filadendron

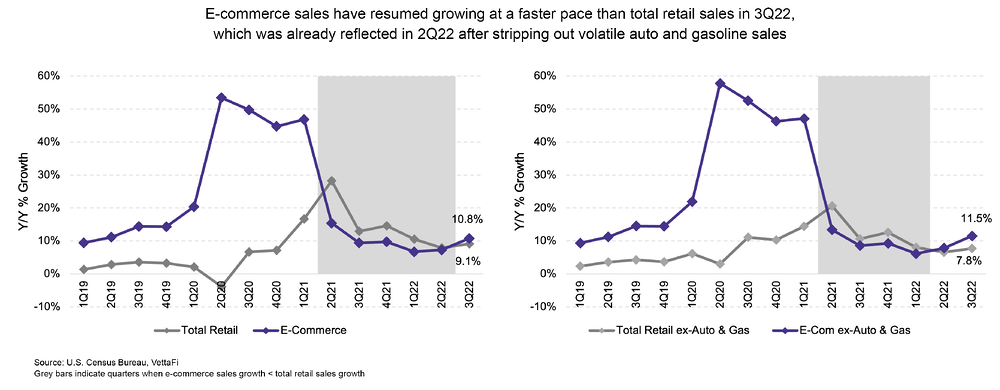

After several quarters, e-commerce sales growth finally resumed growing at a faster pace than total retail sales in 3Q22. This was a trend we saw hints of last quarter, after adjusting out both motor vehicle parts sales and gasoline sales. While consumer spending has seen recent pressure, we believe the e-commerce recovery will continue through the end of 4Q, particularly as price sensitive customers become more strategic with how and when they spend their time and money. Here are three reasons e-commerce will continue to reign this holiday season:

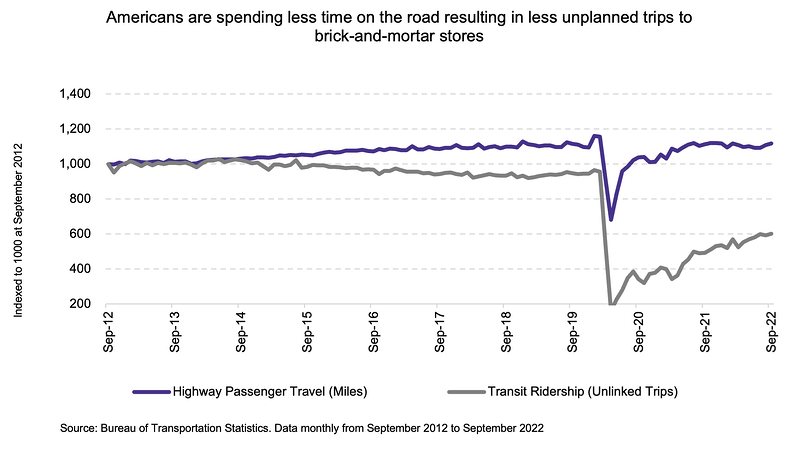

1 – More remote work and higher fuel costs are keeping consumers off the road and on the internet

Consumers are spending less time on the road, which means less unplanned trips to brick-and-mortar stores. According to the U.S. Department of Transportation, highway passenger vehicles miles traveled in 2022 is still below pre-pandemic levels and transit ridership is over 37% below levels seen in early 2020. There are two primary reasons this trend could be occurring. First of all, remote work has become permanent for many Americans post-pandemic. In 2019, 9 million Americans (or 5.7% of employees) worked from home. In 2021, this number tripled to 27.6 million people (or 17.9% of employees).(1) With workers no longer commuting from work to home, many consumers may be less likely to stop in-person at a store. Instead, it is easier to shop online since most of the day is already spent in front of a computer. Less traffic can also be attributed to higher gasoline prices in the short term (retail gas prices have increased over 30% on average in 2022 compared to 2021 according to the U.S. Energy Information Administration). Price-sensitive consumers may prefer to save money on gas and shop online in order to have enough money for holiday shopping—especially after celebrations in both 2020 and 2021 were limited due to the pandemic.

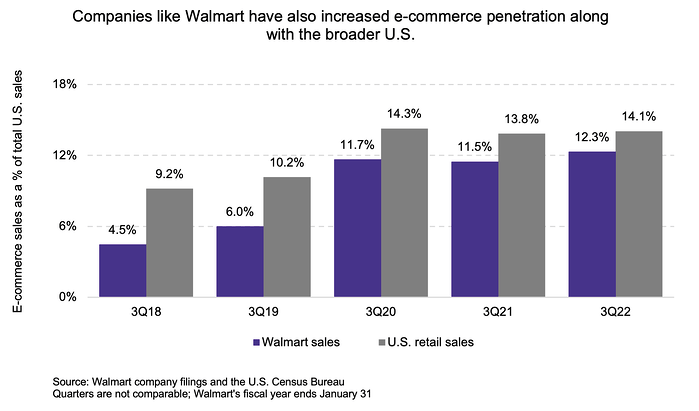

2 – Modern retail operations recognize the importance of e-commerce and omni-channel sales

While many large retailers like Walmart (WMT) are concentrated on brick-and-mortar sales, they are increasingly expanding their e-commerce presence. The company had seen increased customer interest in omni-channel and e-commerce since 2014-2015, which was only validated by the pandemic. Additionally, better inventory tracking and more accurate website data for brick-and-mortar retail all involve modernization of operations—which can more easily be translated into e-commerce channels. Now the company has grown e-commerce sales at a faster pace than retail sales as customers value being able to see item availability, discounts, and price comparisons before making trips to stores.

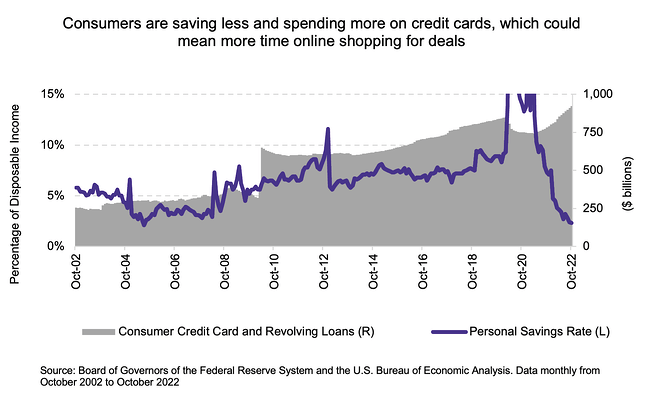

3 – Consumers are shopping early and strategically to find discounts

While consumers still have a desire to spend, retail spending has been pressured by higher inflation. Consumers are now digging deeper into their wallets and saving less money. The current personal savings rate is only 2.3% of disposable income as of October 2022—the lowest level since 2005. For reference, the personal savings rate was around 8.8% on average in 2019. Consumers are also using credit cards more. Credit card and other revolving debt has increased over 17% year-over-year. Price sensitive consumers may be more strategic with their purchases and become more likely to research sales before spending money this holiday season. This is typically easier when shopping online so consumers may either order items for delivery or use online services like BOPIS (buy online pick-up in store). It also seems that consumers will spread out holiday shopping. According to data from Mastercard (MA), consumers got a head start with their holiday shopping as retail sales (ex-auto) increased 10.9% y/y over Thanksgiving weekend (+12.5% y/y for e-commerce sales and +10.5% y/y for in-store sales).(2) Shoppers may even extend large purchases into the sales after Christmas this year, according to Walmart.

Bottom Line:

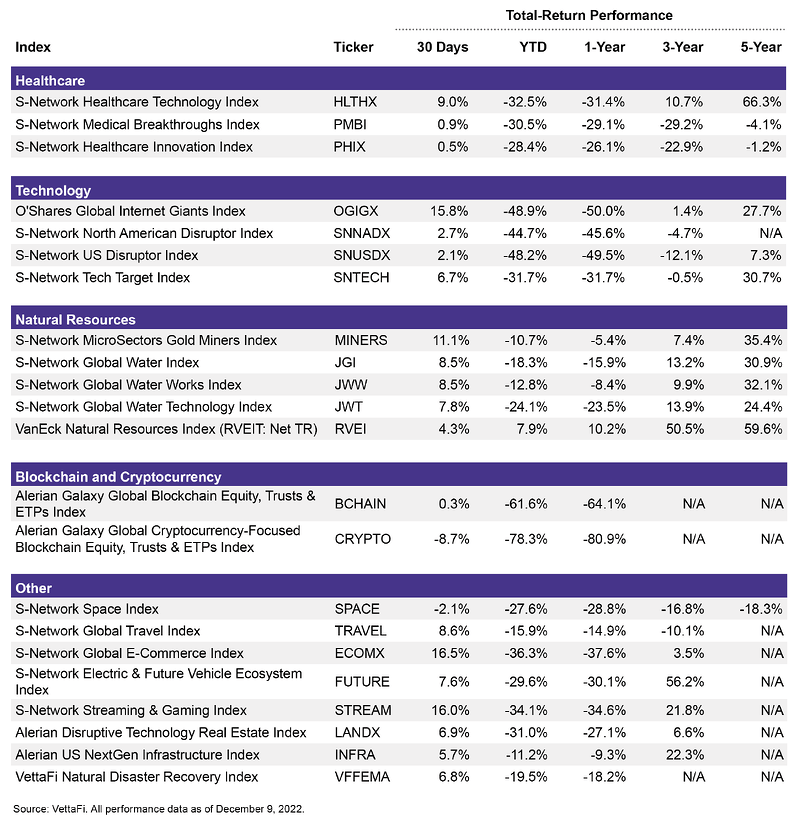

While consumer retail strength is no longer at its peak, e-commerce continues to take share over brick-and-mortar as consumer preferences shift toward online shopping and more large retailers modernize and add e-commerce to their current operations. We see benefits for constituents including online retailers (e.g., Amazon (AMZN)), large retailers (e.g., Walmart), and package delivery companies (e.g., FedEx (FDX) and UPS (UPS)). Although the S-Network Global E-Commerce Index (ECOMX) has experienced the highest growth out of our thematic indexes over the past month, YTD performance has still been down 36.3% on a total return basis. The index includes a large allocation to technology stocks (the index is currently 19.3% technology and communication stocks) which have been punished as cautious investors rotate away from growth stocks. But investors who are long-term bullish on e-commerce may see the pullback in growth as an entry point into the space.

(1) The Number of People Primarily Working From Home Tripled Between 2019 and 2021 (census.gov)

(2) Mastercard SpendingPulse: U.S. Thanksgiving weekend retail insights

Disclosure: © Alerian 2022. All rights reserved. This material is reproduced with the prior consent of Alerian. It is provided as general information only and should not be taken as investment advice. Employees of Alerian are prohibited from owning individual MLPs. For more information on Alerian and to see our full disclaimer, visit Disclaimers | Alerian.

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Be the first to comment