ronen/iStock Editorial via Getty Images

Interest rates that remain higher for longer are likely to be broadly negative for asset prices, with flow through effects on consumer spending. The Fed’s rhetoric in response to equity market strength indicates that this is one of the channels through which they hope to influence inflation. It is not clear that this will drive a reduction in spending in areas impacted by inflation though. Spending on luxury or more frivolous items is most likely to be impacted, and data indicates this is already occurring to some extent.

Asset Prices

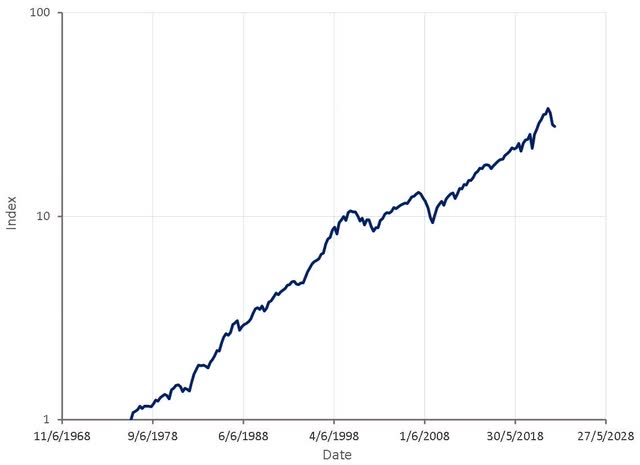

Asset prices have been under pressure in 2022, primarily as a result of rising interest rates. This has been fairly broadly based, outside of a handful of areas like energy, creating a bigger negative wealth impact than might be inferred from equity markets. So far this represents more of a return to the pre-COVID trend, than a dramatic multi-year reduction in wealth, but weakening economic conditions could change this.

Figure 1: Index of Assets Prices for Assets Commonly Held by Households (source: Created by author using data from The Federal Reserve)

Wealth Effect

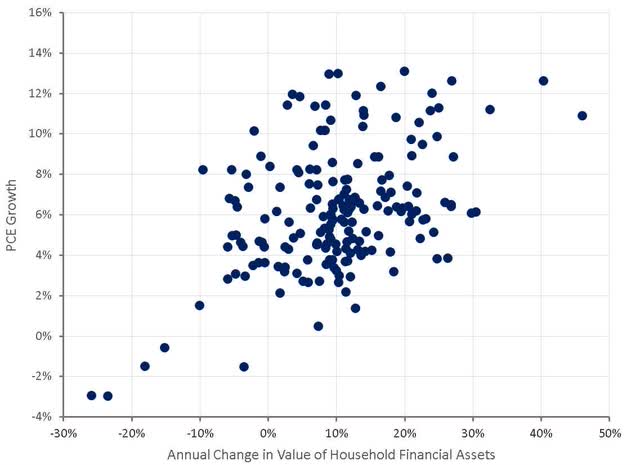

Historical data shows that asset prices influence consumer spending, with a large reduction in asset prices typically associated with a drop in consumer spending. This effect appears to be larger at the extremes (recession or asset price bubble). The causality of this relationship is also up for interpretation.

Figure 2: Impact of Asset Prices on Personal Consumption Expenditure (source: Created by author using data from The Federal Reserve)

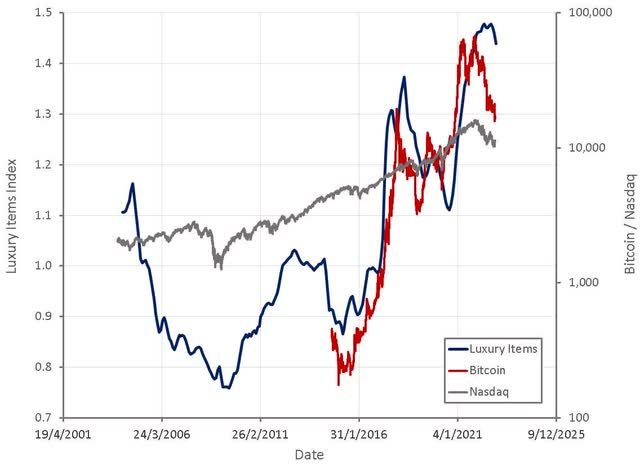

The impact of asset prices on spending is likely to vary significantly across categories, with more discretionary spending impacted first. While spending on luxury items typically holds up well through recessions, at the margin, conspicuous consumption appears to be highly influenced by asset prices. Search interest in brands like Rolex and Lamborghini, and for items like designer clothes and jewelry, is highly correlated with asset prices. Search interest for these types of items has begun to wane in recent months, and this decline in interest is supported by watch and fine wine price indices.

Figure 3: Asset Prices and Search Interest for Luxury Items (source: Created by author using data from Google Trends and Yahoo Finance)

Discretionary spending on everyday luxuries is likely to be impacted next, although appears to be holding up reasonably well so far. For example, Disney’s Park (DIS) revenue is still fairly strong, although the most recent quarter was slightly softer and job opening data indicates potential weakness going forward.

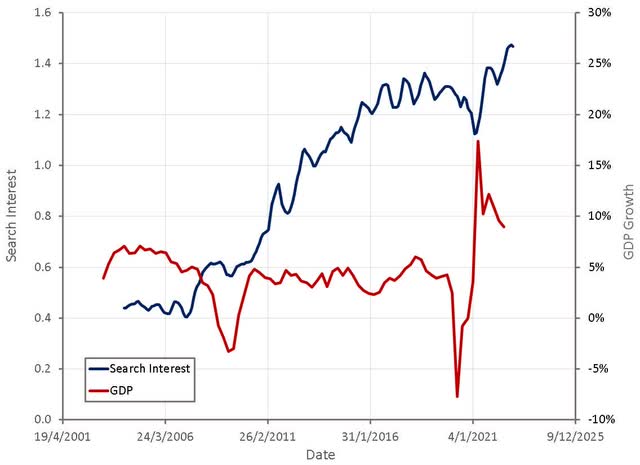

Search interest for services like hair styling and manicures has spiked in recent months, which could be a result of the lipstick effect. The lipstick effect is an observation that during economic downturns consumers increase spending on less expensive luxury items. Olaplex (OLPX) relies heavily on their professional channel (hair dressers) for sales, and this was a major headwind in the most recent quarter, possibly indicating that consumer spending in that area is being impacted.

Figure 4: Search Interest for Manicures and Hair Stylists (source: Created by author using data from Google Trends and The Federal Reserve)

Everyday luxury and discretionary spending are also likely to be impacted by inflation eroding the spending power of consumers. Earnings for Walmart (WMT) and Target (TGT) possibly indicate that discretionary consumer spending is being cut due to pressure on personal budgets. While consumers have excess savings from the pandemic, this is not evenly spread, and data shows that excess savings for low-income individuals is already gone.

Food & Beverage, Beauty and Essentials are driving growth for Target, while spending is soft across Target’s discretionary categories. This may not just be a Target issue either, as the company suggested that their unit share increased across all five of their core merchandising categories. Target believes that inflation is pressuring consumer spending and that as a result demand is shifting towards Target’s own brands and consumer sensitivity to promotions is increasing.

Conclusion

Declining asset prices appears to be impacting consumer behavior in some areas, and this impact is likely to flow through the economy over time. The magnitude of this will depend on how asset prices evolve going forward, but given that the Fed appears committed to dragging stock markets lower, the wealth effect could be important.

At the other end of the spectrum, consumer spending is being pressured by inflation, with consumers having to prioritize spending. At an aggregate level, consumer spending remains robust, but this is only possible due to large increases in debt and a rapid reduction in savings.

Be the first to comment