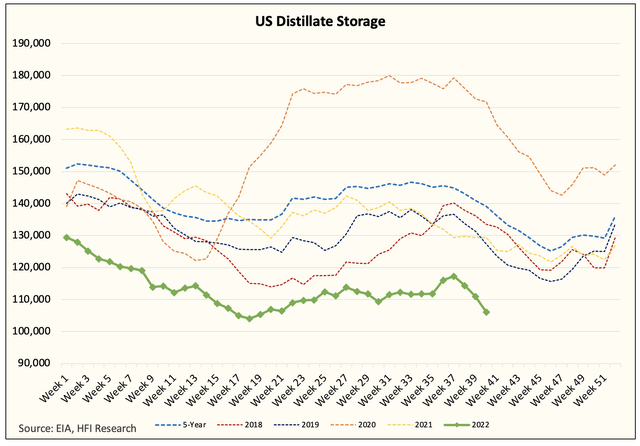

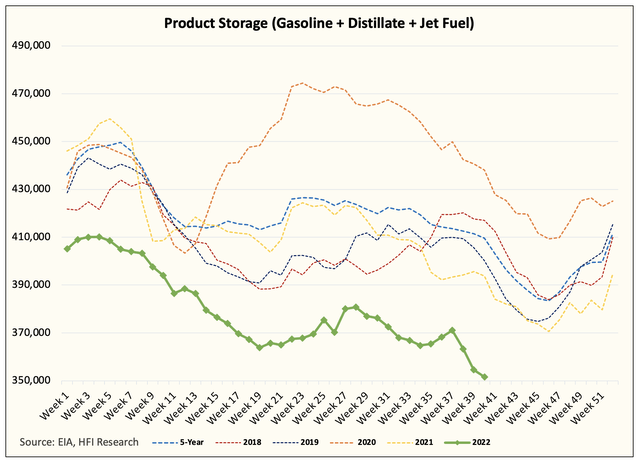

Despite being in the heart of refinery maintenance season, distillate inventories are sitting at multi-year lows. Combine this with gasoline inventory remaining near all-time lows for this time of the year, and we have a situation where product storages are “uncomfortable” going into winter.

As a result, the 3-2-1 crack spread has been roofing.

This tells me that this is not your normal refinery maintenance season. According to Energy Aspects, global refinery maintenance for October and November are 6.952 million b/d and 4.589 million b/d, respectively.

By December, that figure drops down to 2.232 million b/d. In the next 2-months, global refinery throughput is expected to increase by ~4.7 million b/d. Now let’s just assume that China isn’t going to lift its zero COVID policy for a second, refining margins are practically screaming, “please increase throughput.”

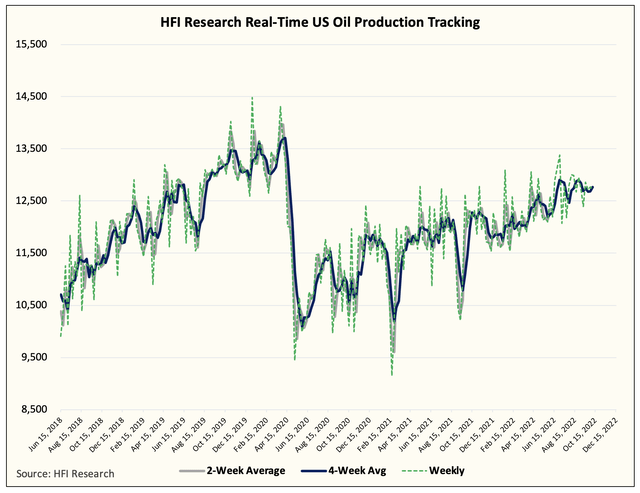

As these refineries attempt to exit maintenance season as quickly as possible (thanks to elevated margins), the demand for crude will jump sharply. But here comes the problem. Saudi and Russian crude exports are going to be lower into year-end. In addition, U.S. shale oil production is disappointing to the downside possibly only finishing the year at ~12.25 million b/d versus ~12.5 million b/d, previously.

From a supply standpoint, we will have zero surprises going forward, which means that if our analysis is correct about the incoming distillate shortage and the associated refinery throughput increase, crude will be in a massive tailwind.

Now you finally throw in the fact that the SPR release will end by the end of November (~10 million bbls slated for release in November), and all of a sudden, you will have a situation where market participants scramble for crude. This happened in Spring this year following the Russian/Ukraine invasion, and we think it’s destined to happen again into year-end.

What does that mean for price?

I think we are going to finish the year north of $100. The only question is whether or not we see China’s demand returning.

You can see in the chart above how much China’s oil demand is down for this year. Assuming no further recovery in China’s oil demand, we expect the range to be closer to $100 to $105. Now if there are any indications China is set to loosen its zero COVID policy, then we see it finishing closer to $120 to $125.

The incoming physical tightness in the product market will catch most financial market participants by surprise. Couple that with lower crude exports from Saudi and Russia, and we see a scenario where refineries scramble for crude going into 2023. SPR is expected to end by the end of November and U.S. shale oil production growth is disappointing to the downside. The oil bulls just need demand to hold up going into year-end. If so, then oil prices will finish much higher by year-end.

Be the first to comment